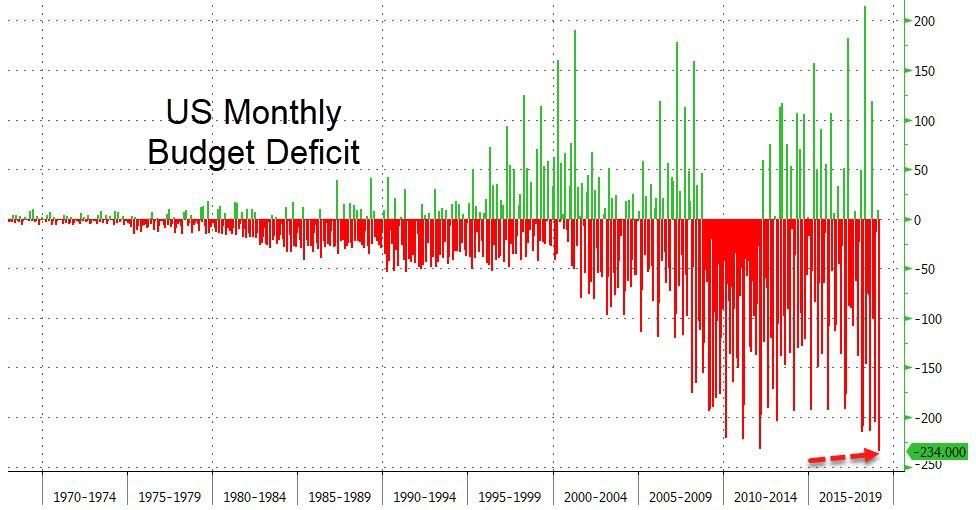

Ontario Budget: $14.6 Billion Deficit Due To Tariffs And Other Factors

Table of Contents

The Impact of Tariffs on Ontario's Economy

Tariffs imposed on Canadian goods by other countries, most notably the US, have significantly negatively affected Ontario's export-oriented sectors. This trade war fallout has had a particularly harsh impact on the manufacturing sector. The resulting decrease in export revenue has directly contributed to the Ontario Budget Deficit.

- Decline in exports from key Ontario industries: The automotive industry, a major contributor to the Ontario economy, has been severely impacted by tariffs, leading to plant closures and job losses. Similar impacts have been felt in the agricultural and forestry sectors.

- Increased production costs for businesses: Businesses reliant on imported materials face increased production costs due to tariffs, reducing profitability and competitiveness in the global marketplace. This directly impacts their ability to contribute to the provincial economy and tax revenue.

- Loss of revenue from decreased economic activity: The ripple effect of reduced exports and higher production costs has led to decreased economic activity across various sectors, resulting in a significant loss of revenue for the provincial government.

- Government support programs: The Ontario government has implemented various support programs aimed at mitigating the impact of tariffs on businesses and workers, but these initiatives add to provincial spending and contribute to the overall deficit.

Rising Healthcare Costs and Provincial Spending

The substantial increase in healthcare spending is a major driver of the Ontario Budget Deficit. This escalating cost is due to a number of factors, placing significant pressure on the provincial healthcare budget.

- Growing demand for long-term care: An aging population necessitates increased investment in long-term care facilities and services, adding substantially to healthcare expenditure.

- Increased drug costs and hospital operating expenses: The cost of pharmaceuticals and hospital operations continues to rise, putting a strain on the healthcare budget.

- Rising salaries and benefits for healthcare workers: Attracting and retaining qualified healthcare professionals requires competitive salaries and benefits, contributing to the rising costs.

- Government investments in healthcare infrastructure: While necessary, investments in new hospitals and healthcare infrastructure represent significant upfront capital expenditures that contribute to the current deficit.

Economic Slowdown and Revenue Shortfalls

A general economic slowdown has directly impacted government revenue, leading to a revenue shortfall that exacerbates the Ontario Budget Deficit. Lower-than-projected economic growth translates to decreased tax collections.

- Lower-than-expected tax revenue: Reduced personal income tax, corporate income tax, and sales tax revenue directly impacts the government's ability to fund programs and services.

- Impact on consumer spending and business investment: Economic uncertainty leads to reduced consumer spending and decreased business investment, further impacting tax revenue.

- Government measures to stimulate economic growth: The government is implementing measures to stimulate economic growth, such as tax incentives and infrastructure projects, but these initiatives require significant funding and contribute to the deficit in the short-term.

- Potential implications for future budget projections: The current economic slowdown and its impact on revenue projections present challenges for future budget planning and fiscal responsibility.

Government Response and Fiscal Measures

The Ontario government is responding to the Ontario Budget Deficit with a combination of fiscal measures aimed at both reducing spending and generating revenue. These austerity measures are designed to address the fiscal imbalance.

- Proposed spending cuts: The government has outlined plans for spending cuts in various areas, aiming to reduce non-essential expenditures. However, the details and impact of these cuts remain subjects of ongoing debate.

- Planned increases in taxes or fees: Revenue-generating measures may include increases in certain taxes or fees to bolster government coffers.

- Strategies to improve government efficiency: Initiatives aimed at improving government efficiency and reducing administrative costs are being explored to reduce spending and improve resource allocation.

- Long-term plans for deficit reduction: The government has committed to a long-term plan for deficit reduction, outlining targets and strategies for achieving fiscal sustainability.

Conclusion

The $14.6 billion Ontario Budget Deficit highlights the complex interplay of global trade impacts (like tariffs), escalating healthcare costs, and economic fluctuations. The government's response will be crucial in determining the province's long-term financial health. Understanding the factors contributing to this significant Ontario fiscal deficit—from tariffs to healthcare spending—is vital for informed public discourse and policy debate.

