XRP's 400% Rally: Is Further Growth Possible? Analysis And Predictions.

Table of Contents

Factors Contributing to XRP's 400% Rally

Several interconnected factors have contributed to XRP's impressive price surge.

Positive Ripple Developments

Recent developments surrounding Ripple Labs have significantly boosted investor confidence.

- Increased RippleNet Adoption: RippleNet, Ripple's global payment network, continues to expand its reach, onboarding new financial institutions and facilitating cross-border transactions. This increased usage demonstrates the real-world utility of XRP. This improved RippleNet growth directly impacts the demand for XRP.

- Strategic Partnerships: Ripple has forged several strategic partnerships with major financial institutions, solidifying its position in the global payments landscape. These partnerships enhance the credibility and adoption of XRP. Examples include partnerships with major banks globally which can be found on Ripple's official website.

- Positive Legal Developments (Conditional): While the SEC lawsuit remains a significant factor, any positive legal developments, such as a favorable court ruling or settlement, would likely trigger a substantial price increase. This is a crucial factor in XRP price prediction. (Note: This section should be updated to reflect the current status of the SEC lawsuit and any relevant developments.)

- Growing Institutional Interest: Increased institutional investment in XRP demonstrates growing confidence in its long-term potential. This institutional investment in XRP reflects a belief in the underlying technology and its future applications. More data on institutional holdings would further solidify this argument.

Overall Cryptocurrency Market Sentiment

The broader cryptocurrency market has also played a significant role in XRP's rally.

- Bitcoin's Price Action: Bitcoin's price movements often influence the entire crypto market, including altcoins like XRP. A strong Bitcoin market generally translates to increased investor confidence across the board. The Bitcoin price correlation with XRP is a key factor to consider.

- Altcoin Season: The current market sentiment suggests a potential "altcoin season," where investors are allocating capital to alternative cryptocurrencies beyond Bitcoin. XRP is a major beneficiary of this trend. This indicates a broader shift in investor interest in the altcoin market cap.

- General Investor Confidence: A general rise in investor confidence in the cryptocurrency market, driven by factors like regulatory clarity (in certain jurisdictions) or technological advancements, boosts the price of XRP and other cryptocurrencies. This general sentiment affects the crypto market cap significantly.

Speculation and FOMO

Psychological factors have also fueled XRP's price increase.

- Social Media Sentiment: Positive social media sentiment and hype around XRP have amplified the rally, driving further price increases. Analyzing social media sentiment around XRP is crucial to understanding short-term volatility.

- Fear of Missing Out (FOMO): As XRP's price rises, the fear of missing out (FOMO) encourages more investors to buy, creating a self-reinforcing cycle. This FOMO effect contributes to rapid price increases but also to increased market volatility.

- News Cycles: Positive news coverage and announcements surrounding Ripple and XRP often translate to immediate price increases, showcasing the impact of news cycles on market psychology. The impact of news cycles on market psychology is a crucial element in understanding short-term price fluctuations.

Analyzing the Sustainability of XRP's Growth

While the rally is impressive, several factors could hinder its sustainability.

Potential Headwinds

Several potential obstacles could limit XRP's continued growth.

- SEC Lawsuit Uncertainty: The ongoing SEC lawsuit against Ripple remains a major overhang, creating uncertainty about XRP's regulatory status in the US. The SEC lawsuit impact on XRP's price is unpredictable but significant.

- Regulatory Changes: Changes in cryptocurrency regulations globally could negatively affect XRP's price. Regulatory uncertainty is a major risk factor for XRP and the cryptocurrency market as a whole.

- Competition from Other Cryptocurrencies: The cryptocurrency market is highly competitive. New projects and innovations could divert investor attention and capital away from XRP. This cryptocurrency competition is a constant factor in the market.

Technical Analysis

Technical indicators provide insights into XRP's potential future price movements.

