BofA's Take: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's analysts employ several key valuation metrics to assess the current market's health. These include the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other proprietary models. While specific data points from BofA's internal reports are proprietary and not publicly available in their entirety, their public commentary generally reflects a cautious outlook.

- Key valuation metrics used by BofA: P/E ratio, Shiller PE, dividend yield, and various growth-based metrics.

- Comparison of current valuations to historical averages: BofA's analysis often compares current valuations to historical averages, identifying whether current levels are significantly above or below long-term trends. This comparison provides context for understanding whether valuations are truly elevated.

- BofA's assessment of whether valuations are overextended: Depending on the specific report and time period, BofA's assessment may vary. However, they consistently highlight the need for caution when valuations deviate significantly from historical norms. This suggests a need for investors to carefully consider risk tolerance and diversification strategies.

Factors Contributing to High Stock Market Valuations

Several factors have contributed to the high stock market valuations we're currently witnessing. Understanding these dynamics is crucial for interpreting BofA's assessment and making informed investment decisions.

- Impact of low interest rates on stock valuations: Historically low interest rates have made bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand has helped inflate stock prices.

- Role of quantitative easing in inflating asset prices: Central banks' quantitative easing programs injected massive liquidity into the market, further boosting asset prices, including stocks.

- Influence of strong corporate earnings on market sentiment: Positive corporate earnings reports and strong future earnings expectations have contributed to higher stock prices. Investor confidence in corporate profitability plays a significant role.

- Analysis of investor behavior and speculation: Increased investor optimism and speculation can lead to higher valuations, particularly in growth-oriented sectors.

Potential Risks Associated with High Valuations

While a robust economy and strong corporate performance support high valuations, there are inherent risks:

- Increased risk of market volatility: High valuations often lead to increased market volatility, meaning sharp price swings are more likely. This can create challenges for investors who need liquidity.

- Potential for significant capital losses: If valuations correct sharply, investors could experience substantial capital losses. This highlights the need for careful risk management.

- Impact on different investment strategies (e.g., value vs. growth): High valuations disproportionately affect growth stocks, which may be more susceptible to corrections than value stocks.

- Considerations for risk-averse investors: Risk-averse investors may want to consider reducing their equity exposure or increasing diversification.

Opportunities Despite High Valuations

High valuations don't necessarily signal an impending market crash. Opportunities may still exist:

- Strategies for mitigating risk in a high-valuation market (e.g., diversification, value investing): Diversification across asset classes and focusing on undervalued companies can help mitigate the risks of a market correction.

- Sectors or industries potentially less susceptible to valuation corrections: Some sectors may be less sensitive to overall market valuations. Thorough research is essential to identify these opportunities.

- Importance of long-term investment strategies: A long-term investment horizon can help investors ride out short-term market fluctuations and benefit from long-term growth.

Conclusion

BofA's analysis suggests that while high stock market valuations present risks, they don't automatically equate to an impending market crash. The bank emphasizes the need for careful consideration of various valuation metrics, a thorough understanding of contributing economic factors, and the implementation of robust risk management strategies. Understanding high stock market valuations is crucial for informed investment decisions. Use BofA's insights to inform your own research and develop a robust investment strategy that aligns with your risk tolerance and financial goals. Careful assessment of high stock market valuations is key to navigating the current market landscape successfully.

