Analysis Of Private Credit Market Vulnerabilities: Credit Weekly Update

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

Rising interest rates significantly impact the private credit market, primarily by increasing borrowing costs for private credit borrowers. This leads to reduced profitability for companies relying on private debt financing and increases the potential for defaults and loan losses. The effect is particularly pronounced in leveraged buyouts (LBOs) and other debt-financed transactions, where high levels of debt amplify the impact of higher interest expense.

- Higher interest expense reduces profitability: Increased interest payments directly eat into a company's earnings, potentially impacting its ability to meet its debt obligations.

- Increased refinancing risk for existing loans: Companies with existing loans face higher costs when refinancing, potentially leading to financial distress if they cannot secure new financing at favorable terms.

- Potential for covenant breaches: Higher interest payments can trigger covenant breaches, leading to potential default and enforcement actions by lenders.

- Reduced investor appetite for new private credit investments: Higher interest rates can decrease the attractiveness of new private credit investments, reducing the supply of capital available to borrowers.

The risk of interest rate hikes, therefore, is a significant factor to consider when assessing private credit market vulnerabilities. Effective interest rate risk management is crucial for mitigating these potential downsides.

Illiquidity and Market Volatility in the Private Credit Market

Unlike public markets, private credit investments are inherently illiquid. This lack of liquidity presents significant challenges during periods of market volatility. When market sentiment shifts, it can be difficult to quickly exit investments, leading to price discovery challenges and potentially impacting valuations. This illiquidity increases the risk of forced selling and fire sales, potentially creating a negative feedback loop and exacerbating market volatility.

- Difficulty in quickly exiting investments: The absence of a readily available market for selling private credit investments makes it challenging to react quickly to changing market conditions.

- Price discovery challenges: The lack of frequent trading makes it harder to determine the fair market value of private credit assets.

- Potential for contagion effects: The illiquidity of the market can amplify the effects of defaults or distress at one firm to spread across the market.

- Increased risk for less liquid strategies: Strategies that focus on less liquid assets are especially vulnerable to market volatility and illiquidity.

Understanding the inherent illiquidity and potential for market volatility is essential for navigating the private credit market effectively.

Due Diligence and Risk Assessment Challenges in Private Credit

Assessing the creditworthiness of private borrowers presents unique challenges compared to publicly traded companies. The information available on private borrowers is often less transparent and standardized than that available for publicly traded companies. This lack of readily accessible data increases the importance of robust due diligence processes. Thorough investigations are critical to gain a clear understanding of a borrower's financial health and risk profile.

- Limited transparency compared to public markets: Private companies are not subject to the same stringent reporting requirements as public companies.

- Reliance on less standardized financial reporting: The financial information provided by private companies may not always adhere to consistent standards, complicating the assessment process.

- Difficulty in assessing collateral values: Accurately assessing the value of collateral used to secure private credit loans can be challenging, particularly in volatile markets.

- Increased need for specialized expertise: Effective due diligence in the private credit market requires specialized knowledge and experience.

Robust due diligence is not merely a best practice; it is a necessity for mitigating the risks associated with private credit investments.

Regulatory Scrutiny and its Impact on the Private Credit Market

The regulatory landscape for private credit is constantly evolving. Increased regulatory scrutiny, including stricter capital requirements and enhanced reporting mandates, can significantly impact market dynamics. Potential regulatory changes introduce uncertainty, increase compliance costs, and add operational burdens for market participants. Navigating this evolving environment requires a clear understanding of existing and potential future regulations.

- Increased reporting requirements: Regulators are increasingly demanding more comprehensive reporting from private credit lenders.

- Potential for stricter capital requirements: Higher capital requirements could constrain the lending capacity of private credit firms.

- Greater scrutiny of lending practices: Regulators are likely to increase their scrutiny of lending practices to ensure responsible lending.

- Uncertainty surrounding future regulations: The evolving regulatory environment introduces uncertainty that can impact investment decisions and market behavior.

Staying informed about the changing regulatory landscape is essential for successful participation in the private credit market.

