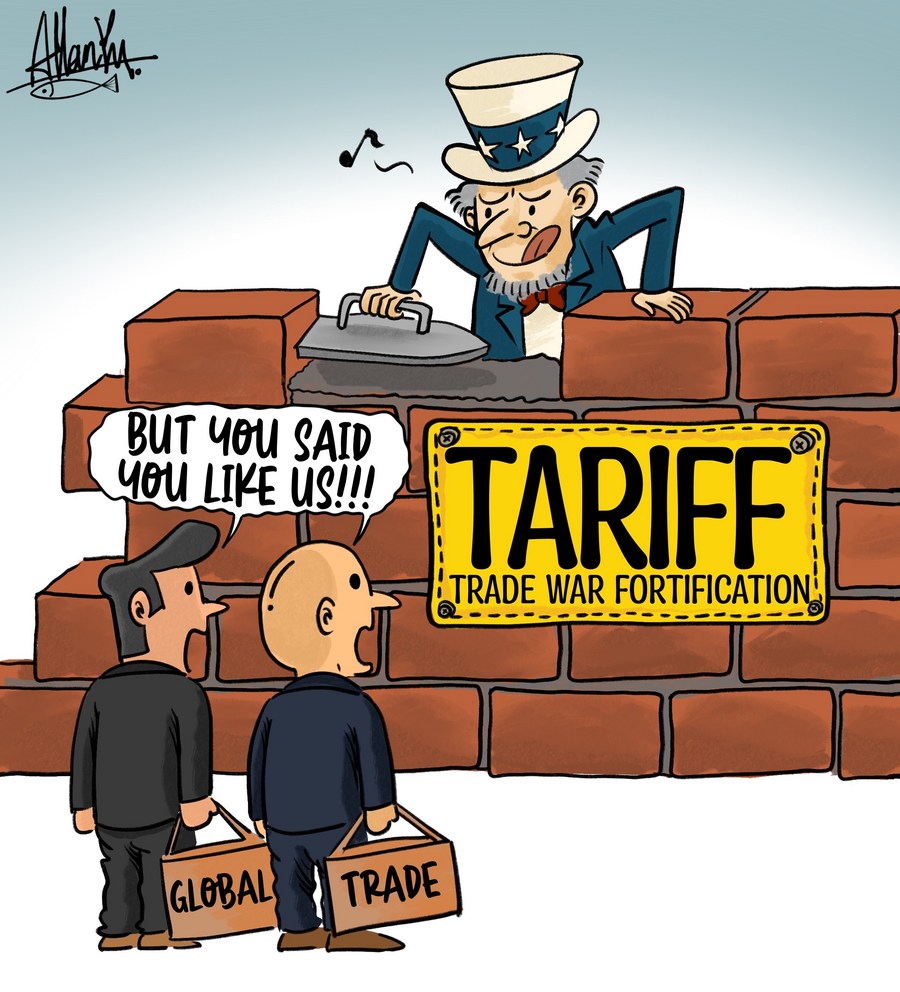

China's Targeted Tariff Exemptions For US Imports

Table of Contents

Understanding the Mechanism of China's Tariff Exemptions

Navigating China's tariff exemption system requires a clear understanding of its processes and eligibility criteria. This section breaks down the key aspects of obtaining these crucial exemptions.

The Process of Applying for Exemptions

Securing a tariff exemption from China involves a multi-step process demanding meticulous attention to detail. The process generally includes:

- Submission of a formal application: This typically requires detailed documentation outlining the specifics of the goods, their intended use, and justification for exemption.

- Review by relevant government agencies: Applications are assessed by various Chinese ministries and agencies, depending on the type of goods. This review process can be lengthy and may involve multiple rounds of clarification.

- Notification of decision: Applicants are eventually informed whether their request for a tariff exemption has been approved or denied. Appeals processes may be available in case of denial.

Key websites and forms for applications vary depending on the specific agency involved. It's crucial to consult the most up-to-date official sources for the most accurate information. Eligibility is based on a range of factors, including whether the goods are considered essential, contribute to technological advancement, or address specific needs within the Chinese economy.

Categories of Goods Eligible for Exemptions

Historically, China has granted tariff exemptions for a variety of US goods. These frequently include:

- Agricultural products: Certain agricultural commodities, such as soybeans and cotton, have been subject to exemption periods, often influenced by bilateral trade negotiations.

- High-tech components: Specific electronic components or technological inputs vital for Chinese manufacturing have also received exemptions. This reflects China’s strategic interests in certain technological sectors.

The rationale behind granting these exemptions often revolves around mitigating negative impacts on Chinese consumers or domestic industries reliant on these imported goods. Data on the volume of goods benefiting from exemptions is often limited in its public availability, highlighting the opacity of the system.

Transparency and Predictability of the Exemption Process

Transparency and predictability remain significant challenges in China's tariff exemption system. Businesses often struggle to anticipate exemption decisions due to:

- Limited public information: Specific criteria for granting exemptions are not always publicly available or clearly defined.

