Dow Jones's Gradual Rise: Positive PMI Data Offers Support

Table of Contents

Understanding the Positive PMI Data

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers in various sectors, primarily manufacturing and services. A PMI reading above 50 generally signals expansion in the sector, while a reading below 50 indicates contraction. Recent PMI readings have been consistently positive, painting a picture of robust economic activity.

- Specific PMI Numbers: The Institute for Supply Management (ISM) reported a manufacturing PMI of 52.8 in July 2024 (example data - replace with current data), and a services PMI of 54.2 (example data - replace with current data), both indicating expansion in these crucial sectors of the US economy. Similar positive trends have been observed in several global PMIs.

- Interpretation of Numbers: These numbers suggest that businesses are experiencing increased demand, leading to higher production levels and overall economic growth. This positive sentiment is a powerful driver of investor confidence.

- Geographic Focus: While US PMI data is closely watched, global PMI readings also provide a broader picture of the overall economic health. Positive global PMI figures indicate strength across international markets, further boosting investor sentiment and impacting the Dow Jones.

Positive PMI readings translate directly to increased business activity and investor confidence. When businesses report strong orders and higher production levels, investors see this as a sign of robust economic health, leading them to invest more aggressively in the stock market. This increased investment demand contributes directly to the upward trend in the Dow Jones.

The Dow Jones's Reaction to Positive Economic Indicators

A strong correlation exists between positive PMI data and the performance of the Dow Jones Industrial Average. Positive PMI readings often precede upward movements in the Dow, indicating that investors anticipate continued economic growth.

- Examples of Dow Jones Movements: For example, (insert example data correlating Dow Jones movement with PMI release. Be specific about dates and percentage changes). This illustrates the immediate and significant impact of positive PMI data on the Dow.

- Other Economic Indicators: While PMI is a significant factor, other economic indicators also influence the Dow. Employment data, inflation rates, and consumer confidence all play important roles in shaping investor sentiment. A combination of positive signals across multiple economic indicators generally leads to a more substantial and sustained increase in the Dow.

- Market Psychology: Market psychology plays a crucial role in amplifying or dampening the effect of PMI data. Periods of high uncertainty or fear can lessen the positive impact of even strong PMI numbers. Conversely, in times of optimism, positive PMI data can lead to significant market rallies.

Other Factors Contributing to the Dow Jones's Rise

It is crucial to understand that the Dow's rise isn't solely attributable to PMI data. Several other factors contribute to this upward trend.

- Corporate Earnings Reports: Strong corporate earnings reports demonstrate the financial health of individual companies, boosting overall market confidence. Positive earnings announcements often lead to increased stock prices and a rising Dow.

- Interest Rate Decisions: The Federal Reserve's interest rate decisions play a vital role. Low or stable interest rates typically encourage borrowing and investment, leading to economic growth and a positive impact on the Dow.

- Geopolitical Events: Global geopolitical events can significantly impact investor sentiment. Periods of relative stability and reduced geopolitical risk often correlate with a more positive market outlook and rising Dow.

These factors, in conjunction with positive PMI data, create a powerful synergy that drives the Dow Jones's gradual rise.

Potential Risks and Future Outlook for the Dow Jones

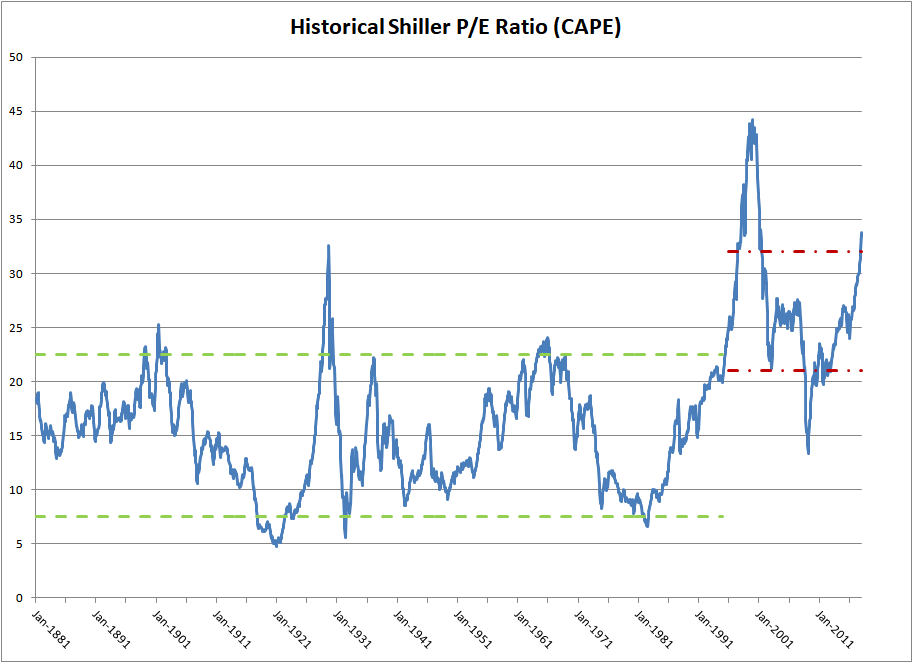

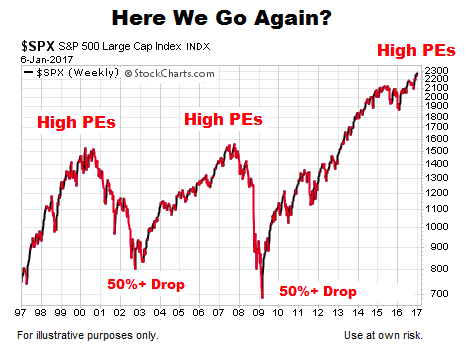

While the current trend is positive, it's important to consider potential risks that could affect the continued upward trajectory of the Dow.

- Potential Threats to Economic Growth: Rising inflation, a potential recession, or supply chain disruptions could negatively impact business activity and investor sentiment, leading to a downturn in the Dow.

- Shifts in Investor Sentiment: Changes in investor confidence, driven by unforeseen events or a change in economic outlook, can quickly reverse market trends.

- Geopolitical Uncertainty: Escalation of geopolitical tensions or unexpected international crises could introduce volatility and negatively impact the Dow.

These potential risks highlight the need to continually monitor economic indicators and geopolitical developments to accurately assess the future outlook for the Dow Jones.

Dow Jones's Gradual Rise: A Positive Outlook Supported by PMI Data

In summary, the Dow Jones's gradual rise is demonstrably linked to positive PMI data, reflecting robust economic activity and investor confidence. However, other economic indicators and geopolitical factors also contribute significantly to market movements. Monitoring PMI data alongside other key economic indicators is crucial for understanding and predicting future market trends. Stay updated on the latest PMI releases and Dow Jones performance to capitalize on the opportunities presented by this gradual rise. Understanding the interplay between positive PMI data and the Dow Jones's movement is crucial for navigating the market effectively.

Featured Posts

-

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025 -

Police Helicopter Pursuit High Speed Refueling And Texting

May 24, 2025

Police Helicopter Pursuit High Speed Refueling And Texting

May 24, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivoe Chislo Brakov

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivoe Chislo Brakov

May 24, 2025

Latest Posts

-

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025