Amundi Dow Jones Industrial Average UCITS ETF: NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net asset value per share of an ETF. It's a fundamental concept for understanding the intrinsic worth of your investment. Unlike the market price, which can fluctuate throughout the trading day based on supply and demand, the NAV provides a snapshot of the ETF's underlying assets' true value. The NAV is calculated daily, typically after the market closes, reflecting the total value of the ETF's holdings (the assets) minus its liabilities.

Several factors influence daily NAV fluctuations. These include:

-

Changes in the value of the underlying assets: The primary driver of NAV changes is the performance of the assets held within the ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the performance of the 30 companies that comprise the Dow Jones Industrial Average.

-

Currency exchange rates: If the ETF holds assets in different currencies, fluctuations in exchange rates will impact the NAV.

-

Accrued income: Any dividends or interest earned by the ETF's holdings will increase the NAV.

-

Expenses: Management fees and other operating expenses reduce the NAV.

-

NAV represents the net asset value per share.

-

Calculated daily after market close.

-

Reflects the total value of the ETF's holdings minus liabilities.

-

Provides a true picture of the underlying asset value.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF NAV calculation mirrors the daily valuation of its underlying index, the Dow Jones Industrial Average (DJIA). This involves:

- Daily valuation of the DJIA components: The value of each of the 30 companies in the DJIA is determined at market close.

- Consideration of currency exchange rates (if applicable): If any of the underlying companies have significant international operations, currency exchange rates are factored into the calculation.

- Deduction of management fees and other expenses: The ETF's operating expenses, including management fees, are subtracted from the total asset value to arrive at the net asset value.

- Publication of the NAV at the end of the trading day: The calculated NAV is then made publicly available.

Understanding the Components of the NAV Calculation

The NAV calculation can be broken down into its core components:

- Assets: This includes the market value of all the holdings in the ETF, directly mirroring the DJIA components.

- Liabilities: These are relatively minor for most ETFs and might include accrued expenses payable.

- Expenses: Management fees and other operational costs are deducted.

For example, if the total market value of the DJIA components is €100 million, and the ETF's expenses are €100,000, the net asset value before considering the number of shares outstanding would be €99,900,000. Dividing this by the number of outstanding shares gives the NAV per share. Changes in the value of the underlying DJIA components directly impact the ETF's assets and, consequently, its NAV.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Investors can access the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF through several reliable channels:

- Amundi's official website: The fund manager, Amundi, typically publishes the daily NAV on its website.

- Major financial data providers (Bloomberg, Refinitiv): These professional platforms provide real-time and historical NAV data for a wide range of ETFs.

- Brokerage account statements: Your brokerage account will usually show the NAV of your ETF holdings.

The NAV is typically updated daily, after the close of the market.

Using NAV to Track Investment Performance

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a key tool for monitoring your investment returns. You can track your performance by:

-

Comparing NAV at different time points: Calculate the difference in NAV between two dates to see the growth or decline of your investment.

-

Calculating percentage change in NAV: This provides a clearer picture of the percentage return on your investment.

-

Understanding premium/discount: Sometimes, the market price of the ETF might trade at a slight premium or discount to the NAV, reflecting market sentiment and trading activity.

-

Comparing NAV at different time points.

-

Calculating percentage change in NAV.

-

Understanding premium/discount to reflect market sentiment.

Conclusion

Understanding the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF is essential for effective investment management. By following the steps outlined above, you can confidently track your investment's performance and make informed decisions. Regular monitoring of the Amundi Dow Jones Industrial Average UCITS ETF NAV, combined with a comprehensive understanding of the factors influencing it, will enable you to optimize your investment strategy. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF NAV and maximize your investment potential today!

Featured Posts

-

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 24, 2025

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 24, 2025 -

Discover Local And Global Destinations The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Discover Local And Global Destinations The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025 -

Euro Vs Dollar Live Analyse Van Kapitaalmarktrentes

May 24, 2025

Euro Vs Dollar Live Analyse Van Kapitaalmarktrentes

May 24, 2025 -

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025

Latest Posts

-

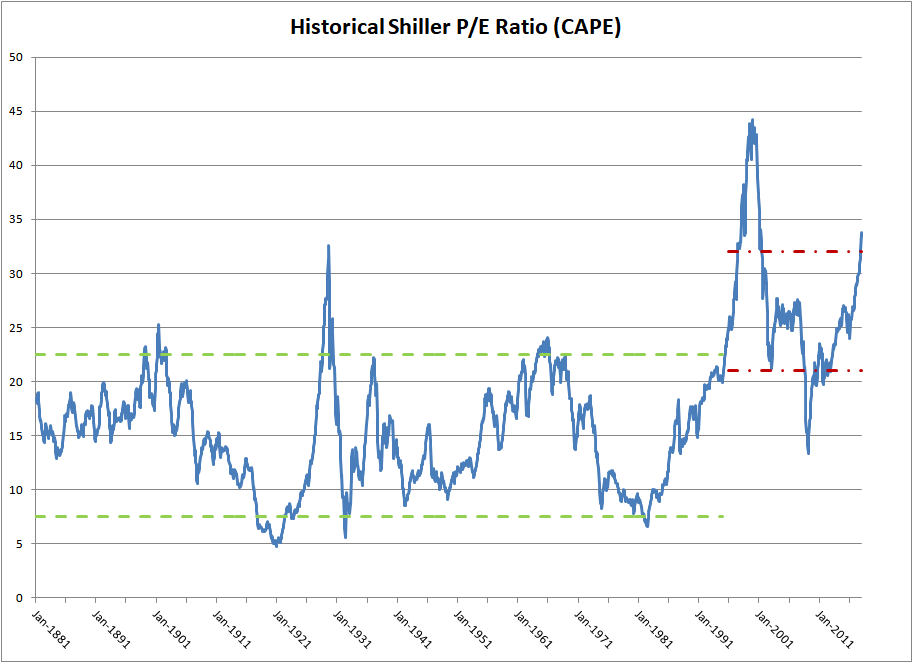

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025