- Subjectivity in decision-making: The process can involve subjective assessments that may not always be consistent or easily understood by applicants.

While ongoing efforts aim to increase transparency and streamline the application process, substantial improvements are still needed to foster greater predictability for businesses seeking these critical exemptions.

The Impact of Tariff Exemptions on US Businesses

The success or failure of obtaining a tariff exemption carries significant consequences for US businesses operating within or exporting to the Chinese market.

Positive Impacts

Securing a tariff exemption offers several advantages:

- Reduced costs: Exemptions directly translate to lower import costs, improving profit margins and competitiveness.

- Increased market share: Lower prices can boost sales volumes, allowing US businesses to gain a stronger foothold in the Chinese market.

Case studies demonstrating specific companies' successes are scarce due to the sensitive nature of the information and the desire to avoid drawing extra attention to the exemption process. However, the potential for substantial financial benefits is undeniable when tariffs are successfully avoided.

Challenges and Uncertainties

Despite the potential upsides, the process presents inherent challenges:

- Bureaucratic hurdles: The application process is often time-consuming and complex, requiring significant resources and expertise.

- Unpredictable outcomes: The lack of transparency and consistency makes it difficult for businesses to accurately assess their chances of success.

Denial or delay in granting an exemption can severely impact profitability, competitiveness, and even business viability, underscoring the high stakes involved in navigating this process.

Future Outlook and Implications for US-China Trade Relations

The future of China's targeted tariff exemptions remains uncertain, subject to evolving geopolitical dynamics and the broader state of US-China trade relations.

Potential for Future Changes

Future changes to exemption policies may be influenced by:

- Geopolitical tensions: Escalating geopolitical tensions could lead to stricter criteria or a reduction in the availability of exemptions.

- Trade negotiations: The outcome of future trade negotiations between the US and China could significantly shape the future of tariff exemptions.

Strategic Implications for US Businesses

Given this uncertainty, US businesses require proactive strategies:

- Risk mitigation: Diversifying supply chains and markets can reduce reliance on tariff exemptions and mitigate potential disruptions.

- Proactive engagement: Maintaining close communication with Chinese authorities and industry experts can help navigate the complexities of the exemption process.

Adapting to the ever-shifting trade landscape is paramount. Thorough due diligence, flexible strategies, and a keen understanding of Chinese regulatory changes are crucial for navigating these challenges successfully.

Conclusion

China's targeted tariff exemptions represent a complex yet crucial element of US-China trade relations. Understanding the intricacies of this process, including its application requirements, eligibility criteria, and potential impacts on US businesses, is fundamental to success in the Chinese market. While the system offers the potential for significant cost savings and increased competitiveness, navigating its bureaucratic hurdles and unpredictable nature demands careful planning, diligent research, and strategic flexibility. Understanding China's targeted tariff exemptions is crucial for success in the Chinese market. Stay informed and plan strategically to navigate this complex landscape.

