XRP Under $3: A Detailed Look At The Current Investment Landscape

Table of Contents

Market Analysis: Understanding the Current XRP Price

XRP, currently trading below $3, holds a significant market capitalization within the cryptocurrency ecosystem. However, its price has experienced considerable fluctuation in recent times. Understanding these fluctuations requires analyzing several key factors.

Factors Influencing XRP Price

Several interconnected factors contribute to XRP's price volatility:

- Supply and demand dynamics within cryptocurrency exchanges: High trading volume and increased demand can drive the price up, while decreased demand can lead to price drops. The availability of XRP on various exchanges also plays a crucial role.

- Impact of Bitcoin's price movements on the altcoin market (including XRP): Bitcoin often acts as a market leader, and its price movements significantly impact the overall cryptocurrency market, including altcoins like XRP. A bullish Bitcoin market frequently correlates with positive movement in altcoin prices, while a bearish Bitcoin market often negatively impacts altcoins.

- Overall sentiment and market trends within the crypto space: General investor sentiment towards cryptocurrencies as a whole influences XRP's price. Positive news and widespread adoption can boost investor confidence, while negative news or regulatory uncertainty can lead to sell-offs.

- News and events affecting XRP's price (e.g., regulatory updates, partnerships): Significant announcements, such as partnerships with financial institutions or regulatory updates, can have a substantial impact on XRP's price. Positive news generally leads to price increases, whereas negative news often results in price declines.

Comparing XRP's Performance to Other Cryptocurrencies

Benchmarking XRP against leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) is crucial. While XRP's market share might be smaller than BTC or ETH, its volatility can differ significantly.

- Benchmarking against BTC and ETH: Analyzing XRP's price performance relative to BTC and ETH provides a perspective on its growth and stability compared to established cryptocurrencies.

- Volatility analysis compared to other altcoins: Assessing XRP's volatility compared to other altcoins helps investors understand the risk associated with holding XRP. Higher volatility implies higher risk and potential reward.

- Market share within the cryptocurrency ecosystem: XRP's market share reflects its overall standing within the cryptocurrency market. A growing market share indicates increased adoption and potential future price appreciation.

Regulatory Landscape and Legal Challenges Facing XRP

The regulatory landscape surrounding cryptocurrencies, particularly for XRP, presents significant challenges and uncertainties.

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple Labs, the company behind XRP, is a critical factor influencing XRP's price.

- Detailed explanation of the ongoing SEC lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security, impacting its price and legal status.

- Potential outcomes of the lawsuit and their impact on XRP's price and future: A favorable ruling for Ripple could lead to increased investor confidence and price appreciation, while an unfavorable outcome could negatively impact XRP's price and adoption.

- Analysis of legal experts' opinions on the case: Legal experts' opinions and predictions regarding the lawsuit's outcome provide valuable insights for investors. The uncertainty surrounding the case is a major factor contributing to XRP's price volatility.

Global Regulatory Scrutiny of Cryptocurrencies

Global regulatory scrutiny of cryptocurrencies affects XRP's adoption and price.

- Varying regulatory landscapes across different countries: Different countries have vastly different regulatory approaches towards cryptocurrencies, creating uncertainty for investors.

- Impact of global regulations on XRP's adoption and price: Favorable regulations in key markets can boost XRP adoption and price, while restrictive regulations can hinder its growth.

- Potential for future regulatory changes and their implications for XRP: Anticipating future regulatory changes and their potential impact is crucial for informed investment decisions.

Future Projections and Potential Growth Opportunities for XRP

Despite the challenges, XRP holds potential for future growth driven by technological advancements and increasing adoption.

Technological Advancements and RippleNet Adoption

Ripple's ongoing development and improvements to its technology, along with the growing adoption of RippleNet, offer potential growth opportunities.

- Ripple's ongoing development and improvements to its technology: Continuous innovation and technological upgrades improve the efficiency and functionality of XRP and RippleNet.

