Apple Stock And Trump Tariffs: A Retrospective Analysis

Table of Contents

The Impact of Tariffs on Apple's Supply Chain

The Trump administration's tariffs, particularly those targeting Chinese imports, significantly impacted Apple's intricate global supply chain. The increased costs and logistical disruptions posed considerable challenges to the tech giant.

Increased Production Costs

Tariffs on imported components drastically increased Apple's manufacturing expenses. Many crucial components for Apple products, such as:

- Displays: LCD and OLED screens sourced primarily from Asian manufacturers faced significant tariff increases.

- Processors: Chips from foundries in Taiwan and other regions were also subject to tariffs.

- Other components: Various other parts, including memory chips, cameras, and other electronics, experienced price increases due to tariffs.

These increased costs were substantial. While precise figures remain largely internal to Apple, analysts estimated considerable increases in the cost of goods sold (COGS), potentially impacting profit margins. To offset these rising costs, Apple engaged in extensive sourcing diversification, seeking alternative suppliers in regions unaffected by tariffs.

Disruptions to Global Manufacturing

The tariffs introduced significant disruptions to Apple's carefully orchestrated global manufacturing network.

- Manufacturing Locations: The concentration of Apple's manufacturing in China made it particularly vulnerable.

- Production Shifts: Apple explored options to diversify its manufacturing base, including increased production in other countries like India and Vietnam. However, these shifts took time and significant investment.

- Geopolitical Risks: The trade war highlighted the inherent geopolitical risks associated with concentrating manufacturing in a single region.

These logistical challenges resulted in potential production delays and increased uncertainty for Apple's operations.

Consumer Price Impacts

While Apple absorbed some of the increased costs, the tariffs likely contributed to higher prices for some Apple products.

- Pricing Changes: Although not explicitly stated as tariff-driven, some price increases coincided with the imposition of tariffs.

- Sales Figures: While Apple's overall sales remained strong, analysts debated whether the price increases impacted consumer demand.

- Competitive Landscape: The price increases may have also altered Apple's competitive position, potentially benefiting competitors offering more affordable alternatives.

Market Reactions to Tariff Announcements and Implementations

The announcement and implementation of Trump-era tariffs caused significant volatility in Apple's stock price.

Short-Term Stock Volatility

Major tariff announcements frequently triggered immediate reactions in the stock market.

- Specific Dates: Tracking Apple's stock price around key tariff announcement dates reveals noticeable fluctuations. For instance, the announcement of tariffs on certain Chinese goods often led to short-term declines in Apple's stock.

- Stock Price Movements: These movements reflected investor uncertainty and concerns about the potential negative impact on Apple's profits and supply chain.

- Charts/Graphs: Visual representations of these stock price movements, comparing them to tariff announcements, would provide compelling evidence.

Investor Sentiment and Confidence

Tariffs negatively impacted investor confidence in Apple.

- Investor Reports: Many investor reports discussed the uncertainty surrounding the tariffs and their potential long-term effects on Apple's business.

- Credit Ratings: While Apple maintained a strong credit rating, the tariffs may have introduced some downward pressure.

- Analyst Predictions: Analyst predictions for Apple's future earnings were often adjusted to account for the potential impact of tariffs.

Long-Term Stock Performance

The long-term impact of Trump tariffs on Apple's stock price is a subject of ongoing debate.

- Performance Comparison: Analyzing Apple's stock performance before, during, and after the tariff period, using metrics like year-over-year growth and return on equity, can provide insights.

- Financial Metrics: Examining other relevant financial data, such as revenue, profit margins, and earnings per share, can offer a more comprehensive understanding of the tariffs' impact.

Apple's Strategic Responses to the Tariffs

Apple adopted various strategies to mitigate the negative consequences of the tariffs.

Lobbying and Political Engagement

Apple actively engaged in political processes to influence trade policy.

- Public Statements: Apple issued public statements expressing concerns about the tariffs and advocating for more predictable trade relations.

- Industry Coalitions: The company likely participated in industry coalitions to lobby against protectionist measures.

- Government Engagement: Apple likely engaged with government officials to express its concerns and advocate for its interests.

Supply Chain Diversification

Diversifying its manufacturing base was a crucial strategic response.

- New Manufacturing Locations: Apple invested significantly in expanding its manufacturing presence in countries like India and Vietnam.

- Supplier Partnerships: The company forged new partnerships with suppliers in diverse geographical locations.

- Investments in Automation: Apple also likely invested in automation to reduce its reliance on labor-intensive manufacturing processes.

Pricing Strategies and Cost Management

Apple implemented various cost-cutting measures and adjusted its pricing strategies.

- Cost Reduction Strategies: These strategies likely included streamlining operations, negotiating better terms with suppliers, and optimizing product designs.

