Dragon Den Shock: Businessman Rejects Top Offers, Accepts Lower Bid

Table of Contents

The High-Stakes Pitch: Analyzing the Business Proposal

The Business and its Potential

Mark Olsen presented EcoPack Solutions, a company specializing in biodegradable and compostable food packaging. His market analysis showcased a rapidly growing demand for sustainable alternatives to traditional plastics, presenting a significant opportunity within the environmentally conscious consumer market. EcoPack's business model focuses on direct sales to restaurants and food retailers, with ambitious revenue projections based on strong early adoption and planned expansion into larger supermarket chains.

- Key features of the business: Patented biodegradable material, competitive pricing, customizable packaging options.

- Market size and target audience: Booming eco-conscious consumer market, targeting restaurants, food retailers, and eventually large supermarkets.

- Financial projections (brief overview): Significant year-on-year growth predicted, based on securing key retail partnerships.

- Unique selling points (USPs): Fully compostable material, superior performance compared to existing biodegradable options, competitive pricing strategy.

The Dragon's Den Offers: A Comparison of Investment Proposals

The High Bids

The Dragons were clearly impressed by Olsen's pitch. Several offered substantial investment packages, vying to secure a stake in this promising venture.

-

Summary of each high bid (Dragon's name, offer details):

- Deborah Meaden offered £250,000 for 20% equity.

- Peter Jones offered £300,000 for 25% equity, with additional marketing support.

- Touker Suleyman offered £200,000 for 15% equity, focusing on rapid expansion.

-

Advantages and disadvantages of each high-value offer: While all offers provided significant capital injection, some came with stricter equity demands or less favorable terms regarding future company direction.

The Chosen Lower Bid

Surprisingly, Olsen accepted an offer of £100,000 for 10% equity from Steven Bartlett. This significantly lower investment amount was coupled with a strong strategic partnership and mentorship component.

- Specifics of the chosen offer: £100,000 investment for 10% equity, plus extensive business mentorship and strategic guidance from Steven Bartlett.

- Reasons why this offer was seen as superior despite the lower investment: Olsen valued Bartlett's extensive experience in scaling startups and his network of contacts more than the extra capital offered by others.

- Focus on the non-financial benefits: Access to Bartlett's mentorship and expertise were deemed invaluable for long-term growth and strategic planning.

Reasons Behind the Unexpected Decision: Strategic Considerations

Beyond the Money

Olsen's decision clearly transcended pure financial gain. He prioritized strategic alignment and long-term growth over immediate capital injection.

- The value of mentorship from the investor: Bartlett's experience and connections were seen as crucial for navigating the challenges of rapid business expansion.

- The potential for future collaboration and growth: The partnership with Bartlett offered access to a wider network and expertise in marketing and scaling businesses.

- The avoidance of potentially unfavorable terms in the higher offers: Some high bids came with stringent conditions that could have hampered Olsen's long-term vision for EcoPack Solutions.

Risk Assessment and Future Projections

Olsen's decision reflects a calculated risk-taking approach, prioritizing sustainable growth and long-term value creation.

- Potential downsides of accepting the higher offers: Giving up a larger equity stake might dilute future returns and limit Olsen’s control over the company's direction.

- Projected long-term benefits of the lower offer: Access to Bartlett’s expertise and network promises exponential growth, potentially outweighing the smaller initial investment.

- The businessman's overall business strategy and goals: Olsen's primary goal is not just rapid financial success, but also building a sustainable and ethically responsible business.

The Aftermath and Lessons Learned

Public Reaction and Media Coverage

Olsen’s decision has generated significant media attention, with many praising his strategic thinking and long-term vision. Some critics questioned his rejection of larger investments, but most acknowledged the potential benefits of Bartlett’s mentorship.

Lessons for Aspiring Entrepreneurs

Olsen's experience provides valuable lessons for entrepreneurs seeking funding:

- Investment strategy: Prioritize strategic partnerships and mentorship alongside financial investment.