Featured Posts

-

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025 -

Worlds Most Influential Chef Impresses Eva Longoria With Fishermans Stew

Apr 28, 2025

Worlds Most Influential Chef Impresses Eva Longoria With Fishermans Stew

Apr 28, 2025 -

Individual Investors Vs Professionals Who Wins During Market Swings

Apr 28, 2025

Individual Investors Vs Professionals Who Wins During Market Swings

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

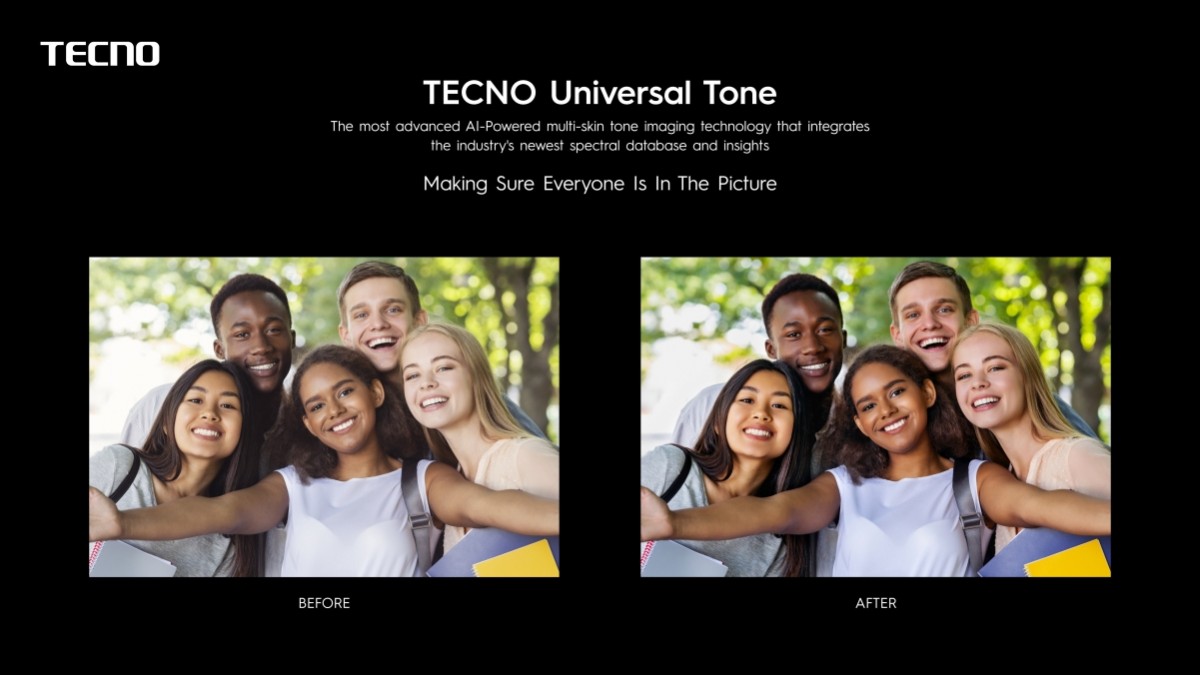

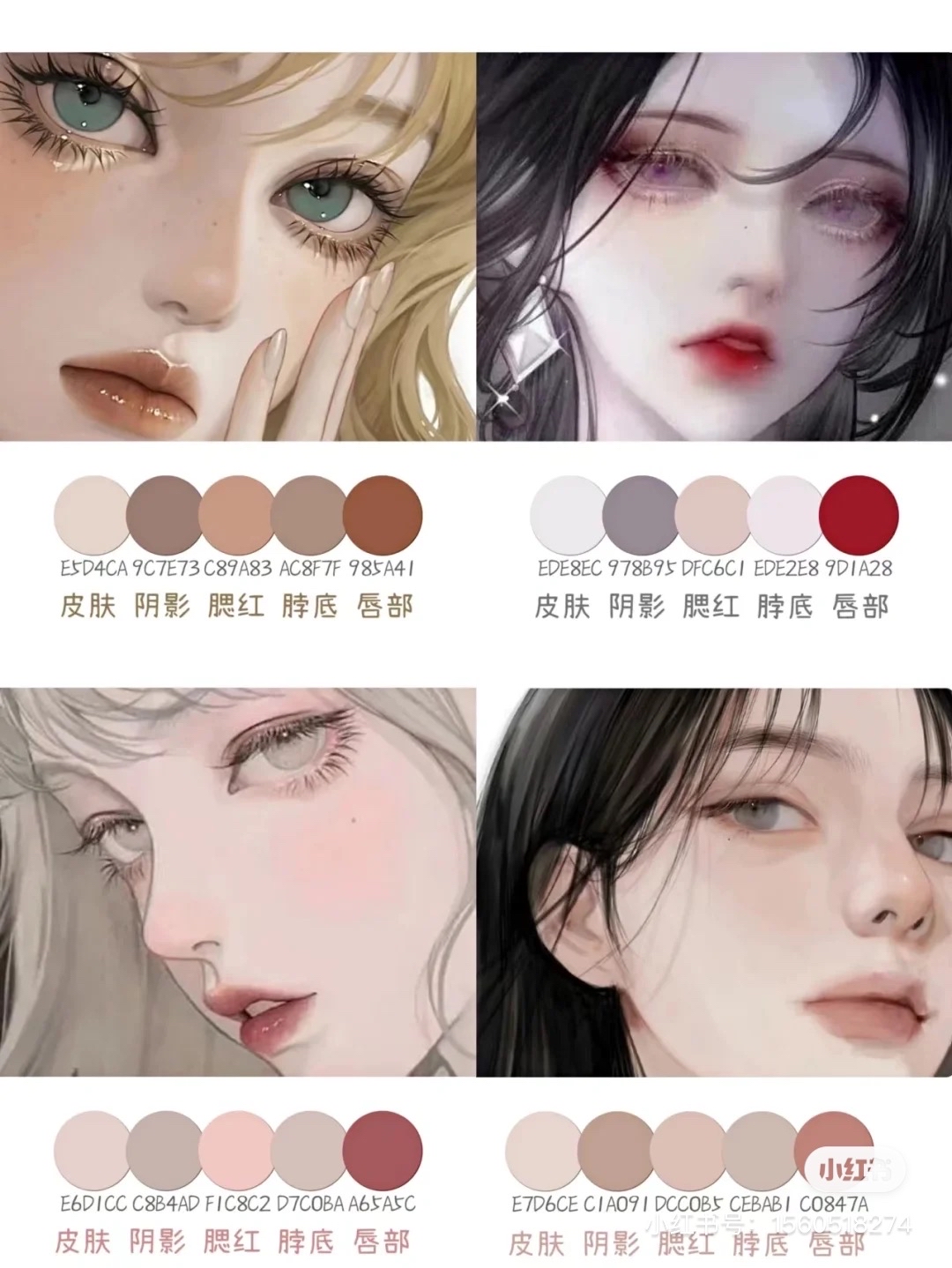

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025