High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Worry

Table of Contents

BofA's Argument: Why Current Valuations Aren't Necessarily Overvalued

BofA's core argument counters the prevailing narrative of overvaluation. They contend that several factors justify the current, seemingly high, Price-to-Earnings (P/E) ratios and paint a more optimistic picture of the stock market's future. Their reasoning rests on several key pillars:

-

Low Interest Rates Justify Higher P/E Ratios: Historically low interest rates significantly impact stock valuations. When borrowing costs are low, companies can reinvest more easily, leading to stronger earnings growth which, in turn, supports higher P/E multiples. This means that a higher P/E ratio isn't necessarily a sign of overvaluation in a low-interest-rate environment.

-

Strong Corporate Earnings Growth Outlook: BofA points to a robust outlook for corporate earnings growth. Projections suggest continued expansion across various sectors, fueled by economic recovery and technological advancements. This strong earnings growth is seen as a counterbalance to the high valuations.

-

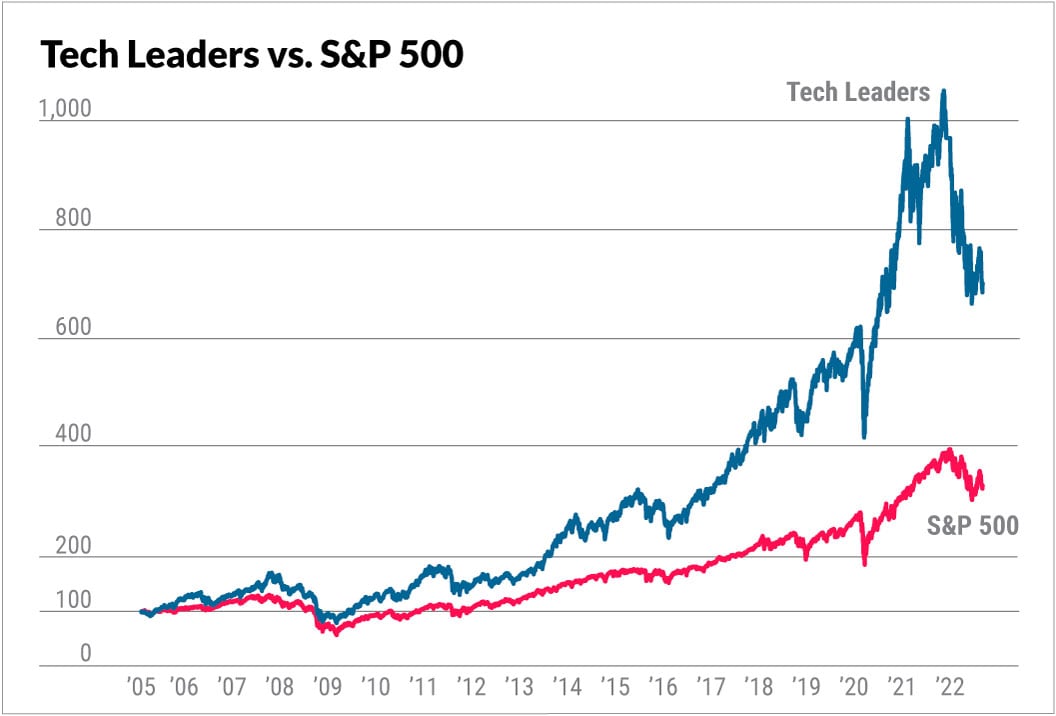

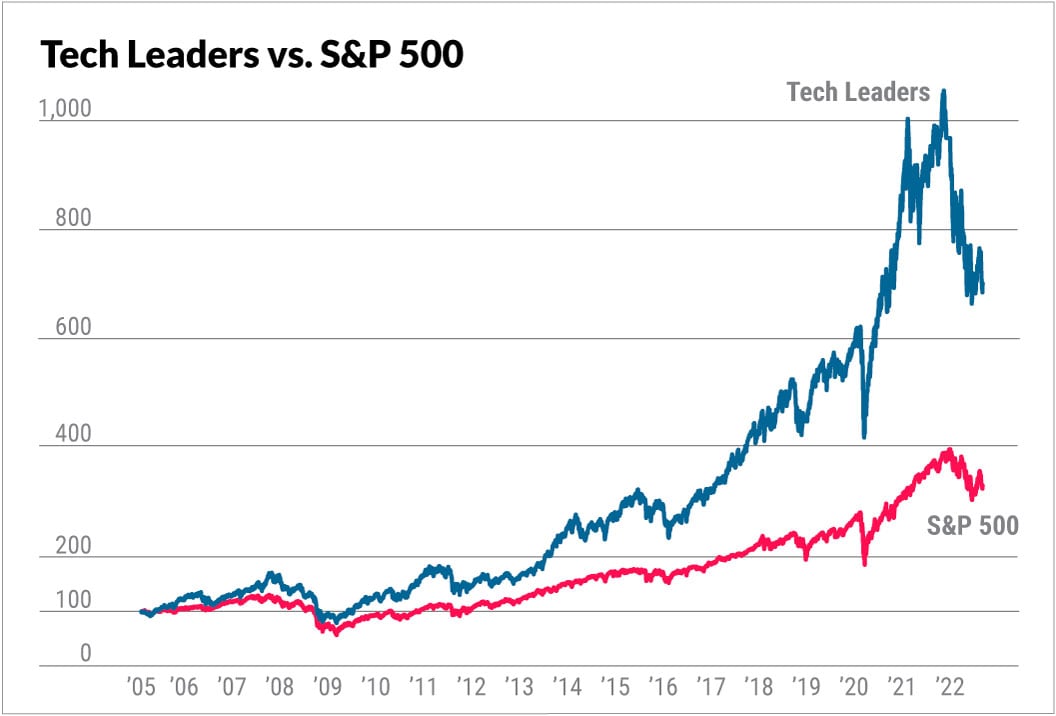

Technological Advancements and Innovation Drive Future Growth: Technological innovation is a key driver of future economic growth. Companies leveraging cutting-edge technologies are expected to experience significant growth, further justifying higher valuations for the overall market. This includes advancements in areas like artificial intelligence, renewable energy, and biotechnology.