Featured Posts

-

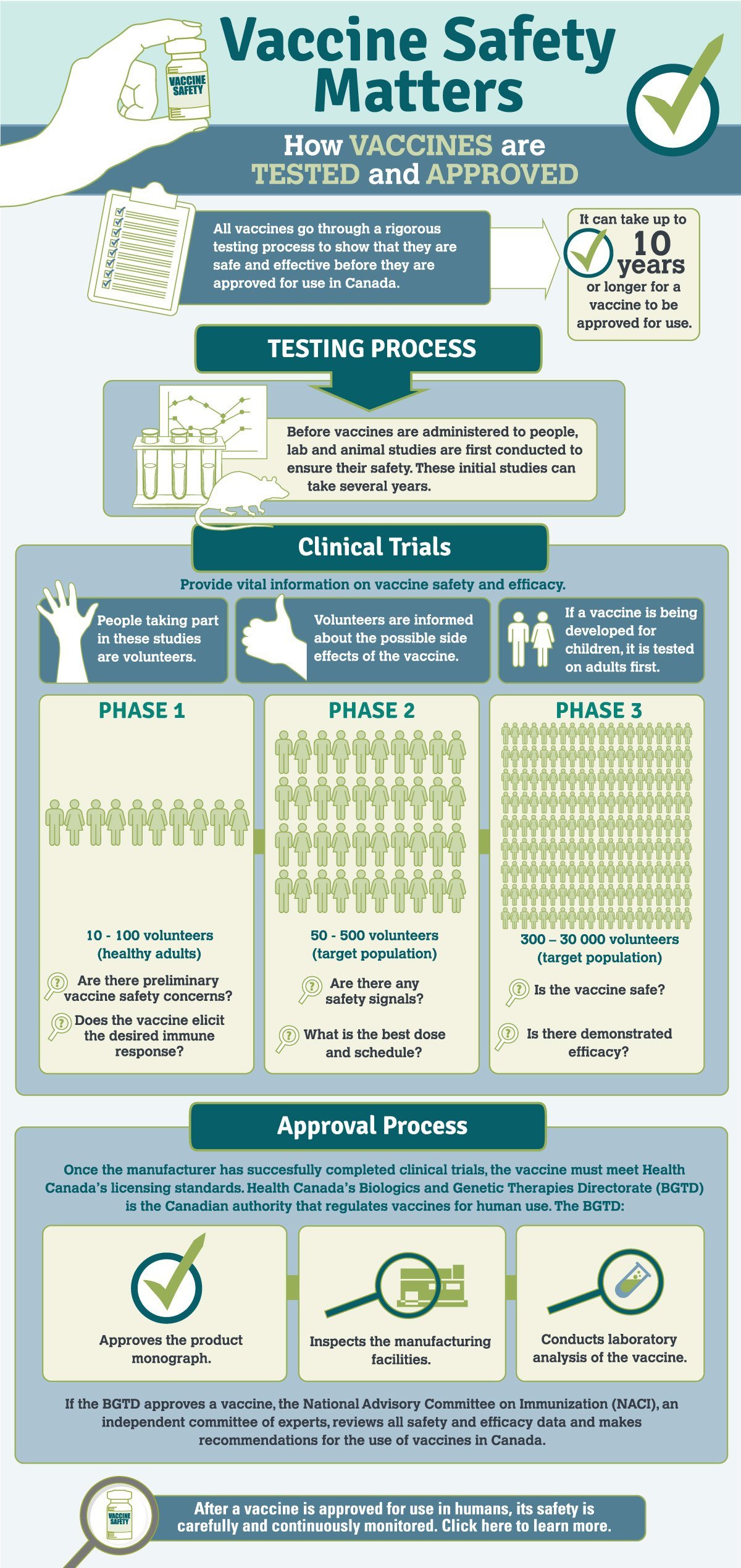

Controversial Hhs Decision Anti Vaccine Advocate To Examine Autism Vaccine Claims

Apr 27, 2025

Controversial Hhs Decision Anti Vaccine Advocate To Examine Autism Vaccine Claims

