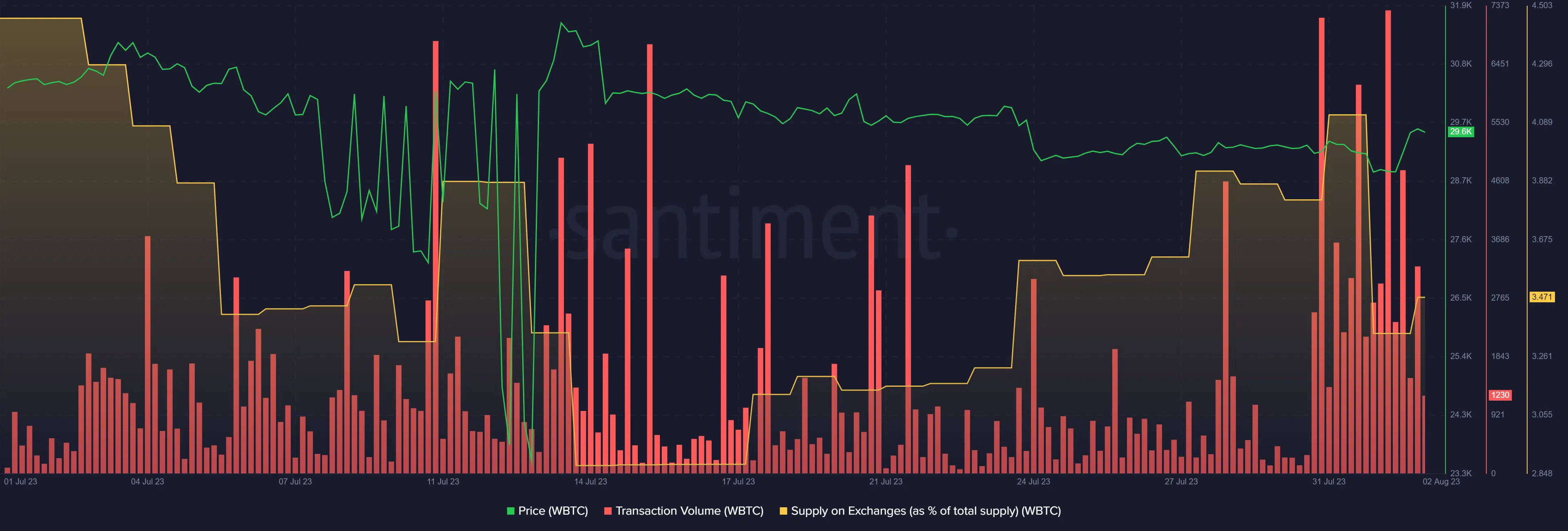

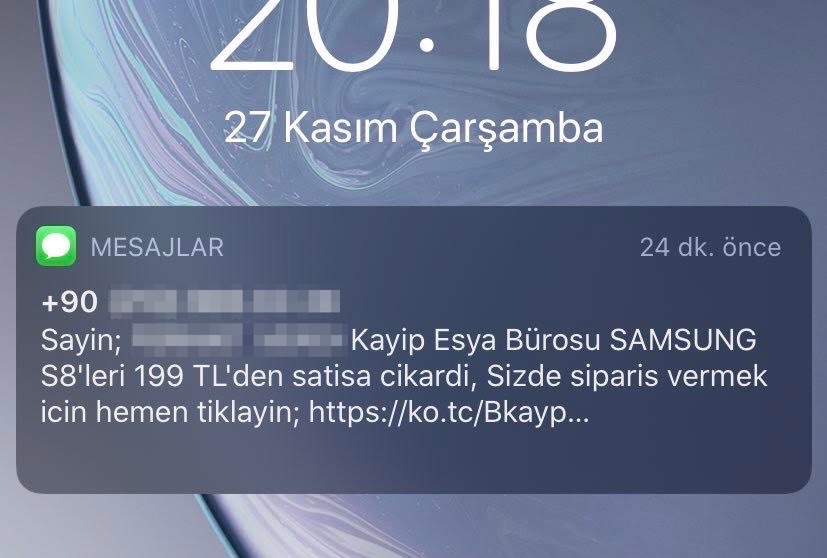

Ethereum Transaction Volume Spikes: Analysis Of Recent Network Activity

Table of Contents

The Role of Decentralized Finance (DeFi) in Increased Ethereum Transaction Volume

Decentralized finance, or DeFi, has emerged as a powerful catalyst for increased Ethereum transaction volume. Built upon the Ethereum blockchain's smart contract functionality, DeFi applications offer a wide range of financial services without relying on traditional intermediaries. This innovative ecosystem is directly responsible for a significant portion of the recent surge in network activity.

