Amsterdam Stock Exchange: Three Days Of Heavy Losses, Down 11%

Table of Contents

Underlying Causes of the Amsterdam Stock Exchange's Decline

The sharp 11% drop in the AEX index wasn't an isolated event; it reflects a confluence of global and regional factors impacting the Dutch stock market.

Global Economic Uncertainty

The recent downturn on the Amsterdam Stock Exchange is inextricably linked to broader global economic anxieties. Several key factors contributed:

-

Rising Inflation and Interest Rate Hikes: Persistent inflationary pressures across the globe have forced central banks, including the European Central Bank, to aggressively raise interest rates. This has increased borrowing costs for businesses, dampening investment and economic growth, impacting the AEX index negatively. Data shows inflation in the Eurozone reached X% in [Month, Year], leading to a Y% interest rate hike.

-

Geopolitical Tensions: The ongoing war in Ukraine and the resulting energy crisis have created significant uncertainty in global markets. The AEX, being closely tied to the European economy, has felt the brunt of these geopolitical headwinds. Disruptions to energy supply chains and increased energy prices directly impact many Dutch companies listed on the AEX.

-

Recessionary Fears: Concerns about a potential global recession are further fueling market volatility. Economic forecasts predicting a slowdown in growth are contributing to investor apprehension and prompting a sell-off in various markets, including the Amsterdam Stock Exchange. Reports suggest a Z% chance of a recession in the Eurozone in [Year].

Performance of Key Sectors

The decline in the AEX index wasn't uniform across all sectors. Some sectors were hit harder than others:

-

Energy Sector: Given the ongoing energy crisis, the energy sector on the AEX experienced a particularly sharp downturn. Fluctuating energy prices and supply chain disruptions have directly impacted the performance of energy companies listed on the exchange.

-

Financial Sector: Banks and financial institutions listed on the AEX also felt the pressure of rising interest rates and global economic uncertainty. Concerns about loan defaults and decreased lending activity contributed to their decline.

-

Technology Stocks: Technology stocks, often considered more sensitive to economic downturns, also experienced significant losses as investors sought safer havens.

(Insert chart or graph here visually representing the performance of different sectors on the AEX during the three-day period.)

Investor Sentiment and Market Volatility

The significant drop in the AEX was exacerbated by a shift in investor sentiment.

-

Decreasing Investor Confidence: As global economic uncertainty increased, investor confidence waned, leading to a sell-off in the stock market. Negative news headlines and pessimistic economic forecasts further fueled this decline.

-

Increased Risk Aversion: Investors became more risk-averse, moving away from higher-risk assets like stocks and seeking safer investments, such as government bonds. This contributed to the sharp decline in the AEX index.

-

Panic Selling: As the AEX began to fall, panic selling amplified the downward momentum, creating a vicious cycle of selling pressure. This accelerated the decline in the AEX index over the three-day period. Data on trading volume during this period would highlight this heightened activity.

Potential Consequences of the Amsterdam Stock Exchange's Drop

The 11% drop in the AEX carries significant implications for both the Dutch economy and individual investors.

Impact on the Dutch Economy

The decline on the Amsterdam Stock Exchange has potential ripple effects throughout the Dutch economy:

-

Reduced Consumer Spending: Lower stock market valuations can lead to decreased consumer confidence, potentially impacting consumer spending and overall economic growth.

-

Impact on Business Investment: Uncertainty in the stock market may discourage businesses from making new investments, further hindering economic growth.

-

Potential Job Losses: Economic downturns often lead to job losses, particularly in sectors heavily impacted by the stock market decline. The extent of job losses will depend on the duration and severity of the economic downturn.

