Amundi DJIA UCITS ETF: NAV Explained & How It Impacts Your Investment

Table of Contents

What is Net Asset Value (NAV) in the context of the Amundi DJIA UCITS ETF?

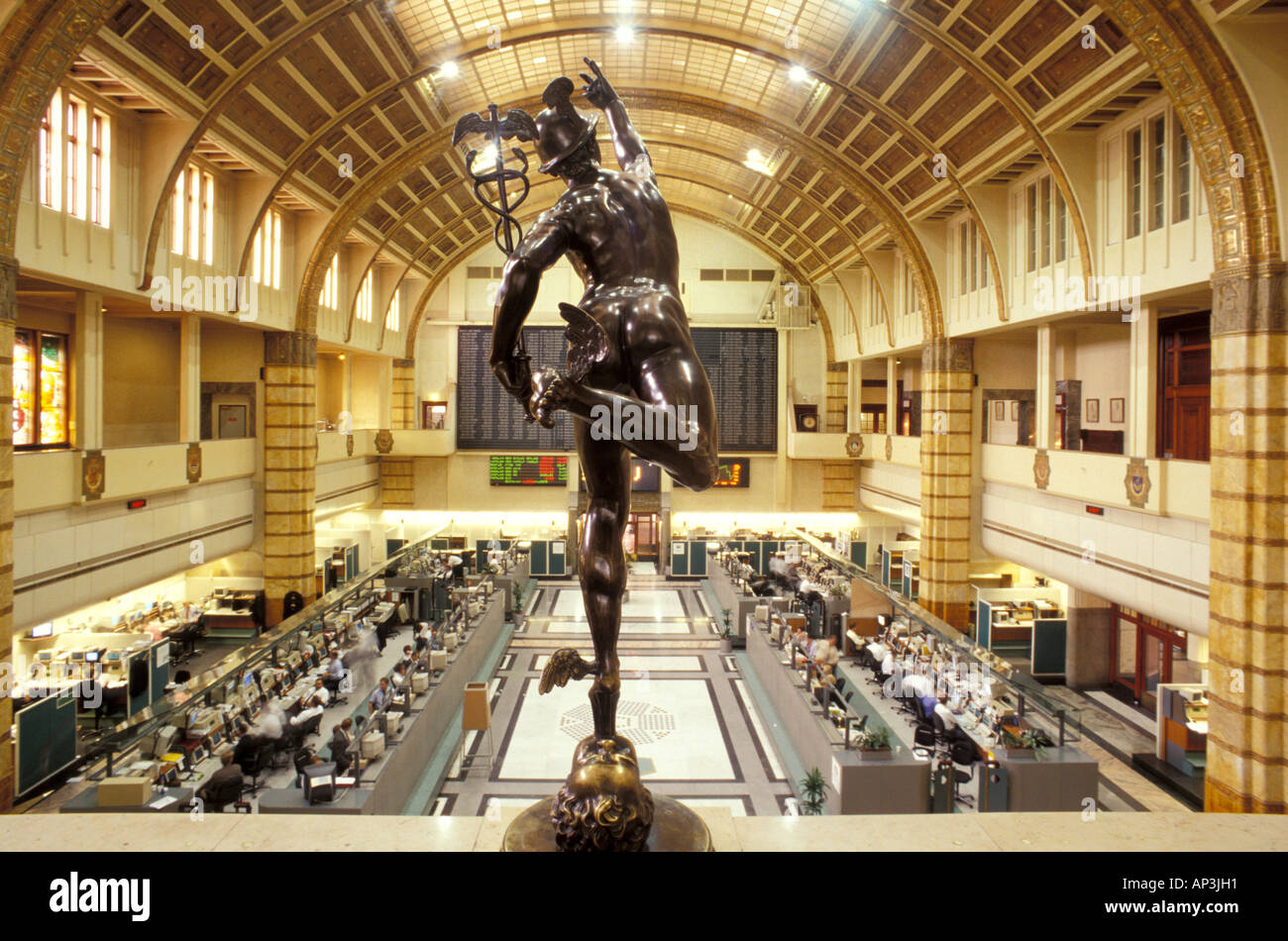

The Net Asset Value (NAV) of an ETF, like the Amundi DJIA UCITS ETF, represents the value of its underlying assets per share. Understanding this value is fundamental to assessing the ETF's true worth. For the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average (DJIA), the NAV is calculated daily, typically at market close. This calculation involves determining the market value of all the constituent stocks within the DJIA that the ETF holds, adding any accrued income (like dividends), and then subtracting expenses.

