Specific US Products Exempted From Chinese Tariffs

Table of Contents

The History and Context of Tariff Exemptions

The US-China trade war, marked by the imposition of tariffs on billions of dollars worth of goods, began in 2018. These tariffs, intended to address trade imbalances and intellectual property concerns, significantly impacted businesses on both sides of the Pacific. Recognizing the potential negative consequences for US businesses and consumers, the US government established a process for granting exemptions to specific products. This process involved submitting detailed applications demonstrating the economic hardship caused by the tariffs and the lack of viable domestic alternatives. Key agencies involved included the Office of the United States Trade Representative (USTR) and other relevant departments within the US government.

- Timeline of major tariff announcements and exemption periods: The initial rounds of tariffs were implemented in 2018, with subsequent increases and modifications throughout 2019 and 2020. Exemption requests were accepted and reviewed during specific windows, with approvals often contingent upon the specific circumstances of each case.

- Factors considered when granting exemptions: The USTR considered several critical factors when evaluating exemption requests, including the availability of alternative sources for the product, the impact on US consumers (e.g., price increases), and the overall economic consequences of maintaining the tariff. The aim was to minimize negative repercussions while addressing broader trade objectives.

- Statistics illustrating the overall number of exemption requests and approvals: Thousands of exemption requests were filed, with a significant but smaller percentage receiving approval. The exact numbers fluctuate depending on the product categories and the periods under consideration. Official data can be found on the USTR website.

Categories of Exempted Products

Exempted products spanned various categories, reflecting the broad impact of the tariffs on the US economy. These categories broadly included agricultural goods, manufactured goods, and technology products.

Agricultural Goods: These exemptions often involved products for which the US held a significant competitive advantage, or where there were limited alternative supply sources.

- Examples: Certain types of soybeans, fruits, and nuts frequently received exemptions due to their significant economic impact and the difficulty of sourcing similar products elsewhere. The rationale often involved protecting US farmers and maintaining agricultural exports to China.

Manufactured Goods: Exemptions in this sector typically focused on products where tariffs caused disproportionate harm to US manufacturers or consumers.

- Examples: Specific components for medical devices or specialized machinery often received exemptions because domestic alternatives were either unavailable or significantly more expensive. The aim was to prevent disruptions in healthcare or manufacturing.

Technology Products: This category often involved advanced technologies or specialized components that had limited alternatives within the global marketplace.

- Examples: Certain semiconductor components or specialized software were sometimes exempted due to their critical role in high-tech industries. The rationale often considered broader national security and economic competitiveness implications.

The economic impact of these exemptions varied depending on the specific product and the overall market dynamics. While providing relief to some US businesses, the exemptions also influenced pricing strategies and competitive landscapes in both US and Chinese markets.

Finding Information on Exempted Products

Locating official information on specific US products exempted from Chinese tariffs requires diligent research and navigation of government resources. The primary source for this information is the Office of the United States Trade Representative (USTR) website.

- Links to official government resources: The USTR website provides announcements, press releases, and often, downloadable lists of exempted products categorized by product code (e.g., Harmonized Tariff Schedule codes). Additional information may be available from other relevant government agencies depending on the product category.

- Tips for searching and navigating these resources: Utilize the website's search functions, focusing on keywords like "tariff exemptions," "exclusion requests," and specific product names or codes. Refer to the website's help section or contact the USTR directly if you encounter difficulties.

- Suggestions for subscribing to updates and notifications: Many government websites offer email subscription services for updates on policy changes and new announcements. Subscribing to these services ensures that you remain informed about any alterations in the list of exempted products.

Navigating the Complexity of Tariff Exemptions

Dealing with tariff exemptions involves inherent complexities. Businesses often face challenges in understanding the eligibility criteria, preparing comprehensive applications, and navigating the bureaucratic process.

- Common misconceptions regarding tariff exemptions: A common misconception is that any product can be exempt. Exemptions are granted based on specific economic justifications, not on a first-come, first-served basis.

- Potential pitfalls to avoid: Inadequate preparation of the exemption application or missing key deadlines can lead to rejection. Businesses should seek legal and professional advice to avoid such pitfalls.

