BofA's Reassuring View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

The stock market's recent fluctuations have left many investors feeling uneasy. Are current valuations justified, or is a correction imminent? The uncertainty is palpable. However, Bank of America's (BofA) latest research offers a reassuring perspective, suggesting that current valuations, while seemingly high, aren't necessarily cause for alarm. This article will delve into BofA's reasoning, exploring the key factors that contribute to their optimistic view and why investors should remain confident in the market's long-term prospects.

<h2>BofA's Key Arguments for a Bullish Outlook</h2>

BofA's bullish outlook rests on several key pillars, all pointing towards continued, albeit potentially volatile, market growth. Their analysis suggests that current valuations, while appearing high on the surface, are supported by strong fundamentals and a positive economic outlook.

<h3>Strong Corporate Earnings</h3>

BofA projects robust corporate earnings growth in the coming year, a crucial factor underpinning their positive market assessment. This anticipated growth helps justify, in their view, current valuation levels. Their report highlights several key points:

- Projected EPS growth for the next year: BofA forecasts a healthy increase in earnings per share (EPS) for the S&P 500, exceeding previous projections. Specific numbers would need to be referenced from their actual report for accuracy.

- Sectors expected to outperform: The analysis pinpoints specific sectors, such as technology and healthcare, as poised for significant growth, driving overall market performance. Identifying these sectors within BofA's report is crucial for a complete picture.

- Resilience of corporate balance sheets: BofA emphasizes the strong financial health of many corporations, providing a buffer against potential economic downturns and contributing to sustained earnings growth. Details regarding debt levels and cash reserves would be beneficial here, again referencing BofA's data.

<h3>Low Interest Rates and Monetary Policy</h3>

The current low-interest-rate environment, coupled with potential further monetary easing by central banks, significantly influences BofA's positive outlook. This supportive monetary policy helps to keep borrowing costs low, encouraging investment and supporting asset prices.

- Current interest rate environment: The current historically low interest rates make borrowing cheaper for businesses, supporting expansion and investment, which in turn impacts stock valuations positively.

- BofA's prediction of future interest rate movements: BofA's analysis likely includes predictions regarding future interest rate adjustments. Their assessment of the likelihood of further rate cuts or maintaining the status quo heavily influences their view.

- Impact of quantitative easing (if applicable): If applicable, the analysis should include discussion on the impact of quantitative easing (QE) programs on liquidity and market valuations.

<h3>Long-Term Growth Potential</h3>

Beyond short-term factors, BofA emphasizes the significant long-term growth potential of the global economy. This is fueled by several key trends:

- Key sectors driving long-term growth: BofA likely identifies key sectors such as renewable energy, artificial intelligence, and biotechnology as crucial drivers of long-term economic expansion.

- Geographical regions with high growth potential: Emerging markets are likely highlighted as areas with significant growth potential, offering diversification and attractive investment opportunities.

- Impact of technological advancements on valuations: The transformative impact of technology on various industries is a key driver of long-term growth and a justification for the current valuations in BofA’s view.

<h2>Addressing Concerns About High Valuations</h2>

While acknowledging the seemingly high valuations in certain sectors, BofA contextualizes these figures within the broader economic landscape.

<h3>Valuation Metrics in Context</h3>

BofA's analysis likely addresses concerns about high valuations by comparing current metrics to historical data and adjusting for factors such as low interest rates and strong earnings growth.