The Amundi DJIA UCITS ETF NAV might differ slightly from its market price. This discrepancy stems from factors like the bid-ask spread (the difference between the buying and selling prices) and trading volume. A high trading volume generally leads to a smaller gap between NAV and market price. Conversely, low liquidity may result in a wider difference.

- NAV represents the value of the ETF's assets per share.

- It’s calculated daily, usually at market close.

- Understanding NAV helps assess the ETF's true underlying value. Keywords: Amundi DJIA UCITS ETF NAV, Net Asset Value calculation, ETF pricing, market price, bid-ask spread.

How Does the Amundi DJIA UCITS ETF NAV Impact Your Investment Decisions?

Fluctuations in the Amundi DJIA UCITS ETF NAV directly influence your investment returns. A rising NAV generally signifies positive performance, reflecting growth in the underlying DJIA stocks. Conversely, a falling NAV indicates potential losses. By tracking daily NAV changes, you can monitor the ETF's performance against its benchmark index, the DJIA.

Comparing the current NAV to the previous day's value provides a clear picture of daily performance. This allows you to make more informed buy/sell decisions. For example, if the NAV consistently outperforms the DJIA, it might indicate strong index tracking and potentially attractive investment opportunities. Conversely, persistent underperformance might suggest reevaluating your investment strategy.

- Rising NAV generally indicates positive investment performance.

- Falling NAV suggests potential losses.

- Comparing NAV to the previous day’s value shows daily performance.

- Regular NAV monitoring is crucial for informed investment choices. Keywords: Amundi DJIA UCITS ETF performance, NAV fluctuations, investment returns, DJIA index, buy/sell signals.

Practical Implications of Understanding Amundi DJIA UCITS ETF NAV

Understanding the Amundi DJIA UCITS ETF NAV has several practical implications for your investment strategy. For instance, if you reinvest dividends, knowing the NAV helps you calculate the additional shares acquired. Monitoring NAV alongside other factors like the expense ratio and trading volume provides a holistic view of the ETF's performance and value.

Accessing daily NAV information is straightforward. You can usually find this data on the Amundi website, major financial news platforms, and brokerage account statements.

It's important to remember that NAV is just one piece of the puzzle. Consider factors like the ETF's expense ratio (the annual cost of managing the fund) before making investment decisions.

- Regularly check NAV for performance tracking.

- Use NAV alongside other metrics for comprehensive analysis.

- Consider the impact of NAV on tax implications.

- Consult a financial advisor for personalized investment advice. Keywords: Amundi DJIA UCITS ETF investment strategy, dividend reinvestment, expense ratio, long-term growth, accessing NAV data.

Conclusion: Mastering the Amundi DJIA UCITS ETF through NAV Understanding

Understanding the Amundi DJIA UCITS ETF NAV is crucial for successful investing. We’ve explored its definition, calculation method, impact on investment decisions, and practical applications. By regularly monitoring the NAV and comparing it to the DJIA, you can gain valuable insights into your investment performance. Remember to consider other crucial factors like the expense ratio and trading volume for a well-rounded assessment. Make informed decisions, optimize your portfolio management, and harness the power of the Amundi DJIA UCITS ETF NAV. Learn more about the Amundi DJIA UCITS ETF NAV and its impact on your portfolio today! Keywords: Amundi DJIA UCITS ETF NAV, Net Asset Value, ETF investment, informed decisions, portfolio management.

