Frankfurt Stock Exchange: DAX Ends Day Below 24,000

Table of Contents

DAX Performance and Key Factors

The DAX index experienced a challenging day, opening slightly higher but ultimately closing below 24,000, representing a significant decline compared to the previous day's close. The exact percentage change will be available at the close of trading, but preliminary reports suggest a drop of [Insert Percentage Change Here]%. This downward trend reflects a confluence of factors impacting investor confidence in the German stock market.

-

Global Economic News: Negative economic news from key global markets, particularly [mention specific country or region and news], has dampened investor optimism and triggered risk-averse behavior. This uncertainty is spilling over into European markets, including Germany.

-

Interest Rate Hikes: Continued interest rate hikes by the European Central Bank (ECB) aim to curb inflation, but this also increases borrowing costs for businesses, potentially hindering economic growth and impacting corporate profitability. This is reflected in the performance of sectors sensitive to interest rate changes.

-

Inflation Concerns: Persistent inflation remains a major concern, impacting consumer spending and business investment. High inflation erodes purchasing power and creates uncertainty about future economic prospects.

-

Specific Sector Performance: The [mention specific sector, e.g., automotive] sector experienced a particularly difficult day, contributing significantly to the DAX's overall decline. This is likely due to [mention specific reasons, e.g., supply chain issues or decreased consumer demand]. Conversely, the [mention another sector, e.g., technology] sector showed some resilience, although it wasn't enough to offset the broader market weakness.

-

Geopolitical Events: Ongoing geopolitical instability, particularly [mention specific event impacting investor sentiment], adds another layer of uncertainty and risk aversion to the market.

Analysis of Individual DAX Companies

Several prominent DAX companies experienced significant price movements today, contributing to the overall negative performance of the index.

-

[Company Name 1]: This company saw a [percentage]% drop in its share price following [mention specific news, e.g., a disappointing earnings report or a negative outlook].

-

[Company Name 2]: Conversely, [Company Name 2] showed relative resilience, with a [percentage]% increase attributable to [mention specific positive news].

-

Sectoral Performance: A detailed breakdown of sectoral performance reveals that cyclical sectors, particularly sensitive to economic fluctuations, were hit hardest. Conversely, defensive sectors showed relatively better resistance. This highlights the current risk-off sentiment prevailing in the market.

Investor Sentiment and Future Outlook

Investor sentiment is currently cautious, with many analysts expressing concerns about the potential for further market corrections. The DAX closing below 24,000 reinforces this negativity.

-

Expert Opinions: [Quote or paraphrase opinions from financial experts on the current market situation and outlook].

-

Market Trends: Short-term predictions suggest continued volatility, with the potential for further declines depending on upcoming economic data and geopolitical developments. The long-term outlook remains uncertain, with varying opinions among experts.

-

Risks and Opportunities: Investors should carefully assess their risk tolerance and diversify their portfolios. While the current market presents challenges, it also offers potential opportunities for those with a long-term investment horizon and a strategic approach. However, remember that all investments carry inherent risks.

-

Suggestions for Investors (Disclaimer): This is not financial advice. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

Conclusion:

The Frankfurt Stock Exchange's DAX index closing below 24,000 signifies a concerning day for the German stock market, reflecting a confluence of global economic uncertainties, inflation fears, and interest rate hikes. The performance of individual DAX companies and sectoral trends further highlight the prevailing market volatility. Staying informed about market trends and conducting thorough research is crucial for navigating this dynamic environment.

Call to Action: Stay informed about the fluctuations of the Frankfurt Stock Exchange and the DAX index. Follow our updates for the latest news on the DAX and the German stock market. Consider subscribing to our newsletter for regular analysis and insights into the DAX and the Frankfurt Stock Exchange to make informed investment decisions.