- Increased usage of lending and borrowing protocols: Platforms like Aave and Compound enable users to lend and borrow cryptocurrencies, generating a constant stream of transactions for interest accrual, repayments, and asset transfers.

- Growth in decentralized exchanges (DEXs): Uniswap and SushiSwap, among others, allow peer-to-peer trading of tokens without the need for centralized exchanges. This decentralized trading activity contributes significantly to Ethereum's transaction volume.

- Rise of yield farming and staking activities: Users actively participate in yield farming strategies, constantly shifting assets between various DeFi protocols to maximize returns, leading to numerous transactions. Staking ETH to secure the network also contributes to the overall transaction volume.

- Complex smart contract interactions: DeFi applications often involve multiple, intricate smart contract interactions for each transaction, further increasing the total number of transactions processed on the Ethereum network.

- These activities translate into high transaction counts because each DeFi interaction, whether it's swapping tokens, lending assets, or participating in yield farming, necessitates one or more transactions on the Ethereum blockchain.

The Impact of Non-Fungible Tokens (NFTs) on Ethereum Transaction Volume

The explosion of the NFT market has significantly impacted Ethereum transaction volume. NFTs, unique digital assets representing ownership of items such as digital art, collectibles, and in-game items, are primarily built on the Ethereum blockchain, driving substantial network activity.

- Increased NFT trading and minting activity: The buying, selling, and creation of NFTs involve numerous transactions on the Ethereum blockchain. As the NFT market booms, so does the transaction volume associated with it.

- Popularity of NFT marketplaces: Platforms like OpenSea and Rarible facilitate the buying and selling of NFTs, resulting in a significant increase in Ethereum transactions. Each purchase and sale requires an Ethereum transaction to finalize the transfer of ownership.

- The role of new NFT projects and collections: The constant influx of new projects and collections generates hype and trading activity, contributing significantly to transaction spikes.

- Correlation between NFT hype cycles and transaction volume spikes: Periods of intense NFT market hype often correspond with significant increases in Ethereum transaction volume, as traders rush to buy, sell, and mint new NFTs.

- Each NFT transaction – from minting a new NFT to listing it on a marketplace to transferring ownership – incurs Ethereum transaction fees, further contributing to the overall network activity.

Analyzing Ethereum Gas Prices and Transaction Fees

The increased Ethereum transaction volume directly correlates with higher gas prices. Gas is the fee paid to miners for processing transactions on the Ethereum network. When demand for block space increases (due to higher transaction volume), so does the price of gas.

- Increased demand for block space affects gas prices: As more transactions compete for inclusion in blocks, miners can charge higher gas fees, leading to increased costs for users.

- Impact of high gas fees on user experience and adoption: High gas fees can make it prohibitively expensive for some users to participate in the Ethereum ecosystem, potentially hindering adoption.

- Potential solutions to network congestion: Layer-2 scaling solutions, such as rollups and state channels, aim to alleviate network congestion and reduce gas fees by processing transactions off-chain before settling them on the main Ethereum chain.

- Correlation between ETH price and transaction fees: While not directly proportional, there's often a correlation between the price of ETH and gas fees. A rising ETH price might encourage higher gas fees as miners seek to maximize their profits.

The Influence of Other Factors on Ethereum Transaction Volume

While DeFi and NFTs are primary drivers, other factors contribute to the increased Ethereum transaction volume. These include:

- Ethereum upgrades: Network upgrades aiming to improve scalability and efficiency can influence transaction volume, both positively and negatively during implementation.

- Growing number of dApps: The increasing number of decentralized applications (dApps) built on Ethereum continues to fuel transaction demand.

- General blockchain adoption: The broader adoption of blockchain technology and its applications contributes to the overall growth and activity on the Ethereum network.