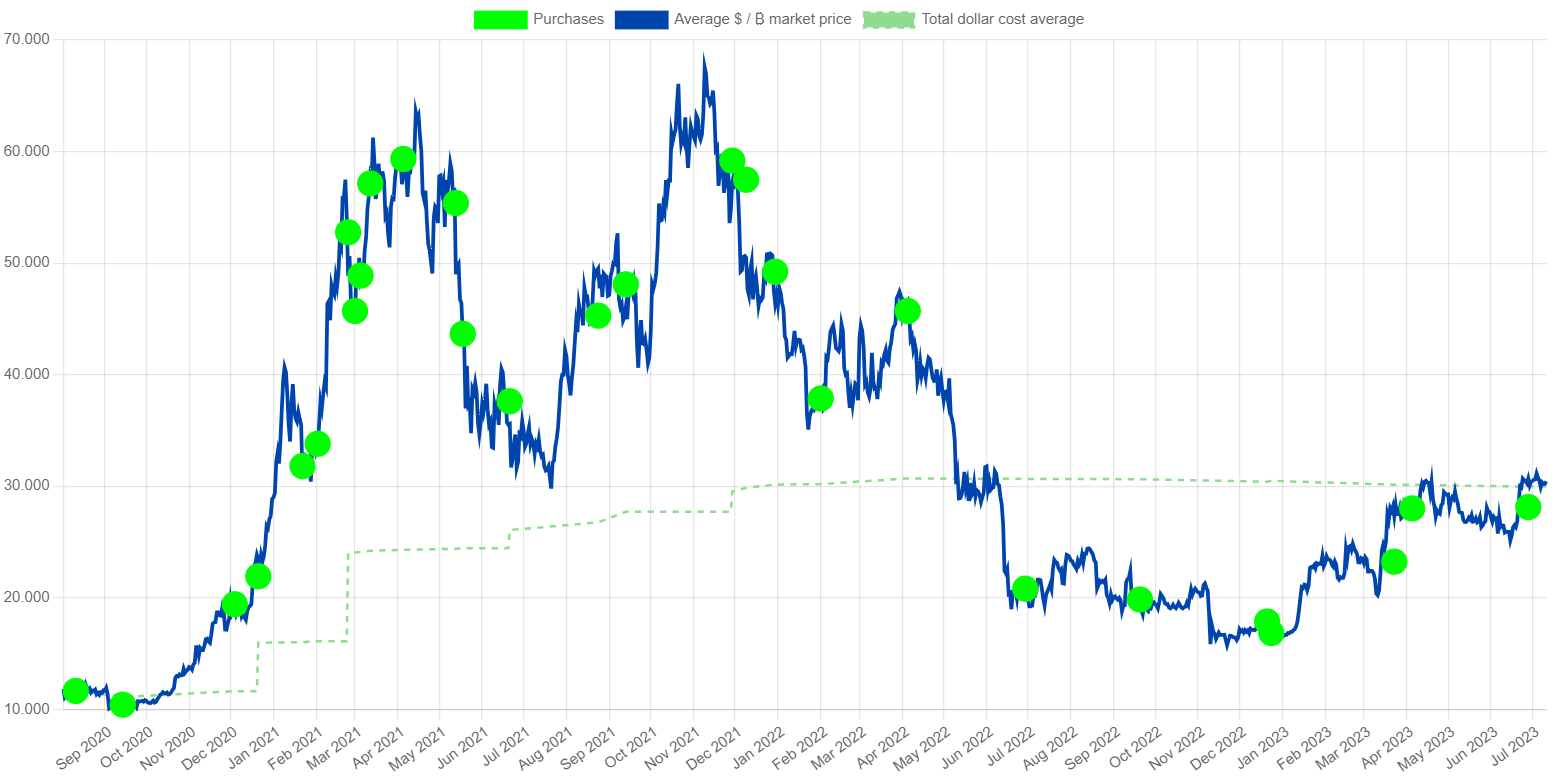

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can identify potential support and resistance levels.

- RSI (Relative Strength Index): The RSI can indicate whether XRP is overbought or oversold, suggesting potential price reversals.

- Chart Patterns: Identifying chart patterns (e.g., head and shoulders, double tops/bottoms) can offer clues about future price direction. (Note: This section would ideally include relevant charts).

Fundamental Analysis

Assessing Ripple's business model and technological advancements is crucial for long-term XRP price prediction.

- RippleNet Utility: The ongoing adoption and utility of RippleNet are crucial to XRP's long-term value.

- Technological Advancements: Ripple's ongoing innovation and technological advancements will impact XRP's attractiveness to investors.

- Ripple's Business Model: The long-term viability and profitability of Ripple's business model are central to XRP's fundamental value.

XRP Price Predictions: Short-Term and Long-Term

It's important to remember that any price prediction carries inherent uncertainty.

Short-Term Predictions (Next 3-6 Months)

Based on the analysis above, a range of $[Price range] is possible in the next 3-6 months. This prediction considers the positive factors mentioned earlier but also acknowledges the significant uncertainties, including the SEC lawsuit.

Long-Term Predictions (Next 1-5 Years)

Looking further ahead, a range of $[Price range] is possible over the next 1-5 years. This long-term XRP price prediction is based on the assumption of continued RippleNet growth, positive regulatory developments (or adaptation to new regulations), and sustained market interest in XRP.

Conclusion: XRP's Future: A Cautious Optimism?

XRP's 400% rally is undeniably impressive, driven by positive Ripple developments, broader market sentiment, and psychological factors. However, significant headwinds remain, including the SEC lawsuit and regulatory uncertainty. While the short-term outlook is uncertain, the long-term potential hinges on Ripple's continued success in building its payment network and adapting to the evolving regulatory landscape. Our price predictions provide a potential range, but remember that cryptocurrency investments carry significant risk. While XRP's 400% rally is impressive, remember that thorough research is crucial before investing in XRP or any cryptocurrency. Learn more about XRP price prediction and consider your risk tolerance before making any investment decisions.

Featured Posts

-

Luxury Carmakers Face Headwinds In China Analyzing The Bmw And Porsche Cases

May 08, 2025

Luxury Carmakers Face Headwinds In China Analyzing The Bmw And Porsche Cases

May 08, 2025 -

Ubers New Driver Subscription A Commission Free Alternative

May 08, 2025

Ubers New Driver Subscription A Commission Free Alternative

May 08, 2025 -

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Look

May 08, 2025

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Look

May 08, 2025 -

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025