Apple Stock Under Pressure: Q2 Earnings Report Looms

Table of Contents

Weakening iPhone Sales and Supply Chain Issues

Declining iPhone sales compared to previous quarters are a significant factor contributing to the pressure on Apple stock. Concerns about "iPhone sales decline" are amplified by persistent "supply chain disruptions" and ongoing "component shortages." This confluence of challenges has impacted Apple's ability to meet demand and maintain its robust sales growth trajectory.

- Sales Figures and Projections: Recent analyst reports suggest a slowdown in iPhone sales, with some predicting a year-over-year decline in the double digits for Q2 2024. These figures highlight the impact of several factors.

- Global Economic Slowdown: The global economic slowdown has significantly impacted consumer spending on premium electronics like iPhones. Consumers are increasingly hesitant to make large purchases amidst inflationary pressures and uncertainty about the future.

- Competition from Samsung and Others: Samsung and other Android manufacturers continue to gain market share, offering competitive alternatives at various price points. This intensified competition puts further pressure on iPhone sales and Apple's overall market dominance.

Competition in the Tech Market and Emerging Threats

The competitive landscape in the tech market is evolving rapidly, posing a significant threat to Apple's long-term growth. The "tech market competition" is fierce, with Android's growing "market share" and the emergence of innovative competitors challenging Apple's established dominance.

- Competitor Product Analysis: The success of Android devices, particularly in the mid-range and budget segments, directly impacts Apple's market share. Innovative features and aggressive pricing strategies employed by competitors are chipping away at Apple's traditionally strong customer loyalty.

- Apple's Competitive Advantages and Disadvantages: While Apple boasts a strong brand reputation and a loyal customer base, its reliance on a premium pricing strategy makes it vulnerable to economic downturns. Furthermore, the innovation race in areas like AI and AR/VR necessitates significant investment and poses a potential threat to Apple's leadership.

- Disruptive Technologies: Emerging technologies like foldable smartphones and advancements in AI-powered features represent potential disruptive forces that could challenge Apple's technological edge and market leadership.

Macroeconomic Factors and Investor Sentiment

The current macroeconomic environment significantly impacts "investor sentiment" towards Apple stock. Factors like "inflation impact," "interest rate hikes," and "recessionary fears" create uncertainty and risk aversion among investors.

- Impact on Consumer Spending and Investor Behavior: High inflation and rising interest rates directly impact consumer purchasing power, leading to decreased demand for discretionary items like iPhones. This translates to lower sales and reduced profitability for Apple, affecting investor confidence.

- Correlation between Macroeconomic Indicators and Apple Stock Performance: Historical data shows a strong correlation between macroeconomic indicators and Apple's stock price. Periods of economic uncertainty typically lead to decreased investor confidence and downward pressure on Apple's stock.

- Expert Opinions and Forecasts: Many financial analysts predict a continued challenging macroeconomic environment in the near term, which could further negatively impact Apple's stock performance.

What to Expect from the Q2 Earnings Report

The upcoming Q2 earnings report is crucial for assessing the current state of Apple and its future prospects. Investors will closely scrutinize key metrics like "Q2 earnings," "revenue growth," "EPS," and "earnings guidance."

- Analysts' Expectations and Consensus Forecasts: Analysts' forecasts for Q2 earnings vary, reflecting the uncertainty surrounding the current economic climate and the challenges facing Apple. The consensus forecast will offer a benchmark against which Apple's actual performance will be measured.

- Potential Scenarios: The report could show Apple exceeding expectations, meeting expectations, or falling short. Each scenario will have a significant impact on the stock price and investor sentiment.

- Impact on Apple's Stock Price and Investor Confidence: A positive surprise could significantly boost Apple's stock price, while a negative surprise could exacerbate the existing pressure on the stock. The earnings call and subsequent investor commentary will be crucial in shaping investor perceptions.

Conclusion: Navigating the Pressure on Apple Stock

In summary, Apple stock is facing significant pressure due to weakening iPhone sales, intensified competition, and unfavorable macroeconomic headwinds. The upcoming Q2 earnings report will be pivotal in shaping investor sentiment and determining the near-term trajectory of the stock. While these factors pose challenges, Apple's strong brand, loyal customer base, and potential for future growth in areas like services and wearables offer reasons for optimism. However, understanding and acknowledging these risks is crucial for navigating the current situation. Stay informed about the upcoming Q2 earnings release and continue monitoring Apple stock under pressure for significant updates. Follow our blog for further analysis and expert insights.

