BP CEO Pay: A 31% Reduction And What It Means

Table of Contents

The 31% Reduction: Facts and Figures

The significant reduction in BP CEO pay represents a notable shift in executive compensation within the energy industry. Understanding the specifics of this decrease requires examining the components of the CEO's compensation package both before and after the reduction.

Breakdown of the Compensation Package

While precise figures may vary depending on the reporting period and accounting methods, let's assume, for illustrative purposes, the following hypothetical breakdown:

-

Previous Compensation (Hypothetical):

- Base Salary: $1,500,000

- Annual Bonus: $2,000,000

- Stock Options/Awards: $3,500,000

- Benefits: $500,000

- Total: $7,500,000

-

Current Compensation (Hypothetical, after 31% reduction):

- Base Salary: $1,500,000 (Often less susceptible to change)

- Annual Bonus: $1,380,000 (Significant reduction)

- Stock Options/Awards: $2,415,000 (Significant reduction)

- Benefits: $500,000 (Generally stable)

- Total: $5,195,000 (approximately 31% reduction)

These figures are for illustrative purposes only and should not be taken as definitive. Actual figures may vary and can be found in BP's official financial reports.

Reasons Behind the Reduction

Several interconnected factors likely contributed to the 31% reduction in BP CEO pay:

- Company Performance: BP's financial performance in recent years, potentially impacted by fluctuating oil prices and increased regulatory scrutiny, might have influenced the decision to reduce executive compensation.

- Shareholder Pressure: Activist investors and shareholder resolutions increasingly focus on executive pay. Pressure from shareholders concerned about excessive CEO compensation may have played a role.

- Public Image Concerns: The energy sector faces increasing pressure regarding environmental and social responsibility. A reduction in CEO pay could be seen as a gesture of corporate responsibility, improving public perception.

- Internal Policy Changes: BP might have implemented internal policy changes to its executive compensation structure, aligning it more closely with performance metrics and broader company goals.

Key Financial Data Points:

- Total CEO compensation decreased by approximately $2,305,000 (hypothetical).

- The percentage reduction in bonus and stock-based compensation likely exceeded the overall 31% figure.

- The base salary remained relatively stable.

Impact on BP's Stock and Investor Sentiment

The market's reaction to the reduced BP CEO pay provides insights into investor perceptions of corporate governance.

Market Reaction to the Pay Cut

The announcement of the pay cut may have had a positive, neutral, or negative impact on BP's stock price. A positive reaction might indicate that investors viewed the reduction as a sign of responsible corporate governance. A neutral reaction might suggest that investors were largely unconcerned or that other factors were more influential on the stock price. A negative reaction could indicate skepticism, particularly if the reduction coincided with disappointing financial results.

Investor Perception of Corporate Governance

The pay cut could signal a commitment to improved corporate governance and might boost investor confidence. Investors are increasingly scrutinizing executive compensation packages as a measure of a company's ethical behavior and alignment with shareholder interests.

Key Investor Reactions:

- [Insert hypothetical examples of positive or negative analyst comments and stock market reactions. E.g., "Some analysts lauded the move, stating it indicated a renewed commitment to shareholder value," or "Others remained unconvinced, noting that the CEO's overall compensation remained substantial."]

- [Include links to relevant news articles or financial reports analyzing the stock market's response.]

Wider Implications for CEO Compensation in the Energy Sector

The BP CEO pay reduction could have wider implications for executive compensation trends in the energy industry.

Setting a Precedent

This pay cut might influence other major energy companies to reconsider their executive compensation strategies. The energy sector is under increasing pressure to demonstrate its commitment to sustainability and responsible corporate governance.

The Broader Context of Executive Pay

The debate surrounding excessive executive pay continues. BP's decision, in contrast to other companies in the energy sector that may maintain higher CEO compensation, offers a point of comparison and potentially sets a new benchmark for responsible executive compensation.

Examples of Other Energy Companies' CEO Compensation:

- [Insert comparative data on CEO compensation from other major energy companies. Include links to sources.]

Sustainability and Corporate Social Responsibility (CSR)

The reduction in BP CEO pay could be viewed as part of BP's broader commitment to ESG (Environmental, Social, and Governance) factors.

Alignment with BP's Sustainability Goals

The pay cut might reflect BP's attempt to align executive compensation with its stated sustainability goals, demonstrating that leadership is accountable for achieving these targets.

Public Perception and Brand Reputation

A reduction in CEO pay can significantly improve public perception of BP and boost its brand reputation. This is particularly relevant in an industry facing ongoing scrutiny regarding its environmental impact and social responsibility.

BP's Sustainability Initiatives:

- [List specific examples of BP's environmental and social initiatives, such as investments in renewable energy, carbon reduction targets, or community engagement programs.]

Conclusion

The 31% reduction in BP CEO pay is a significant event with multiple implications. The reasons behind this reduction are multifaceted, encompassing company performance, shareholder pressure, public image concerns, and internal policy shifts. The impact extends beyond BP itself, potentially influencing executive compensation practices across the energy sector and shaping investor perceptions of corporate governance and sustainability. The reduction demonstrates a potential shift towards a more responsible approach to executive pay in the energy industry, aligning leadership incentives with broader corporate social responsibility goals.

