Canadians Sacrifice Auto Security Due To Increased Living Costs

Table of Contents

The Impact of Inflation on Car Security Spending

The relentless pressure of inflation is directly impacting Canadians' ability to invest in robust car security measures. This translates to a noticeable decline in spending across various aspects of vehicle protection.

Reduced Spending on Security Systems

Budget constraints are leading to a significant decrease in investment in anti-theft devices. Many are foregoing advanced security systems due to their cost.

- Examples of security systems and their costs: GPS trackers ($100-$500), alarm systems ($100-$300), immobilizers (integrated into newer vehicles, but retrofitting can cost several hundred dollars).

- Statistics on the percentage decrease in sales of these systems: (Insert relevant statistic if available; otherwise, use a placeholder like "Industry reports suggest a 15% decrease in sales of aftermarket car alarms in the last year").

- Quotes from auto security professionals: "(Insert quote from a relevant expert emphasizing the decline in sales of security systems due to economic pressures)."

Neglecting Vehicle Maintenance Affecting Security

Delayed or forgone vehicle maintenance due to financial strain directly compromises car security. Broken locks, damaged windows, and malfunctioning lights all represent easy access points for thieves.

- Examples of maintenance neglect impacting security: Ignoring a broken car window, delaying the repair of a faulty lock, not replacing worn tires that could be easily slashed.

- Statistics on vehicle break-ins linked to poor maintenance: (Insert relevant statistic or a placeholder such as "Police reports show a correlation between poor vehicle maintenance and a higher likelihood of break-ins.")

- Tips on affordable maintenance: Prioritizing essential repairs, seeking out cheaper repair options, performing basic maintenance tasks independently.

Increased Risk of Vehicle Theft

The combination of reduced investment in security systems and neglected maintenance creates a perfect storm for increased vehicle theft.

- Statistics on car theft rates in Canada: (Insert relevant statistic from a reliable source, such as Statistics Canada or police reports.)

- Examples of recent car theft incidents: (Include brief, anonymized examples if available.)

- Expert opinions on the correlation: "(Insert quote from a law enforcement officer or security expert confirming the link between reduced security measures and increased car thefts)."

Alternative Choices and Their Security Implications

Faced with financial pressure, Canadians are making difficult choices that often compromise vehicle security.

Choosing Older, Less Secure Vehicles

To save money, many are opting for older vehicles, which often lack the advanced security features found in newer models. This increases the risk of theft.

- Statistics comparing theft rates of newer vs. older vehicles: (Insert statistics showing higher theft rates for older vehicles.)

- Costs associated with repairing older vehicles after theft: Repairing an older vehicle after theft can be prohibitively expensive, potentially exceeding the vehicle's value.

Opting for Cheaper Insurance with Reduced Coverage

Cost-cutting measures often extend to auto insurance, with many choosing cheaper plans that offer minimal or no theft coverage.

- Comparison of different insurance packages and their theft coverage: (Include a brief comparison of insurance options and their levels of theft protection.)

- Tips for finding affordable but adequate insurance: Comparing quotes from multiple insurers, considering higher deductibles, bundling insurance policies.

- Statistics on underinsured car owners: (Include statistics on the percentage of Canadian drivers with inadequate insurance coverage.)

Parking in Less Secure Locations

The need to save money on parking fees often leads to parking in less secure locations, thereby increasing the risk of vehicle theft or vandalism.

- Examples of unsafe parking locations and the higher risk of theft: Unlit parking lots, poorly maintained areas, parking on the street.

- Advice on selecting safer parking spots: Choose well-lit, secure parking garages or lots, avoid isolated areas, park in well-populated areas.

- Statistics on thefts in various parking locations: (Include statistics illustrating the higher theft rates in less secure parking areas.)

The Long-Term Costs of Sacrificing Auto Security

While cutting corners on car security might seem like a short-term solution to financial pressures, the long-term costs can be significant.

Financial Implications of Vehicle Theft

Vehicle theft carries substantial financial consequences, including insurance deductibles, replacement costs, and potential legal fees.

- Average costs of vehicle theft recovery and replacement: (Include estimates of these costs based on average vehicle values and insurance deductibles.)

- Examples of hidden costs associated with theft: Towing fees, loss of personal belongings, administrative costs.

Emotional Toll of Vehicle Theft

Beyond the financial burden, vehicle theft inflicts significant emotional distress and inconvenience.

- Personal stories of car theft victims: (Include brief, anonymized accounts illustrating the emotional impact.)

