Berkshire Hathaway's Apple Holdings: The Impact Of CEO Transition

Table of Contents

Berkshire Hathaway's Investment Strategy and Apple's Performance

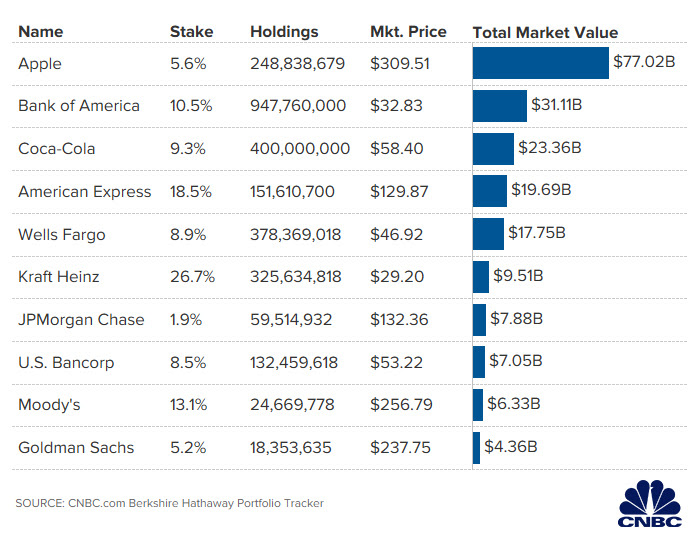

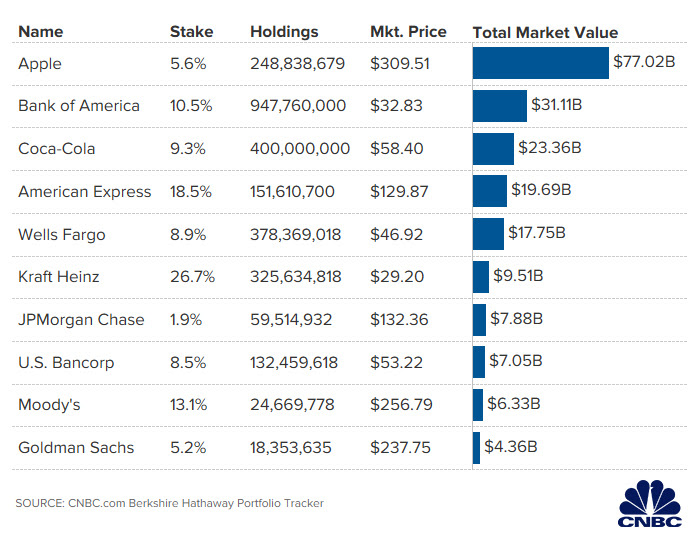

Berkshire Hathaway's investment strategy, largely shaped by Warren Buffett's philosophy of value investing, focuses on acquiring stakes in fundamentally sound, stable companies with long-term growth potential. This long-term investment approach contrasts sharply with short-term market speculation.

Long-Term Investment Approach

Berkshire Hathaway's success is built on its unwavering commitment to long-term value creation. This is evident in its long-held positions in companies like Coca-Cola and American Express.

- Coca-Cola: Decades-long investment showcasing remarkable returns.

- American Express: A long-standing partnership built on trust and shared values.

- Bank of America: Significant stake demonstrating confidence in the financial sector.

Apple aligns perfectly with this investment philosophy. Its consistent profitability, strong brand loyalty, and massive global market share exemplify the kind of stable, high-quality company Berkshire Hathaway seeks. The "value investing" strategy employed by Berkshire Hathaway perfectly complements Apple's consistent growth and predictable financial performance.

Apple's Financial Performance and Future Outlook

Apple's recent financial performance has been nothing short of spectacular. The company consistently delivers strong revenue growth, substantial profits, and maintains a dominant market share in several key sectors.

- Revenue Growth: Consistently exceeding expectations year after year.

- Profit Margins: High and stable, indicating strong pricing power and operational efficiency.

- Market Share: Dominant position in smartphones, wearables, and services.

However, maintaining this trajectory presents challenges. Future performance will depend on factors such as:

- Successful launches of innovative new products.

- Maintaining competitiveness in a rapidly evolving tech landscape.

- Navigating geopolitical uncertainties and supply chain disruptions.

Potential Impacts of the Apple CEO Transition on Berkshire Hathaway

The upcoming CEO transition at Apple presents both opportunities and risks for Berkshire Hathaway's substantial Apple holdings.

Leadership Changes and Strategic Shifts

A new CEO could bring about significant changes to Apple's strategic direction. This could involve:

- Increased Focus on Innovation: A renewed emphasis on groundbreaking products and technologies.

