Ethereum Forecast: Rising Accumulation Signals Potential Price Increase

Table of Contents

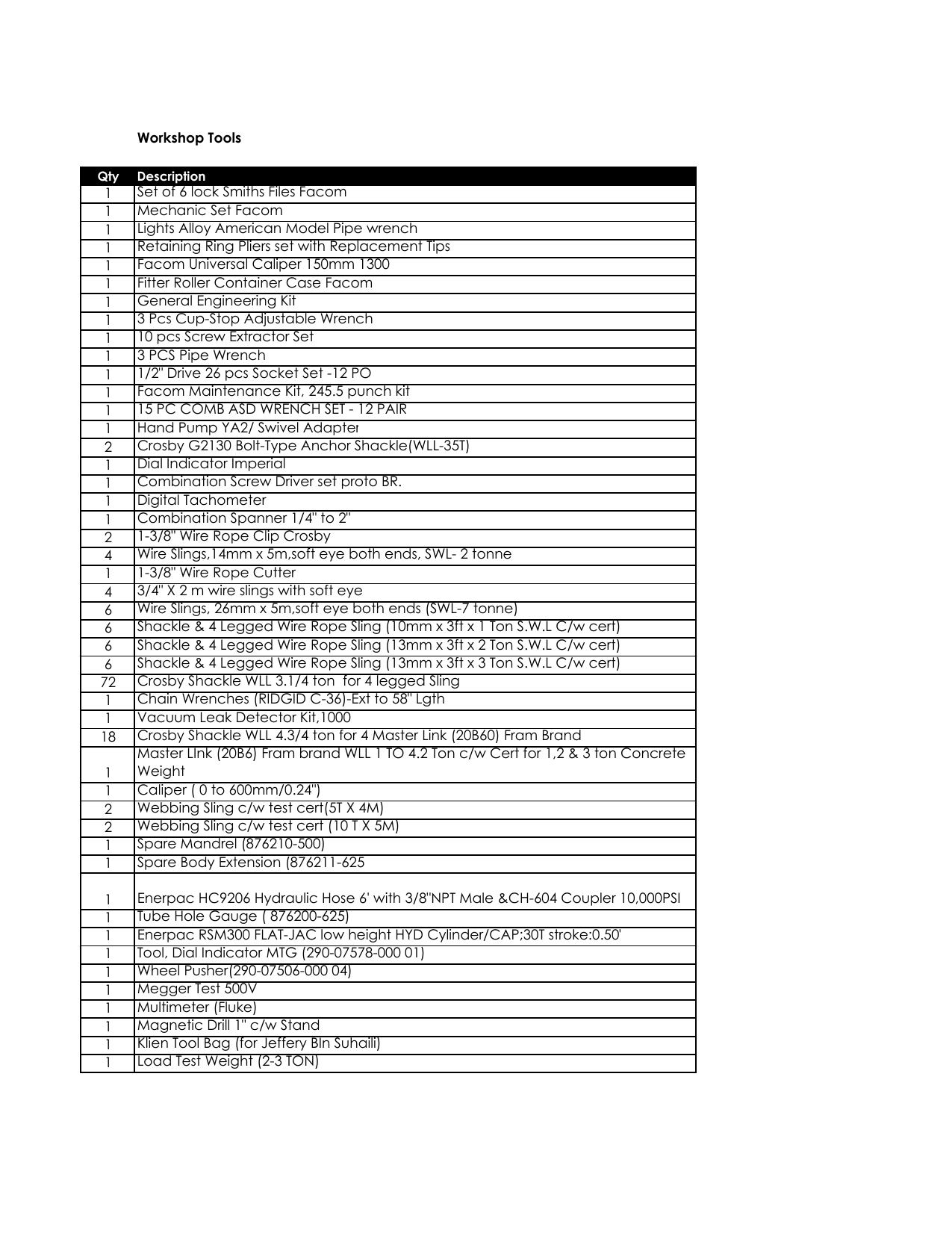

On-Chain Data Supporting Accumulation

Increasing Number of Addresses Holding Significant ETH

The accumulation of Ethereum by high-net-worth investors is a significant indicator of potential price appreciation. These "whales," holding substantial quantities of ETH, are key players whose actions often influence market trends. Data from reputable blockchain explorers like Etherscan shows a marked increase in the number of addresses holding over 1000 ETH in recent months. This surge in whale activity suggests a growing belief in Ethereum's long-term value.

- Increased whale activity observed. The number of addresses holding significant ETH has risen steadily, indicating strong accumulation.

- Data sourced from reputable blockchain explorers (e.g., Etherscan). Our analysis is based on verifiable, publicly available data.

