XRP (Ripple) Below $3: Investment Analysis And Risks

Table of Contents

XRP, the native cryptocurrency of Ripple Labs, has experienced periods where its price has fallen below $3. This presents a complex scenario for investors: a potentially attractive entry point, but also a market fraught with risk. This article provides a comprehensive investment analysis of XRP trading below $3, exploring the potential rewards and significant risks involved. We will delve into current market dynamics, regulatory hurdles, Ripple's technological advancements, and strategic investment approaches to help you navigate this volatile landscape.

1. