Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. For ETFs, it's essentially the total value of all the underlying securities held within the fund, minus any expenses or liabilities. This figure is then divided by the total number of outstanding shares to arrive at the NAV per share. Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is vital for assessing its performance and value.

The basic formula for calculating NAV is: Total Assets - Total Liabilities = Net Asset Value. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the NAV is typically calculated and published daily, usually at the close of market trading.

- NAV reflects the underlying asset value of the ETF.

- NAV is a per-share value.

- NAV fluctuates throughout the trading day, reflecting changes in the value of the underlying assets.

How NAV Impacts the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is directly related to its share price, although they aren't always identical. The ETF aims to track the Dow Jones Industrial Average (DJIA), so its NAV should closely mirror the index's performance. However, market forces can cause the ETF's market price to trade at a slight premium or discount to its NAV.

Dividend distributions from the underlying companies within the DJIA also impact the NAV. When the ETF distributes dividends, the NAV decreases accordingly, reflecting the payout to shareholders.

- The ETF aims to track the Dow Jones Industrial Average, so NAV should closely reflect its performance.

- Differences between NAV and market price can indicate trading opportunities or market inefficiencies. A significant discount might suggest an undervalued ETF.

- Understanding NAV helps assess the ETF's performance against its benchmark (the DJIA).

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing).

-

Market movements of the Dow Jones Industrial Average: The most significant influence on the NAV is the performance of the DJIA itself. A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV.

-

Currency fluctuations: While the DJIA is a US-dollar denominated index, currency fluctuations could indirectly impact the NAV if the ETF engages in any currency hedging strategies or holds international assets as part of its management strategy. (Note: This point would need clarification based on the ETF's specific prospectus).

-

Expense ratio: The ETF's expense ratio, representing management fees and other operational costs, subtly erodes the NAV over time. This is a small, ongoing deduction but needs to be considered in performance analysis.

-

Changes in the composition of the Dow Jones Industrial Average.

-

Corporate actions (dividends, stock splits) of the underlying companies.

-

Management fees and other expenses.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Investors can find the official NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) from several reliable sources:

-

Official sources: Amundi's official website is the primary source for this information. They usually publish this data daily.

-

Brokerage platforms: Most reputable brokerage platforms that offer the ETF will also display the NAV alongside the current market price.

-

Regularly check the NAV to monitor your investment.

-

Compare the NAV to the market price to identify potential discrepancies.

-

Understand the time lag between NAV calculation and publication.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is fundamental to informed investment decision-making. By regularly monitoring the NAV and comparing it to the market price, investors can assess the ETF's performance against its benchmark and identify potential investment opportunities. Remember, while the NAV closely follows the DJIA, market dynamics can create short-term discrepancies. Therefore, actively monitoring the NAV is key to maximizing your investment potential with this ETF. By understanding and utilizing NAV data, you'll be better equipped to manage your investments in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) effectively.

