Understanding Tesla's Canadian Price Increase And Inventory Strategy

Table of Contents

Factors Contributing to Tesla's Canadian Price Increases

Several interconnected factors contribute to Tesla's recent price increases in Canada. Understanding these elements is crucial to grasping the company's overall pricing strategy.

Currency Fluctuations and Exchange Rates

The fluctuating Canadian dollar (CAD) against the US dollar (USD) significantly impacts Tesla's pricing in Canada. A weaker CAD makes importing vehicles from Tesla's US manufacturing plants more expensive.

- Impact of a weaker Canadian dollar: A weaker CAD increases the cost of importing Tesla vehicles, necessitating price adjustments to maintain profitability.

- Hedging strategies: While Tesla might employ hedging strategies to mitigate currency risk, these strategies aren't always completely effective in neutralizing the effects of volatile exchange rates.

- Historical comparisons of CAD/USD and Tesla pricing: Examining historical data reveals a strong correlation between CAD/USD exchange rate movements and Tesla's price changes in Canada. (Insert chart or graph showing correlation here).

Increased Raw Material Costs

The rising cost of raw materials used in Tesla vehicle production, such as lithium for batteries, steel, and aluminum, directly impacts manufacturing costs.

- Specific examples of raw material price increases: The price of lithium, a crucial component in electric vehicle batteries, has seen significant increases in recent years, directly impacting Tesla's production costs. Similar increases have been observed in the prices of steel and other essential components.

- Their impact on manufacturing costs: These escalating raw material costs necessitate price adjustments to maintain profit margins.

- Tesla's efforts to mitigate these costs: Tesla is actively exploring alternative materials and supply chains to mitigate the impact of rising raw material costs, but these efforts take time to implement and may not fully offset price pressures. (Insert chart or graph showing raw material price increases over time here).

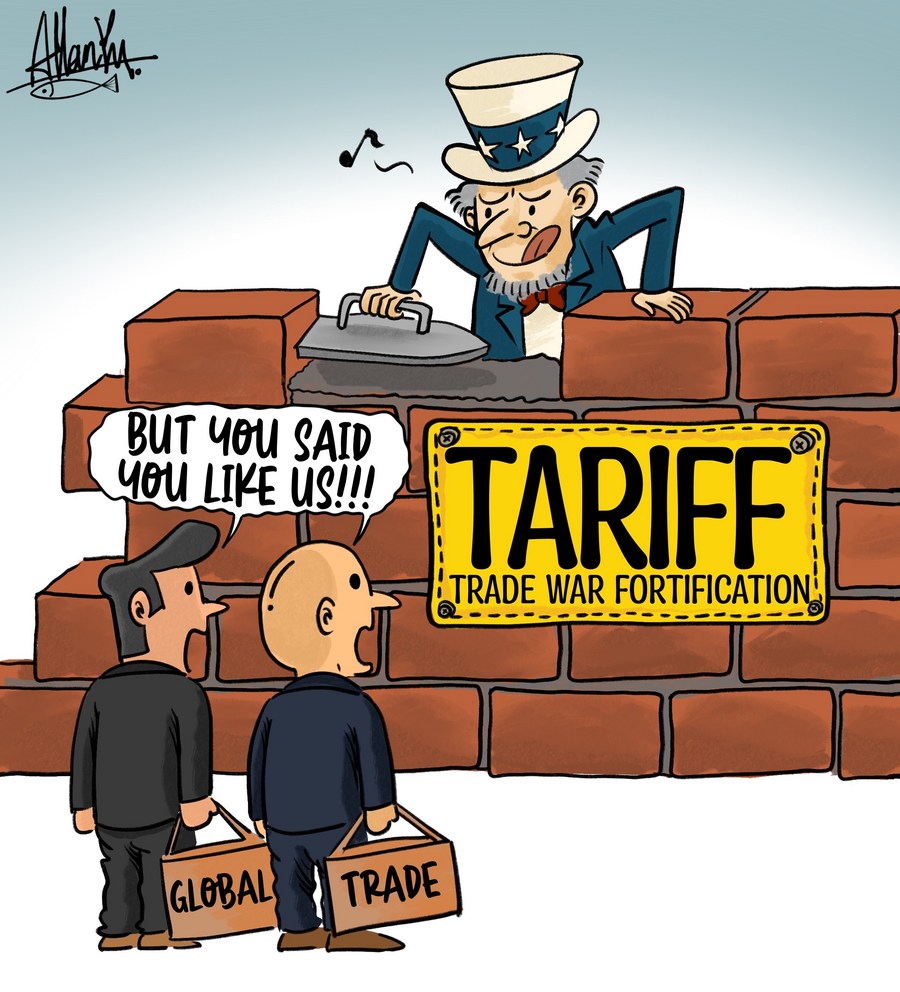

Tariffs and Import Duties

Tariffs and import duties levied on imported vehicles into Canada can add substantially to the final price paid by consumers.

- Specific tariffs or duties: Canadian import regulations and tariffs specifically applicable to electric vehicles or vehicles originating from the US may impact Tesla's pricing.