- Resources for seeking professional assistance: Consult with trade lawyers, customs brokers, or international trade specialists who possess expertise in navigating US-China trade regulations.

Conclusion

Understanding which specific US products are exempted from Chinese tariffs is crucial for businesses operating in the US-China trade corridor. Successfully navigating these exemptions can unlock significant cost savings and competitive advantages. This article highlighted the historical context of these exemptions, the categories of products involved, and the resources available for finding relevant information. Remember to leverage the resources provided, stay updated on changes to the exemption lists, and seek professional assistance when navigating the complexities of this process. By actively engaging with the resources available and staying informed about updates regarding specific US products exempted from Chinese tariffs, businesses can effectively manage their trade strategies and minimize the impact of trade policies.

Featured Posts

-

Analyzing Market Swings The Actions Of Pros And Individuals

Apr 28, 2025

Analyzing Market Swings The Actions Of Pros And Individuals

Apr 28, 2025 -

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025 -

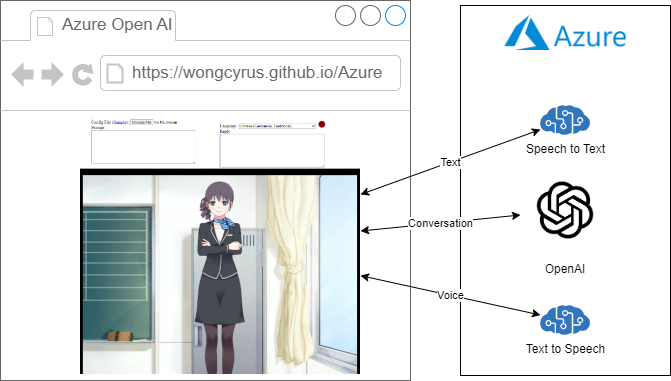

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025 -

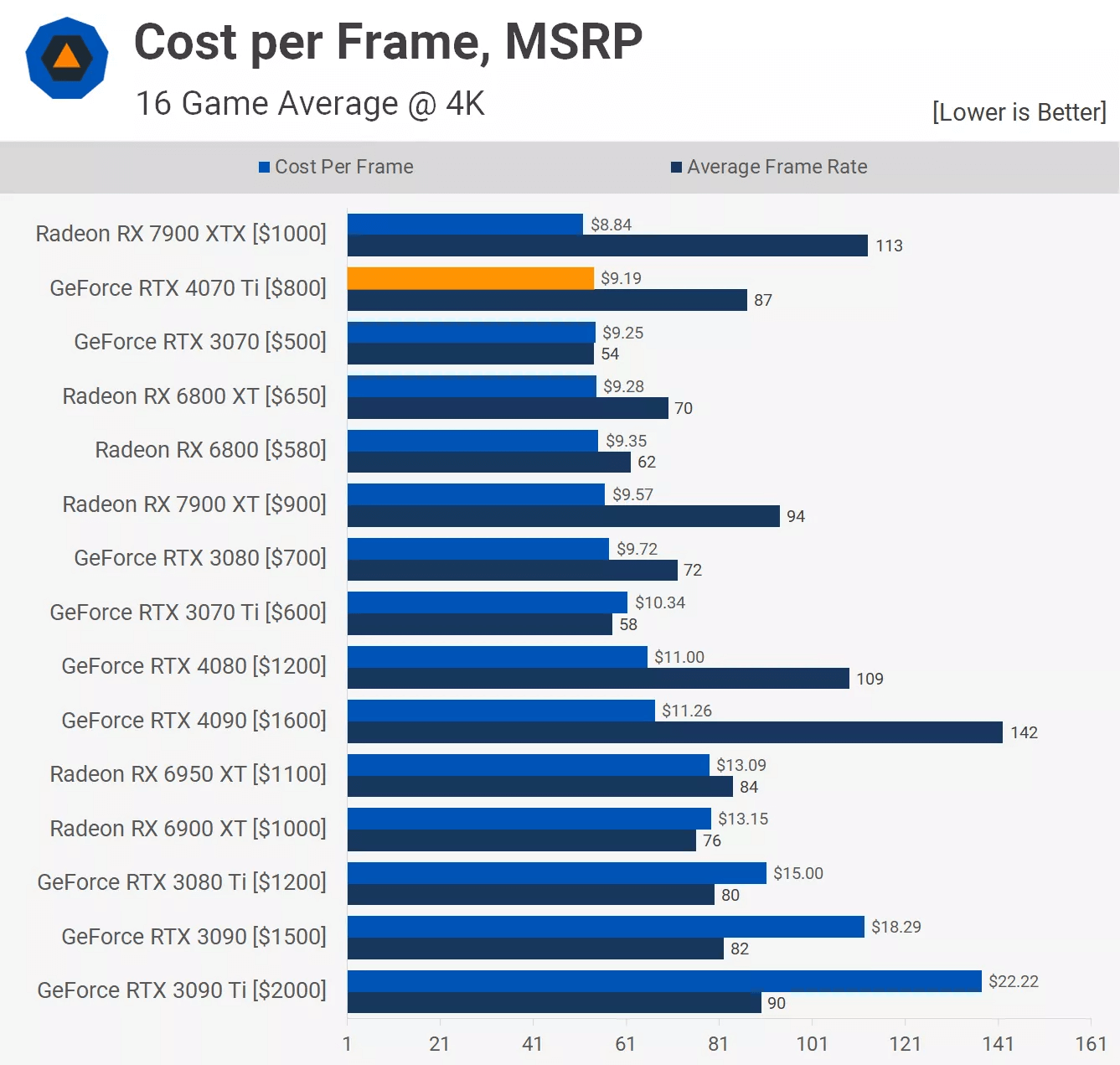

Gpu Prices A Look At The Latest Trends

Apr 28, 2025

Gpu Prices A Look At The Latest Trends

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanders To The Cleveland Browns

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanders To The Cleveland Browns