- Product Design Changes: Certain product designs may have been altered to reduce the reliance on tariff-affected components.

Conclusion: Key Takeaways and Call to Action

This analysis reveals a complex interplay between Apple Stock and Trump Tariffs. While the tariffs did not cause a catastrophic collapse in Apple's stock price, they undeniably created significant challenges, leading to increased production costs, supply chain disruptions, and investor uncertainty. Apple's strategic responses, including supply chain diversification and political engagement, mitigated some of the negative impacts. However, the experience highlighted the vulnerability of global tech companies to unpredictable trade policies. To further your understanding of the complex relationship between global trade and the tech industry, explore other case studies examining the impact of trade policies on Apple stock and other tech giants. [Link to relevant resource]

Featured Posts

-

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 25, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 25, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025 -

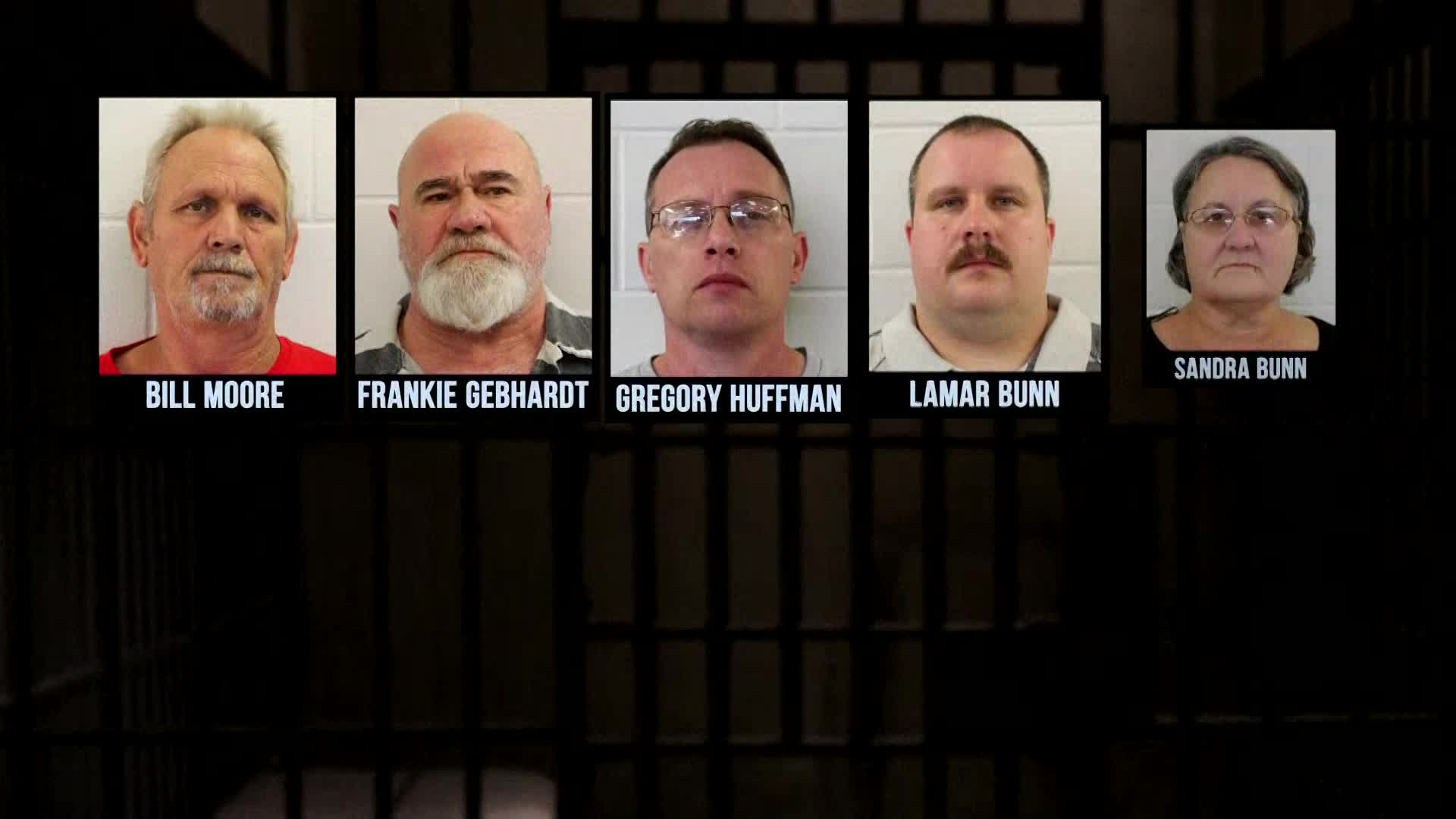

Georgia Cold Case Solved Man Charged After 19 Years In Wifes Murder

May 25, 2025

Georgia Cold Case Solved Man Charged After 19 Years In Wifes Murder

May 25, 2025 -

Presidential Seal Vetting Scrutiny Expensive Watches And Marriott Events Raise Questions

