David Rosenberg On The Bank Of Canada's Interest Rate Strategy

Table of Contents

Rosenberg's Critique of the Bank of Canada's Current Approach

David Rosenberg has consistently expressed a more cautious outlook than the BoC regarding its current monetary policy. While not strictly "dovish" or "hawkish," his stance leans towards a more gradual and nuanced approach to interest rate hikes. He argues that the BoC's aggressive tightening could inadvertently trigger a deeper economic slowdown than anticipated.

His key criticisms include:

- Overestimation of Inflation: Rosenberg believes the BoC might be overestimating the persistence of inflation, potentially leading to unnecessary and economically damaging rate hikes. He points to factors like supply chain improvements and decreasing commodity prices as signs that inflation may be cooling faster than projected.

- Concerns about Economic Growth: A significant concern for Rosenberg is the potential negative impact of aggressive rate hikes on economic growth. He warns that excessively high interest rates could stifle business investment, reduce consumer spending, and ultimately lead to a recession.

- Labor Market Analysis: While acknowledging a tight labor market, Rosenberg argues the BoC's reliance solely on employment numbers as an inflation indicator may be misleading. He suggests that wage growth needs to be considered more carefully in relation to productivity gains to avoid misinterpreting inflationary pressures.

- International Comparisons: Rosenberg often compares the BoC's strategy with other central banks globally, highlighting instances where a more measured approach may have yielded better results. He points to the varying economic conditions in different countries, emphasizing the need for a tailored strategy rather than a one-size-fits-all approach.

For example, in a recent interview (citation needed – replace with actual citation), Rosenberg stated, “[Insert a relevant quote from Rosenberg criticizing the Bank of Canada's approach]”. This highlights his concern about [explain the concern highlighted in the quote].

Analyzing the Potential Economic Impacts According to Rosenberg

Based on his analysis, Rosenberg predicts several potential consequences of the Bank of Canada's current interest rate strategy:

- Housing Market Impact: Higher interest rates are expected to further cool the already softening Canadian housing market, potentially leading to a more significant correction than initially anticipated. This could have ripple effects throughout the economy.

- Consumer Spending and Business Investment: Increased borrowing costs will likely reduce consumer spending and discourage business investment, leading to a slowdown in overall economic activity.

- Recessionary Pressures: Rosenberg suggests that the cumulative effect of these factors could push the Canadian economy into a recession, particularly if the BoC maintains its aggressive stance.

- Canadian Dollar Exchange Rate: The impact on the Canadian dollar is complex. While higher interest rates can initially attract foreign investment and strengthen the currency, an economic slowdown could ultimately weaken it. (Insert chart or data visualizing these predictions if available).

Alternative Interest Rate Strategies Suggested (or Implied) by Rosenberg

Rosenberg doesn't explicitly propose a detailed alternative plan, but his criticisms imply a preference for a more cautious and data-driven approach. This could involve:

- Gradual Rate Increases: Instead of sharp increases, Rosenberg seems to favor more gradual adjustments, allowing the BoC to better assess the impact of each move on the economy.

- Alternative Monetary Policy Tools: He might suggest exploring other policy tools alongside interest rate changes, such as quantitative easing or forward guidance, to fine-tune monetary policy.

- Emphasis on Specific Economic Indicators: A greater focus on indicators beyond employment numbers, such as wage growth and productivity, could provide a more comprehensive view of inflation and guide more effective interest rate decisions.

- Learning from International Experiences: Rosenberg's international comparisons suggest the BoC should learn from the experiences of other central banks and adapt its strategy based on Canada’s unique economic circumstances.

Comparing Rosenberg's Views with Other Economists

Rosenberg's perspective often contrasts with that of other economists. While some agree on the need for caution, others may argue that the BoC’s aggressive approach is necessary to curb persistent inflation. These differing viewpoints reflect the inherent complexities and uncertainties associated with macroeconomic forecasting and policymaking. (Include names and viewpoints of other economists for comparison).

Conclusion: Understanding David Rosenberg's Insights on the Bank of Canada's Interest Rate Strategy

David Rosenberg's analysis of the Bank of Canada's interest rate strategy offers a valuable contrarian perspective. His concerns about overestimating inflation, the potential for an economic slowdown, and the impact on the housing market merit careful consideration. While he doesn't offer a concrete alternative plan, his criticisms imply a preference for a more gradual and nuanced approach to monetary policy, one that carefully considers the interplay between inflation, employment, and economic growth. By understanding his analysis, we can gain a more comprehensive understanding of the challenges and uncertainties facing the Canadian economy. To stay informed on David Rosenberg's views on the Bank of Canada's interest rate strategy and its effect on the Canadian economy, continue following his work and analysis.