Featured Posts

-

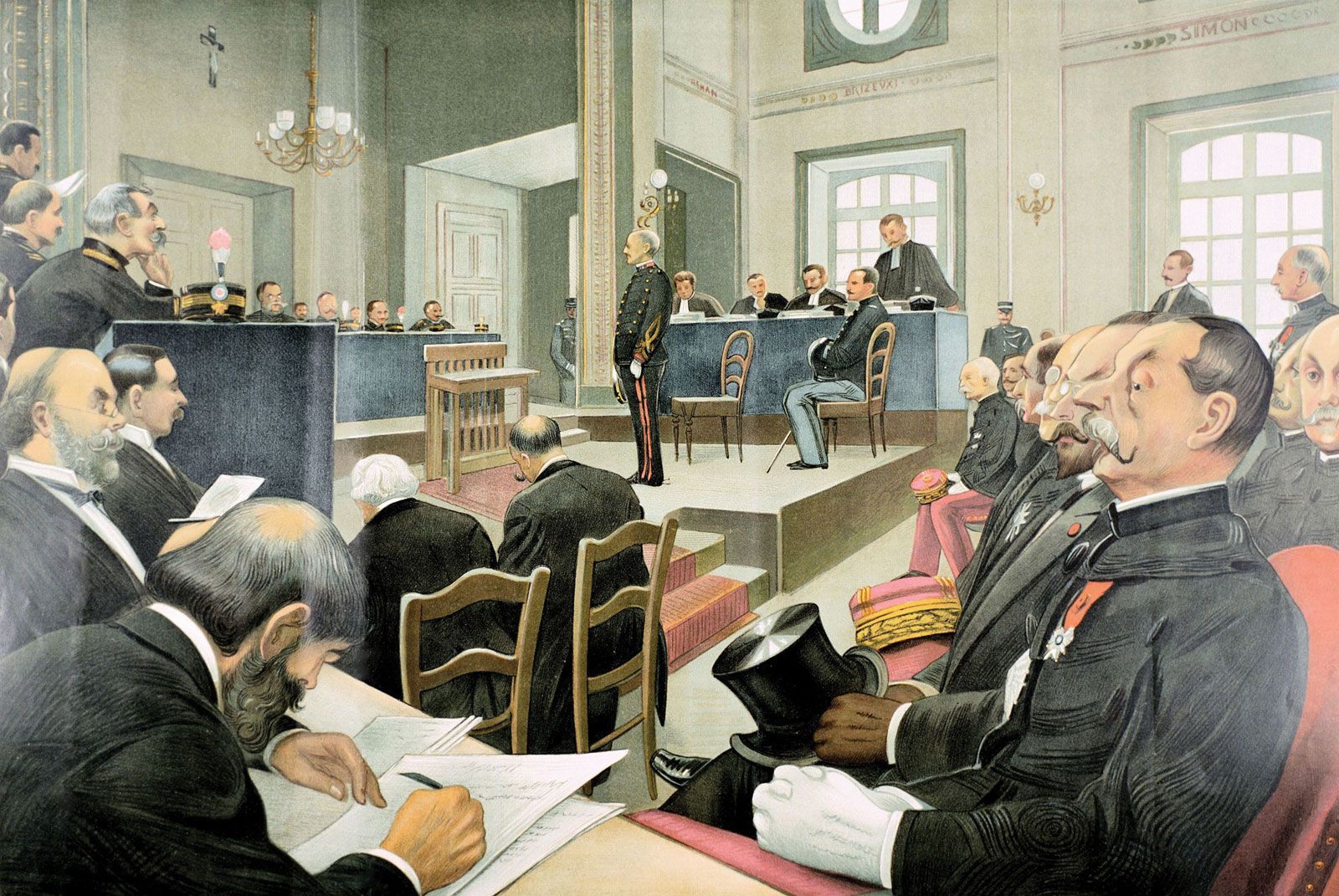

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025 -

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025 -

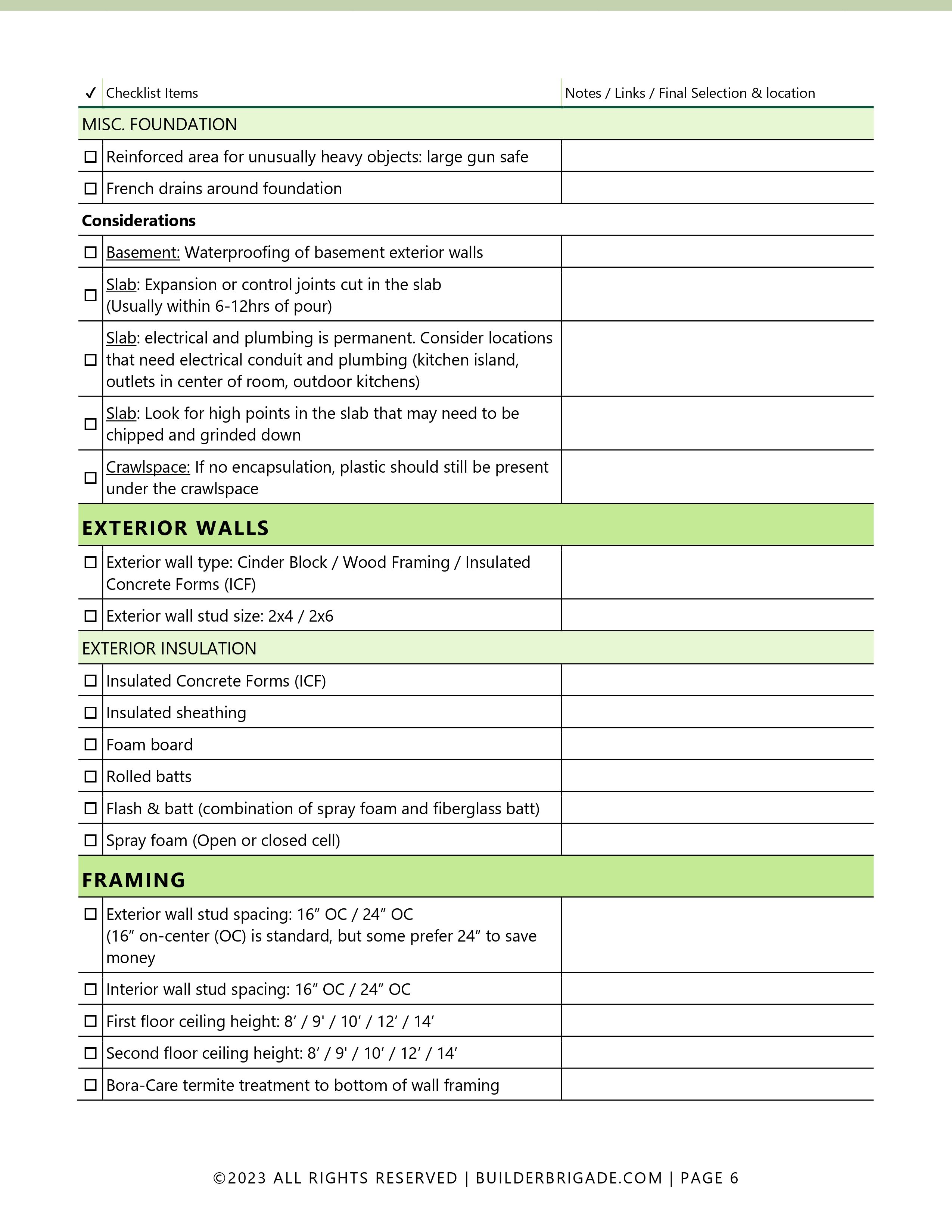

The Ultimate Escape To The Country A Comprehensive Checklist

May 24, 2025

The Ultimate Escape To The Country A Comprehensive Checklist

May 24, 2025 -

Pandemic Isolation How A Seattle Green Space Provided Refuge

May 24, 2025

Pandemic Isolation How A Seattle Green Space Provided Refuge

May 24, 2025

Latest Posts

-

Onrust Op De Amerikaanse Beurs Hoe Beinvloedt Dit De Aex Index

May 24, 2025

Onrust Op De Amerikaanse Beurs Hoe Beinvloedt Dit De Aex Index

May 24, 2025 -

Marktdraai Europese Aandelen Analyse En Voorspelling Ten Opzichte Van Wall Street

May 24, 2025

Marktdraai Europese Aandelen Analyse En Voorspelling Ten Opzichte Van Wall Street

May 24, 2025 -

Amerikaanse Beurs Daalt Aex Blijft Positief Wat Betekenen Deze Tegengestelde Trends

May 24, 2025

Amerikaanse Beurs Daalt Aex Blijft Positief Wat Betekenen Deze Tegengestelde Trends

May 24, 2025 -

Europese Aandelen Een Vergelijking Met Wall Street En De Toekomst Van De Marktdraai

May 24, 2025

Europese Aandelen Een Vergelijking Met Wall Street En De Toekomst Van De Marktdraai

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025