- Graphical representation to visually highlight the trend. [Insert chart/graph showing the increase in addresses holding significant ETH].

Decreased Exchange Balances

Another crucial indicator pointing towards a positive Ethereum forecast is the decreasing amount of ETH held on centralized exchanges. A reduction in exchange balances signifies less ETH available for immediate selling, thereby reducing selling pressure and potentially supporting price appreciation. This trend suggests stronger long-term investor confidence.

- Less ETH available for immediate selling. Lower exchange balances imply reduced potential for sudden sell-offs.

- Implies stronger long-term investor confidence. Investors are moving their ETH off exchanges, suggesting a belief in its long-term value.

- Comparison of current exchange balances with historical data. [Insert chart/graph showing the decline in ETH exchange reserves]. The current levels are significantly lower than previous peaks, highlighting the accumulation trend.

Ethereum's Technological Advancements & Ecosystem Growth

The Merge & Post-Merge Performance

The successful Ethereum Merge, transitioning the network from Proof-of-Work to Proof-of-Stake, was a landmark achievement. This upgrade has significantly improved Ethereum's energy efficiency and scalability, leading to lower transaction fees and faster transaction speeds. The positive market sentiment following the Merge further contributed to the bullish Ethereum forecast.

- Lower transaction fees and faster transaction speeds. The Merge has made Ethereum more accessible and efficient for users.

- Increased environmental sustainability of Ethereum. The transition to Proof-of-Stake drastically reduced Ethereum's energy consumption.

- Positive market sentiment following the successful Merge. The successful completion of the Merge boosted investor confidence.

Growing DeFi Ecosystem & NFT Market

Ethereum's thriving decentralized finance (DeFi) ecosystem and non-fungible token (NFT) market are major drivers of demand for ETH. The continued innovation and growth within these sectors contribute significantly to the overall value and adoption of the Ethereum blockchain.

- Increased usage of decentralized applications (dApps). The DeFi ecosystem continues to expand, driving demand for ETH.

- High demand for NFTs built on the Ethereum blockchain. The NFT market remains vibrant, with significant trading volume and ongoing innovation.

- Potential for future growth and development within the ecosystem. The Ethereum ecosystem shows immense potential for further expansion and innovation.

Potential Risks & Challenges

Macroeconomic Factors & Market Volatility

It's crucial to acknowledge that macroeconomic factors and overall market volatility can significantly impact cryptocurrency prices. Global economic conditions, inflation, interest rate hikes, and regulatory uncertainty can all influence the Ethereum price.

- Impact of inflation and interest rate hikes. Macroeconomic instability can lead to market corrections.

- Regulatory uncertainty and potential government interventions. Changes in regulatory landscapes can affect cryptocurrency prices.

- General cryptocurrency market volatility. The cryptocurrency market is inherently volatile and prone to price swings.

Competition from Other Blockchains

Ethereum faces competition from other Layer-1 and Layer-2 blockchain solutions. While Ethereum maintains a strong market position, the emergence of competing technologies presents potential challenges.

- Comparison of Ethereum's strengths and weaknesses against competitors. Ethereum's strengths lie in its established ecosystem and network effects.

- Assessment of the long-term viability of Ethereum's market position. Ethereum's continued innovation and development are crucial for maintaining its dominance.

- Discussion of potential disruptive technologies. Emerging technologies could potentially disrupt Ethereum's market share.

Conclusion

While the cryptocurrency market remains inherently volatile, the current indicators, including a strong Ethereum accumulation trend, coupled with significant technological advancements and robust ecosystem growth, suggest a positive Ethereum forecast. However, it is essential to carefully consider macroeconomic factors and competitive pressures. Conduct thorough due diligence and manage your risk effectively before investing in Ethereum. Stay informed about the latest developments and monitor the Ethereum price and accumulation trends closely to make informed investment decisions. Don't miss out on potential opportunities – keep a close eye on the Ethereum forecast and price movements.

Featured Posts

-

How Chinas Lowered Rates Address Tariff Induced Economic Slowdown

May 08, 2025

How Chinas Lowered Rates Address Tariff Induced Economic Slowdown

May 08, 2025 -

The 10x Bitcoin Multiplier Chart Analysis And Market Implications

May 08, 2025

The 10x Bitcoin Multiplier Chart Analysis And Market Implications

May 08, 2025 -

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025 -

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025 -

Increased Earnings For Uber Drivers And Couriers In Kenya Plus Cashback For Customers

May 08, 2025

Increased Earnings For Uber Drivers And Couriers In Kenya Plus Cashback For Customers

May 08, 2025