China Market Slowdown: Impact On BMW, Porsche, And Other Automakers

Table of Contents

Declining Sales Figures and Market Share Erosion

The China market slowdown is undeniably impacting sales figures for luxury car brands. Both BMW and Porsche have reported significant declines in sales compared to previous years. This translates to a concerning erosion of market share, not only to other international competitors but also, and perhaps more significantly, to rapidly growing domestic Chinese brands.

- Specific Sales Declines: While precise figures fluctuate, reports indicate double-digit percentage drops in year-over-year sales for BMW and Porsche in China. This isn't an isolated incident; many other luxury brands are experiencing similar trends.

- Market Share Loss: The loss of market share is a critical concern. Chinese consumers, once enamored with foreign luxury brands, are increasingly opting for domestic alternatives offering comparable quality and features at potentially more competitive price points.

- Reduced Consumer Confidence: Weakening consumer confidence and decreased purchasing power play a significant role. Economic uncertainty makes consumers hesitant to spend on luxury goods.

- Increased Domestic Competition: The rise of competitive Chinese luxury brands like Hongqi, Li Xiang and Geely is a major factor. These brands are aggressively targeting the luxury market with sophisticated vehicles and marketing campaigns.

Economic Factors Fueling the Slowdown

The China market slowdown is intrinsically linked to broader economic factors. A slowdown in GDP growth directly impacts consumer spending, particularly on discretionary items like luxury cars.

- Slowing GDP Growth: China's economic growth has slowed in recent years, impacting consumer spending across the board. This decline has a disproportionate effect on luxury goods, which are often the first to be cut from budgets during economic uncertainty.

- Inflation and Rising Living Costs: Increased inflation and the rising cost of living are squeezing household budgets. Consumers are prioritizing essential spending, leaving less room for luxury purchases.

- Real Estate Market Woes: The struggling Chinese real estate market has a significant impact on consumer sentiment and overall economic confidence. A shaky property market often signals broader economic instability, influencing purchasing decisions.

- Geopolitical Risks: Global geopolitical uncertainties and trade tensions add to the overall economic uncertainty, further dampening consumer confidence and impacting investment in the automotive sector.

Supply Chain Disruptions and Production Challenges

Adding to the challenges, supply chain disruptions continue to hamper production and sales. The global semiconductor chip shortage remains a major obstacle for automakers worldwide, including those operating in China.

- Chip Shortage Impact: The ongoing chip shortage directly limits the production capacity of luxury automakers, leading to delays in vehicle deliveries and reduced availability.

- Logistical Challenges: Port congestion and logistical bottlenecks further exacerbate the issue, delaying the delivery of essential parts and components.

- Raw Material Costs: Rising costs for raw materials, including steel and aluminum, increase vehicle production costs, impacting profitability and potentially pricing.

- Production Delays and Sales Impact: Production delays directly translate into lower sales figures and impact revenue projections for luxury automakers.

The Rise of Electric Vehicles (EVs) and its Implications

The rapid growth of the Chinese EV market presents both opportunities and challenges. Domestic EV brands like Tesla, NIO, and Xpeng are rapidly gaining market share, putting pressure on established players.

- Chinese EV Market Boom: The Chinese EV market is experiencing explosive growth, driven by government incentives and increasing consumer demand for sustainable transportation.

- Transition Challenges for BMW and Porsche: BMW and Porsche face the challenge of transitioning to electric vehicles while competing with established Chinese EV brands that have a head start in the market and are deeply embedded in the local ecosystem.

- Government Incentives: Government incentives for EV adoption in China are significantly impacting market dynamics, favoring domestic brands and making it crucial for international automakers to adapt.

Strategies for Adaptation and Future Outlook

To navigate the China market slowdown, luxury automakers like BMW and Porsche are employing various strategies. A key focus is on adaptation and diversification.

- Product Diversification & Price Adjustments: Focusing on specific models that resonate with Chinese preferences and adjusting pricing strategies to remain competitive are vital.

- Localization Efforts: Tailoring products and marketing to Chinese consumer preferences and cultural nuances through localization is crucial for success.

- Investment in New Technologies: Investment in new technologies, including EV development and autonomous driving features, is key to maintaining competitiveness.

- Future Outlook: The outlook for the Chinese automotive market remains complex. While challenges persist, strategic adaptation and a focus on the burgeoning EV market offer potential for long-term success.

Conclusion

The China market slowdown poses a substantial challenge to luxury automakers like BMW and Porsche. Declining sales, economic headwinds, supply chain disruptions, and the rise of EVs are all intertwined factors. However, strategic adaptation, including localization, investment in new technologies, and a focus on the EV market, will be crucial for these brands to maintain a strong presence and achieve long-term success in this crucial market. Understanding the nuances of the China market slowdown is paramount for any business in the automotive sector. Stay updated on the latest developments and adapt your strategies to navigate this dynamic landscape and thrive in the evolving China market.

