Dow's Response To Volatility: A Major Canadian Project Delayed

Table of Contents

The Impact of Global Economic Volatility on Dow's Decision

The current global economic landscape is characterized by significant uncertainty. Dow's response to volatility is a direct reflection of this challenging environment. Several key factors contributed to the decision to postpone the Canadian project:

-

Inflationary Pressures: Soaring inflation rates globally have increased the cost of raw materials, labor, and transportation, making the project less financially viable in the short term. These inflationary pressures significantly impact Dow's ability to accurately predict project costs and maintain profitability.

-

Energy Price Volatility: Fluctuations in energy prices, particularly natural gas and oil, create significant risk for Dow's operations. These unpredictable energy costs directly influence production expenses and overall project feasibility.

-

Supply Chain Disruptions: Ongoing supply chain challenges continue to hamper the timely delivery of essential materials and equipment. These disruptions add further complexity and uncertainty to project timelines and budgets.

-

Geopolitical Instability: Global geopolitical tensions add another layer of unpredictability, impacting market stability and increasing risk aversion among investors. This instability contributes to Dow's overall assessment of risk related to long-term investments.

The following economic indicators underscore the severity of the situation:

- High inflation rates exceeding central bank targets.

- Volatile energy markets leading to unpredictable price swings.

- Persistent supply chain bottlenecks causing delays and increased costs.

- Heightened geopolitical risks affecting global trade and investment.

Analyzing Dow's Financial Performance and Investment Strategies

Dow's recent financial reports reveal a complex picture. While the company has demonstrated resilience in certain areas, the current market instability has impacted profitability and influenced its investment strategy. Dow's response to volatility involves a reassessment of its risk tolerance and a focus on preserving capital during this period of uncertainty.

-

Return on Investment (ROI) Concerns: The projected ROI for the Canadian project may have been deemed insufficient given the current economic headwinds. Dow's prioritization of maximizing shareholder value necessitates a careful evaluation of potential risks and returns in the current volatile market.

-

Conservative Investment Approach: In response to volatility, Dow may have adopted a more conservative investment approach, prioritizing projects with lower risk profiles and higher chances of success in the short to medium term.

-

Strategic Resource Allocation: Dow is likely reallocating its resources to projects deemed more resilient to the current market fluctuations. This could involve prioritizing existing operations or projects with lower exposure to the aforementioned risks.

The Delayed Canadian Project: Scope and Potential Implications

The delayed project, a large-scale petrochemical facility in Alberta, Canada, represents a significant investment and was anticipated to generate considerable economic benefits for the region. The project's delay has considerable implications:

-

Economic Impact: The project was expected to create thousands of jobs during construction and operation, boosting the local and regional economies. The delay jeopardizes this economic growth.

-

Job Creation: The anticipated job creation, ranging from skilled labor to administrative roles, is now postponed, impacting employment opportunities in the area.

-

Sustainable Development: The project included components focused on sustainable development and environmental protection. The delay temporarily stalls progress towards these goals.

Dow's Communication and Stakeholder Engagement

Dow has released public statements acknowledging the delay and attributing it to the current market volatility. The company's response to stakeholder concerns has involved transparent communication with governments, local communities, and investors.

-

Public Relations Strategy: Dow's public relations strategy aims to manage expectations and maintain positive relationships with stakeholders. This includes providing regular updates on the project's status and outlining the factors influencing the decision.

-

Community Engagement: Open communication with local communities helps address any concerns and maintain trust. This engagement is vital for mitigating potential negative perceptions of the delay.

-

Investor Relations: Maintaining transparency with investors is crucial to minimize potential negative market reactions. Providing accurate information about the company's financial outlook and investment decisions is paramount.

Conclusion: Navigating Volatility: The Future of Dow's Canadian Investments

Dow's decision to delay the major Canadian project underscores the significant influence of market volatility on large-scale investments. The interplay of inflation, energy prices, supply chain disruptions, and geopolitical instability has forced Dow to reassess its risk tolerance and prioritize projects with more predictable returns. While the delay represents a setback, Dow's response to volatility demonstrates a commitment to prudent financial management. The company's continued engagement with stakeholders and transparent communication are crucial for managing expectations and fostering trust. Stay tuned for further updates on Dow's response to volatility and the future of this significant Canadian project.

