DAX Remains Steady: Frankfurt Stock Market Opens

Table of Contents

Key Factors Influencing DAX Stability

Several interconnected factors contribute to the DAX's current stability. Understanding these elements is crucial for investors navigating the German stock market.

Global Economic Outlook

The global economic climate significantly impacts the DAX. Current trends, while exhibiting some fragility, haven't triggered widespread panic selling.

- Inflation Rates: While inflation remains a concern in major economies, recent data suggests a potential slowing of the rate of increase, easing some pressure on central banks. This less aggressive inflation, compared to previous months, has had a positive, albeit cautious, effect on investor sentiment.

- Interest Rate Decisions: The European Central Bank (ECB)'s recent interest rate decisions, while still aiming to curb inflation, have been perceived as less hawkish than anticipated by some analysts. This less aggressive approach helps avoid unduly impacting economic growth.

- Geopolitical Events: Ongoing geopolitical instability continues to cast a shadow, but its immediate impact on the DAX seems to be contained for now. However, any significant escalation could easily disrupt this stability.

Performance of Key DAX Companies

The performance of individual DAX-listed companies plays a vital role in the overall index movement. Today, many key players showed resilience.

- Volkswagen: Volkswagen's stock price held steady, boosted by positive news regarding its electric vehicle (EV) strategy and continued strong sales figures.

- Siemens: Siemens, a major industrial conglomerate, saw only minor fluctuations, reflecting confidence in its long-term prospects.

- Allianz: Allianz, a leading insurance company, experienced a slight increase, indicating continued investor trust despite ongoing market uncertainties. These companies represent significant portions of the DAX's weight, making their performance crucial to the index's overall stability.

Eurozone Economic Data

Recent economic data releases from the Eurozone have contributed to the relatively calm market conditions. Positive indicators ease investor concerns.

- Unemployment Figures: Unemployment in the Eurozone remains relatively low, indicating a robust labor market and supporting consumer confidence.

- Inflation Data: As mentioned, although inflation remains elevated, signs of moderation offer some relief to market participants.

- GDP Growth Projections: While growth forecasts are still subject to revision, current projections suggest continued, albeit modest, expansion in the Eurozone economy, further underpinning the DAX’s stability.

Trading Activity and Volume

This morning's trading activity on the Frankfurt Stock Exchange reveals a relatively subdued market.

- Trading Volume: Trading volume is slightly below recent averages, suggesting a degree of caution among investors. This lower volume might indicate a wait-and-see approach before making significant trades.

- Unusual Patterns: No significant unusual trading patterns have been observed, indicating a lack of widespread panic selling or aggressive buying. This relatively calm trading activity supports the DAX's steady opening.

Expert Opinions and Market Sentiment

Financial analysts offer varied perspectives on the DAX's current state and future prospects.

- Positive Outlook: Several analysts highlight the resilience of German companies and the potential for further growth, particularly in sectors like renewable energy and technology.

- Cautious Optimism: Others express cautious optimism, emphasizing the lingering risks associated with inflation, geopolitical instability, and potential economic slowdowns.

- Market Sentiment: Overall market sentiment appears to be cautiously optimistic, with investors awaiting further economic data and corporate announcements before making significant moves.

Conclusion

The DAX's steady opening at the Frankfurt Stock Exchange today reflects a complex interplay of factors. The relatively stable global economic outlook, positive performance of key DAX companies, and encouraging Eurozone economic data have all contributed to this calm start. While subdued trading volumes suggest a degree of investor caution, the absence of significant negative news and a cautiously optimistic market sentiment suggests continued stability, at least for the near term. However, continued monitoring of global economic trends and key company performances remains crucial for understanding the future trajectory of the DAX. Stay informed about the DAX and other key indices affecting the German and European economies. Continue to monitor the Frankfurt Stock Exchange for updates and analysis on the DAX index and the overall market performance. For more in-depth insights into the DAX and German stock market trends, visit [link to relevant resource].

Featured Posts

-

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 25, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 25, 2025 -

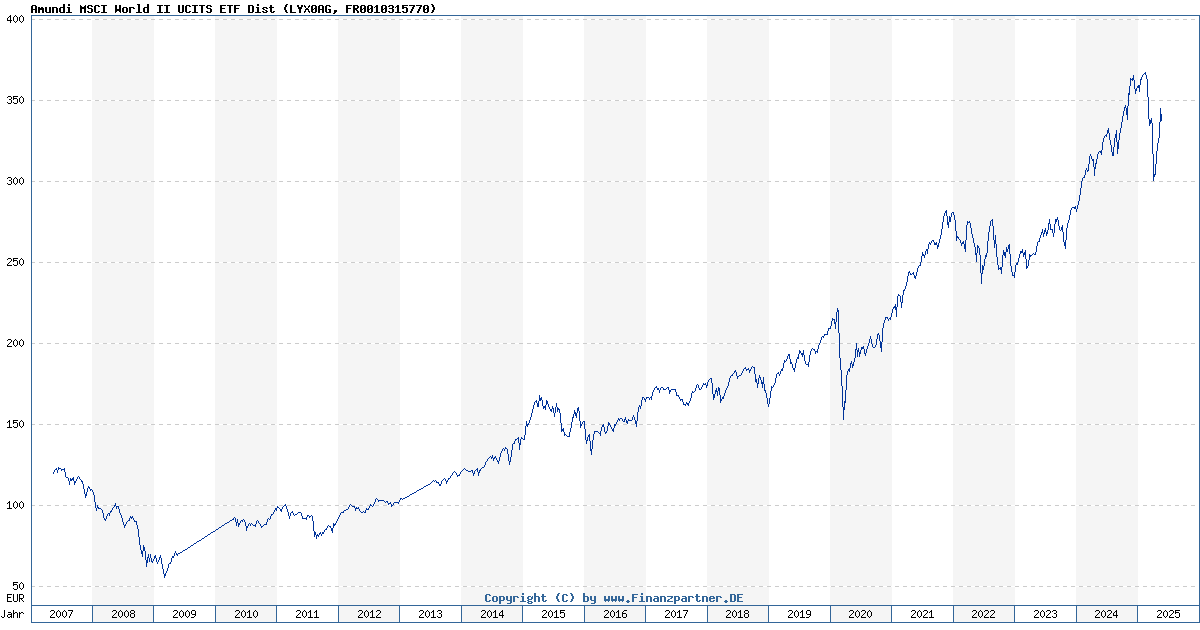

Amundi Msci World Ii Ucits Etf Dist Net Asset Value Nav Explained

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Net Asset Value Nav Explained

May 25, 2025 -

Investing In Amundi Msci All Country World Ucits Etf Usd Acc A Nav Perspective

May 25, 2025

Investing In Amundi Msci All Country World Ucits Etf Usd Acc A Nav Perspective

May 25, 2025 -

Labubu Porsche Now

May 25, 2025

Labubu Porsche Now

May 25, 2025 -

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

Latest Posts

-

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025 -

Apple Stock Under Pressure Q2 Earnings Report Looms

May 25, 2025

Apple Stock Under Pressure Q2 Earnings Report Looms

May 25, 2025 -

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 25, 2025

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 25, 2025 -

Apple Stock And Trump Tariffs A Retrospective Analysis

May 25, 2025

Apple Stock And Trump Tariffs A Retrospective Analysis

May 25, 2025 -

Apple Stock Aapl Price Targets Key Levels To Watch

May 25, 2025

Apple Stock Aapl Price Targets Key Levels To Watch

May 25, 2025