Dismissing Valuation Concerns: BofA's Rationale For A Bullish Stock Market

Table of Contents

BofA's Core Argument: Why High Valuations Aren't a Major Concern

BofA's central thesis rests on several key pillars that mitigate the risks typically associated with high valuations. They argue that current market prices are justified by robust underlying economic fundamentals and strong corporate performance. This isn't simply blind optimism; their bullish stance is backed by specific projections and data analysis.

-

Strong Corporate Earnings Growth Projections: BofA projects continued, robust earnings growth for many sectors, suggesting that current valuations, while high, are sustainable given the anticipated increase in profits. This is particularly true for companies demonstrating consistent revenue growth and strong balance sheets.

-

Sustained Low Interest Rates (or a Slow Rate Hike Trajectory): The current low-interest-rate environment (or a gradual increase) significantly impacts stock valuations. Lower borrowing costs boost corporate profitability and investor appetite for equities, offsetting some of the pressure from high price-to-earnings (P/E) ratios.

-

Positive Economic Outlook (GDP Growth, Employment Data): A healthy economic backdrop, as indicated by positive GDP growth and strong employment numbers, supports higher valuations. A thriving economy fuels corporate earnings and boosts investor confidence, justifying higher stock prices.

-

Specific Sectors BofA Sees as Particularly Strong: BofA highlights specific sectors poised for growth, such as technology and healthcare, as key drivers of their bullish prediction. These sectors are expected to continue outperforming the broader market, further supporting their positive outlook.

-

Key Metrics: BofA's analysis likely incorporates various indices like the S&P 500 and specific metrics such as forward P/E ratios to support their claims. These metrics, while not presented explicitly in this overview, are likely factored into their overall assessment.

Addressing the Valuation Metrics: A Detailed Look at BofA's Analysis

Traditional valuation metrics like P/E ratios and the cyclically adjusted price-to-earnings ratio (Shiller PE) often raise red flags at current levels. However, BofA’s analysis attempts to counter this negative implication.

-

BofA's Counterarguments to High P/E Ratios: BofA likely argues that future earnings growth will justify the current elevated P/E ratios. The low-interest-rate environment also plays a crucial role, as it allows companies to borrow cheaply, fueling further expansion and earnings growth.

-

Alternative Valuation Metrics: BofA might be employing alternative valuation metrics beyond traditional P/E ratios, possibly considering factors like free cash flow yield or return on invested capital (ROIC) to provide a more holistic picture of valuation.

-

Visual Support: BofA's report likely includes charts and graphs comparing current valuations to historical data, demonstrating that while valuations are high, they may not be unprecedented in the context of past economic cycles and growth periods.

The Role of Monetary Policy in BofA's Bullish Prediction

The Federal Reserve's monetary policy plays a pivotal role in shaping BofA's bullish prediction.

-

Federal Reserve Actions: BofA's outlook likely incorporates an analysis of the Federal Reserve's actions and their predicted future course, considering the potential impact of interest rate hikes on the market.

-

Interest Rate Changes and Stock Valuations: The pace and magnitude of interest rate changes are critical. A gradual increase could be manageable, allowing the market to adjust, while a rapid increase could trigger a sell-off.

-

Inflation and Market Effects: BofA's prediction for inflation is crucial. Sustained, moderate inflation is typically positive for equities, while runaway inflation can severely damage market sentiment.

Potential Risks and Caveats to BofA's Bullish Prediction

While BofA presents a compelling case, it's essential to acknowledge potential risks that could derail their optimistic forecast.

-

Geopolitical Risks: Global geopolitical instability, such as international conflicts or escalating trade wars, can negatively impact market confidence and derail economic growth.

-

Unexpected Economic Downturn: An unforeseen economic downturn, possibly triggered by factors not currently accounted for, could significantly impact corporate earnings and lead to a market correction.

-

Inflationary Pressures Exceeding Expectations: If inflationary pressures escalate beyond BofA’s projections, it could force the Federal Reserve to implement more aggressive interest rate hikes, potentially leading to a market downturn.

-

Regulatory Changes: Significant regulatory changes impacting specific sectors could negatively affect company performance and stock prices, creating headwinds for the overall market.

Reassessing Valuation Concerns: BofA's Case for a Bull Market and a Call to Action

BofA's bullish outlook rests on the belief that strong corporate earnings growth, a supportive monetary policy environment, and a generally positive economic outlook outweigh the concerns surrounding high valuations. They address these concerns by highlighting future earnings potential and the role of low interest rates in justifying higher multiples. While acknowledging potential risks, their analysis suggests that the current market environment is not necessarily overvalued, given the underlying fundamentals.