Call to Action: Stay informed about the implications of the Ontario Budget and its impact on your community. Follow updates on the Ontario government's plans to address the $14.6 billion Ontario Budget Deficit and engage in discussions about sustainable fiscal policies for a strong Ontario economy. Learn more about the detailed breakdown of the Ontario Budget and participate in the ongoing conversation about managing the provincial Ontario Budget Deficit.

Featured Posts

-

The Knicks Landry Shamet Situation Analysis And Potential Outcomes

May 17, 2025

The Knicks Landry Shamet Situation Analysis And Potential Outcomes

May 17, 2025 -

Rep Crockett On Trumps Economic Policies Rising Grocery Costs And Wage Stagnation

May 17, 2025

Rep Crockett On Trumps Economic Policies Rising Grocery Costs And Wage Stagnation

May 17, 2025 -

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025 -

How Immigration Agents Investigated Columbia University For Harboring Undocumented Immigrants

May 17, 2025

How Immigration Agents Investigated Columbia University For Harboring Undocumented Immigrants

May 17, 2025 -

Yankees Vs Mariners Expert Mlb Predictions And Betting Odds For Tonight

May 17, 2025

Yankees Vs Mariners Expert Mlb Predictions And Betting Odds For Tonight

May 17, 2025

Latest Posts

-

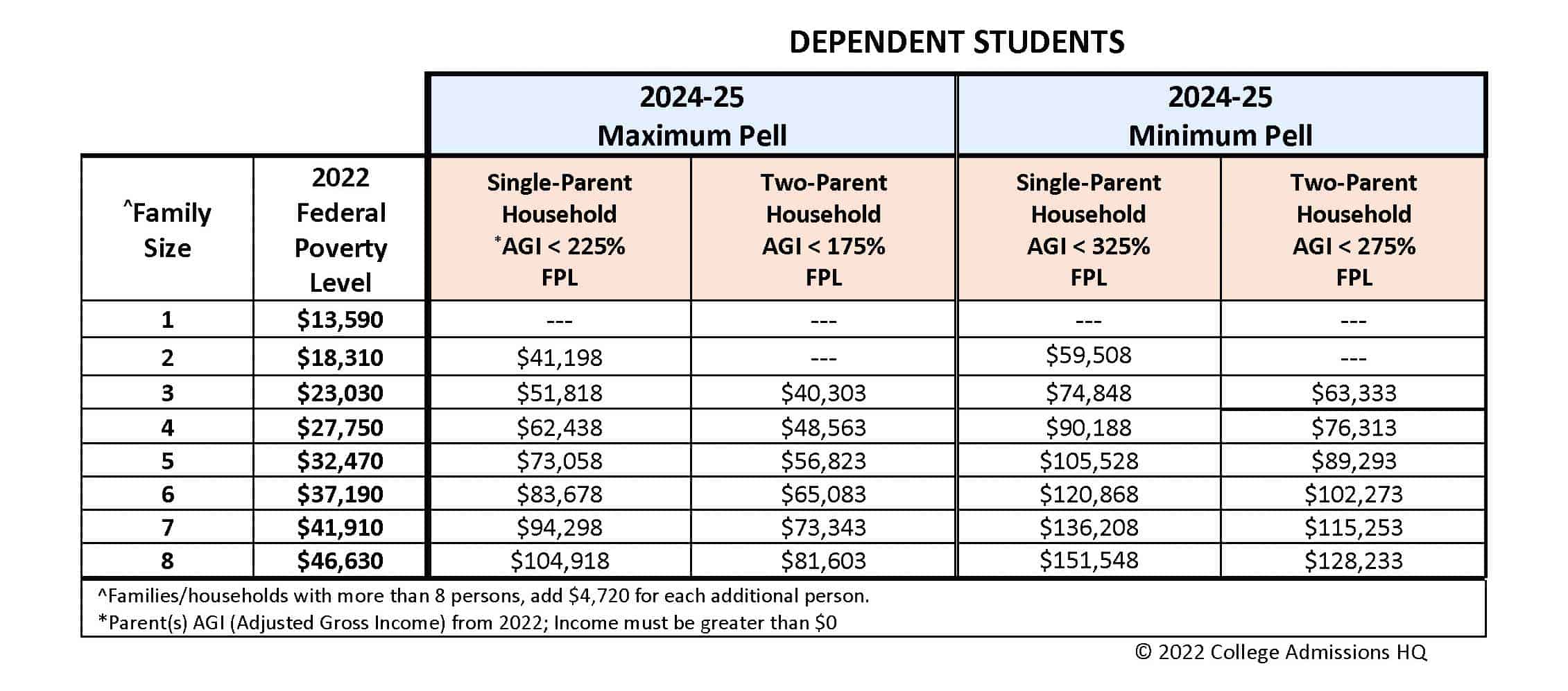

Understanding The Gops Proposed Changes To Student Loan Programs

May 17, 2025

Understanding The Gops Proposed Changes To Student Loan Programs

May 17, 2025 -

Gops Student Loan Plan Changes To Pell Grants Repayment And More

May 17, 2025

Gops Student Loan Plan Changes To Pell Grants Repayment And More

May 17, 2025 -

Crockett Accuses Trump Of Fueling Inflation Higher Grocery Bills And Lower Paychecks

May 17, 2025

Crockett Accuses Trump Of Fueling Inflation Higher Grocery Bills And Lower Paychecks

May 17, 2025 -

Student Loans Gops New Plan And What It Means For Pell Grants And Repayment

May 17, 2025

Student Loans Gops New Plan And What It Means For Pell Grants And Repayment

May 17, 2025 -

Rep Crockett On Trumps Economic Policies Rising Grocery Costs And Wage Stagnation

May 17, 2025

Rep Crockett On Trumps Economic Policies Rising Grocery Costs And Wage Stagnation

May 17, 2025