How AIMSCAP Conquered The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Cutting-Edge Algorithmic Trading Strategy

AIMSCAP's success hinges on its innovative algorithmic trading strategy, leveraging the power of AI and machine learning to navigate the complexities of the financial markets. Unlike traditional trading methods relying on human intuition, AIMSCAP employs advanced algorithms to analyze vast quantities of market data, predict price movements, and execute trades with unparalleled speed and precision. This AI trading approach incorporates several key elements:

- Diverse Data Sources: The algorithm ingests a wide range of data, including real-time market prices, news sentiment analysis, economic indicators, and social media trends, providing a comprehensive view of market dynamics.

- Sophisticated Predictive Models: Machine learning techniques, such as deep learning and reinforcement learning, are used to build predictive models capable of identifying profitable trading opportunities and predicting short-term price fluctuations with considerable accuracy.

- Robust Risk Management: Built-in risk mitigation protocols are crucial. The algorithm continuously monitors market volatility and adjusts trading parameters to minimize potential losses while maximizing potential gains. This includes setting stop-loss orders and dynamically adjusting position sizing.

- Continuous Optimization: The algorithm undergoes continuous backtesting and optimization. Historical data is used to refine the model, ensuring its adaptability to changing market conditions and improving its predictive accuracy over time.

- High-Frequency Trading Capabilities: The system is designed for high-frequency trading, allowing it to react to market changes in milliseconds, seizing fleeting opportunities that human traders might miss. This requires specialized technology and infrastructure.

Overcoming Challenges in the WTT

The WTT presented AIMSCAP with a series of formidable challenges. The intense competition, characterized by sophisticated algorithms from other teams, created a highly volatile and unpredictable environment. Furthermore, unexpected market events and technical glitches posed additional hurdles.

- Market Volatility: Sudden shifts in market sentiment and unexpected news events required the algorithm to adapt swiftly. AIMSCAP's strategy incorporated built-in resilience to weather these storms.

- Competitive Pressure: The intense competition required constant optimization and refinement of the algorithm. The team monitored competitor strategies and adjusted its own approach to maintain a competitive edge.

- Technical Challenges: Addressing and resolving any technical issues promptly was critical. AIMSCAP had robust contingency plans in place to minimize downtime and ensure uninterrupted trading.

AIMSCAP's response to these challenges demonstrated remarkable resilience and adaptability. The team's ability to swiftly identify and address problems, coupled with the algorithm's inherent flexibility, proved instrumental to their success.

The Key to AIMSCAP's Success: A Data-Driven Approach

At the heart of AIMSCAP's victory lies its unwavering commitment to a data-driven approach. The team leveraged the power of big data and real-time data analytics to gain a deep understanding of market dynamics, inform trading decisions, and ultimately outperform the competition.

- Real-Time Data Integration: The algorithm’s access to real-time market data streams was crucial, providing the speed and accuracy necessary to react to market changes instantly.

- Advanced Data Analytics: Sophisticated data analysis techniques, including statistical modeling and machine learning algorithms, were employed to extract actionable insights from the vast datasets.

- Data Visualization: Visualizing the data allowed the team to identify patterns and trends otherwise invisible in raw data, providing critical context for trading decisions. This includes visualizing correlations, volatility clusters, and other key market indicators.

Lessons Learned and Future Implications

AIMSCAP's triumph at the WTT offers invaluable lessons for the future of algorithmic trading. The team's success highlights the transformative power of AI and machine learning in finance, paving the way for more sophisticated trading strategies and potentially more efficient markets.

- The Importance of Adaptability: The ability to adapt to unexpected market changes is crucial for success in algorithmic trading.

- Continuous Improvement: Constant monitoring, testing, and optimization of algorithms are essential to maintain a competitive edge.

- The Power of Data: Access to high-quality data and the expertise to analyze it effectively are paramount.

The potential applications of AIMSCAP's technology extend far beyond trading competitions. Their innovative approach has the potential to revolutionize portfolio management, risk assessment, and other areas of finance, driving innovation and efficiency within the industry. The future of trading is likely to be increasingly driven by AI and machine learning, with strategies like AIMSCAP's leading the way.

Conclusion

AIMSCAP's dominance at the WTT was not a fluke; it was the culmination of years of research, development, and unwavering dedication to a data-driven, AI-powered algorithmic trading strategy. Their ability to overcome challenges, adapt to market volatility, and leverage the power of big data solidified their position as a leader in the field. This victory underscores the growing importance of AI and machine learning in modern finance and points to an exciting future for algorithmic trading. Learn more about how AIMSCAP and its advanced algorithmic trading strategies are revolutionizing the financial world. Explore the future of trading with AIMSCAP!

