Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis

Table of Contents

A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of exchange-traded fund that complies with EU regulations, offering investors a high level of protection and transparency. The benefits include regulatory oversight, investor protection mechanisms, and simplified cross-border investment. The Amundi Dow Jones Industrial Average UCITS ETF specifically provides investors with access to the performance of the Dow Jones Industrial Average, a widely recognized barometer of the US economy. This article aims to provide a detailed NAV analysis of this ETF and its implications for your investment strategy.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Amundi Dow Jones Industrial Average UCITS ETF's NAV (Net Asset Value) is intrinsically linked to the performance of the underlying Dow Jones Industrial Average. Understanding the factors that influence the Dow is crucial to interpreting the ETF's NAV.

The relationship is essentially one of direct correlation: as the Dow rises, so too does the ETF's NAV, and vice versa. However, several factors can influence this relationship:

- Market Fluctuations: Daily fluctuations in the Dow Jones, driven by investor sentiment, news events (both domestic and global), and economic data releases, directly impact the ETF's NAV. Periods of market volatility can lead to significant daily changes in NAV.

- Macroeconomic Factors: Broad economic conditions, such as interest rate changes, inflation rates, and overall economic growth, significantly influence the performance of the Dow and, consequently, the ETF's NAV. A strong economy usually boosts the NAV, while economic downturns typically lead to declines.

- Company Performance: The Dow Jones Industrial Average comprises 30 large-cap companies. The individual performance of these companies, driven by factors such as earnings reports, product launches, and management changes, significantly affects the overall index and, therefore, the ETF's NAV. A strong performance from a significant component can boost the NAV while underperformance can negatively affect it.

- Expense Ratio: The ETF's expense ratio, a small annual fee charged to investors, indirectly impacts the NAV. While the impact is typically minor, it slightly reduces the overall return compared to the underlying index's performance.

Analyzing Historical NAV Data of the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing historical NAV data provides crucial insights into the ETF's past performance and helps predict potential future trends. (Insert chart or graph showing historical NAV performance here). This visual representation allows for easy identification of key periods of growth and decline.

By comparing the ETF's NAV performance to the Dow Jones Industrial Average itself, we can assess the ETF's tracking accuracy. Ideally, the ETF should closely mirror the index's performance, although minor discrepancies due to the expense ratio are expected.

- Long-term NAV Trends: Examining long-term trends reveals the overall growth potential of the ETF. This can inform long-term investment strategies.

- Short-term NAV Volatility: Analyzing short-term fluctuations helps gauge the ETF's risk profile and assess its suitability for different risk tolerances.

- Benchmark Comparisons: Comparing the ETF's performance against other benchmark indices like the S&P 500 provides a broader context for evaluating its performance.

- Key Performance Indicators (KPIs): Analyzing KPIs such as the Sharpe ratio (risk-adjusted return), Alpha (excess return), and Beta (volatility relative to the market) offers a more quantitative assessment of the ETF's performance.

Interpreting NAV for Investment Decision-Making

Understanding how to interpret NAV data is vital for making informed investment decisions. While not the sole factor, NAV movements can offer valuable insights into potential buying and selling opportunities.

- Timing Investments: Investors might consider buying the ETF when the NAV is relatively low and selling when it's relatively high. However, this strategy requires careful consideration of market timing and carries inherent risks.

- NAV vs. Market Price: It's crucial to understand the difference between NAV and the market price of the ETF. The market price can deviate slightly from the NAV due to supply and demand dynamics.

- Portfolio Suitability: Consider the ETF's suitability within your overall investment portfolio. Its performance characteristics should align with your risk tolerance and investment objectives.

- Risk Assessment and Diversification: Remember that investing in any ETF involves risk. Diversification across different asset classes is crucial to mitigate overall portfolio risk.

Risks Associated with Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Investing in index funds, including the Amundi Dow Jones Industrial Average UCITS ETF, carries inherent risks:

- Market Risk: The primary risk is market fluctuations. The Dow Jones Industrial Average, and consequently the ETF, is susceptible to overall market downturns.

- Underperformance: The ETF might underperform the Dow Jones Industrial Average slightly due to its expense ratio and tracking error.

- Currency Risk: While the ETF tracks a US index, currency fluctuations between your base currency and the US dollar can impact the overall returns if you're not investing in USD.

- Due Diligence: Always conduct thorough due diligence before investing in any ETF. Understand the underlying assets, fees, and risks involved.

Conclusion: Investing Wisely with the Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis and Beyond

This article provided a comprehensive NAV analysis of the Amundi Dow Jones Industrial Average UCITS ETF, highlighting the key factors influencing its NAV and demonstrating how to interpret this data for informed investment decisions. Remember that while NAV is a crucial metric, it shouldn't be the sole determinant of your investment strategy. Consider the ETF's performance alongside other relevant factors, conducting thorough research before investing. Consult financial professionals if needed.

To make the most of your investment strategy with the Amundi Dow Jones Industrial Average UCITS ETF, continue your research by exploring additional resources on ETFs and investment strategies. Remember that successful investing requires a comprehensive understanding of both market dynamics and your own risk tolerance. Use this NAV analysis as one piece of your overall decision-making process.

