BP's Future: CEO's Plan For Valuation Increase, No Change In Listing

Table of Contents

The CEO's Strategic Vision for Enhanced BP Valuation

The core of BP's valuation increase plan rests on a multi-pronged approach focusing on enhancing profitability, operational efficiency, and sustainable growth. The CEO's long-term goal is to solidify BP's position as a leading global energy company, adapting to the evolving energy landscape while maximizing shareholder value. Key performance indicators (KPIs) targeted for improvement include:

- Increased Profitability: This involves optimizing existing oil and gas operations, improving production efficiency, and achieving higher profit margins through strategic cost reduction and revenue enhancement.

- Improved Operational Efficiency: Streamlining processes, leveraging technology, and implementing innovative solutions to reduce operational costs across all segments of the business are key priorities.

- Growth in Renewable Energy Sectors: Significant investments in renewable energy sources, such as solar, wind, and bioenergy, are crucial for long-term growth and aligning with the global shift towards sustainable energy. This contributes to a higher BP valuation by demonstrating forward-thinking and adaptation to market trends.

- Stronger Environmental, Social, and Governance (ESG) Performance: Improving BP's ESG profile is vital for attracting environmentally conscious investors, enhancing its reputation, and mitigating potential risks associated with climate change regulations. This improves the BP stock price by enhancing investor confidence.

Specific initiatives within this plan include expanding renewable energy portfolios, divesting from non-core assets, and investing heavily in research and development (R&D) to improve efficiency and develop new technologies.

Investment Strategies Driving BP's Valuation Growth

BP's investment strategy is two-fold: optimizing existing assets and investing in future-oriented technologies. In the existing oil and gas sector, the focus is on maximizing production efficiency through technological upgrades and process improvements, ensuring stable revenue streams while enhancing profitability and contributing to the BP share price.

Simultaneously, substantial investments are being channeled into R&D for renewable energy sources. This strategic diversification reduces reliance on volatile fossil fuel markets and positions BP for growth in a rapidly expanding sector, leading to improved long-term BP valuation.

However, these strategies are not without risks:

- Market Volatility in the Energy Sector: Fluctuations in oil and gas prices can significantly impact profitability.

- Competition from Other Energy Companies: Intense competition from both traditional and renewable energy companies requires continuous innovation and strategic maneuvering.

- Regulatory Changes Affecting the Industry: Evolving regulations related to emissions and environmental protection can necessitate significant adjustments to BP's operational strategies.

To mitigate these risks, BP is employing robust risk management strategies, including hedging against price volatility, diversifying its energy portfolio, and proactively engaging with regulators to ensure compliance. Successful strategies from other energy majors, such as diversification into renewables and strategic partnerships, serve as valuable benchmarks.

Maintaining BP's Stock Market Listing: A Key Consideration

Maintaining BP's current stock market listing is a strategic priority for several reasons. Remaining listed provides access to crucial capital markets for funding growth initiatives, especially in the capital-intensive renewable energy sector. This also enhances investor confidence and transparency, improving the BP stock price through easier access to investment.

Delisting, on the other hand, would limit access to capital, potentially hindering growth ambitions and potentially damaging investor confidence. Further, the regulatory hurdles associated with delisting and the potential loss of investor liquidity make this option less desirable.

Addressing Investor Concerns and Maintaining Transparency

Open communication with investors is paramount to maintaining confidence in BP's valuation strategy. BP plans to regularly report its progress on key KPIs, providing transparent updates on its financial performance, investment activities, and ESG initiatives. This will be achieved through various channels, including:

- Detailed investor relations reports

- Regular press releases announcing significant milestones and strategic decisions

- Active participation in shareholder meetings and investor conferences

This open communication is designed to address investor concerns proactively, build trust, and showcase the company’s commitment to sustainable, long-term growth, thereby bolstering the BP share price.