Apr 27, 2025 -

Bundestag Elections And Key Business Figures Their Effects On The Dax Index

Apr 27, 2025

Bundestag Elections And Key Business Figures Their Effects On The Dax Index

Apr 27, 2025 -

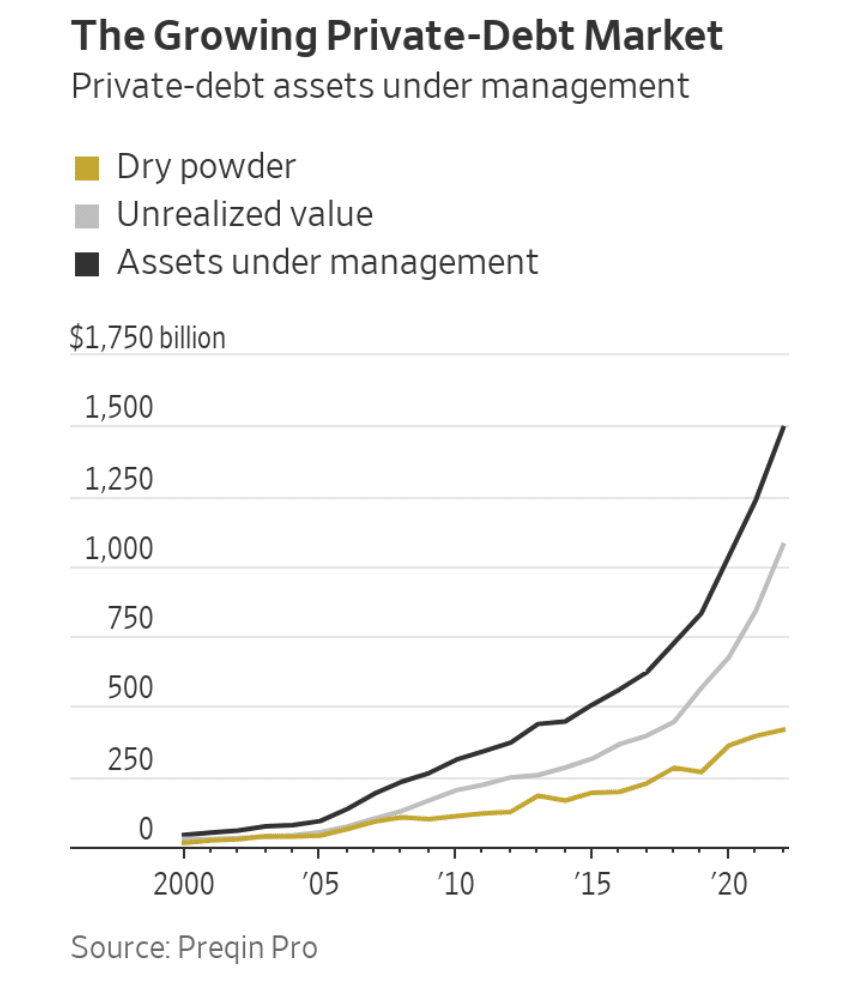

Analysis Of Private Credit Market Vulnerabilities Credit Weekly Update

Apr 27, 2025

Analysis Of Private Credit Market Vulnerabilities Credit Weekly Update

Apr 27, 2025 -

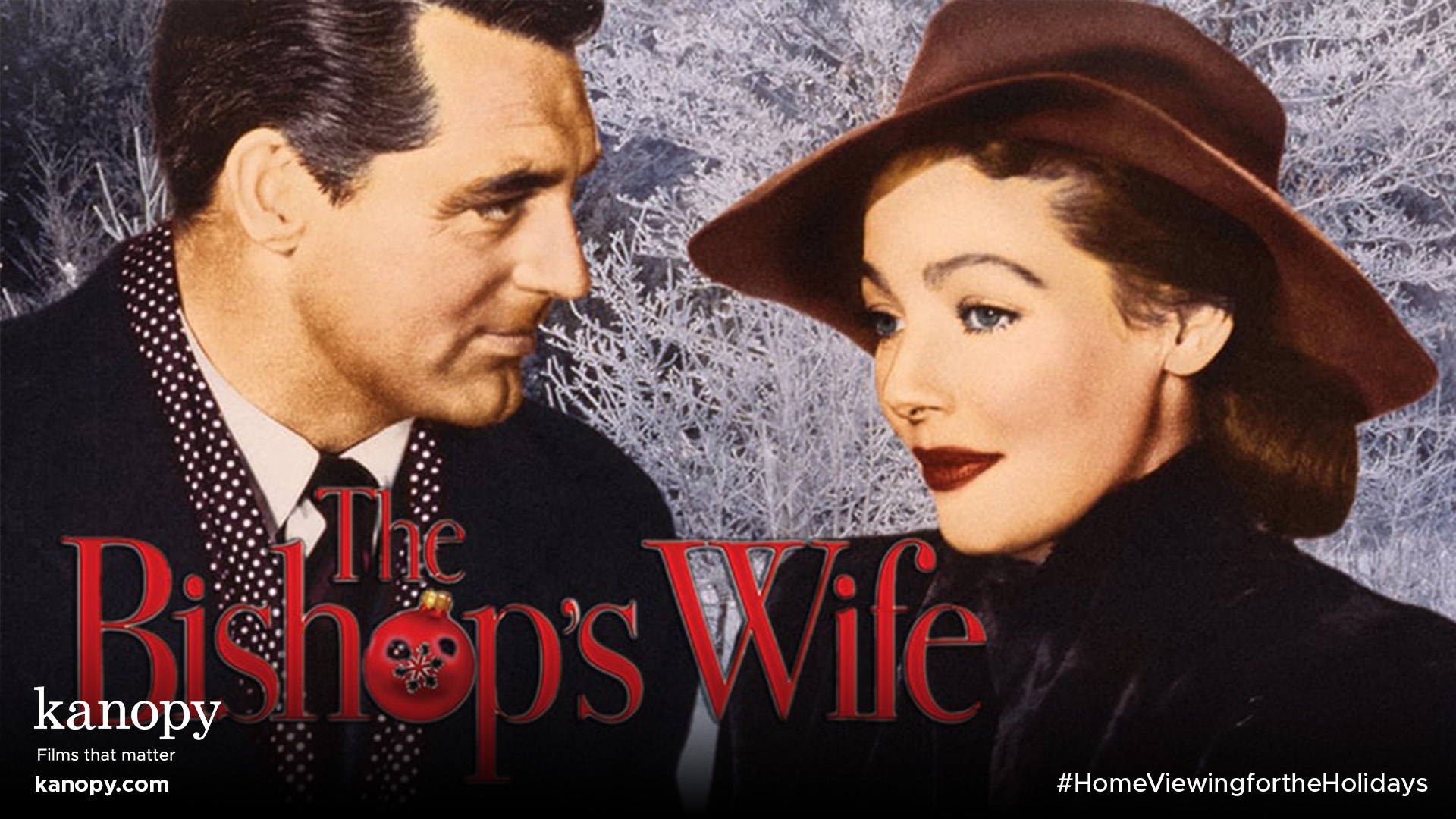

Discover Great Movies And Shows Free Streaming On Kanopy

Apr 27, 2025

Discover Great Movies And Shows Free Streaming On Kanopy

Apr 27, 2025 -

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025

Latest Posts

-

Auto Dealerships Intensify Opposition To Electric Vehicle Regulations

Apr 28, 2025

Auto Dealerships Intensify Opposition To Electric Vehicle Regulations

Apr 28, 2025 -

Dealers Double Down Opposition To Electric Vehicle Mandates Intensifies

Apr 28, 2025

Dealers Double Down Opposition To Electric Vehicle Mandates Intensifies

Apr 28, 2025 -

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025