Ace The Private Credit Job Hunt: 5 Do's And Don'ts

Table of Contents

Do's: Maximize Your Private Credit Job Search

Successfully navigating the private credit job hunt requires proactive and strategic action. Here are five key "do's" to boost your chances:

1. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count!

- Highlight relevant skills and experience: Focus on skills directly applicable to private credit roles such as underwriting, due diligence, financial modeling, leveraged finance, credit analysis, debt investing, and private equity experience. Use action verbs to describe your accomplishments.

- Quantify your achievements: Instead of simply stating "Improved efficiency," say "Improved efficiency by 15% through process optimization, resulting in $X cost savings." Use metrics and numbers to demonstrate your impact.

- Optimize for Applicant Tracking Systems (ATS): Incorporate keywords from job descriptions to improve your ATS compatibility. This helps your resume get noticed by recruiters. Common keywords include: financial modeling, underwriting, due diligence, leveraged finance, credit analysis, debt investing, private equity, LBO modeling, distressed debt, mezzanine financing.

- Customize for each application: Generic applications rarely succeed. Each cover letter should specifically address the company's needs and demonstrate your understanding of their business and the specific role. Show genuine interest!

2. Network Strategically

Networking is crucial in the private credit industry. Don't underestimate its power.

- Attend industry events: Conferences and networking events provide opportunities to meet professionals and learn about new opportunities.

- Leverage LinkedIn: Connect with professionals in private credit, engage with their content, and participate in relevant groups.

- Informational interviews: Request informational interviews to gain insights into specific roles and companies. These conversations can lead to unexpected opportunities.

- Join professional organizations: The CFA Institute and various industry-specific groups offer networking opportunities and access to valuable resources.

- Utilize alumni networks: If applicable, leverage your alumni network to connect with professionals who attended your university.

3. Master the Interview Process

The interview is your chance to shine. Preparation is key.

- Practice behavioral interview questions (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your responses and highlight your accomplishments.

- Thorough research: Research the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Prepare insightful questions: Asking thoughtful questions demonstrates your interest and engagement. Prepare questions beforehand.

- Showcase market knowledge: Demonstrate your understanding of current trends and challenges in the private credit markets.

- Highlight analytical and problem-solving skills: Private credit requires strong analytical abilities. Use examples to showcase your skills.

4. Showcase Your Financial Modeling Expertise

Proficiency in financial modeling is paramount in private credit.

- Highlight Excel and software skills: Emphasize your proficiency in Excel, and other relevant financial modeling software like Argus or Bloomberg.

- Discuss model experience: Be prepared to discuss your experience building and using financial models, including different types of models relevant to private credit.

- Interpret model outputs: Demonstrate your ability to analyze model outputs, draw meaningful conclusions, and make informed recommendations.

- Showcase projects: Include relevant projects or case studies in your portfolio to highlight your capabilities.

5. Follow Up Professionally

A professional follow-up can solidify your candidacy.

- Send thank-you notes: Send personalized thank-you notes after each interview, reiterating your interest and highlighting key discussion points.

- Follow up politely: If you haven't heard back within a reasonable timeframe, a polite follow-up email is acceptable.

- Maintain professional communication: Maintain professional and courteous communication throughout the entire process.

Don'ts: Avoid These Common Mistakes During Your Private Credit Job Hunt

Avoiding common pitfalls can significantly increase your success rate. Here are five key "don'ts":

1. Submit a Generic Resume and Cover Letter

Sending the same materials repeatedly shows a lack of effort and interest. Tailor each application to the specific company and role.

2. Neglect Networking

Don't underestimate the power of networking. Building relationships is crucial for uncovering hidden opportunities and gaining valuable insights.

3. Go Unprepared for Interviews

Thorough preparation is non-negotiable. Research the firm, practice your answers, and prepare insightful questions to ask the interviewers.

4. Downplay Your Skills and Experience

Quantify your achievements and highlight your accomplishments to demonstrate your capabilities and value.

5. Forget to Follow Up

A simple thank-you note can make a significant difference. It showcases your professionalism and continued interest.

Conclusion

Landing a rewarding job in private credit requires a strategic and proactive approach. By following these do's and don'ts, you can significantly improve your chances of acing the private credit job hunt. Remember to tailor your applications, network strategically, master the interview process, and follow up professionally. Start your successful private credit job search today by implementing these tips and securing your dream role in this dynamic field. Good luck!

Featured Posts

-

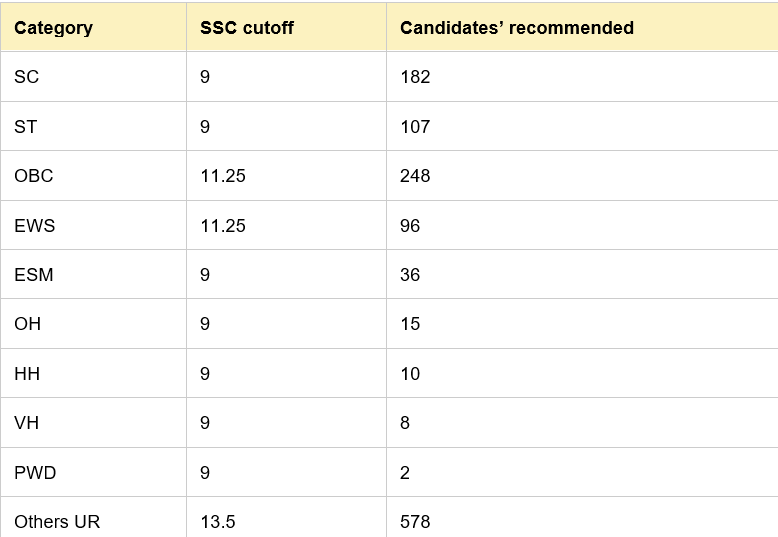

Ssc Chsl Final Result 2025 How To Check And Download Your Scorecard

May 07, 2025

Ssc Chsl Final Result 2025 How To Check And Download Your Scorecard

May 07, 2025 -

A Hilarious Media Moment Anthony Edwards Interrupts Julius Randle

May 07, 2025

A Hilarious Media Moment Anthony Edwards Interrupts Julius Randle

May 07, 2025 -

Ralph Macchio Offers My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025

Ralph Macchio Offers My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025 -

Bancheros 24 Points Lead Magic Past Cavaliers

May 07, 2025

Bancheros 24 Points Lead Magic Past Cavaliers

May 07, 2025 -

Ranking Zaufania Ib Ri S Dla Onetu Trzaskowski Na Czele

May 07, 2025

Ranking Zaufania Ib Ri S Dla Onetu Trzaskowski Na Czele

May 07, 2025

Latest Posts

-

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025 -

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025 -

Ethereums Growing Momentum 10 Increase In Address Activity Signals Bullish Trend

May 08, 2025

Ethereums Growing Momentum 10 Increase In Address Activity Signals Bullish Trend

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025