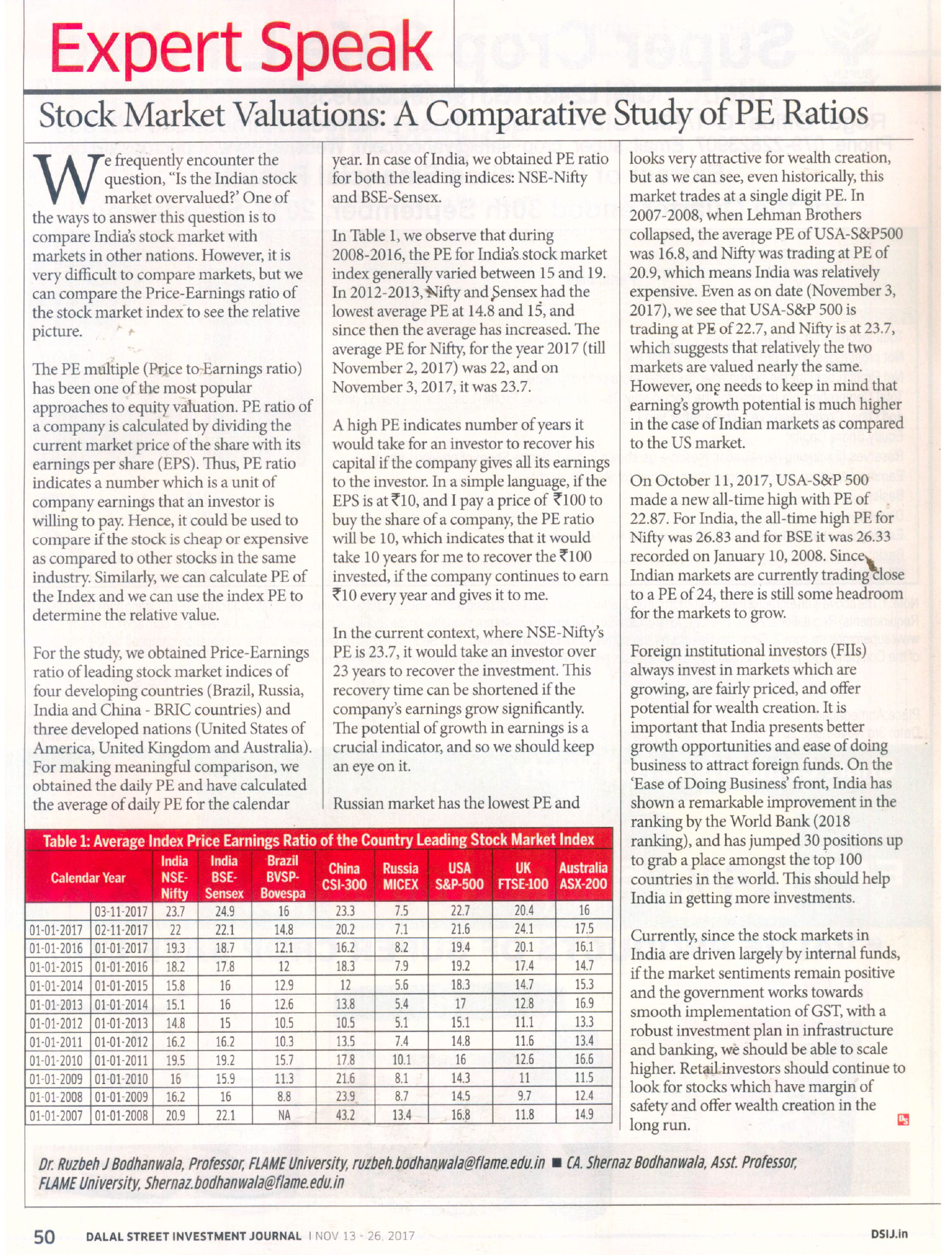

- Specific valuation metrics used (e.g., P/E ratio, Shiller P/E): Understanding which valuation metrics BofA utilizes is crucial. Their rationale for choosing specific metrics should be explained.

- Comparison to historical averages: The comparison of current valuations to historical averages, adjusted for relevant factors, helps determine whether current levels are truly excessive or within a reasonable range.

- Justification for seemingly high valuations: BofA likely provides a justification for seemingly high valuations, highlighting factors such as the low-interest-rate environment, strong corporate earnings, and the potential for future growth.

<h3>Risk Mitigation Strategies</h3>

BofA likely also provides guidance on risk mitigation strategies to help investors navigate the market effectively.

- Importance of diversification across asset classes: Diversification across different asset classes is a key element of mitigating risk and reducing the impact of potential market downturns.

- Suggestions for sector-specific allocation: Investors may find sector-specific allocation recommendations within BofA's report, which can help optimize portfolio construction.

- Risk management techniques for a volatile market: The report might contain additional advice on risk management techniques suitable for the current market volatility, perhaps including hedging strategies or stop-loss orders.

<h2>Conclusion</h2>

BofA's reassuring view on current stock market valuations offers a valuable perspective for investors. Their analysis emphasizes strong corporate earnings, the supportive impact of low interest rates and monetary policy, and significant long-term growth potential as key factors justifying current valuations. While acknowledging the seemingly high valuations in some sectors, BofA contextualizes these figures and offers strategies for risk mitigation. By understanding the factors contributing to this optimistic outlook and implementing sound risk mitigation strategies, you can navigate the market with confidence. Learn more about BofA's market analysis and refine your investment strategy today!

Featured Posts

-

Jayson Tatum Ankle Injury Celtics Face Playoff Uncertainty

May 08, 2025

Jayson Tatum Ankle Injury Celtics Face Playoff Uncertainty

May 08, 2025 -

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025 -

Hetimi I Uefa S Ndaj Arsenalit Per Shkelje Te Rregullave Ne Ndeshjen Me Psg

May 08, 2025

Hetimi I Uefa S Ndaj Arsenalit Per Shkelje Te Rregullave Ne Ndeshjen Me Psg

May 08, 2025