Investing In 2025: MicroStrategy Stock Vs Bitcoin - A Detailed Look

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model & Bitcoin Holdings

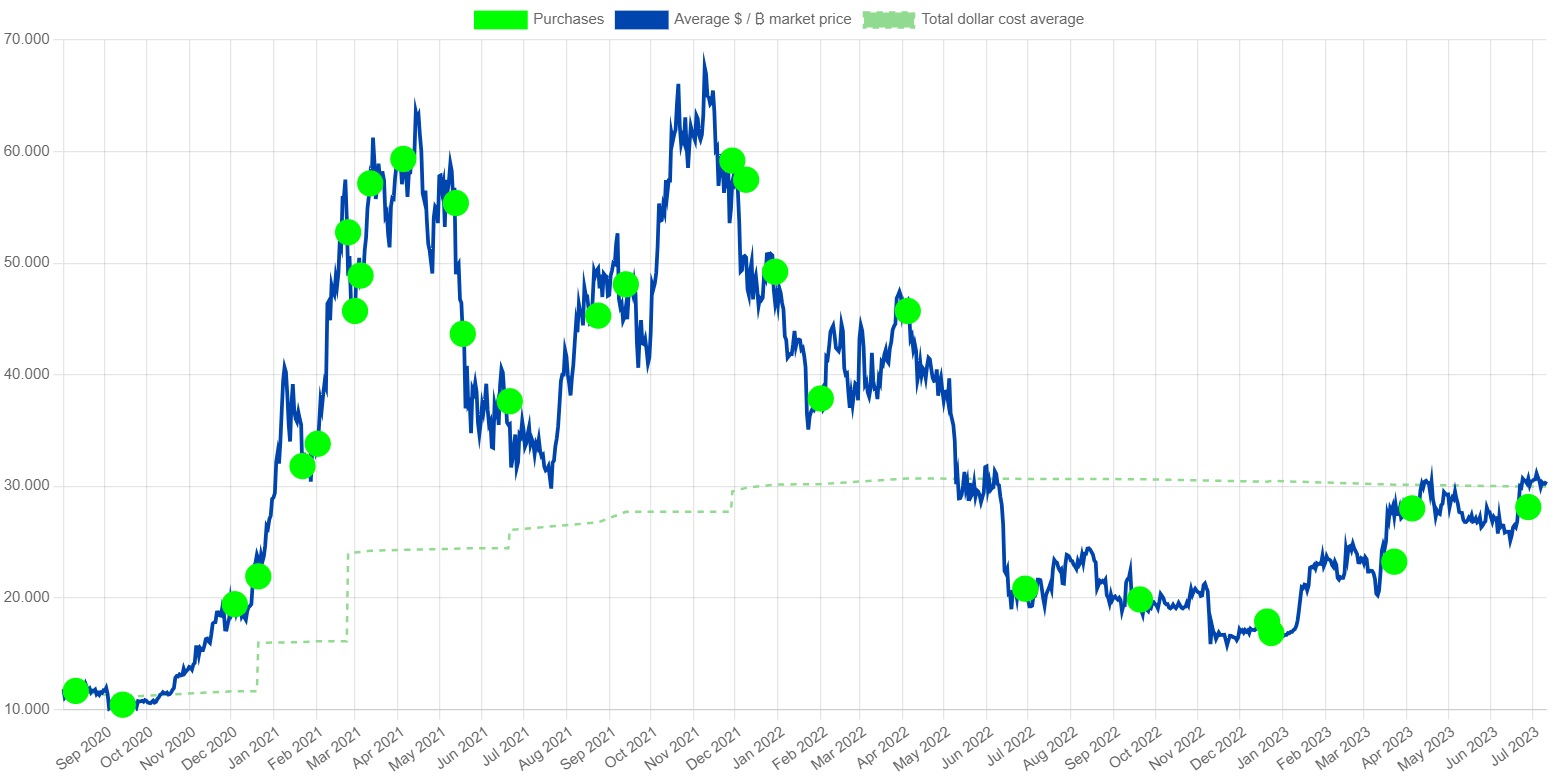

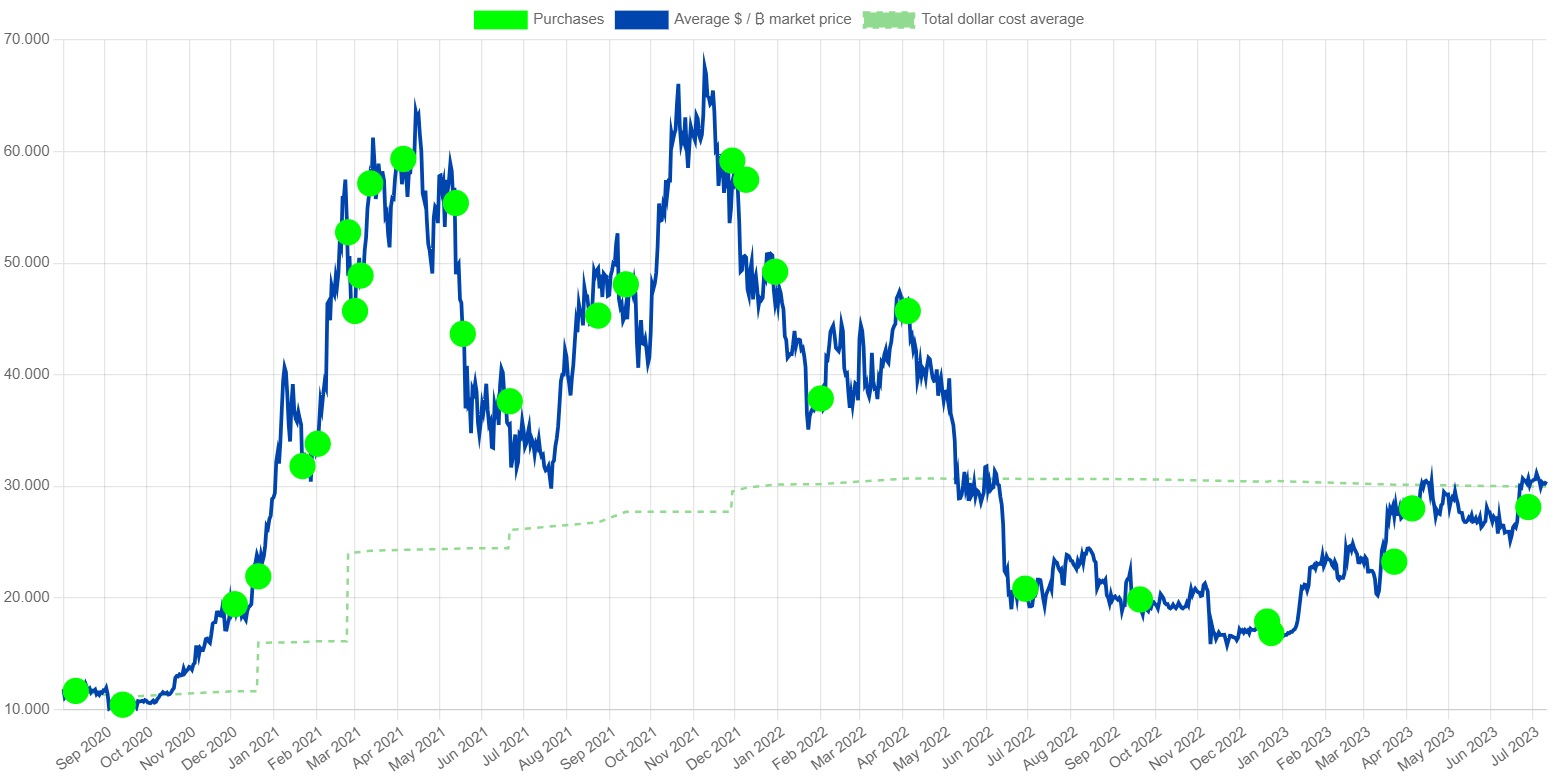

MicroStrategy, a publicly traded business intelligence company, has famously adopted a bold corporate strategy: accumulating Bitcoin as a primary treasury asset. Their core business revolves around providing enterprise analytics and mobility software. However, since 2020, their massive Bitcoin acquisitions have redefined their public image and significantly impacted their financial performance. This strategy reflects a belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

- Market Capitalization: Fluctuates based on stock price and Bitcoin's value.

- Number of BTC Held: Constantly updated, representing a substantial holding in the overall Bitcoin market.

- Average Acquisition Price: The average price MicroStrategy paid for its Bitcoin holdings, influencing their overall profit/loss on this investment.

- Impact on the Company's Balance Sheet: Bitcoin holdings represent a significant portion of MicroStrategy's assets, affecting its overall financial position. The value of these holdings impacts their reported earnings and financial health. This is a key factor in understanding the risks and rewards of investing in MicroStrategy stock.

Keywords: MicroStrategy business model, Bitcoin acquisition strategy, MicroStrategy balance sheet, Bitcoin reserves, MicroStrategy stock price.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique risk-reward profile. The company’s fortunes are inextricably linked to the price of Bitcoin.

- Price Volatility: MicroStrategy's stock price exhibits significant volatility, directly mirroring the price fluctuations of Bitcoin.

- Correlation with Bitcoin Price: A strong positive correlation exists between MicroStrategy's stock price and the price of Bitcoin. When Bitcoin rises, so does MicroStrategy's stock, and vice-versa.

- Dependence on a Single Asset: The company’s heavy reliance on Bitcoin exposes it to substantial risk if the cryptocurrency market experiences a significant downturn.

- Potential for High Returns: If Bitcoin's price appreciates significantly, MicroStrategy's stock could experience substantial gains, making it an attractive proposition for high-risk investors.

- Company Performance Indicators: Investors should also monitor MicroStrategy's core business performance indicators beyond their Bitcoin holdings to gauge their overall financial health.

Keywords: MicroStrategy stock volatility, Bitcoin price correlation, investment risks, high-risk high-reward, MicroStrategy stock forecast, MicroStrategy earnings.

