BofA's Reassurance: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Outlook and Underlying Rationale

Bank of America's recent reports paint a more optimistic picture of current stock market valuations than many headlines suggest. Their analysts cite several key factors contributing to their positive outlook. These factors point towards a market that, while volatile, isn't necessarily overvalued to the point of imminent collapse. The underlying rationale rests on a combination of strong corporate fundamentals and a resilient economy.

- Strong Corporate Earnings: BofA's analysts highlight the robust performance of many corporations, with earnings growth exceeding expectations in several key sectors. This positive trend suggests that companies are well-positioned to weather economic headwinds.

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending has remained relatively strong, indicating a healthy underlying economy that continues to support corporate profitability. This is a crucial factor in supporting current stock market valuations.

- Interest Rate Projections: While interest rate hikes are a concern, BofA's projections suggest a potential leveling off in the near future, reducing the pressure on valuations caused by rising borrowing costs.

Specific Data Points from BofA's Reports:

- BofA's equity strategists predict a [insert predicted growth rate]% growth in corporate earnings for [insert year].

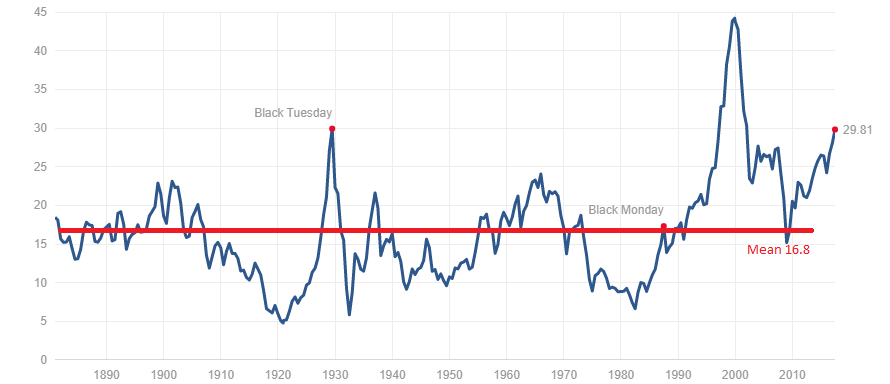

- Their analysis shows that the current P/E ratio, while elevated, is still within historical norms when considering the low interest rate environment and projected future growth.

- [Insert specific analyst name], a leading equity strategist at BofA, highlights the importance of considering forward-looking P/E ratios rather than solely focusing on trailing twelve-month figures. Their research incorporates future growth projections into their valuation model.

These data points, coupled with the overall economic picture, contribute to BofA's relatively positive outlook on current stock market valuations, mitigating some investor concerns.

Addressing Common Investor Concerns about High Valuations

Despite BofA's positive outlook, it's important to acknowledge common investor anxieties. High Price-to-Earnings (P/E) ratios and other valuation metrics often trigger concerns about a potential market correction. Let's address these concerns using BofA's arguments:

Counterarguments to Common Concerns:

-

Counterargument 1 (High P/E Ratios): While P/E ratios might appear high, BofA's analysts argue that these need to be considered in the context of low interest rates and anticipated future earnings growth. Low interest rates allow companies to borrow more cheaply and invest more in growth, thus justifying higher valuations.

-

Counterargument 2 (High Valuations in Specific Sectors): Some sectors might show higher valuations than others. BofA's analysis often highlights sector-specific drivers of these valuations, emphasizing the long-term growth potential in those sectors, even if they appear expensive relative to the broader market. They would suggest a focus on diversification to mitigate the risk associated with high valuations in specific sectors.

-

Counterargument 3 (Potential Market Corrections): Market corrections are a normal part of the investment cycle. BofA doesn't deny the possibility of a correction, but their analysis suggests that the current valuations are not necessarily unsustainable and that a correction, if it were to occur, would likely be a healthy adjustment rather than a catastrophic collapse.

Long-Term Investment Strategies in Light of BofA's Assessment

BofA's assessment underscores the importance of a long-term investment strategy. Rather than reacting to short-term market fluctuations, investors should focus on building diversified portfolios and maintaining a long-term perspective.

Investment Approach Recommendations:

- Recommendation 1 (Diversification): Diversification across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk.

- Recommendation 2 (Sector-Specific Advice): BofA's research can inform sector-specific investment choices. For example, they might highlight sectors poised for growth based on their analysis, while suggesting caution in others.

- Recommendation 3 (Risk Management): Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. This might involve holding a mix of growth and value stocks or incorporating risk-mitigating strategies like dollar-cost averaging.

The Role of External Factors in Shaping Market Valuations

While BofA's analysis provides valuable insights, it's crucial to acknowledge that external factors can significantly influence stock market valuations. Geopolitical events, technological disruptions, and regulatory changes can create both opportunities and risks.