- Cost-Cutting Measures: Streamlining operations to improve efficiency and profitability.

- Expansion into New Markets: Diversification into new sectors to drive further growth.

These strategic shifts could influence Apple's stock price, directly impacting Berkshire Hathaway's investment. A positive shift could lead to increased stock appreciation, while a negative one could result in volatility. The "CEO succession" planning process within Apple will be crucial in mitigating potential negative impacts.

Berkshire Hathaway's Response to CEO Transitions

Berkshire Hathaway has a proven track record of navigating CEO transitions within its portfolio companies. Historically, they have employed a combination of strategies:

- Maintaining Long-Term Perspective: Focusing on the fundamental value of the underlying business rather than short-term market fluctuations.

- Active Engagement: Engaging with management to understand the transition plan and potential impacts.

- Portfolio Diversification: Maintaining a diverse portfolio to mitigate risk associated with any single investment.

Berkshire Hathaway likely will continue this measured approach, combining careful monitoring with their established long-term investment strategy. Their "risk management" practices are known to be prudent and effective.

Analyzing the Risk and Reward for Berkshire Hathaway

The Apple CEO transition presents both significant risks and potential rewards for Berkshire Hathaway.

Risk Assessment

The potential risks associated with the CEO transition include:

- Stock Price Volatility: Uncertainty surrounding the transition could lead to short-term fluctuations in Apple's stock price.

- Strategic Missteps: A new CEO might make decisions that negatively impact Apple's long-term performance.

- Loss of Momentum: The change in leadership could momentarily disrupt Apple's operational efficiency.

Berkshire Hathaway can mitigate these risks through careful monitoring, diversification within their portfolio, and engagement with Apple's management team. "Risk mitigation strategies" are already a core part of their investment approach.

Potential Rewards

Despite the risks, the transition also presents potential rewards for Berkshire Hathaway. A successful transition could lead to:

- Increased Innovation: A new CEO might revitalize Apple's product innovation, leading to higher growth and stock appreciation.

- Improved Efficiency: Cost-cutting measures could enhance profitability and shareholder returns.

- Expansion into New Markets: Successful diversification could unlock new revenue streams and enhance long-term growth.

The potential "return on investment" could be substantial if the transition leads to a stronger, more profitable Apple. The long-term growth prospects of Apple, under new leadership, remain strong.

Conclusion: The Future of Berkshire Hathaway's Apple Holdings

The Apple CEO transition presents a complex scenario for Berkshire Hathaway, demanding a balanced consideration of both risks and rewards. While short-term market volatility is possible, Berkshire Hathaway's long-term investment strategy positions them to weather any storm. The success of this transition hinges on Apple's ability to maintain its innovative drive and operational excellence under new leadership. Stay updated on Berkshire Hathaway's Apple holdings and follow the impact of this CEO transition. The long-term implications of this event will significantly shape the future of both these corporate giants. Learn more about Berkshire Hathaway's investment strategy and its approach to navigating market uncertainty.

Featured Posts

-

Amundi Djia Ucits Etf Nav Explained And How It Impacts Your Investment

May 24, 2025

Amundi Djia Ucits Etf Nav Explained And How It Impacts Your Investment

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025 -

England Airpark And Alexandria International Airport Ae Xplore Campaign Details And Launch Information

May 24, 2025

England Airpark And Alexandria International Airport Ae Xplore Campaign Details And Launch Information

May 24, 2025 -

Canadians Sacrifice Auto Security Due To Increased Living Costs

May 24, 2025

Canadians Sacrifice Auto Security Due To Increased Living Costs

May 24, 2025

Latest Posts

-

Billie Jean King Cup Rybakinas Crucial Role In Kazakhstans Finals Qualification

May 24, 2025

Billie Jean King Cup Rybakinas Crucial Role In Kazakhstans Finals Qualification

May 24, 2025 -

Absence And Daily Life Sheinelle Joness Conversation On The Today Show

May 24, 2025

Absence And Daily Life Sheinelle Joness Conversation On The Today Show

May 24, 2025 -

Rybakina Propels Kazakhstan Into Billie Jean King Cup Finals

May 24, 2025

Rybakina Propels Kazakhstan Into Billie Jean King Cup Finals

May 24, 2025 -

Rybakina V Tretem Kruge Turnira V Rime

May 24, 2025

Rybakina V Tretem Kruge Turnira V Rime

May 24, 2025 -

Update On Sheinelle Jones Colleagues Comment On Her Absence From Today

May 24, 2025

Update On Sheinelle Jones Colleagues Comment On Her Absence From Today

May 24, 2025