Amundi MSCI All Country World UCITS ETF USD Acc: NAV Analysis And Investment Implications

Table of Contents

Understanding the Amundi ETF's NAV

What is NAV and why is it important?

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's calculated by taking the total market value of all the securities held within the ETF, subtracting any liabilities, and dividing by the total number of outstanding shares. The NAV is a critical indicator of an ETF's intrinsic value. It fluctuates throughout the day based on the performance of the underlying assets. Unlike the market price, which can deviate slightly due to supply and demand, the NAV reflects the true value of the holdings. The Amundi ETF's NAV is typically calculated daily, providing investors with a clear picture of its value.

- Significance of NAV: Provides a benchmark for evaluating the ETF's performance.

- NAV Fluctuations: Reflect changes in the value of the underlying global equities.

- NAV vs. Market Price: While typically close, discrepancies can occur due to trading volume.

- Frequency of Calculation: Daily calculation for the Amundi ETF.

Analyzing Historical NAV Performance

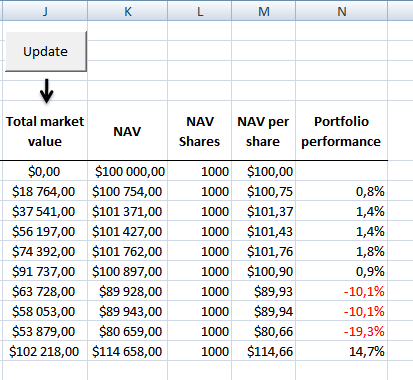

[Insert a chart here showing the historical NAV performance of the Amundi ETF. Clearly label the axes (Date and NAV). Include relevant data points and annotations showing periods of significant growth or decline.]

The chart above illustrates the historical NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc. We observe periods of both robust growth, driven by positive global market sentiment and strong underlying asset performance, and periods of decline, often correlated with market corrections or geopolitical uncertainties. Comparing this performance to a benchmark like the MSCI ACWI index helps determine the ETF's relative performance. Factors influencing NAV fluctuations include:

- Market Cycles: Bull and bear markets significantly impact NAV.

- Geopolitical Events: Global events, such as wars or trade disputes, can cause volatility.

- Economic Data Releases: Positive economic data generally supports higher NAV.

Factors Influencing Amundi ETF NAV

Global Market Conditions

Global economic growth or recession directly impacts the Amundi ETF's NAV. Positive global growth typically leads to higher company earnings, boosting the value of the underlying assets. Conversely, economic downturns often result in decreased earnings and lower NAV. Major market indices like the S&P 500 and FTSE 100 significantly influence the ETF's performance as many of the companies in these indices are also represented within the Amundi ETF's holdings. Interest rate changes and inflation also play crucial roles.

- Economic Growth: Positive growth leads to higher NAV.

- Market Indices: S&P 500, FTSE 100, and others influence performance.

- Interest Rates: Rising rates can negatively affect valuations.

- Inflation: High inflation can erode purchasing power and impact earnings.

Currency Fluctuations

As the Amundi ETF is denominated in USD (USD Acc share class), fluctuations in USD exchange rates against other currencies directly influence the NAV for investors holding the ETF in different currencies. A strengthening US dollar can reduce the NAV for non-USD investors, while a weakening dollar can have the opposite effect.

- Impact of USD Exchange Rates: Significant impact on non-USD investors.

- Hedging Strategies: Currency hedging strategies can mitigate this risk.

Sectoral Performance

The Amundi ETF's NAV is a composite of the performance of various sectors within its holdings. The contribution of sectors like technology, healthcare, energy, and financials varies depending on market conditions. Overweighting or underweighting specific sectors based on market forecasts can impact the ETF's overall performance. Analyzing sectoral performance helps investors understand the drivers behind NAV fluctuations.

Investment Implications and Strategies

Assessing Risk and Return

The Amundi ETF, while offering global diversification, carries inherent market risk. The historical risk-adjusted return, such as the Sharpe ratio, provides insight into the ETF's risk-return profile compared to similar ETFs. While global diversification reduces risk compared to regional-specific investments, market downturns can still impact the NAV.

- Risk Profile: Moderate to high depending on market conditions and investor's time horizon.

- Risk-Adjusted Return: Analysis of Sharpe Ratio and other metrics are necessary.

Portfolio Allocation Strategies

The Amundi ETF can be a valuable component of a well-diversified portfolio. The appropriate allocation depends on individual risk tolerance, investment time horizon, and financial goals. For instance, younger investors with a longer time horizon might allocate a larger portion to the Amundi ETF, whereas more risk-averse investors may prefer a smaller allocation.

- Asset Allocation: Consider diversification across asset classes (bonds, real estate, etc.).

- Time Horizon: Longer time horizons generally allow for greater risk-taking.

- Risk Tolerance: Align allocation with your comfort level regarding market fluctuations.

Tax Implications

Tax implications vary depending on your jurisdiction and individual circumstances. Capital gains taxes may apply upon selling shares of the Amundi ETF. Consult a qualified financial advisor for personalized tax advice related to your investment in the Amundi MSCI All Country World UCITS ETF USD Acc.

Conclusion

Analyzing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc provides valuable insights into its performance and investment implications. Understanding the factors influencing NAV fluctuations – global market conditions, currency exchange rates, and sectoral performance – is key to making informed investment decisions. Remember that while global diversification reduces risk, market risk remains inherent. Incorporating the Amundi ETF into a well-diversified portfolio, aligned with your risk tolerance and financial goals, is a strategy many investors might consider. Remember to consult a financial advisor before investing in the Amundi MSCI All Country World UCITS ETF USD Acc or any other investment product for personalized guidance tailored to your specific circumstances. Consider a long-term investment perspective for optimal results.

Featured Posts

-

Darwin Shop Owner Stabbed To Death Teenager In Custody

May 24, 2025

Darwin Shop Owner Stabbed To Death Teenager In Custody

May 24, 2025 -

Frankfurt Stock Exchange Dax Ends Day Below 24 000

May 24, 2025

Frankfurt Stock Exchange Dax Ends Day Below 24 000

May 24, 2025 -

Your Guide To Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

Your Guide To Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Us Bands Glastonbury Gig Fan Speculation Soars After Cryptic Post

May 24, 2025

Us Bands Glastonbury Gig Fan Speculation Soars After Cryptic Post

May 24, 2025 -

Teenager Arrested After Darwin Shop Owners Murder In Nightcliff

May 24, 2025

Teenager Arrested After Darwin Shop Owners Murder In Nightcliff

May 24, 2025

Latest Posts

-

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Importance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Importance

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025