Long-Term Implications for Investors

Investors who experienced losses during this period face crucial long-term decisions:

-

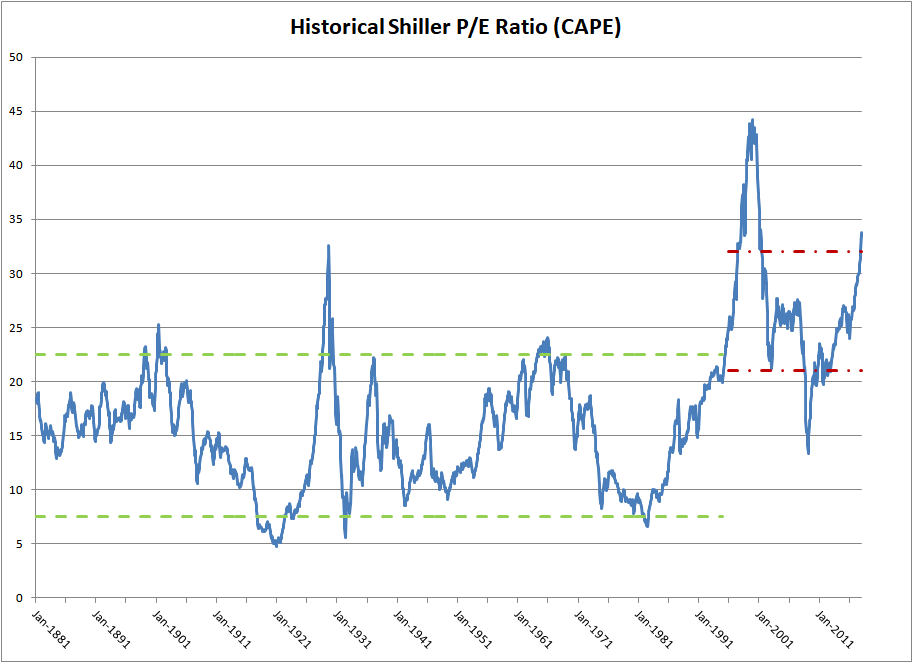

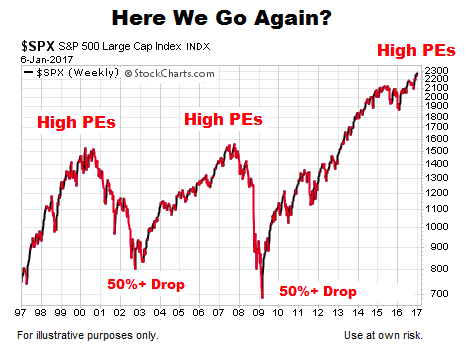

Long-Term Investment Strategy: It is crucial for investors to review their long-term investment strategies and assess their risk tolerance in light of recent market volatility.

-

Portfolio Diversification: Diversifying investments across different asset classes and sectors can help mitigate risk and reduce the impact of market fluctuations.

-

Risk Management: Investors should regularly review their risk management strategies and adjust their portfolios as needed to align with their risk tolerance and investment goals. (Disclaimer: This is general advice and not financial advice. Consult a financial professional for personalized guidance.)

Conclusion: Navigating the Volatility of the Amsterdam Stock Exchange

The 11% plunge in the AEX index over three days highlights the significant impact of global economic uncertainty and changing investor sentiment. The potential consequences for the Dutch economy, including reduced consumer spending and potential job losses, are substantial. Investors must adopt a long-term perspective, focusing on diversification and risk management. To understand market fluctuations and make informed investment decisions, monitor the AEX index closely, stay informed about global market trends, and consider subscribing to reputable financial news sources and newsletters. Investing wisely in the Dutch market requires careful consideration of these factors and a proactive approach to managing risk.

Featured Posts

-

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Fotoreportazh

May 24, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Fotoreportazh

May 24, 2025 -

High Speed Chase Texting Drivers Refuel At 90mph Evade Police

May 24, 2025

High Speed Chase Texting Drivers Refuel At 90mph Evade Police

May 24, 2025 -

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Artistami Pislya Konkursu

May 24, 2025

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Artistami Pislya Konkursu

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph While Texting

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph While Texting

May 24, 2025 -

Important Notice

May 24, 2025

Important Notice

May 24, 2025

Latest Posts

-

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025