Analyzing Private Credit Market Vulnerabilities – Key Takeaways and Next Steps

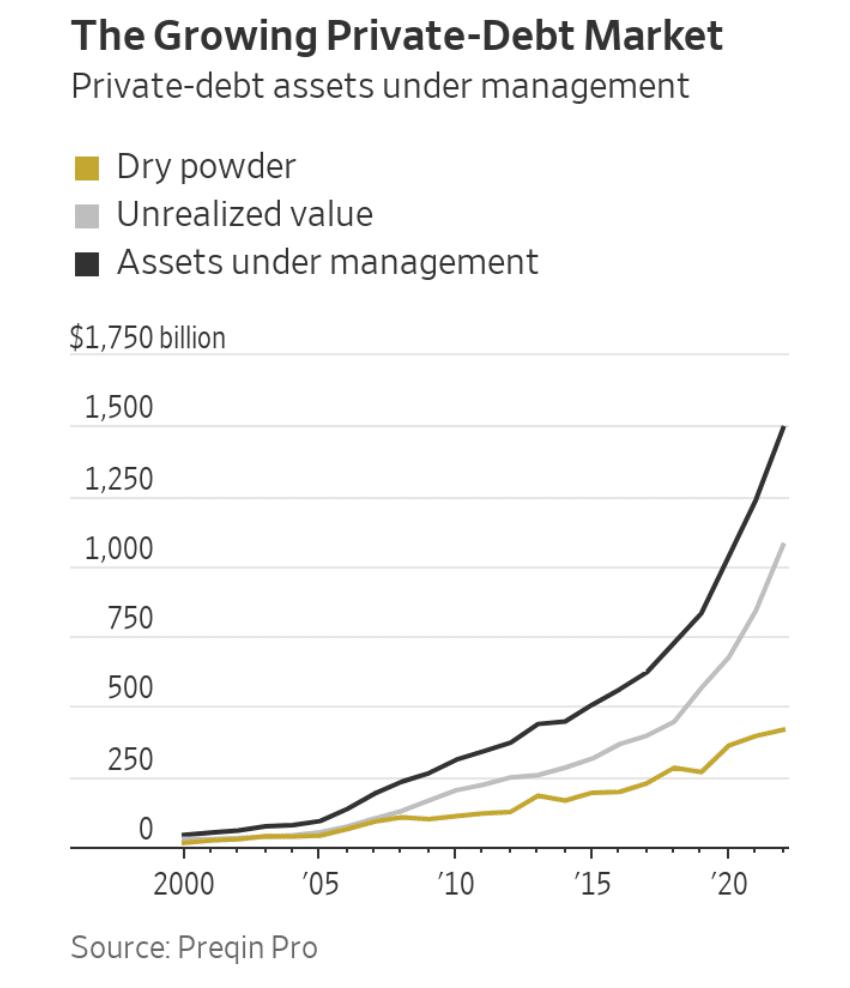

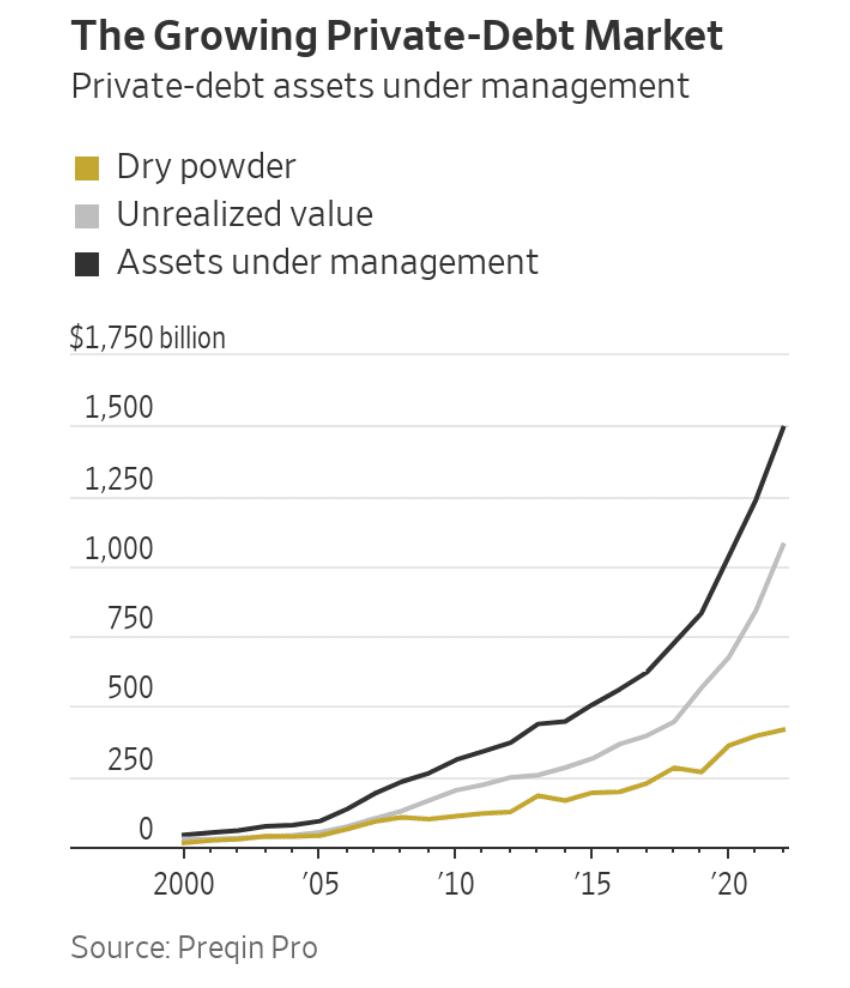

This Credit Weekly Update highlights several key vulnerabilities in the private credit market: rising interest rates impacting borrowing costs and increasing default risks; inherent illiquidity and market volatility making quick exits difficult and potentially triggering forced sales; complexities in due diligence and risk assessment due to limited transparency and less standardized information; and the evolving regulatory environment introducing uncertainty and increasing compliance burdens. Proactive risk management, thorough due diligence, and a keen awareness of the regulatory environment are crucial for success in this dynamic market.