Featured Posts

-

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025 -

Hollywood Production Halts Writers And Actors Unite In Joint Strike Action

May 25, 2025

Hollywood Production Halts Writers And Actors Unite In Joint Strike Action

May 25, 2025 -

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025 -

From Plaza To Pavement The Story Of Black Lives Matter Plaza

May 25, 2025

From Plaza To Pavement The Story Of Black Lives Matter Plaza

May 25, 2025 -

Classifica Forbes 2025 Ecco Gli Uomini Piu Ricchi Del Mondo

May 25, 2025

Classifica Forbes 2025 Ecco Gli Uomini Piu Ricchi Del Mondo

May 25, 2025

Latest Posts

-

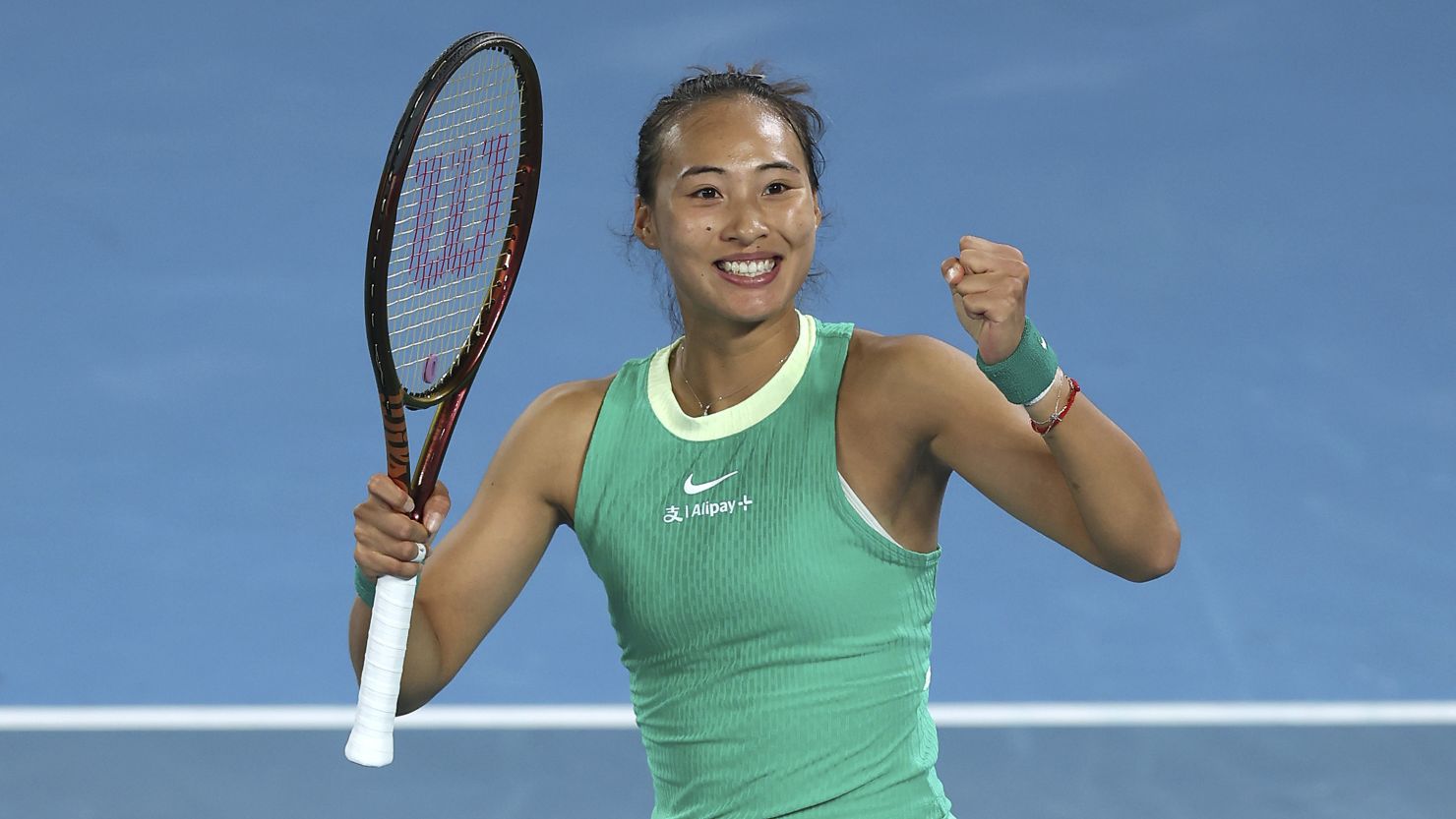

Wta Italian Open Chinese Player Advances To Quarterfinals

May 25, 2025

Wta Italian Open Chinese Player Advances To Quarterfinals

May 25, 2025 -

Chinese Tennis Ace Through To Italian Open Quarters

May 25, 2025

Chinese Tennis Ace Through To Italian Open Quarters

May 25, 2025 -

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 25, 2025

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 25, 2025 -

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025 -

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025