Featured Posts

-

When To Fly Around Memorial Day 2025 Avoiding Crowds And Saving Money

May 24, 2025

When To Fly Around Memorial Day 2025 Avoiding Crowds And Saving Money

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Full Account

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Full Account

May 24, 2025 -

Memorial Day 2025 Flights Peak Travel Dates And How To Find Deals

May 24, 2025

Memorial Day 2025 Flights Peak Travel Dates And How To Find Deals

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025

Latest Posts

-

Live Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Live Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Agm

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Agm

May 24, 2025 -

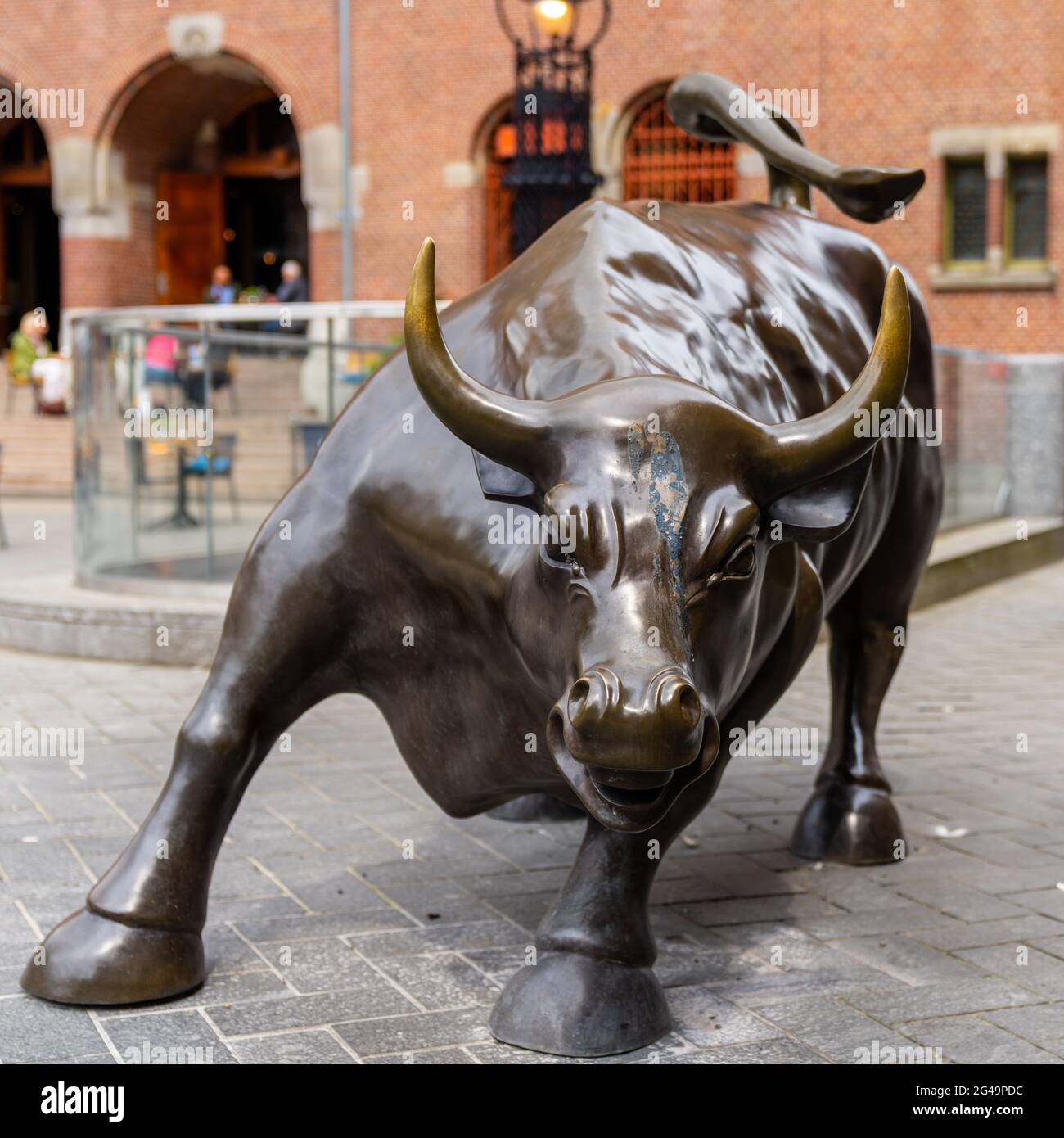

Amsterdam Stock Exchange 11 Drop Highlights Market Volatility

May 24, 2025

Amsterdam Stock Exchange 11 Drop Highlights Market Volatility

May 24, 2025 -

Three Day Slump On Amsterdam Stock Exchange Market Instability And Future Outlook

May 24, 2025

Three Day Slump On Amsterdam Stock Exchange Market Instability And Future Outlook

May 24, 2025 -

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025