Featured Posts

-

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025 -

Canada The New Top Choice For International Travelers

Apr 27, 2025

Canada The New Top Choice For International Travelers

Apr 27, 2025 -

Review Nosferatu The Vampyre A Now Toronto Detour

Apr 27, 2025

Review Nosferatu The Vampyre A Now Toronto Detour

Apr 27, 2025 -

Ariana Biermanns Alaskan Adventure A Romantic Getaway

Apr 27, 2025

Ariana Biermanns Alaskan Adventure A Romantic Getaway

Apr 27, 2025 -

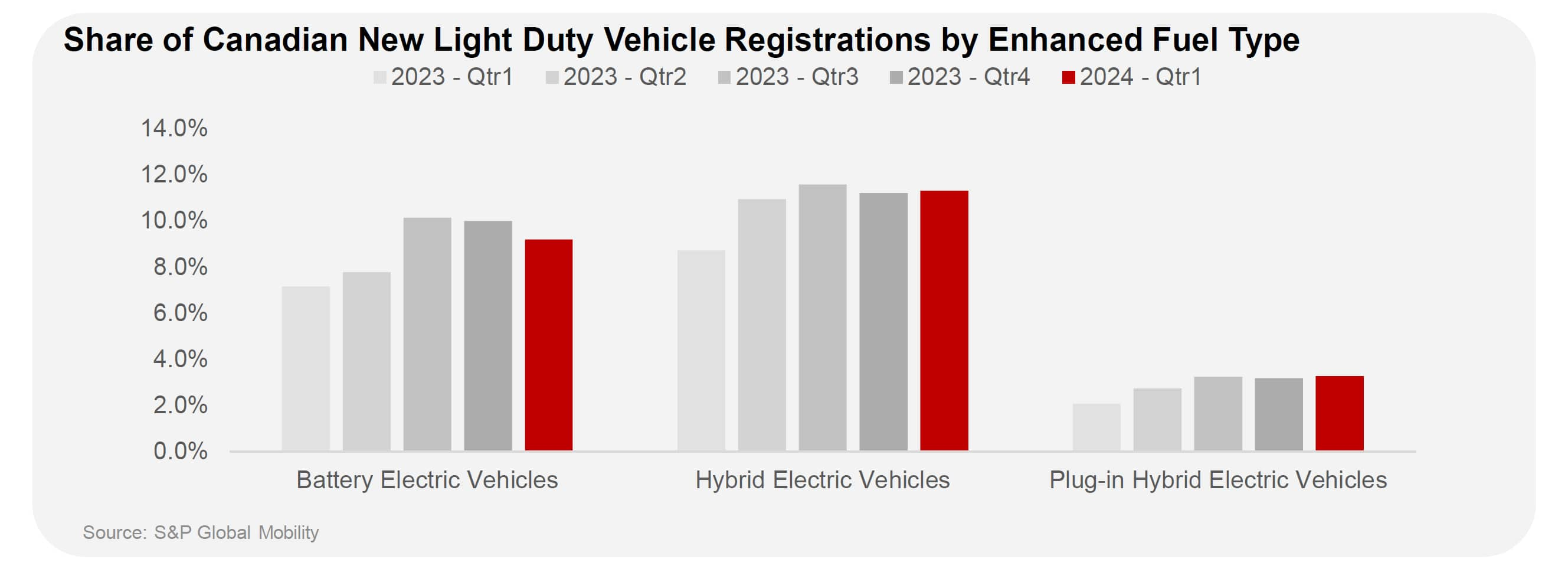

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025

Latest Posts

-

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Apr 27, 2025

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Apr 27, 2025 -

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 27, 2025

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 27, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And The Broader Automotive Landscape

Apr 27, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And The Broader Automotive Landscape

Apr 27, 2025 -

Navigating The Complexities The China Market And Its Impact On Luxury Car Brands Like Bmw And Porsche

Apr 27, 2025

Navigating The Complexities The China Market And Its Impact On Luxury Car Brands Like Bmw And Porsche

Apr 27, 2025 -

China Market Slowdown Impact On Bmw Porsche And Other Automakers

Apr 27, 2025

China Market Slowdown Impact On Bmw Porsche And Other Automakers

Apr 27, 2025