Examples of External Factors:

- Example 1 (Global Economic Slowdown): A global economic slowdown could negatively impact corporate earnings and stock prices, regardless of BofA's assessment.

- Example 2 (Technological Advancements): Rapid technological advancements can create new investment opportunities but also render existing businesses and technologies obsolete.

- Example 3 (Regulatory Changes): New regulations can significantly impact the profitability and valuations of certain industries.

Continuous monitoring of these factors and adapting investment strategies accordingly are essential for long-term success.

Conclusion: BofA's Reassurance and Your Investment Strategy

BofA's analysis offers a degree of reassurance to investors concerned about current stock market valuations. While market volatility is a given, their research suggests that current valuations, considered within a broader context, aren't necessarily cause for immediate alarm. However, it's crucial to remember that this is just one perspective.

Investors should consider BofA's insights as one factor among many in their decision-making process. Understanding stock market valuations requires a comprehensive understanding of the economic environment, corporate performance, and potential external factors. Conduct further research, consult with a qualified financial advisor, and develop a well-informed investment strategy based on your risk tolerance and long-term financial goals, while keeping BofA's assessment of current stock market valuations in mind. Effectively managing your investment portfolio based on BofA's insights and a thorough assessment of current stock market valuations is crucial for long-term success.

Featured Posts

-

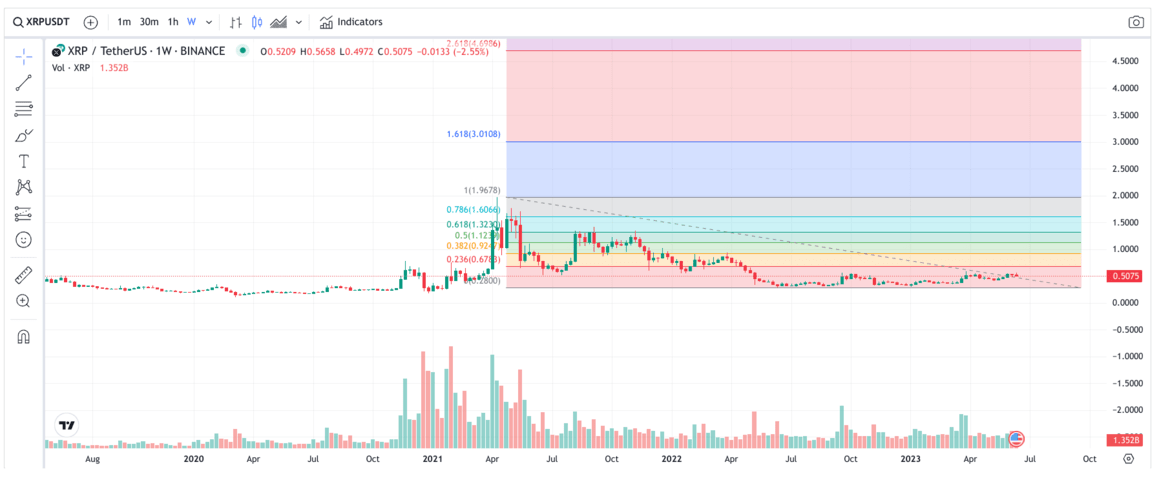

Is This Xrps Big Moment Etf Approvals Sec Changes And Market Impact

May 02, 2025

Is This Xrps Big Moment Etf Approvals Sec Changes And Market Impact

May 02, 2025 -

Rossiya I Chekhiya Ukreplyayut Ekonomicheskoe Partnerstvo

May 02, 2025

Rossiya I Chekhiya Ukreplyayut Ekonomicheskoe Partnerstvo

May 02, 2025 -

Stroomnetaansluiting Geweigerd Kampen Dagvaardt Enexis

May 02, 2025

Stroomnetaansluiting Geweigerd Kampen Dagvaardt Enexis

May 02, 2025 -

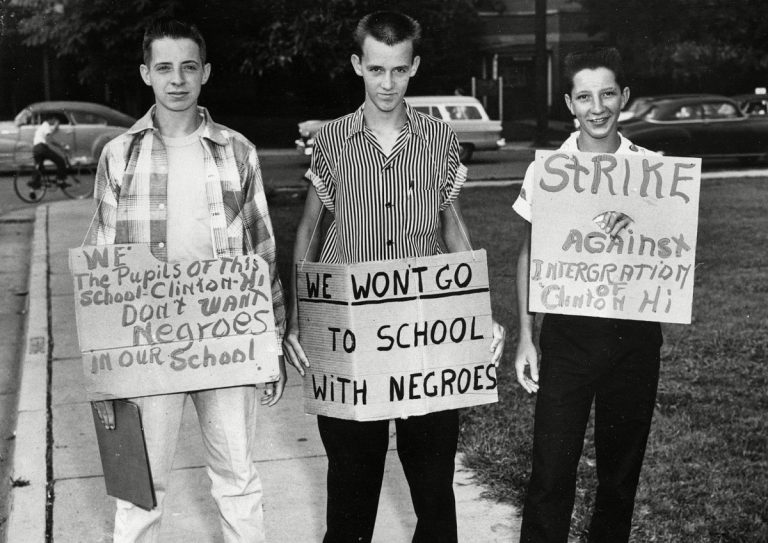

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025 -

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025

Latest Posts

-

Discover This Country Your Ultimate Travel Planner

May 02, 2025

Discover This Country Your Ultimate Travel Planner

May 02, 2025 -

This Country A Travelers Handbook

May 02, 2025

This Country A Travelers Handbook

May 02, 2025 -

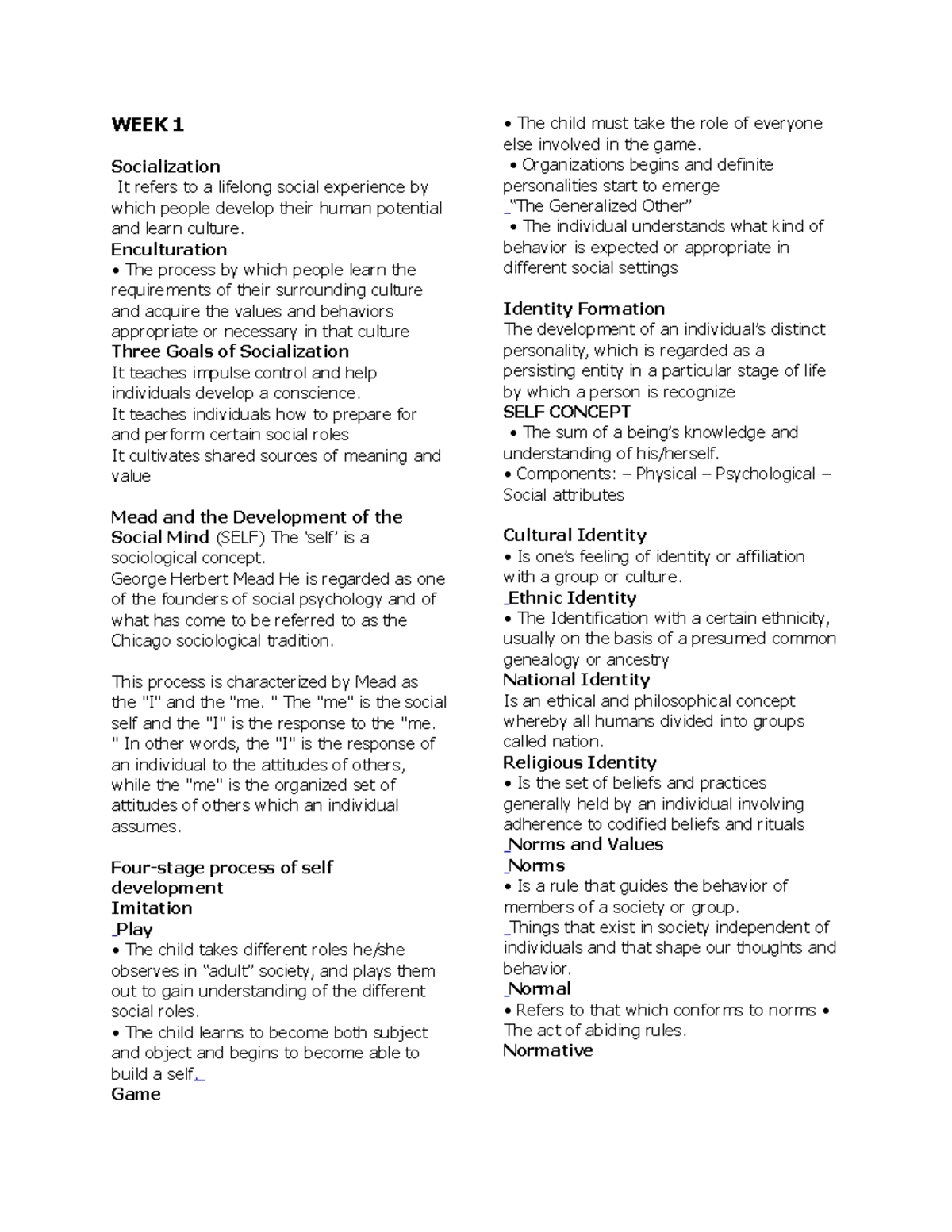

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

Exploring This Country Culture History And Travel

May 02, 2025

Exploring This Country Culture History And Travel

May 02, 2025 -

This Country A Comprehensive Guide

May 02, 2025

This Country A Comprehensive Guide

May 02, 2025