Featured Posts

-

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025 -

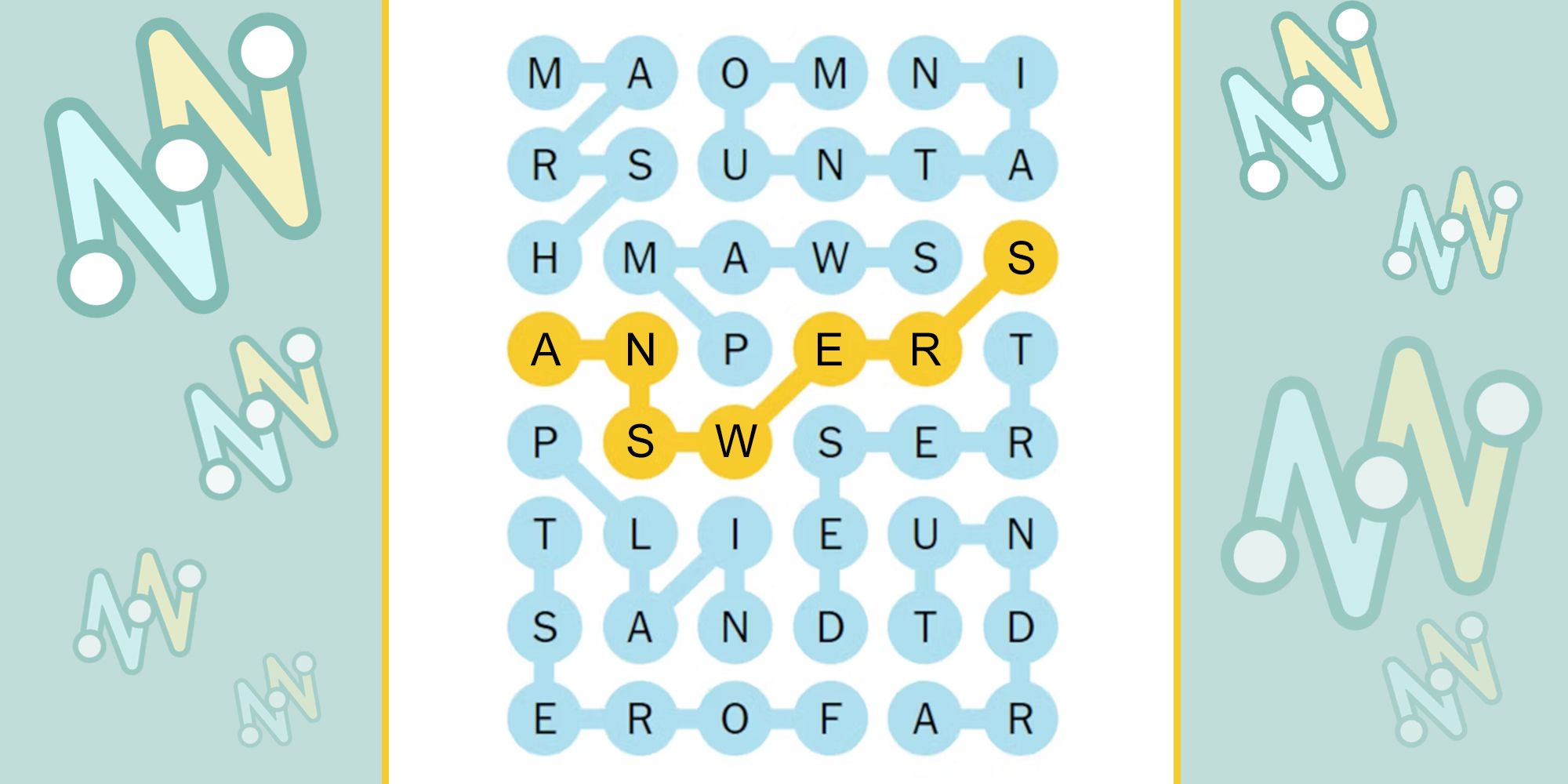

Nyt Strands Finding The Answers For The February 27 2025 Puzzle

Apr 29, 2025

Nyt Strands Finding The Answers For The February 27 2025 Puzzle

Apr 29, 2025 -

A Comprehensive Look At The Countrys New Business Hotspots

Apr 29, 2025

A Comprehensive Look At The Countrys New Business Hotspots

Apr 29, 2025 -

Portlands Outlaw Music Festival See Bob Dylan And Billy Strings This Spring

Apr 29, 2025

Portlands Outlaw Music Festival See Bob Dylan And Billy Strings This Spring

Apr 29, 2025 -

The Complexities Of All American Manufacturing

Apr 29, 2025

The Complexities Of All American Manufacturing

Apr 29, 2025

Latest Posts

-

Pw Cs Strategic Retreat Impact Of The Exit From Nine African Markets

Apr 29, 2025

Pw Cs Strategic Retreat Impact Of The Exit From Nine African Markets

Apr 29, 2025 -

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025 -

Nine African Countries Affected By Pwcs Departure Understanding The Reasons

Apr 29, 2025

Nine African Countries Affected By Pwcs Departure Understanding The Reasons

Apr 29, 2025 -

Erfolgsbilanz Deutsche Teams In Champions League Duellen

Apr 29, 2025

Erfolgsbilanz Deutsche Teams In Champions League Duellen

Apr 29, 2025 -

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025