- Analyzing the growing adoption of RippleNet by financial institutions: Increased adoption by financial institutions indicates growing confidence in Ripple's technology and potential for wider use of XRP.

- Highlighting potential future applications of XRP within the financial sector: Exploring potential applications in cross-border payments, remittances, and other financial services highlights XRP's long-term potential.

Long-Term Investment Potential of XRP

Evaluating the long-term potential of XRP requires considering current market trends, future projections, and various investment strategies.

- Evaluating the long-term growth potential based on current market trends and future projections: Analyzing market trends and future projections helps determine the potential return on investment.

- Considering different investment strategies (long-term holding, short-term trading, etc.): Different investment strategies suit different risk tolerances and financial goals.

- Offering risk assessment and potential return on investment analysis: A comprehensive risk assessment is crucial for making informed investment decisions.

Conclusion

This analysis has explored the complex factors influencing XRP's current price, which sits below $3. We examined the market dynamics, regulatory hurdles presented by the ongoing SEC lawsuit, and the potential future growth opportunities related to RippleNet adoption and technological advancements. Understanding these factors is crucial for navigating the investment landscape surrounding XRP.

Call to Action: While the future of XRP remains uncertain, particularly given the ongoing legal battles, a thorough understanding of the current state of XRP under $3 is essential for informed decision-making. Conduct your own research and carefully consider the risks before investing in XRP or any other cryptocurrency. Learn more about the current XRP landscape and make informed investment decisions.

Featured Posts

-

Te Ipukarea Society Contributions To Rare Seabird Conservation

May 01, 2025

Te Ipukarea Society Contributions To Rare Seabird Conservation

May 01, 2025 -

Rugby Match Report France Defeats Italy Duponts Stellar Display

May 01, 2025

Rugby Match Report France Defeats Italy Duponts Stellar Display

May 01, 2025 -

Research On Scarce Seabirds The Role Of Te Ipukarea Society

May 01, 2025

Research On Scarce Seabirds The Role Of Te Ipukarea Society

May 01, 2025 -

Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 01, 2025

Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 01, 2025 -

Bespaar Geld Opladen Met Enexis In Noord Nederland Buiten Piektijden

May 01, 2025

Bespaar Geld Opladen Met Enexis In Noord Nederland Buiten Piektijden

May 01, 2025

Latest Posts

-

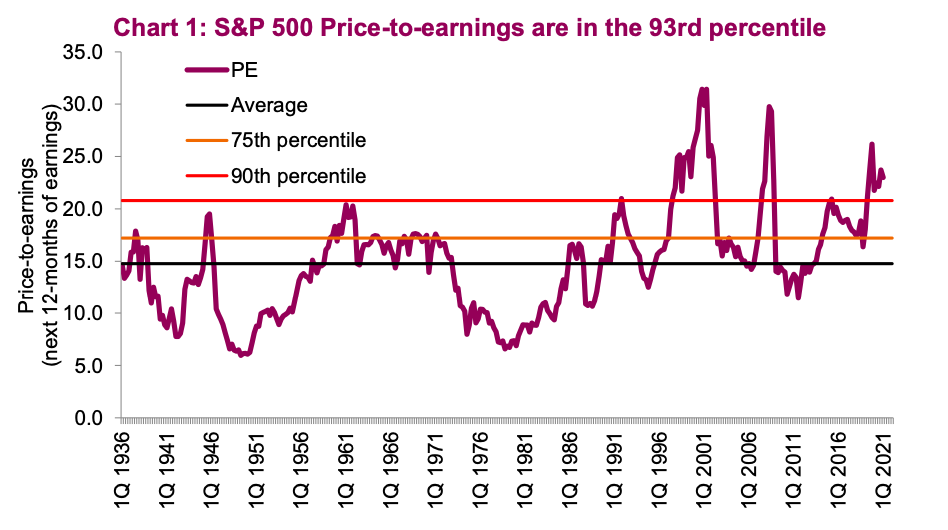

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025 -

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025