-

Focus on Long-Term Growth: BofA emphasizes the importance of focusing on long-term growth potential rather than reacting to short-term market fluctuations. They advise investors to maintain a long-term investment horizon to weather temporary market volatility.

-

Supporting Data: BofA's arguments are backed by extensive research and data analysis. Their reports often include detailed macroeconomic forecasts, corporate earnings projections, and sector-specific analyses supporting their positive outlook. While specific data points change frequently, consistent review of their publications reveals this underlying theme.

Addressing Key Investor Concerns Regarding High Stock Market Valuations

While BofA presents a relatively optimistic outlook, they acknowledge the valid concerns many investors have. Let's delve into some of these key anxieties:

The Risk of a Market Correction

The possibility of a market correction is a primary concern for many. BofA acknowledges this risk but points to several mitigating factors:

-

Strong Economic Fundamentals: Underlying economic strength, as indicated by various indicators, provides a buffer against a sharp correction.

-

Resilient Corporate Balance Sheets: Many companies have strengthened their balance sheets in recent years, providing financial resilience in the face of potential economic headwinds.

-

Potential for Further Monetary Policy Support: While less likely, the possibility of further monetary policy support from central banks could act as a safety net if the market experiences significant downturn.

Inflationary Pressures and Their Impact on Valuations

Inflation is another significant concern impacting stock market valuations. BofA addresses this by:

-

Inflation Projections: Providing carefully considered inflation projections and assessing their potential impact on corporate profitability and stock prices.

-

Company Ability to Manage Rising Costs: Analyzing the ability of companies to manage rising input costs through pricing power or efficiency improvements.

-

Inflation's Impact on Interest Rates: Examining how inflation affects interest rates and subsequently influences stock valuations through changes in discount rates.

Geopolitical Risks and Market Uncertainty

Geopolitical uncertainty remains a persistent concern in the investment landscape. BofA addresses this through:

-

Risk Assessment Methodology: Employing sophisticated risk assessment methodologies to evaluate the impact of global events on different asset classes.

-

Diversification Strategies: Recommending diversification strategies to mitigate exposure to specific geopolitical risks.

-

Historical Precedent and Market Resilience: Examining historical precedent to show that markets have historically recovered from periods of geopolitical uncertainty.

BofA's Investment Strategy Recommendations in a High-Valuation Environment

Given the current market conditions, BofA suggests a prudent investment approach focusing on:

-

Quality Companies with Strong Fundamentals: Prioritizing companies with strong balance sheets, consistent earnings growth, and competitive advantages.

-

Long-Term Investment Horizon: Maintaining a long-term perspective, avoiding short-term market reactions, and focusing on long-term value creation.

-

Diversification Across Sectors and Asset Classes: Spreading investments across various sectors and asset classes to reduce overall portfolio risk.

-

Value Investing Strategies Alongside Growth: Balancing growth-oriented investments with value-oriented investments to optimize returns and risk management.

-

Regular Portfolio Review and Adjustments: Regularly reviewing and adjusting portfolios based on evolving market conditions and new information.

High Stock Market Valuations: A Cautious Optimism

In conclusion, while high stock market valuations are a valid concern, BofA's analysis suggests that the prevailing narrative of imminent collapse may be overly pessimistic. Their arguments highlight strong corporate earnings growth, low interest rates, and the significant potential for long-term growth driven by technological innovation. However, this isn’t a call for reckless investment. The importance of a long-term perspective and a well-diversified investment strategy, tailored to individual risk tolerance, cannot be overstated. Don't let high stock market valuations deter you from achieving your financial goals. Consult a financial advisor today to create a personalized investment plan that aligns with your unique circumstances.

Featured Posts

-

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025 -

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025 -

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025 -

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 21, 2025

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 21, 2025 -

Trans Australia Run Imminent Record Attempt

May 21, 2025

Trans Australia Run Imminent Record Attempt

May 21, 2025

Latest Posts

-

Dortmunds Victory Over Mainz Driven By Maximilian Beiers Brace

May 21, 2025

Dortmunds Victory Over Mainz Driven By Maximilian Beiers Brace

May 21, 2025 -

Nations League Nagelsmann Selects Goretzka For Germany

May 21, 2025

Nations League Nagelsmann Selects Goretzka For Germany

May 21, 2025 -

Maximilian Beiers Brace Leads Borussia Dortmund To Victory Against Mainz

May 21, 2025

Maximilian Beiers Brace Leads Borussia Dortmund To Victory Against Mainz

May 21, 2025 -

Uefa Nations League Germany Overcomes Italy Advances To Final Four

May 21, 2025

Uefa Nations League Germany Overcomes Italy Advances To Final Four

May 21, 2025 -

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025