- Ethereum 2.0: The transition to Ethereum 2.0, with its shift to a proof-of-stake consensus mechanism, is expected to impact transaction volume and gas fees in the long term.

Conclusion

The recent spike in Ethereum transaction volume is predominantly driven by the flourishing DeFi and NFT ecosystems. The increased demand for block space translates directly into higher gas prices and network congestion, emphasizing the critical need for scaling solutions. Understanding these dynamics is crucial for navigating the evolving Ethereum landscape. Stay informed about the ever-evolving Ethereum ecosystem and its impact on transaction volume. Follow our blog for further analysis and insights into Ethereum network activity and continue to monitor Ethereum transaction volume fluctuations to understand future trends in the cryptocurrency space.

Featured Posts

-

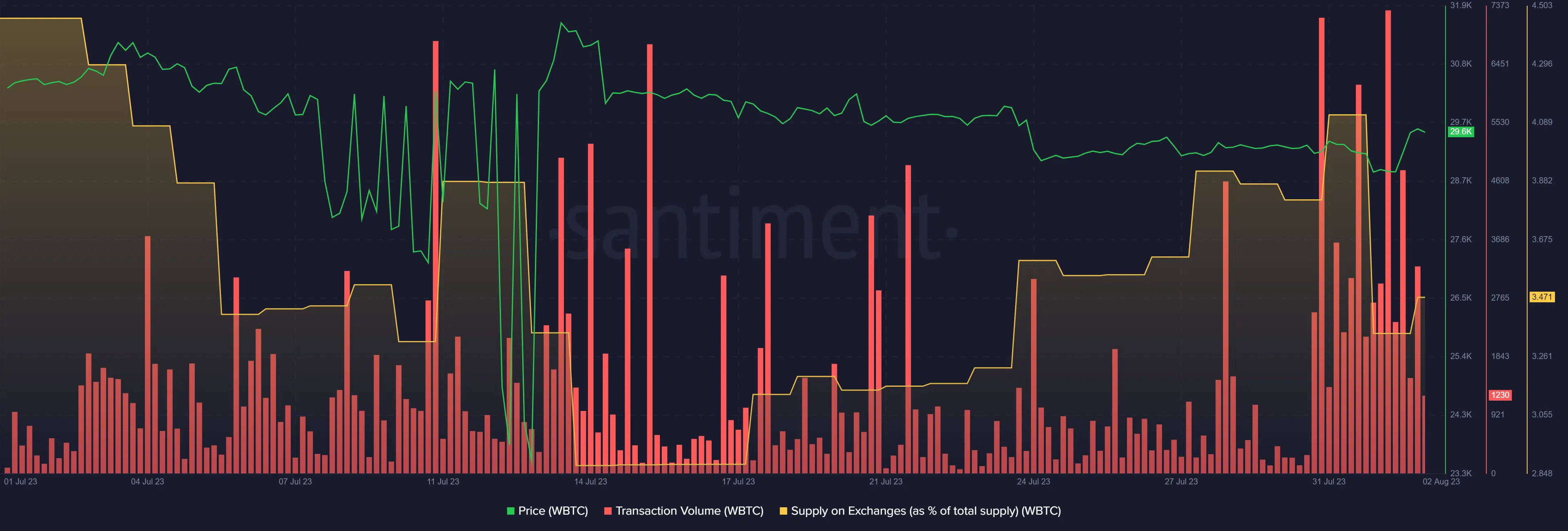

Winning Lotto Numbers Wednesday April 9th Complete Results

May 08, 2025

Winning Lotto Numbers Wednesday April 9th Complete Results

May 08, 2025 -

El Emotivo Gesto De Pulgar Un Detalle Que Enamoro A Los Hinchas Del Flamengo

May 08, 2025

El Emotivo Gesto De Pulgar Un Detalle Que Enamoro A Los Hinchas Del Flamengo

May 08, 2025 -

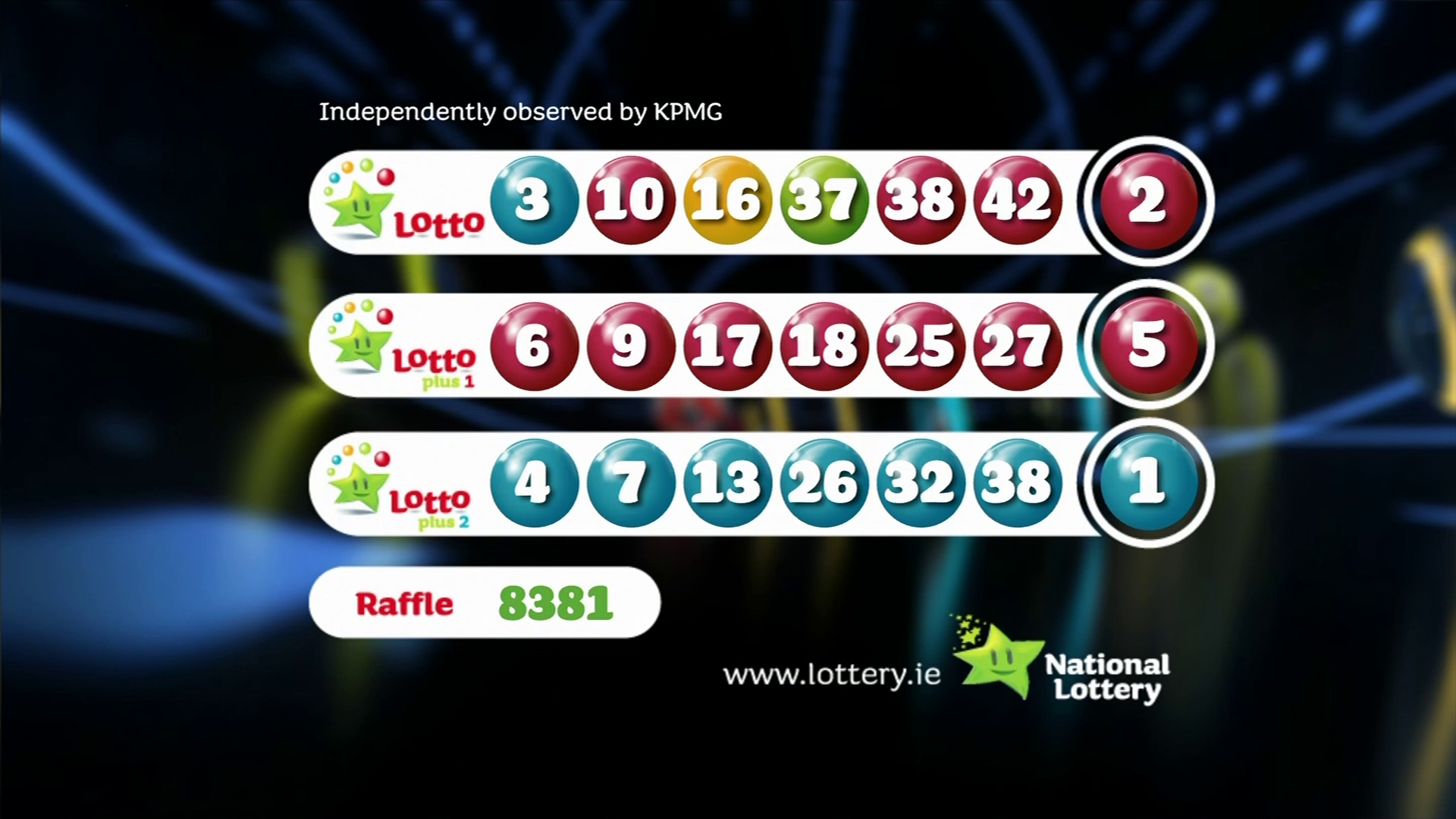

Tuerkiye De Sms Dolandiriciligi Sikayetleri Patladi

May 08, 2025

Tuerkiye De Sms Dolandiriciligi Sikayetleri Patladi

May 08, 2025 -

Fifth Straight Loss For Angels Mike Trouts Knee Injury A Major Factor

May 08, 2025

Fifth Straight Loss For Angels Mike Trouts Knee Injury A Major Factor

May 08, 2025 -

1 500 Ethereum Price Target Evaluating The Current Support Level

May 08, 2025

1 500 Ethereum Price Target Evaluating The Current Support Level

May 08, 2025