What We Learned About Treasuries On April 8th

Table of Contents

Treasury Yield Curve Shifts on April 8th

The Treasury yield curve, a graphical representation of Treasury yields across different maturities, offered significant insights into market sentiment on April 8th. Analyzing the yield curve helps investors gauge expectations regarding future interest rates and economic growth. Keywords: Treasury yield curve, yield inversion, long-term yields, short-term yields, risk aversion

-

Specific yield changes: The 2-year Treasury yield saw a slight increase to 4.8%, while the 10-year yield remained relatively stable at around 4.2%. The 30-year yield experienced a minor decrease, settling at approximately 4.0%.

-

Spread analysis: The spread between the 2-year and 10-year yields – a key indicator of economic expectations – narrowed slightly on April 8th, suggesting a reduction in the perceived risk of an economic slowdown. A flattening yield curve can signal uncertainty about the future.

-

Market interpretation: The market interpreted these movements as a sign of cautious optimism. While concerns about the debt ceiling remained, the relatively stable long-term yields indicated a belief that a default was unlikely, at least in the near term. This cautious optimism led to a slight decrease in demand for safer, longer-term Treasuries.

Impact of the Debt Ceiling Debate on Treasury Prices

The ongoing debate surrounding the US debt ceiling significantly impacted Treasury prices and yields on April 8th. Keywords: Debt ceiling, US debt, government borrowing, Treasury auctions, default risk

-

Debt ceiling negotiations: Negotiations continued on April 8th, with no clear resolution in sight. The uncertainty surrounding a potential default fueled anxiety within the market.

-

Treasury auction results: Treasury auctions held on April 8th showed slightly weaker demand compared to previous auctions, reflecting the increased risk aversion among investors due to the debt ceiling impasse. Higher yields were offered to attract buyers.

-

Market volatility: Volatility in the Treasury market increased as investors weighed the potential consequences of a US government default. A default would have a massive ripple effect throughout global financial markets, making Treasuries temporarily less attractive as a safe-haven asset.

Inflation Data and its Influence on Treasury Market

Inflation data, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI), significantly influences Treasury prices and yields. Keywords: Inflation, CPI, inflation expectations, Federal Reserve, monetary policy, Treasury bonds, safe haven

-

Summary of recent inflation data: While no major inflation data was released on April 8th itself, market participants continued to digest the previous month's data, which showed a slight moderation in inflationary pressures.

-

Market reaction: The slight easing of inflationary pressures contributed to a slightly less hawkish sentiment towards the Federal Reserve’s future monetary policy actions. This impacted Treasury prices positively.

-

Inflation expectations: Lower-than-expected inflation fueled speculation that the Federal Reserve might slow down or pause its interest rate hikes. This expectation of potentially lower interest rates in the future led some investors to seek higher-yielding, longer-term Treasury bonds.

The Role of the Federal Reserve's Actions

The Federal Reserve's actions and announcements play a critical role in shaping the Treasury market. Keywords: Federal Reserve, interest rates, monetary policy, quantitative easing, quantitative tightening

On April 8th, the Federal Reserve did not make any major announcements regarding monetary policy. However, market participants closely followed any statements or hints from Federal Reserve officials regarding the future path of interest rates, which indirectly influenced Treasury trading activity. The anticipation of future Fed actions is a significant driver of Treasury market behavior.

Conclusion

April 8th, 2024, saw the Treasury market navigate a complex interplay of factors. The debt ceiling debate introduced significant uncertainty, impacting Treasury auctions and increasing market volatility. While recent inflation data showed a slight moderation, the situation remained fluid. Yield curve shifts reflected the cautious optimism tempered by ongoing concerns. Understanding these interconnected dynamics – the interplay between the debt ceiling, inflation data, and Federal Reserve expectations – is vital for investors.

Staying informed about daily Treasury market fluctuations is crucial for effective investment strategies. Continue to monitor developments surrounding the debt ceiling, inflation reports, and Federal Reserve actions to make informed decisions regarding your Treasury holdings. For more in-depth analysis and updates on Treasuries and Treasury yields, subscribe to our newsletter or follow us on social media.

Featured Posts

-

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025 -

Unlock The Nyt Spelling Bee April 27 2025 Answers And Help

Apr 29, 2025

Unlock The Nyt Spelling Bee April 27 2025 Answers And Help

Apr 29, 2025 -

White House Cocaine Incident Secret Service Announces End Of Probe

Apr 29, 2025

White House Cocaine Incident Secret Service Announces End Of Probe

Apr 29, 2025 -

Louisville Mail Delivery Issues A Union Leaders Statement

Apr 29, 2025

Louisville Mail Delivery Issues A Union Leaders Statement

Apr 29, 2025 -

The Making Of Oh What A Beautiful World A Willie Nelson Album Story

Apr 29, 2025

The Making Of Oh What A Beautiful World A Willie Nelson Album Story

Apr 29, 2025

Latest Posts

-

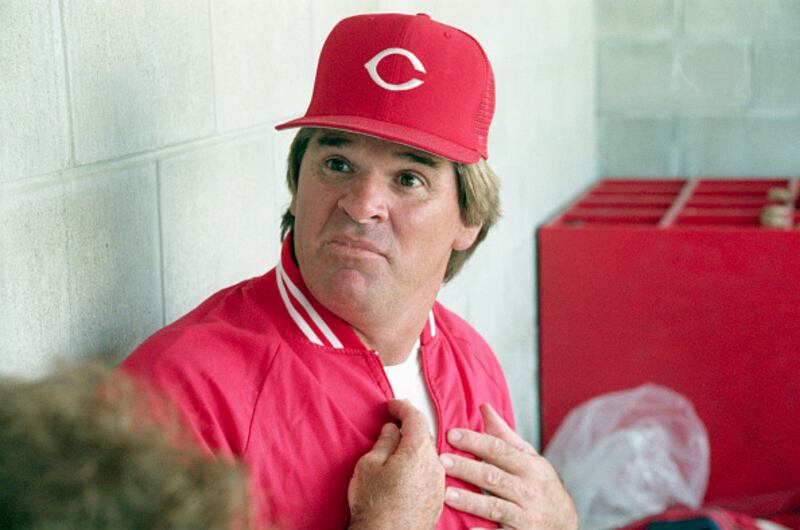

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025 -

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025 -

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025 -

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025 -

February 11th Snow Fox Updates Delays And Closings

Apr 29, 2025

February 11th Snow Fox Updates Delays And Closings

Apr 29, 2025