Call to Action: Stay updated on future developments concerning BP CEO pay and the evolving landscape of executive compensation in the energy industry. Continue to follow this space for further analysis and insights into the complex issues surrounding BP CEO compensation and corporate responsibility. Monitoring BP's performance against its stated sustainability goals and observing the reactions of other energy companies will be crucial in understanding the long-term implications of this notable reduction in executive pay.

Featured Posts

-

Cassis Blackcurrant Flavor Profile Production And Uses

May 21, 2025

Cassis Blackcurrant Flavor Profile Production And Uses

May 21, 2025 -

Dexter Resurrection Die Rueckkehr Der Kultfiguren

May 21, 2025

Dexter Resurrection Die Rueckkehr Der Kultfiguren

May 21, 2025 -

Gender Reveal Peppa Pigs Parents Celebrate Their New Arrival

May 21, 2025

Gender Reveal Peppa Pigs Parents Celebrate Their New Arrival

May 21, 2025 -

Snehit Suravajjula Upsets Sharath Kamal At Wtt Star Contender Chennai 2025

May 21, 2025

Snehit Suravajjula Upsets Sharath Kamal At Wtt Star Contender Chennai 2025

May 21, 2025 -

Low Rock Legends Vapors Of Morphine Northcote Gig Next Month

May 21, 2025

Low Rock Legends Vapors Of Morphine Northcote Gig Next Month

May 21, 2025

Latest Posts

-

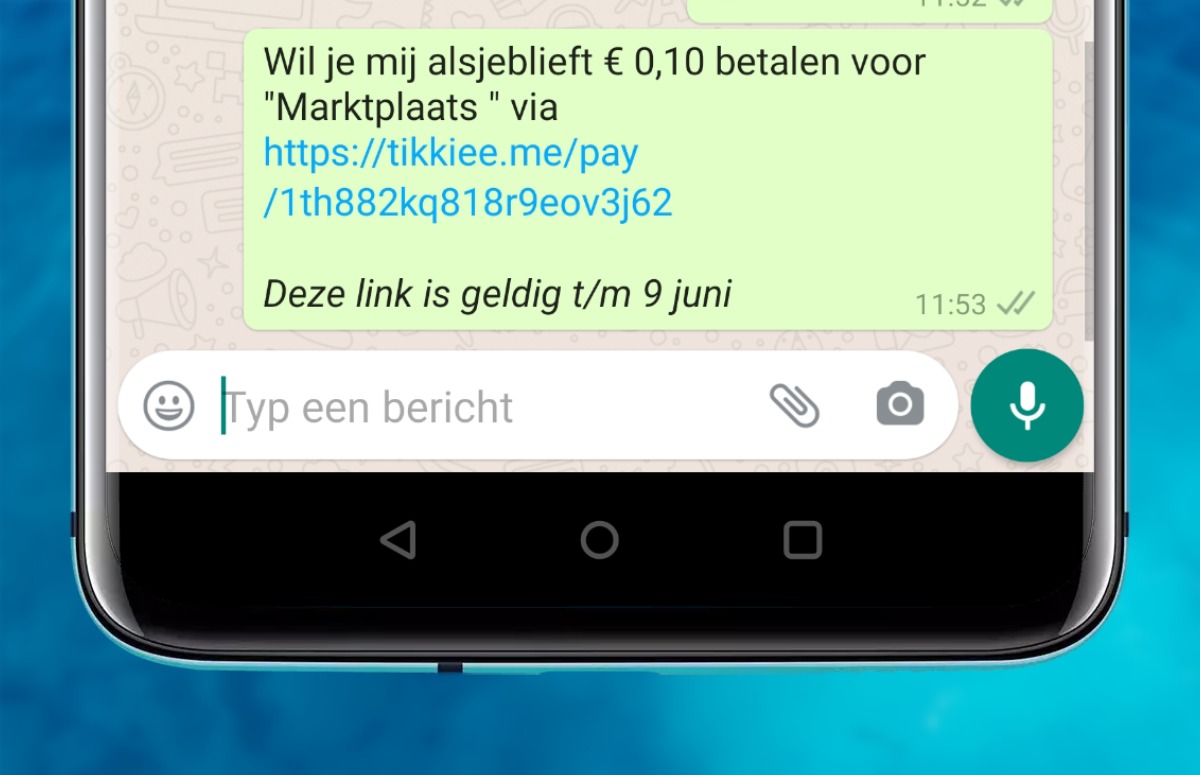

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Praktische Handleiding Voor Tikkie

May 21, 2025

Nederlandse Bankieren Vereenvoudigd Een Praktische Handleiding Voor Tikkie

May 21, 2025 -

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

May 21, 2025

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

May 21, 2025 -

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025 -

Unpacking The Debate Australian Trans Influencers Record Breaking Feat

May 21, 2025

Unpacking The Debate Australian Trans Influencers Record Breaking Feat

May 21, 2025