Featured Posts

-

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 21, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 21, 2025 -

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025 -

Cassis Blackcurrant Flavor Profile Production And Uses

May 21, 2025

Cassis Blackcurrant Flavor Profile Production And Uses

May 21, 2025 -

Challenging The Trans Australia Run World Record

May 21, 2025

Challenging The Trans Australia Run World Record

May 21, 2025 -

Klopp Un Geri Doenuesue Bir Devrin Baslangici Mi

May 21, 2025

Klopp Un Geri Doenuesue Bir Devrin Baslangici Mi

May 21, 2025

Latest Posts

-

Dismissing Valuation Concerns Bof As Rationale For A Bullish Stock Market

May 21, 2025

Dismissing Valuation Concerns Bof As Rationale For A Bullish Stock Market

May 21, 2025 -

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 21, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 21, 2025 -

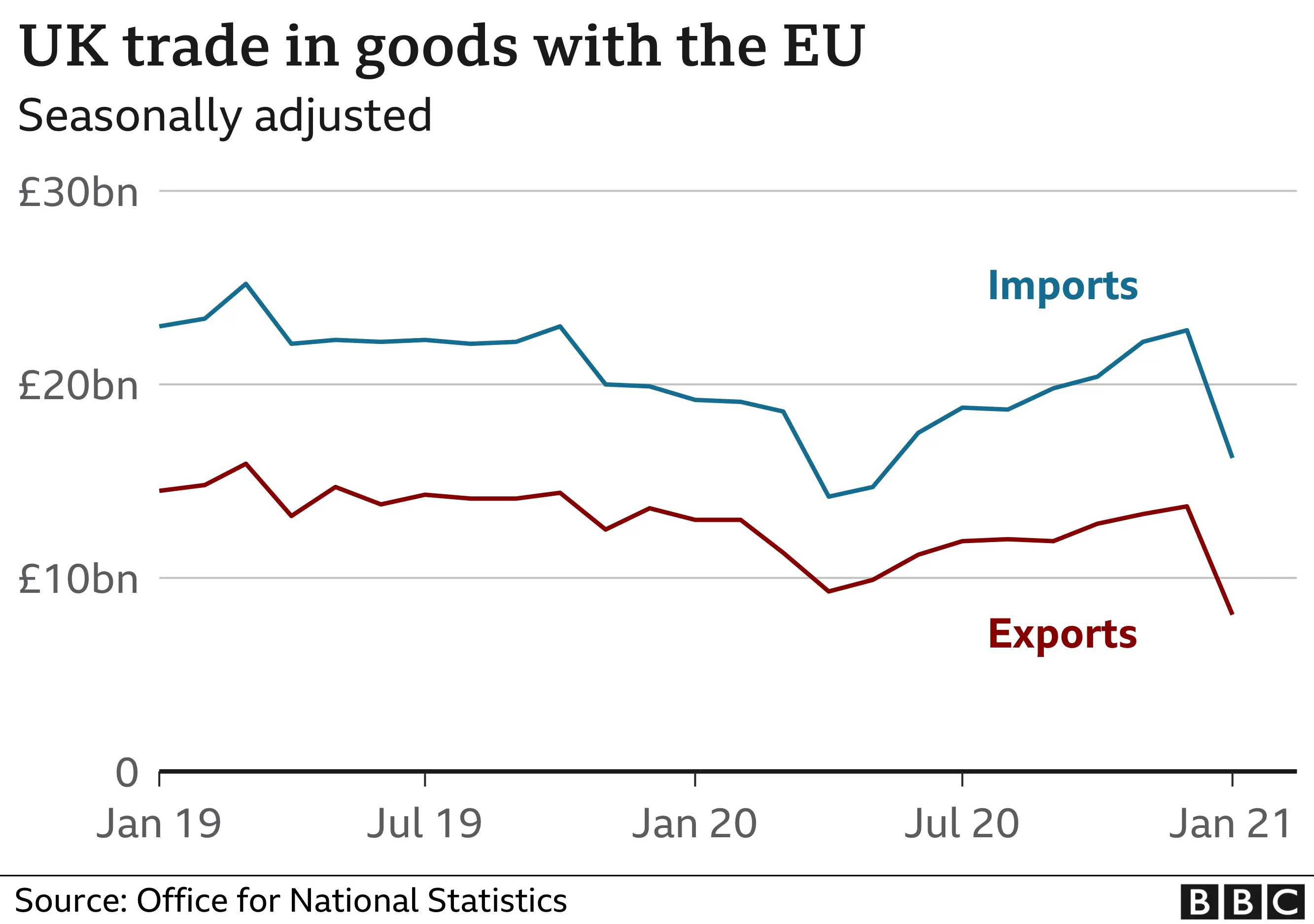

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025 -

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025 -

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025