- Negotiating deals: Don't just focus on the monetary value, but also consider the terms and conditions and the long-term implications.

- Due diligence: Thoroughly research potential investors and assess their expertise and network.

- Strategic partnerships: Seek partnerships that align with your business goals and offer valuable non-financial benefits.

- Long-term planning: Develop a clear long-term vision and prioritize sustainable growth over short-term gains.

Conclusion: Analyzing the Dragon Den Shock – A Strategic Decision

Mark Olsen's decision to reject higher investment offers in favor of a strategic partnership with Steven Bartlett showcases the importance of considering factors beyond pure financial investment. The "Dragon's Den shock" highlights the value of mentorship, strategic alignment, and long-term vision in building a successful business. This surprising outcome offers valuable lessons for aspiring entrepreneurs navigating the complexities of securing funding and building a sustainable business. What are your thoughts on this Dragon's Den shock? Share your opinions on strategic investment decisions in the comments below!

Featured Posts

-

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory Against Portland

May 01, 2025

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory Against Portland

May 01, 2025 -

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025 -

Processo Vaticano Slitta L Apertura Del Dibattimento Per Il Fratello Di Becciu Fondi 8xmille

May 01, 2025

Processo Vaticano Slitta L Apertura Del Dibattimento Per Il Fratello Di Becciu Fondi 8xmille

May 01, 2025 -

Is 5 Realistic Xrp Price Prediction And Future Outlook

May 01, 2025

Is 5 Realistic Xrp Price Prediction And Future Outlook

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Latest Posts

-

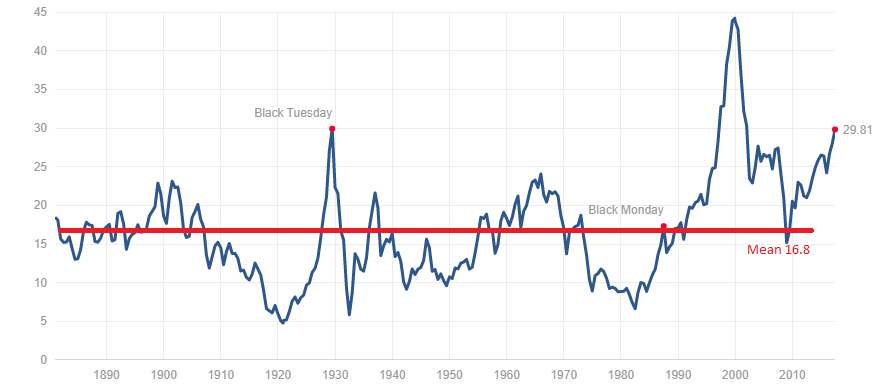

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 02, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 02, 2025 -

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Worry Investors

May 02, 2025

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Worry Investors

May 02, 2025 -

Invest Smart A Map Of The Countrys Rising Business Hot Spots

May 02, 2025

Invest Smart A Map Of The Countrys Rising Business Hot Spots

May 02, 2025 -

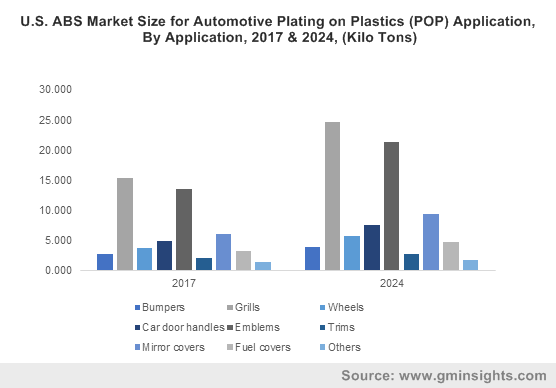

The Saudi Abs Market How A Single Rule Change Created Massive Opportunity

May 02, 2025

The Saudi Abs Market How A Single Rule Change Created Massive Opportunity

May 02, 2025