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

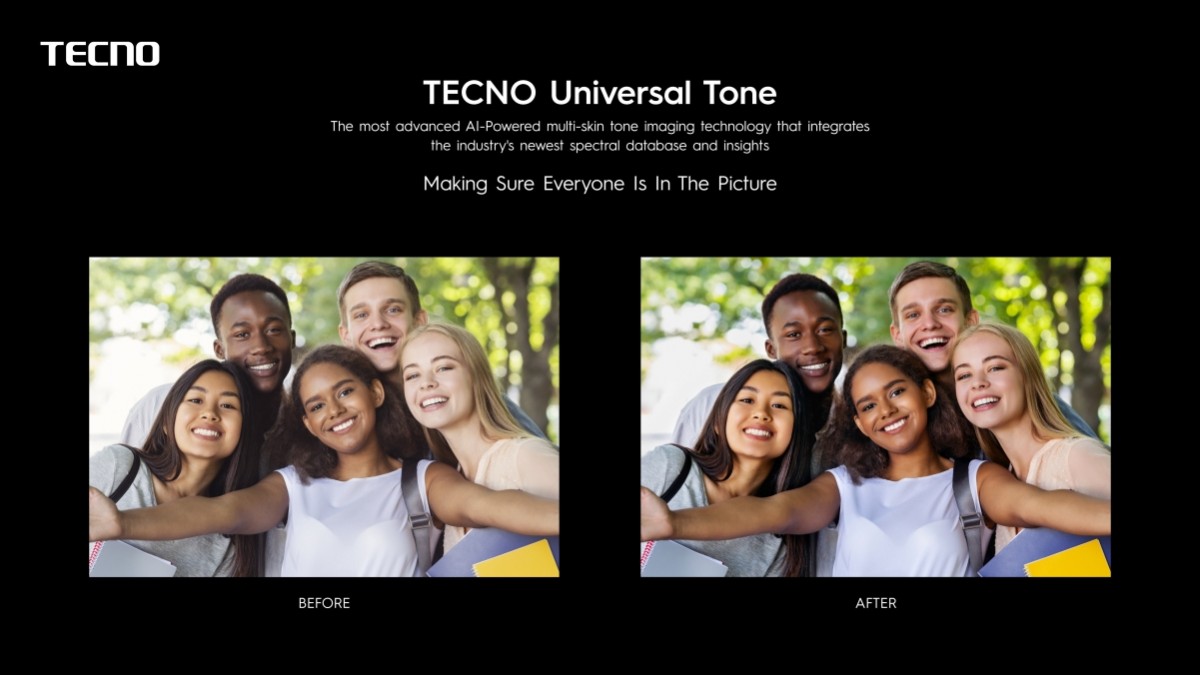