- The impact on daily life and mental health: The loss of a vehicle can disrupt daily routines and create significant stress.

Increased Insurance Premiums

A history of vehicle theft can lead to significantly higher insurance premiums in the future, exacerbating the financial burden.

- Statistics on how theft claims affect future insurance rates: (Include statistics showing how insurance premiums increase after a theft claim.)

- Tips for mitigating insurance premium increases: Maintaining a clean driving record, opting for comprehensive coverage.

Conclusion

Increased living costs are undeniably forcing Canadians to make difficult choices, and compromising on car security is a common consequence. This decision, however, comes with significant long-term financial and emotional burdens. Canadians Sacrifice Auto Security Due to Increased Living Costs is not just a statistic; it's a reflection of the economic pressures faced by many. Don't let rising living costs compromise your auto security. Take steps today to protect your vehicle and your peace of mind. Explore affordable security measures, choose safer parking locations, and ensure you have adequate insurance coverage. By taking proactive steps, you can mitigate the risks associated with vehicle theft and safeguard your valuable asset.

Featured Posts

-

Demna At Gucci Examining The Creative Direction Change

May 24, 2025

Demna At Gucci Examining The Creative Direction Change

May 24, 2025 -

Kerings Q1 Results Send Shares Down 6

May 24, 2025

Kerings Q1 Results Send Shares Down 6

May 24, 2025 -

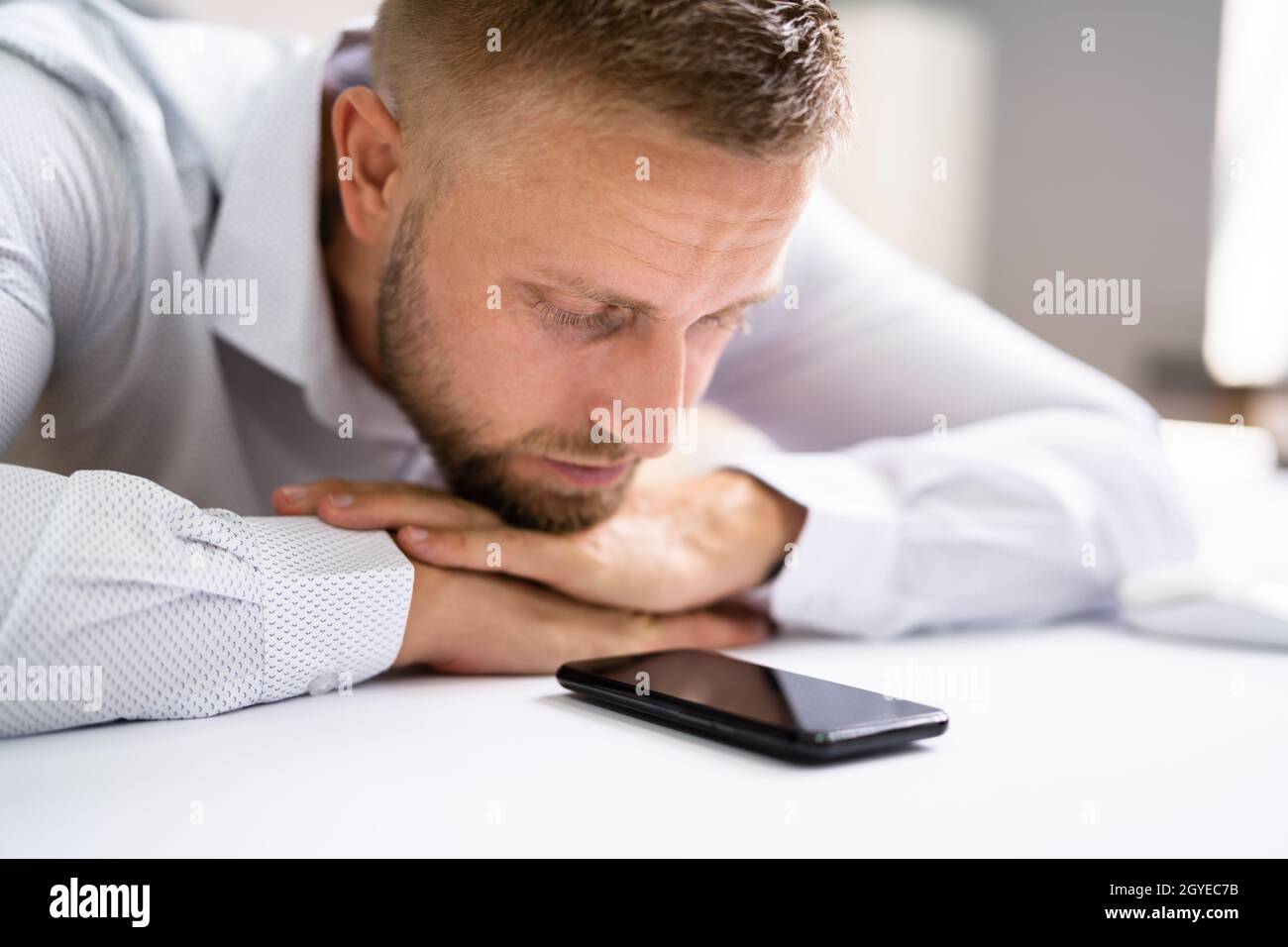

A Long Wait Reflections On Waiting By The Phone

May 24, 2025

A Long Wait Reflections On Waiting By The Phone

May 24, 2025 -

Chetyre Vozmozhnykh Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025

Chetyre Vozmozhnykh Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025 -

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

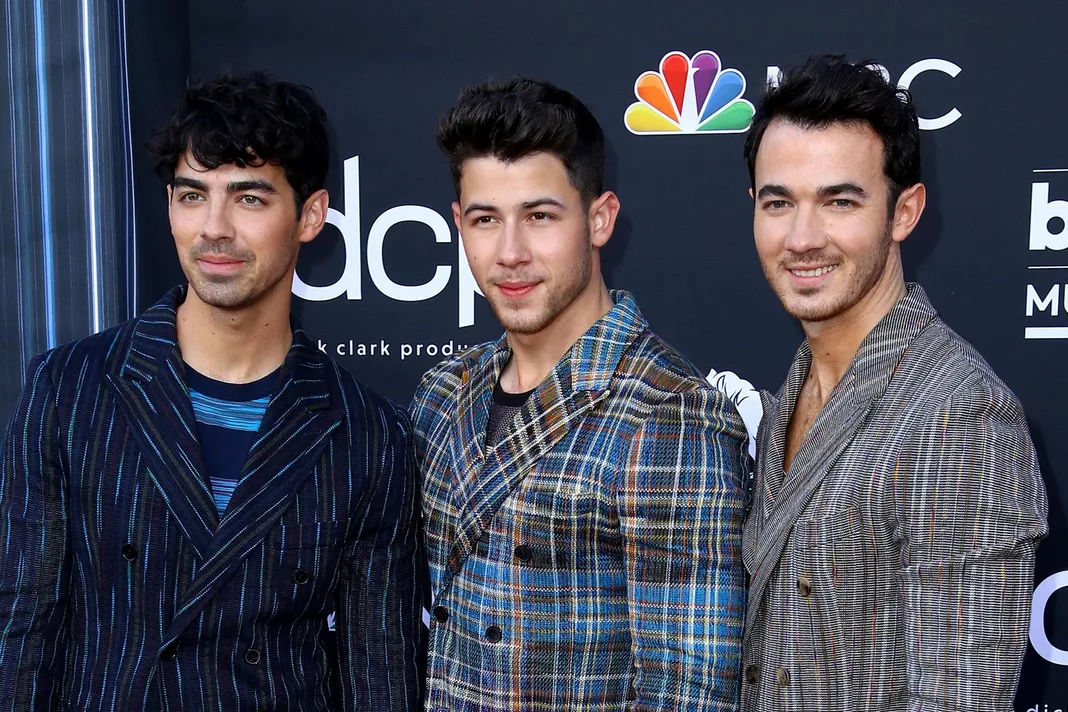

The Jonas Brothers Drama How Joe Handled A Couples Argument

May 24, 2025

The Jonas Brothers Drama How Joe Handled A Couples Argument

May 24, 2025 -

Couple Fights Over Joe Jonas His Reaction Is Going Viral

May 24, 2025

Couple Fights Over Joe Jonas His Reaction Is Going Viral

May 24, 2025 -

The Unexpected Response A Couples Argument And Joe Jonas

May 24, 2025

The Unexpected Response A Couples Argument And Joe Jonas

May 24, 2025 -

Joe Jonas Responds To Married Couples Dispute The Full Story

May 24, 2025

Joe Jonas Responds To Married Couples Dispute The Full Story

May 24, 2025 -

Joe Jonas Addresses Couples Dispute His Classy Response

May 24, 2025

Joe Jonas Addresses Couples Dispute His Classy Response

May 24, 2025