The Future of BP Valuation: A Path to Growth Without Listing Changes

BP's CEO's plan to enhance the company's valuation while maintaining its current stock market listing represents a strategic balance between short-term profitability and long-term sustainable growth. The multi-pronged approach focusing on operational efficiency, renewable energy investments, and robust ESG performance positions BP for success in the evolving energy landscape. The transparency and communication strategy aimed at maintaining investor confidence are crucial for achieving the intended valuation increase.

The long-term implications of this strategy could significantly impact BP's market position and shareholder value. To stay informed about BP's progress towards its valuation goals, monitor company news, financial reports, and investor updates related to BP share price, BP stock performance, BP future growth, and BP valuation strategy. This will help you effectively gauge the success of this ambitious plan.

Featured Posts

-

Former Tory Councillors Wife Challenges Racial Hatred Verdict

May 21, 2025

Former Tory Councillors Wife Challenges Racial Hatred Verdict

May 21, 2025 -

Plouzane Et Clisson Sites Bretons Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025

Plouzane Et Clisson Sites Bretons Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025 -

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025 -

White House Cocaine Found Secret Service Concludes Investigation

May 21, 2025

White House Cocaine Found Secret Service Concludes Investigation

May 21, 2025 -

Bp Ceo Pay A 31 Reduction And What It Means

May 21, 2025

Bp Ceo Pay A 31 Reduction And What It Means

May 21, 2025

Latest Posts

-

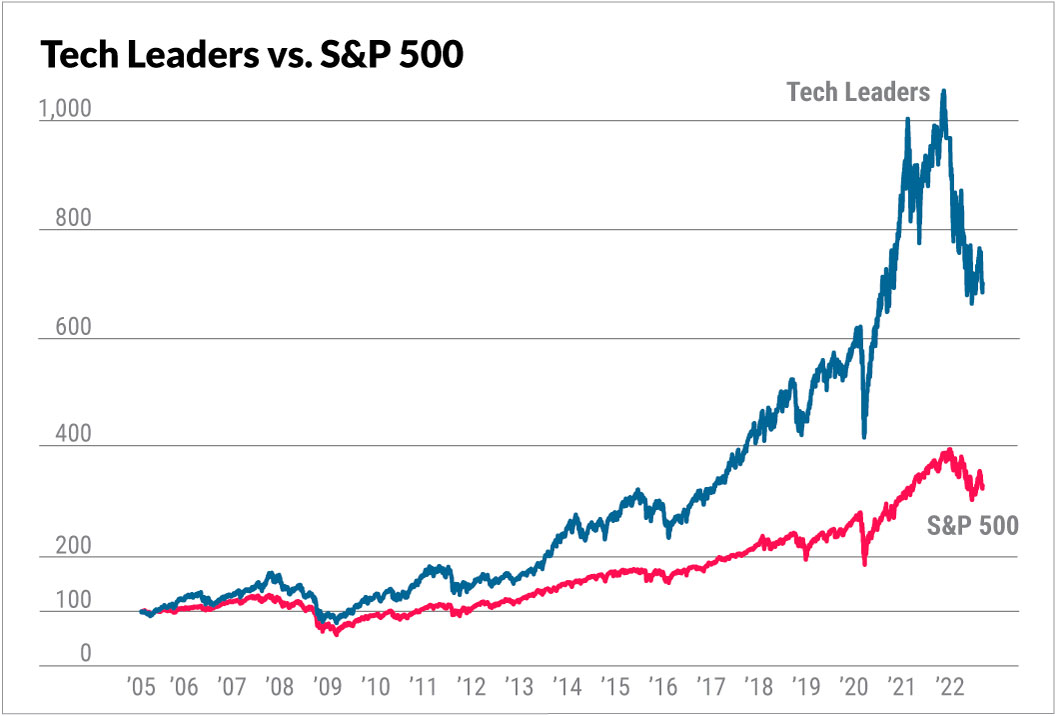

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 21, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 21, 2025 -