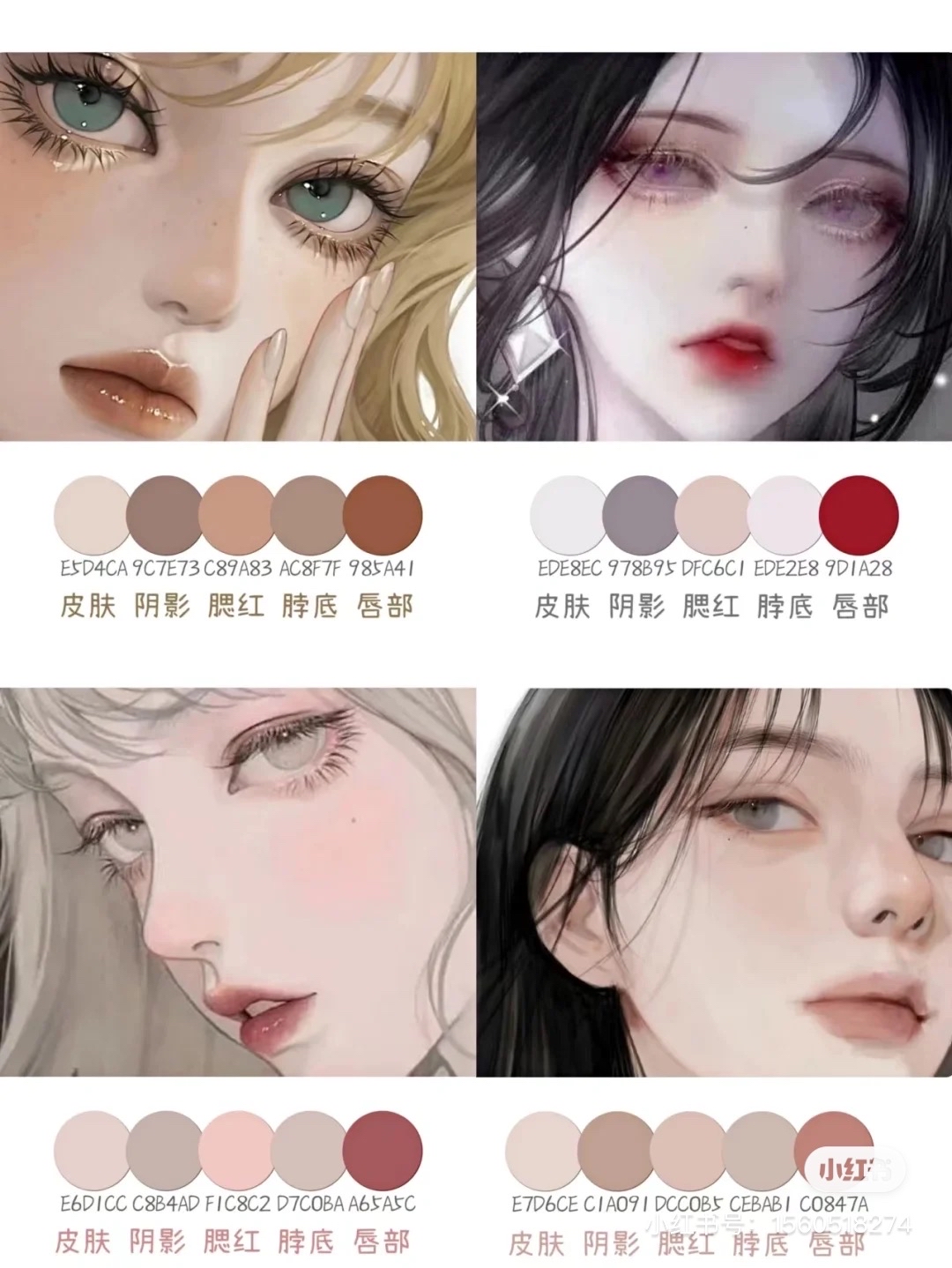

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025