Featured Posts

-

Long Delays On M56 Due To Serious Crash Real Time Updates

May 24, 2025

Long Delays On M56 Due To Serious Crash Real Time Updates

May 24, 2025 -

Forecasting Apple Stock Aapl Price Levels

May 24, 2025

Forecasting Apple Stock Aapl Price Levels

May 24, 2025 -

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Legends

May 24, 2025

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Legends

May 24, 2025 -

G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025

G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025 -

The Thames Water Bonus Scandal A Critical Analysis Of Executive Pay

May 24, 2025

The Thames Water Bonus Scandal A Critical Analysis Of Executive Pay

May 24, 2025

Latest Posts

-

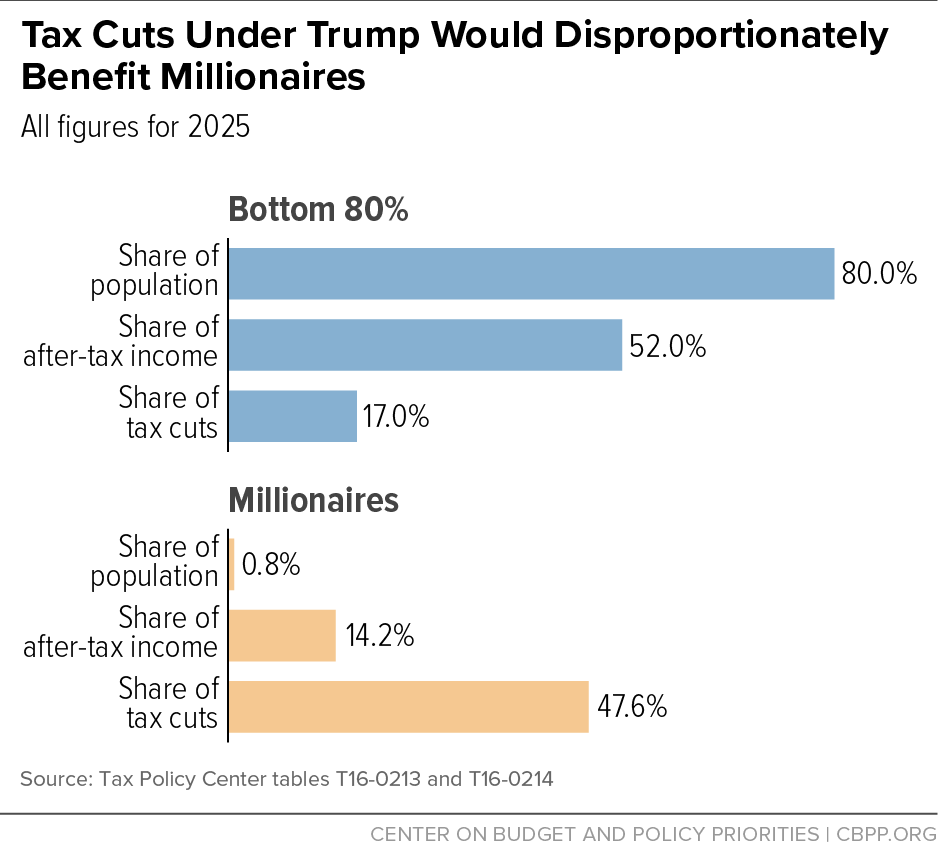

Analysis The Houses Passage Of The Revised Trump Tax Bill

May 24, 2025

Analysis The Houses Passage Of The Revised Trump Tax Bill

May 24, 2025 -

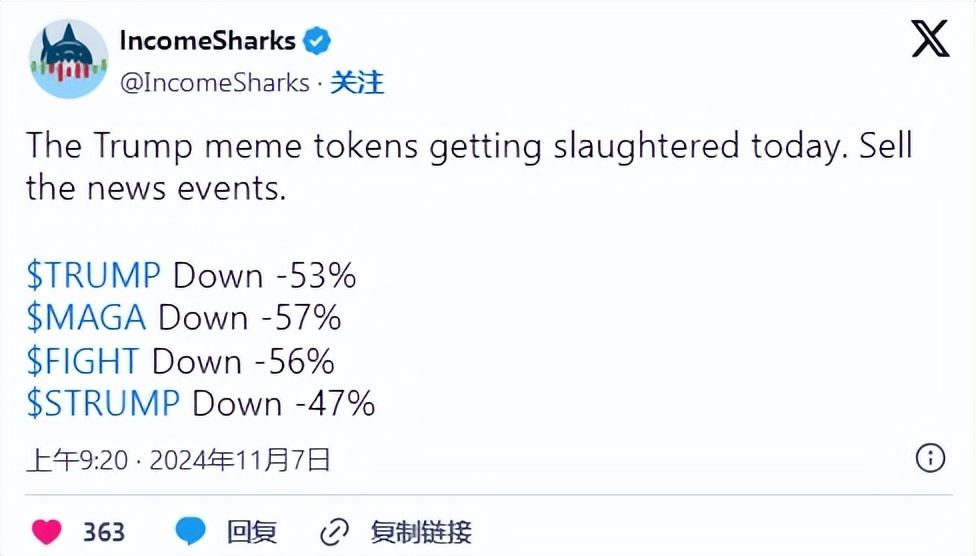

Investigating Anonymity At Trumps High Price Memecoin Dinner

May 24, 2025

Investigating Anonymity At Trumps High Price Memecoin Dinner

May 24, 2025 -

Accessibility In Games Feeling The Pinch Of Industry Downturn

May 24, 2025

Accessibility In Games Feeling The Pinch Of Industry Downturn

May 24, 2025 -

Dr Beachs Top 10 Us Beaches Your 2025 Guide

May 24, 2025

Dr Beachs Top 10 Us Beaches Your 2025 Guide

May 24, 2025 -

Southwest Airlines Restricts Portable Chargers In Carry On Baggage

May 24, 2025

Southwest Airlines Restricts Portable Chargers In Carry On Baggage

May 24, 2025