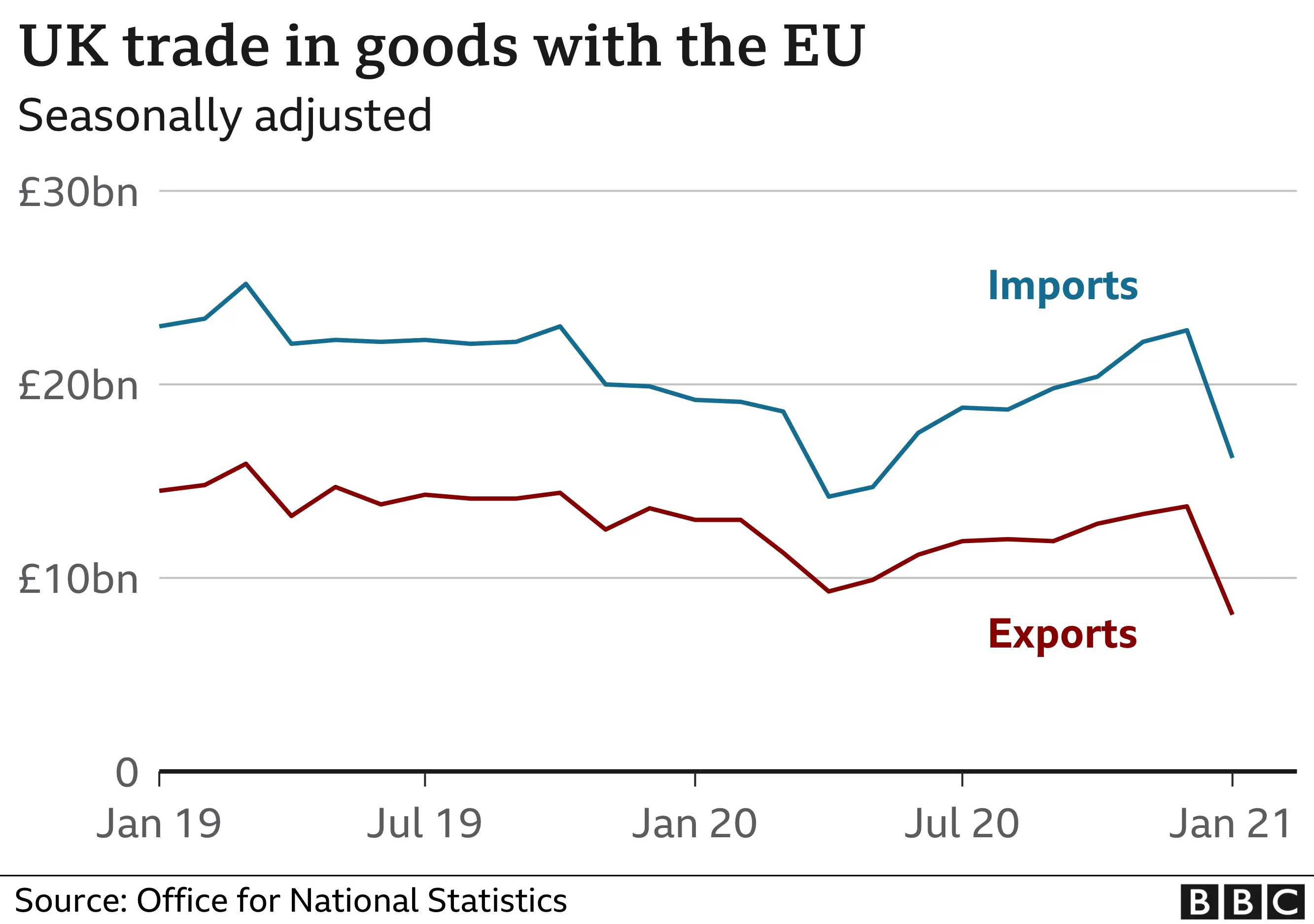

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025 -

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025 -

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025 -

Navigating The Path To European Citizenship For Americans

May 21, 2025

Navigating The Path To European Citizenship For Americans

May 21, 2025