- Their impact on the final price: These duties add a layer of cost that is passed on to the consumer, contributing to the overall price increase.

- Potential changes in future tariffs: Any changes to existing tariffs or the introduction of new ones could further influence Tesla's pricing strategy in the Canadian market. [Link to relevant government website regarding import tariffs].

Supply Chain Disruptions

Global supply chain disruptions, exacerbated by factors such as the COVID-19 pandemic and geopolitical events, have constrained Tesla's production capabilities and contributed to price increases.

- Examples of supply chain disruptions impacting Tesla: Delays in receiving crucial components from suppliers due to factory closures, transportation bottlenecks, or geopolitical instability have affected Tesla's production output.

- How these disruptions affect vehicle availability and pricing: Reduced production capacity due to supply chain disruptions can lead to increased prices due to limited vehicle availability and higher demand.

Tesla's Inventory Management Strategies in Canada

Tesla's unique direct-to-consumer sales model significantly shapes its inventory management strategy in Canada, differing markedly from traditional dealership models.

Direct Sales Model and Inventory Control

Tesla's direct sales model allows for tighter control over inventory levels compared to traditional dealerships.

- Advantages and disadvantages of this model regarding inventory management: The advantages include reduced reliance on third-party dealerships and better control over pricing and distribution. However, managing inventory directly requires sophisticated forecasting and logistics.

- Comparison to traditional dealerships: Unlike dealerships with large inventories, Tesla manages a leaner inventory, reducing storage costs but potentially impacting immediate vehicle availability.

Demand Forecasting and Production Planning

Accurate demand forecasting is essential for Tesla's inventory management.

- How Tesla forecasts demand in the Canadian market: Tesla likely uses sophisticated data analytics, taking into account market trends, consumer preferences, and economic indicators to predict demand in the Canadian market.

- How this impacts vehicle production and allocation: Accurate forecasting allows Tesla to adjust its production levels to match anticipated demand, minimizing excess inventory and maximizing efficiency.

Optimizing Inventory Turnover

Tesla aims to maintain an optimal inventory turnover rate, minimizing storage costs and reducing the risk of obsolescence.

- Strategies used to optimize inventory: Tesla employs just-in-time inventory management techniques, ensuring that vehicles are produced and delivered as close as possible to the time of purchase.

- Metrics used to measure inventory efficiency: Key performance indicators (KPIs) like inventory turnover ratio and days of inventory on hand are likely used to track and measure the efficiency of Tesla's inventory management.

Impact on Canadian Consumers and the Automotive Market

Tesla's Canadian price increase and inventory strategies have notable implications for both consumers and the competitive landscape.

Affordability and Consumer Choice

The price increases directly impact the affordability of Tesla vehicles for Canadian consumers.

- Comparison of Tesla prices to competitors: Comparing Tesla's prices to competing electric vehicles reveals Tesla's positioning in the market, potentially impacting consumer purchasing decisions.

- Impact on consumer purchasing decisions: Higher prices may deter some potential buyers, while others may remain committed to Tesla's brand and technology.

Competition and Market Share

Tesla's pricing strategy influences its competitive position within the Canadian electric vehicle market.

- Analysis of Tesla's market share in Canada: Tesla's market share in Canada provides insights into the effectiveness of its pricing and inventory strategies.

- Comparison to competitors' pricing and market share: Analyzing competitor pricing and market share helps understand how Tesla’s strategies affect its competitiveness in the Canadian EV market.

Conclusion: Understanding Tesla's Canadian Price Increase and Inventory Strategy

In conclusion, Tesla's Canadian price increases are a result of several intertwined factors: currency fluctuations, rising raw material costs, tariffs, and supply chain disruptions. Simultaneously, Tesla employs a refined inventory management strategy based on its direct sales model, sophisticated demand forecasting, and a focus on optimizing inventory turnover. These strategies, however, impact the affordability of Tesla vehicles for Canadian consumers and their choices in the broader EV market. The interplay between these factors significantly shapes Tesla's position within the Canadian automotive landscape. Stay updated on Tesla's Canadian price increases and inventory strategies by following our blog for the latest news and analysis.

Featured Posts

-

Moscow Blasts Russia Ukraine Tensions Escalate After Generals Death

Apr 27, 2025

Moscow Blasts Russia Ukraine Tensions Escalate After Generals Death

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation Exploring The Significance

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation Exploring The Significance

Apr 27, 2025 -

Camille Claudel Bronze Sculpture Sells For 3 Million At French Auction

Apr 27, 2025

Camille Claudel Bronze Sculpture Sells For 3 Million At French Auction

Apr 27, 2025 -

Bof A On Stock Market Valuations A Balanced Assessment

Apr 27, 2025

Bof A On Stock Market Valuations A Balanced Assessment

Apr 27, 2025 -

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025

Latest Posts

-

Specific Us Products Exempted From Chinese Tariffs

Apr 28, 2025

Specific Us Products Exempted From Chinese Tariffs

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025 -

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025 -

China Quietly Eases Tariffs On Select Us Goods

Apr 28, 2025

China Quietly Eases Tariffs On Select Us Goods

Apr 28, 2025 -

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025