The outlook for the private credit market remains complex. While the potential for high returns persists, careful consideration of the identified vulnerabilities is essential. To stay abreast of evolving market conditions and receive ongoing analysis of private credit market vulnerabilities, subscribe to our Credit Weekly Update. For more in-depth analyses and resources, please visit [link to relevant resources] or contact our experts at [contact information].

Featured Posts

-

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025 -

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025 -

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Lead Autism Vaccine Study

Apr 27, 2025

Government Appoints Vaccine Skeptic To Lead Autism Vaccine Study

Apr 27, 2025 -

Bof A On Stock Market Valuations A Balanced Assessment

Apr 27, 2025

Bof A On Stock Market Valuations A Balanced Assessment

Apr 27, 2025

Latest Posts

-

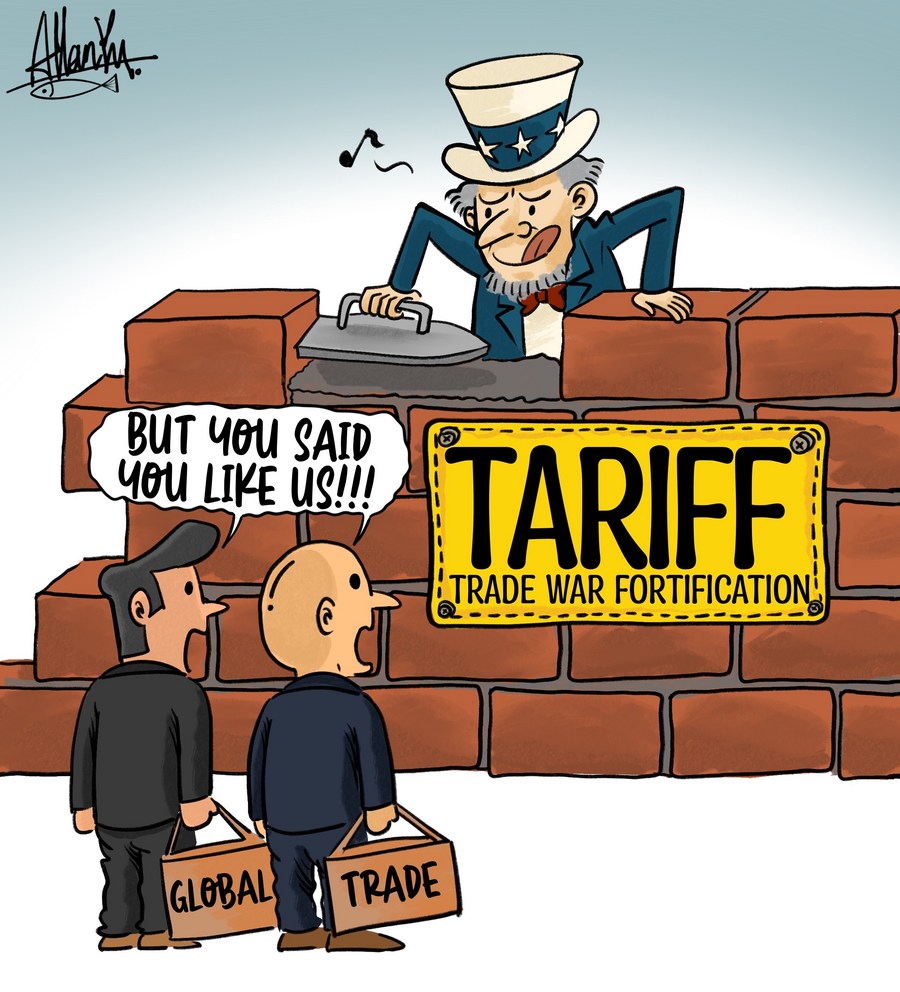

Specific Us Products Exempted From Chinese Tariffs

Apr 28, 2025

Specific Us Products Exempted From Chinese Tariffs

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025 -

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025 -

China Quietly Eases Tariffs On Select Us Goods

Apr 28, 2025

China Quietly Eases Tariffs On Select Us Goods

Apr 28, 2025 -

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025