Direct Bitcoin Investment: Advantages and Disadvantages

Bitcoin's Market Position & Potential for Growth

Bitcoin, the original cryptocurrency, maintains a dominant position in the market. Its potential for long-term growth is fueled by several factors:

- Market Dominance: Bitcoin holds the largest market capitalization among cryptocurrencies, establishing itself as the leading digital asset.

- Adoption Rate: Increasing adoption by individuals, businesses, and institutions is driving demand and potentially increasing its value.

- Institutional Investment: Major financial institutions are gradually incorporating Bitcoin into their investment strategies, adding legitimacy and potentially driving price increases.

- Technological Advancements: Ongoing development and improvements in Bitcoin's underlying technology could enhance its scalability and efficiency.

- Regulatory Landscape: Although still evolving, greater regulatory clarity could boost confidence and investment in Bitcoin.

Keywords: Bitcoin market cap, Bitcoin adoption, Bitcoin price prediction, cryptocurrency regulation, Bitcoin future, Bitcoin investment.

Risks Associated with Direct Bitcoin Investment

Directly investing in Bitcoin carries significant risks:

- Price Fluctuations: Bitcoin's price is notoriously volatile, experiencing substantial swings in short periods.

- Volatility Risk: The high volatility makes it unsuitable for risk-averse investors with shorter-term investment horizons.

- Security Breaches: Investors need to secure their Bitcoin holdings carefully, as losses due to hacking or theft are possible.

- Regulatory Changes: Government regulations concerning cryptocurrencies can significantly impact Bitcoin's value and trading.

- Tax Implications: The tax implications of Bitcoin investments can be complex and vary depending on jurisdiction.

Keywords: Bitcoin volatility, Bitcoin security risks, cryptocurrency regulation, Bitcoin taxation, cryptocurrency investment risks, Bitcoin wallet security.

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Risk Tolerance & Investment Goals

Choosing between MicroStrategy stock and direct Bitcoin investment depends significantly on individual risk tolerance and investment goals.

- Long-term vs. Short-term Investment: Bitcoin is often viewed as a long-term investment, while MicroStrategy stock offers a blend of short-term and long-term exposure.

- Risk Appetite: Investors with a higher risk tolerance might prefer direct Bitcoin investment, while those seeking a potentially less volatile option may lean towards MicroStrategy stock.

- Diversification Strategy: Both can be part of a diversified portfolio, but their correlation needs to be considered.

- Investment Timeline: Your investment timeframe (short-term, mid-term, long-term) will influence your choice.

Keywords: Risk tolerance, investment strategy, diversification, long-term investments, short-term investments, investment portfolio.

Which Investment Suits You Best?

The optimal choice depends on your individual circumstances.

- Pros and Cons Summary: MicroStrategy offers exposure to Bitcoin with some diversification through its core business, but is highly correlated to Bitcoin's price. Direct Bitcoin investment offers potentially higher returns but carries significantly higher risk.

- Comparison Table: A table summarizing the key differences can help in making an informed decision.

- Considerations for Different Investor Profiles: Conservative investors might prefer to avoid both. Moderate investors might consider MicroStrategy. Aggressive investors might favour direct Bitcoin investment.

Keywords: MicroStrategy vs Bitcoin, investment comparison, best investment option, investment advice, investment decision.

Conclusion

Investing in either MicroStrategy stock or Bitcoin in 2025 presents both significant opportunities and considerable risks. MicroStrategy offers a leveraged bet on Bitcoin, but its performance remains heavily dependent on the cryptocurrency's price. Direct Bitcoin investment provides direct exposure but with potentially higher volatility and risks. The key takeaway is that understanding your own risk tolerance and investment goals is paramount before investing in either MicroStrategy stock or Bitcoin.

Call to Action: Conduct thorough due diligence and research before making any investment decisions. Consider seeking advice from a qualified financial advisor to determine which approach—investing in MicroStrategy stock, Bitcoin, or a diversified portfolio including both—best aligns with your risk tolerance and long-term investment strategy. Remember that investing in either MicroStrategy stock or Bitcoin involves significant risk.

Featured Posts

-

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025 -

Trumps Crypto Czar Predicts Further Bitcoin Growth Following Price Surge

May 08, 2025

Trumps Crypto Czar Predicts Further Bitcoin Growth Following Price Surge

May 08, 2025 -

Trump On Greenland And China Fact Checking The Presidents Assertions

May 08, 2025

Trump On Greenland And China Fact Checking The Presidents Assertions

May 08, 2025 -

Papal Election Cardinals Review Candidate Dossiers

May 08, 2025

Papal Election Cardinals Review Candidate Dossiers

May 08, 2025 -

Lyon Sufre Derrota En Casa Ante El Psg

May 08, 2025

Lyon Sufre Derrota En Casa Ante El Psg

May 08, 2025

Latest Posts

-

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Surges Past Bitcoin

May 08, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Surges Past Bitcoin

May 08, 2025 -

Xrps Strong Performance After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025

Xrps Strong Performance After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025 -

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025 -

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025 -

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025