Ethereum Price Forecast: 1.11 Million ETH Accumulated, Bullish Momentum Builds

Table of Contents

Massive ETH Accumulation: A Bullish Signal?

The accumulation of over 1.11 million ETH represents a substantial increase in holdings, a significant event that often precedes price increases. This massive influx of ETH into various wallets suggests strong underlying demand and bullish sentiment among investors. Understanding the sources of this accumulation is crucial for interpreting its significance for the Ethereum price forecast.

Potential sources include:

-

Institutional Investors: Large financial institutions are increasingly allocating capital to cryptocurrencies, with Ethereum being a prime target due to its established ecosystem and technological advancements. Their strategic investments often drive significant price movements.

-

Large Wallets: Whale wallets, holding substantial amounts of ETH, are actively accumulating, suggesting a belief in the long-term potential of the asset. This accumulation could indicate a potential future price surge, impacting the Ethereum price forecast.

-

Retail Investors: Increased retail investor participation also contributes to ETH accumulation. Growing confidence in Ethereum's future and its role in the decentralized finance (DeFi) space might be driving this retail accumulation.

-

Evidence from on-chain data supporting accumulation: On-chain metrics like the ETH supply held on exchanges, the number of active addresses, and the increase in the number of large ETH wallets all point towards significant accumulation.

-

Comparison to previous accumulation phases and their impact on price: Historical data shows that previous periods of significant ETH accumulation have often preceded substantial price rallies. Analyzing these historical trends offers valuable insights for the Ethereum price forecast.

-

Analysis of large ETH wallets and their activity: Tracking the activity of large ETH wallets provides clues about potential future price movements. Their accumulation and holding patterns can signal upcoming price changes.

Ethereum's Growing Ecosystem and Development

Ethereum's expanding ecosystem plays a vital role in driving demand and influencing the Ethereum price forecast. The growth of decentralized finance (DeFi), non-fungible tokens (NFTs), and other decentralized applications (dApps) built on Ethereum continues to attract investors.

- Growth in Total Value Locked (TVL) in DeFi protocols: The Total Value Locked (TVL) in various DeFi protocols built on Ethereum has shown significant growth, demonstrating the increasing adoption and utility of the Ethereum network. This increased usage reflects positively on the Ethereum price forecast.

- Increased NFT trading volume and market capitalization: The booming NFT market, heavily reliant on the Ethereum blockchain, has significantly increased trading volume and market capitalization. This ongoing growth contributes to higher demand for ETH and impacts the Ethereum price forecast.

- Progress on Ethereum 2.0 and its potential benefits: The ongoing development and eventual implementation of Ethereum 2.0 will significantly improve scalability and transaction speed, bolstering the network's capacity and further enhancing its attractiveness, ultimately impacting the Ethereum price forecast.

Macroeconomic Factors and Their Influence

Broader economic trends significantly influence cryptocurrency markets, including Ethereum. Factors like inflation, interest rates, and regulatory developments directly impact investor sentiment and risk appetite, consequently affecting the Ethereum price forecast.

- Relationship between inflation and cryptocurrency adoption: In times of high inflation, investors may seek alternative assets like cryptocurrencies to hedge against inflation, potentially driving up demand for ETH.

- Impact of interest rate hikes on investor sentiment: Rising interest rates can reduce investor appetite for riskier assets, potentially leading to a sell-off in the crypto market, thus impacting the Ethereum price forecast.