Featured Posts

-

New Hair New Tattoos Ariana Grandes Style Evolution And The Role Of Professional Stylists

Apr 27, 2025

New Hair New Tattoos Ariana Grandes Style Evolution And The Role Of Professional Stylists

Apr 27, 2025 -

Eo W Complaint Filed Pfc Alleges Gensol Engineering Used Falsified Documents

Apr 27, 2025

Eo W Complaint Filed Pfc Alleges Gensol Engineering Used Falsified Documents

Apr 27, 2025 -

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025 -

Pfc Dividend 2025 Expected Cash Reward Announcement Date Confirmed For March 12th

Apr 27, 2025

Pfc Dividend 2025 Expected Cash Reward Announcement Date Confirmed For March 12th

Apr 27, 2025 -

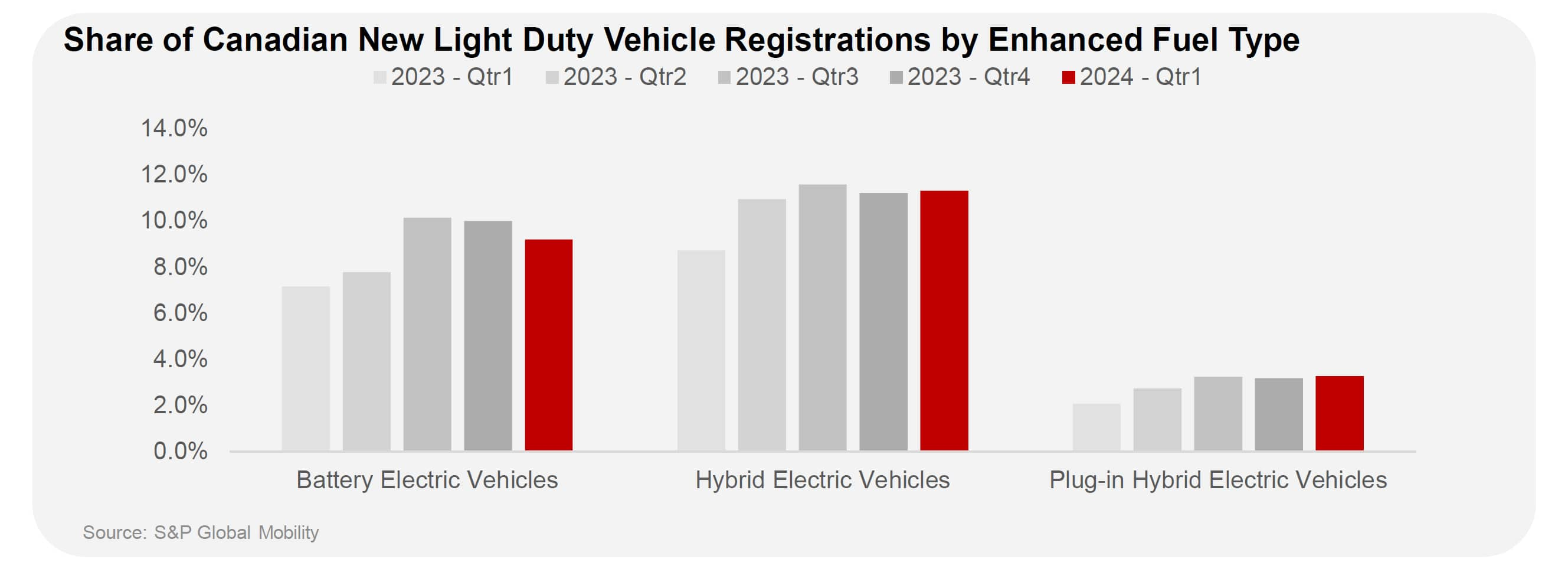

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025

Latest Posts

-

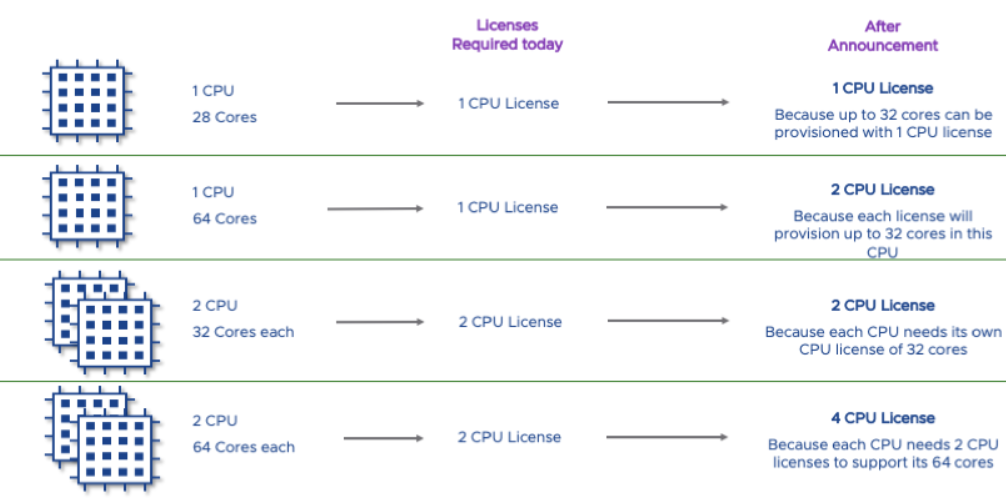

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025 -

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025