May 25, 2025

Presidential Seal Vetting Scrutiny Expensive Watches And Marriott Events Raise Questions

May 25, 2025 -

Ae Xplore England Airpark And Alexandria International Airports Initiative For Local And Global Travel

May 25, 2025

Ae Xplore England Airpark And Alexandria International Airports Initiative For Local And Global Travel

May 25, 2025

Latest Posts

-

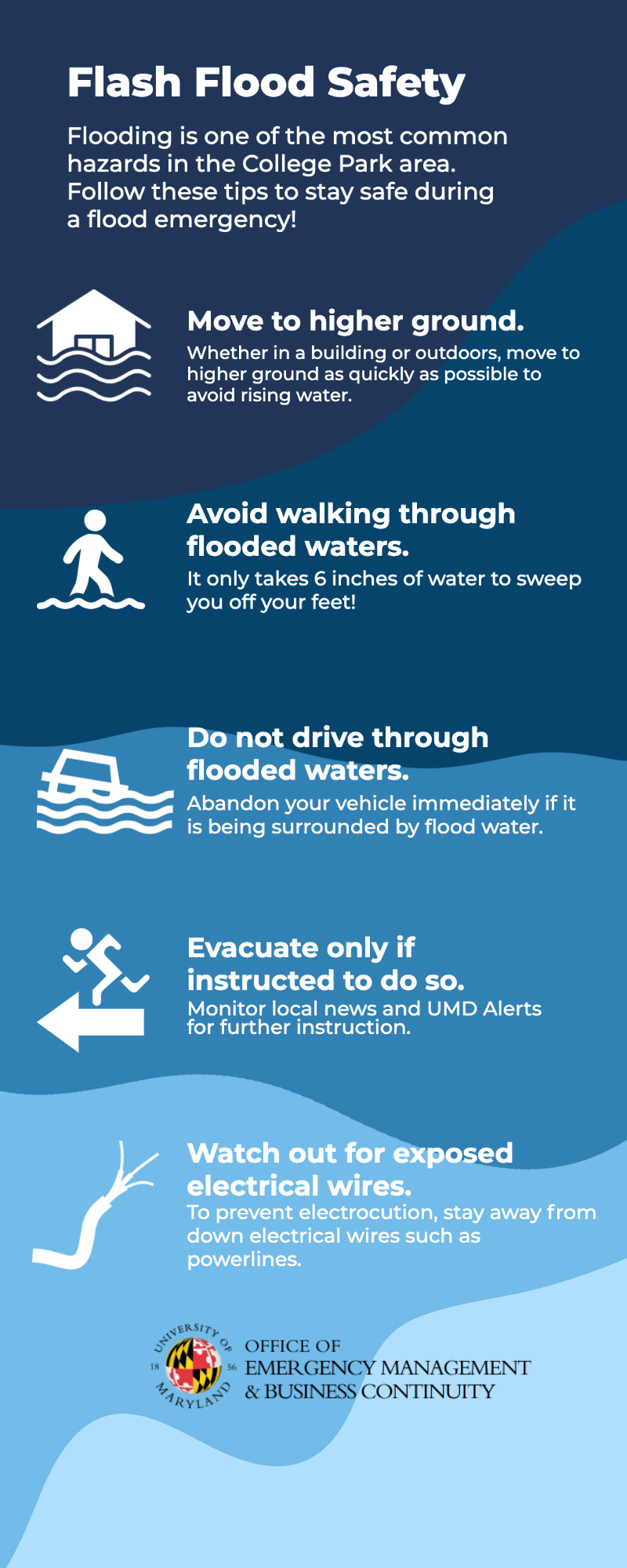

Are You Prepared For A Flash Flood Emergency A Safety Checklist

May 25, 2025

Are You Prepared For A Flash Flood Emergency A Safety Checklist

May 25, 2025 -

Flash Flood Emergency Recognizing The Signs And Taking Action

May 25, 2025

Flash Flood Emergency Recognizing The Signs And Taking Action

May 25, 2025 -

Worlds Largest Rubber Duck A Myrtle Beach Landmark With A Purpose

May 25, 2025

Worlds Largest Rubber Duck A Myrtle Beach Landmark With A Purpose

May 25, 2025 -

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025 -

Massive Rubber Duck Installation In Myrtle Beach Whats The Message

May 25, 2025

Massive Rubber Duck Installation In Myrtle Beach Whats The Message

May 25, 2025