Understanding BofA's rationale for dismissing valuation concerns is crucial for informed investment decision-making. While further due diligence is advised, BofA's bullish outlook on the stock market, despite valuation concerns, warrants careful consideration. Continue to monitor market developments and reassess the issue of dismissing valuation concerns in light of future economic data and company performance. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

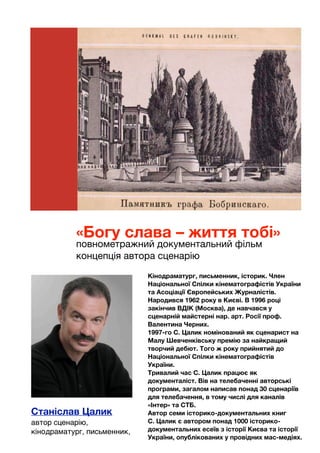

Status Kritichno Vazhlivikh Minkulturi Pidtverdilo Dlya Kanaliv 1 1 Inter Stb Ta Inshikh

May 21, 2025

Status Kritichno Vazhlivikh Minkulturi Pidtverdilo Dlya Kanaliv 1 1 Inter Stb Ta Inshikh

May 21, 2025 -

Growth Opportunities Pinpointing The Countrys Key Business Hot Spots

May 21, 2025

Growth Opportunities Pinpointing The Countrys Key Business Hot Spots

May 21, 2025 -

Almdrb Bwtshytynw Ydyf Thlatht Njwm Ila Tshkylt Mntkhb Amryka

May 21, 2025

Almdrb Bwtshytynw Ydyf Thlatht Njwm Ila Tshkylt Mntkhb Amryka

May 21, 2025 -

The Future Of Mice A Call For A Logitech Forever Mouse

May 21, 2025

The Future Of Mice A Call For A Logitech Forever Mouse

May 21, 2025 -

Half Dome Secures Abn Group Victoria Account

May 21, 2025

Half Dome Secures Abn Group Victoria Account

May 21, 2025

Latest Posts

-

Severe Weather Warning Fast Moving Storms And High Winds

May 21, 2025

Severe Weather Warning Fast Moving Storms And High Winds

May 21, 2025 -

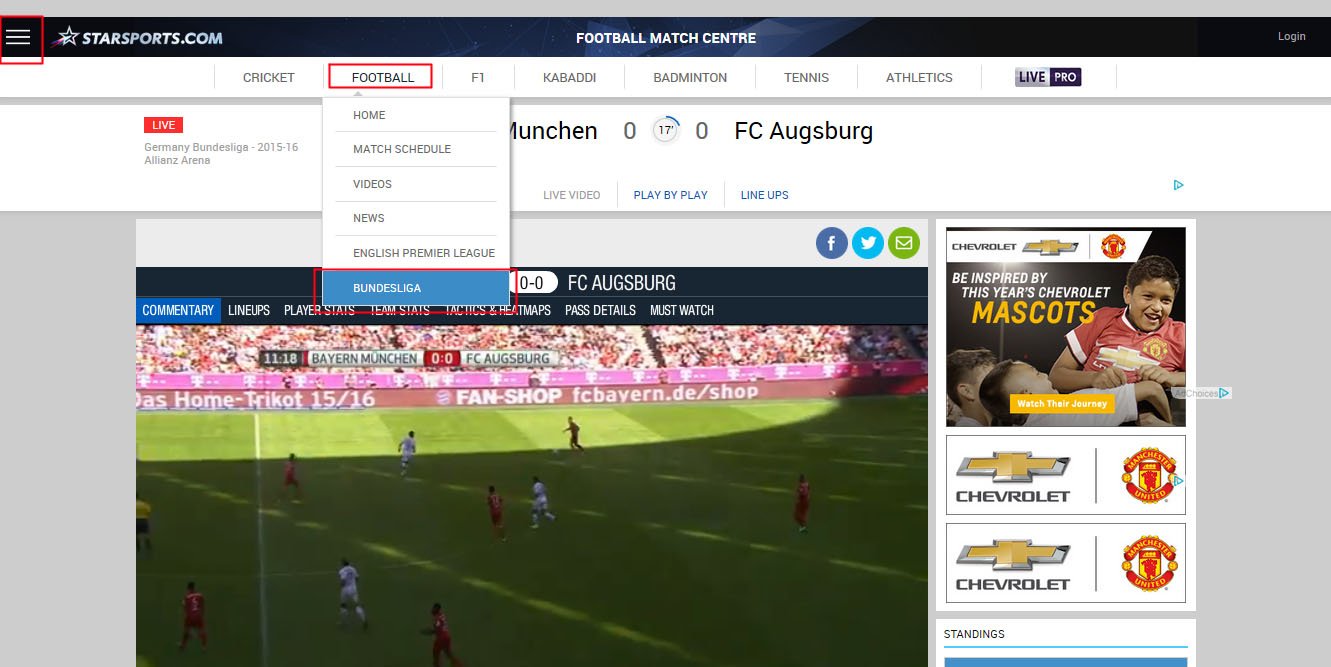

How To Watch Live Bundesliga A Step By Step Guide

May 21, 2025

How To Watch Live Bundesliga A Step By Step Guide

May 21, 2025 -

Damaging Winds And Fast Moving Storms A Guide To Safety

May 21, 2025

Damaging Winds And Fast Moving Storms A Guide To Safety

May 21, 2025 -

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Match Report And Highlights

May 21, 2025

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Match Report And Highlights

May 21, 2025 -

Live Bundesliga Streaming Best Options And Where To Watch

May 21, 2025

Live Bundesliga Streaming Best Options And Where To Watch

May 21, 2025