Stock Market Valuations: Why BofA Says Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Economic Growth

BofA's main argument rests on the foundation of robust corporate earnings and sustained economic growth. They contend that current valuations are justified by the strong performance of many companies.

-

Strong Earnings Growth Across Sectors: Several key sectors are experiencing significant earnings growth, including technology, healthcare, and consumer discretionary. These sectors are benefiting from technological advancements, increased consumer spending, and a generally positive economic environment.

-

Positive Earnings Growth Projections: BofA's analysts project continued earnings growth in the coming years, driven by factors like innovation, expanding global markets, and ongoing economic expansion. This positive outlook contributes to their belief that current valuations are sustainable.

-

Positive Economic Indicators Fueling Growth: Positive economic indicators, such as steady GDP growth and low unemployment rates, point towards a healthy economic environment. This strong economic backdrop supports corporate profitability and, consequently, justifies higher stock prices. The positive economic outlook, coupled with strong corporate profits, is a significant factor in BofA's assessment of stock market valuations.

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

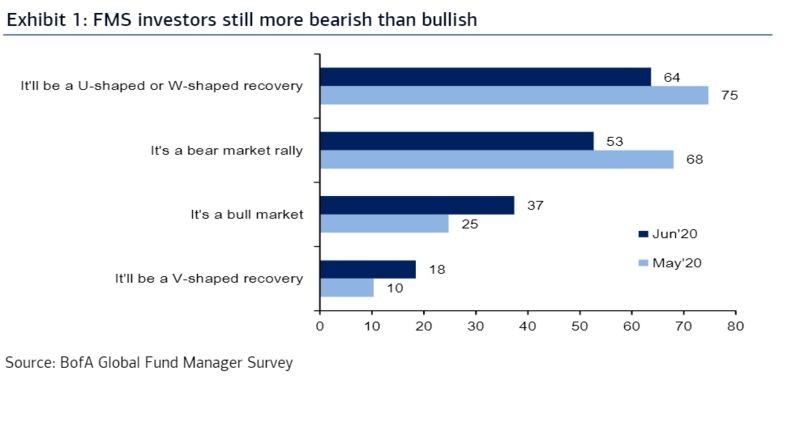

High P/E ratios are often cited as a warning sign of overvaluation. However, BofA's analysis suggests a more nuanced perspective.

-

Low Interest Rates Support Higher Valuations: The current low-interest-rate environment plays a significant role. When interest rates are low, the opportunity cost of investing in stocks is reduced, allowing for higher valuations. Investors are less inclined to seek safer, lower-yielding investments when interest rates are low.

-

Beyond P/E: A Broader Valuation Perspective: While P/E ratios are important, BofA likely considers other valuation metrics as well. Metrics like the price-to-sales ratio and dividend yield provide a more comprehensive picture. A strong dividend yield, for example, can offset concerns about a high P/E ratio. Analyzing the interest rate environment in conjunction with other metrics like the price-to-sales ratio is vital to a complete understanding.

-

Innovation Driving Higher Valuations: Technological advancements and innovation in certain sectors justify higher valuations. Companies pioneering disruptive technologies often command premium valuations due to their high growth potential. This is particularly true in the technology sector, where high valuations often reflect future growth prospects rather than current earnings.

Long-Term Investment Strategies: Why a Long-Term Perspective is Crucial

BofA likely emphasizes the importance of adopting a long-term investment strategy when navigating market fluctuations.

-

Historical Market Performance and Volatility: The stock market has historically delivered strong returns over the long term, despite experiencing short-term volatility. Understanding market volatility and adopting a long-term investing approach helps mitigate the impact of short-term market fluctuations. Investors with a higher risk tolerance might be more inclined to take on potentially higher-risk investments with higher growth potential.

-

Dollar-Cost Averaging and Other Strategies: Strategies like dollar-cost averaging, where investors invest a fixed amount at regular intervals, help mitigate the risk of investing a lump sum at a market peak. Other long-term strategies, such as diversification and rebalancing, further enhance risk management and optimize portfolio performance.

-

Risk Management and Diversification: Proper risk management involves diversifying your investments across different asset classes and sectors to reduce the overall portfolio risk. A well-diversified portfolio can help cushion the impact of losses in any single asset class and ensure long-term investment growth.

Conclusion: Understanding Stock Market Valuations and Making Informed Decisions

BofA's analysis suggests that while high stock market valuations are a valid concern, they are not necessarily a cause for immediate alarm. Strong corporate earnings, a positive economic outlook, and the current low-interest-rate environment offer a counter-argument. However, the importance of a long-term investment perspective cannot be overstated. Understanding stock market valuations requires careful consideration of multiple factors, including earnings growth, economic indicators, interest rates, and various valuation metrics. Assess your own risk tolerance, conduct thorough research, and make informed investment decisions based on your financial goals and time horizon. The potential for long-term growth in the stock market remains significant, even in the face of seemingly high valuations. Remember to regularly reassess your investment strategy and adjust it as needed to maintain alignment with your risk tolerance and financial objectives.

Featured Posts

-

Celebrities And Professional Help Ariana Grandes Hair And Tattoo Journey

Apr 27, 2025

Celebrities And Professional Help Ariana Grandes Hair And Tattoo Journey

Apr 27, 2025 -

Mubadala Abu Dhabi Open Rybakina Wins Close Battle Against Jabeur

Apr 27, 2025

Mubadala Abu Dhabi Open Rybakina Wins Close Battle Against Jabeur

Apr 27, 2025 -

Hhs And The Controversial Autism Vaccine Link Investigation

Apr 27, 2025

Hhs And The Controversial Autism Vaccine Link Investigation

Apr 27, 2025 -

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Reaction

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Reaction

Apr 27, 2025 -

Stock Market Valuation Concerns Bof A Offers A Different Perspective

Apr 27, 2025

Stock Market Valuation Concerns Bof A Offers A Different Perspective

Apr 27, 2025

Latest Posts

-

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025 -

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025