Featured Posts

-

Teenager Rearrested Following Shop Owners Fatal Stabbing

May 24, 2025

Teenager Rearrested Following Shop Owners Fatal Stabbing

May 24, 2025 -

Test Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025

Test Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Joy Crookes Releases New Single Carmen

May 24, 2025

Joy Crookes Releases New Single Carmen

May 24, 2025 -

Brazils Banking Power Shift Brbs Strategic Acquisition Of Banco Master

May 24, 2025

Brazils Banking Power Shift Brbs Strategic Acquisition Of Banco Master

May 24, 2025

Latest Posts

-

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025 -

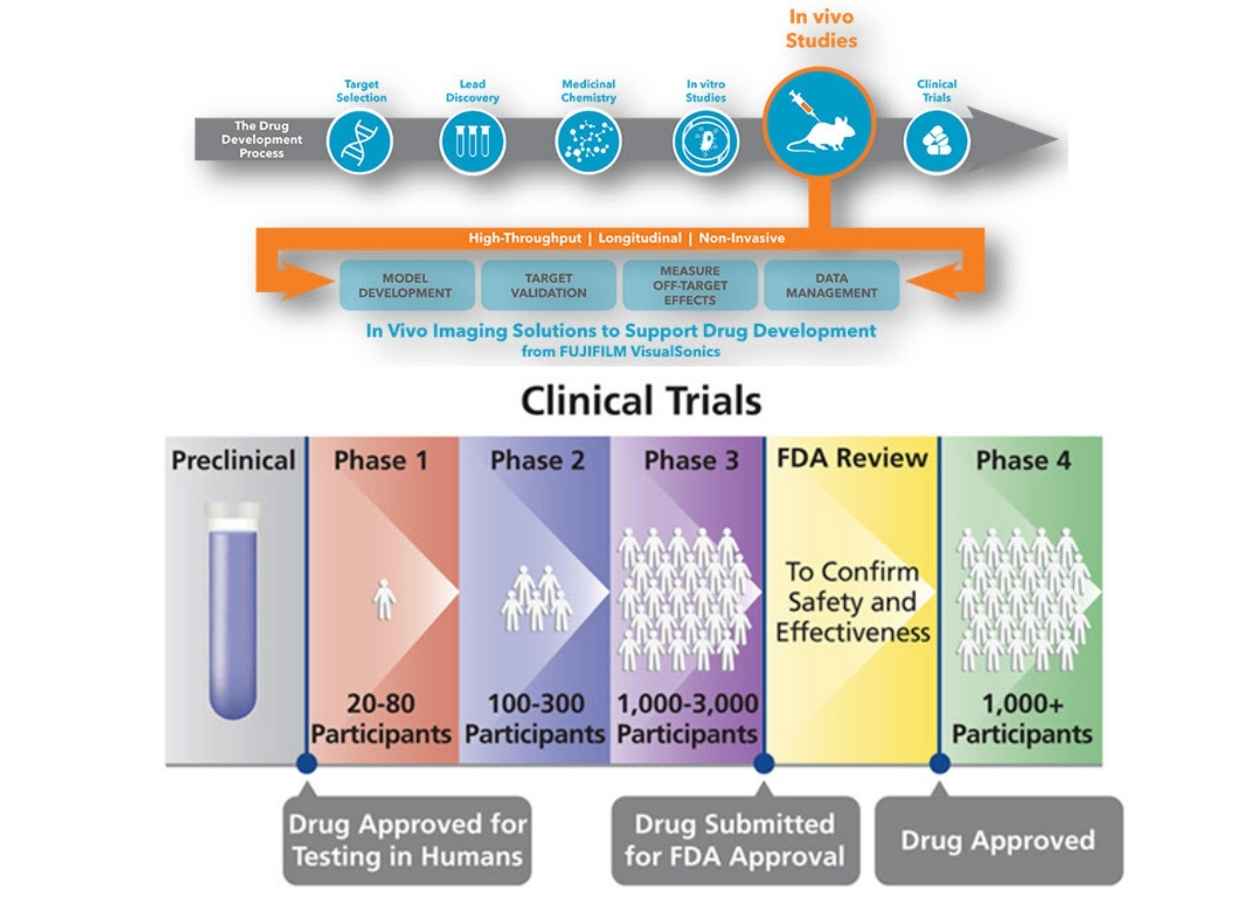

The Role Of Space Crystals In The Development Of Superior Drugs

May 24, 2025

The Role Of Space Crystals In The Development Of Superior Drugs

May 24, 2025 -

From Bishop To Viral Tik Tok Star Pope Leos Unexpected Fame

May 24, 2025

From Bishop To Viral Tik Tok Star Pope Leos Unexpected Fame

May 24, 2025 -

Years Later Tik Tok Connects Woman With Former Bishop Pope Leo

May 24, 2025

Years Later Tik Tok Connects Woman With Former Bishop Pope Leo

May 24, 2025 -

Harnessing Orbital Space Crystals A New Frontier In Drug Discovery

May 24, 2025

Harnessing Orbital Space Crystals A New Frontier In Drug Discovery

May 24, 2025