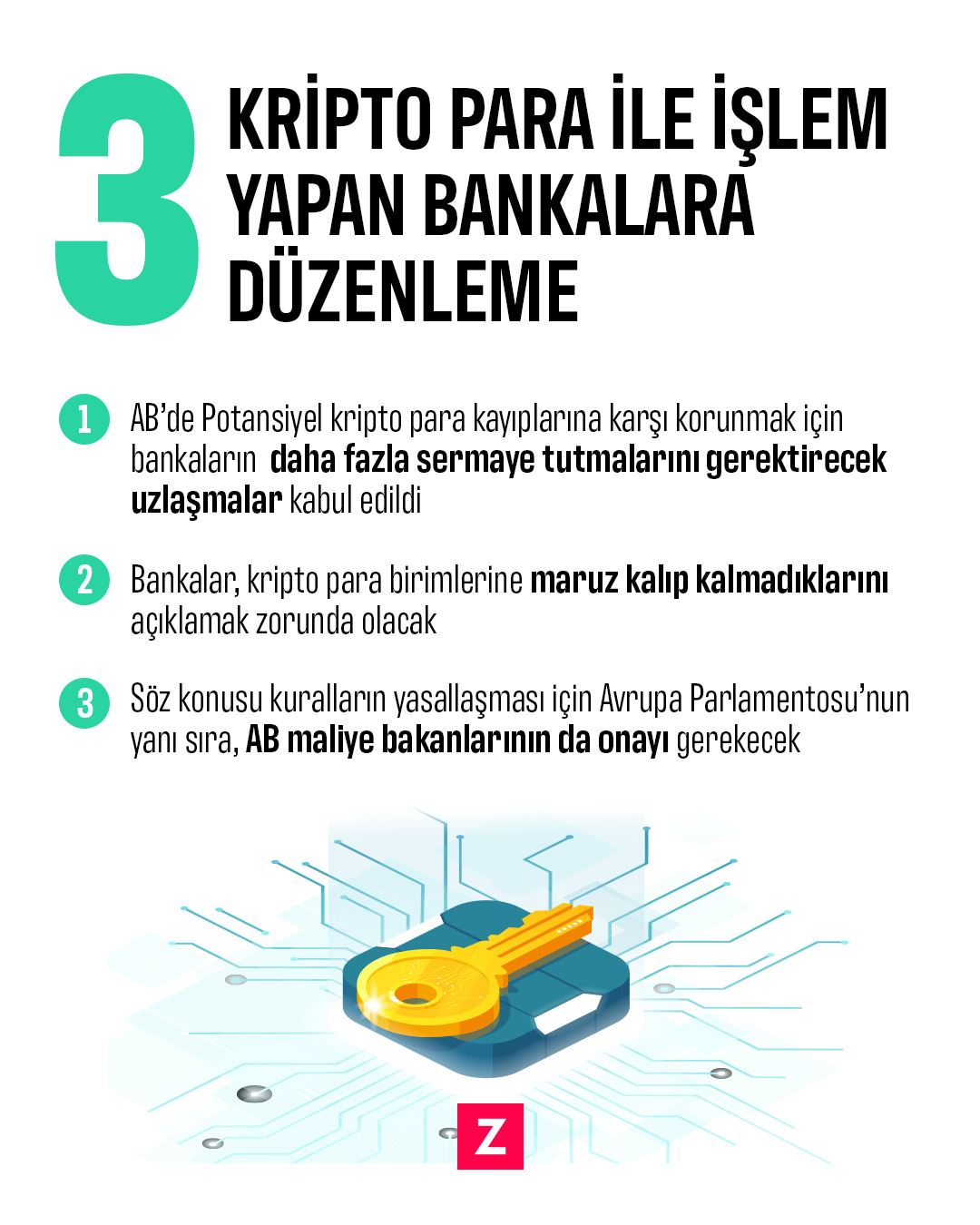

- Influence of regulatory clarity (or uncertainty) on Ethereum’s price: Clear and favorable regulatory frameworks can boost investor confidence and attract institutional capital, while regulatory uncertainty can create volatility and negatively influence the Ethereum price forecast.

Technical Analysis: Chart Patterns and Indicators

Technical analysis provides another perspective on the Ethereum price forecast. By examining chart patterns, support and resistance levels, and key indicators, we can identify potential price trends.

- Key technical indicators (e.g., RSI, MACD): Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help determine the strength of bullish or bearish momentum, aiding in short-term Ethereum price forecast predictions.

- Analysis of chart patterns (e.g., head and shoulders, triangles): Recognizing chart patterns like head and shoulders or triangles can provide insights into potential price reversals or breakouts, thus influencing the Ethereum price forecast.

- Prediction of potential price targets based on technical analysis: Combining various technical indicators and chart patterns allows for the creation of potential price targets, offering a range of possibilities for the Ethereum price forecast.

Conclusion

The accumulation of 1.11 million ETH, coupled with the growth of Ethereum's ecosystem, and considered alongside macroeconomic factors and technical analysis, suggests a potentially bullish outlook for Ethereum. However, remember that cryptocurrency investments are inherently volatile. While this analysis points towards a positive Ethereum price forecast, it's crucial to conduct thorough research, understand the risks involved before investing, and stay informed on the latest developments. Keep an eye on our future updates for more in-depth Ethereum price forecasts. Remember to diversify your portfolio and only invest what you can afford to lose. Stay updated on the latest Ethereum price forecast!

Featured Posts

-

Bitcoin Madenciliginde Duesues Neden Karlilik Azaldi

May 08, 2025

Bitcoin Madenciliginde Duesues Neden Karlilik Azaldi

May 08, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Gelecege Bakis

May 08, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Gelecege Bakis

May 08, 2025 -

Al West Showdown Angels Outlast Dodgers Without Key Shortstops

May 08, 2025

Al West Showdown Angels Outlast Dodgers Without Key Shortstops

May 08, 2025 -

Brezilya Da Bitcoin Oedemeleri Yasal Mi Maaslar Icin Yeni Kurallar

May 08, 2025

Brezilya Da Bitcoin Oedemeleri Yasal Mi Maaslar Icin Yeni Kurallar

May 08, 2025 -

Recent Crypto Market Trends Dogecoin Shiba Inu And Suis Unexpected Gains

May 08, 2025

Recent Crypto Market Trends Dogecoin Shiba Inu And Suis Unexpected Gains

May 08, 2025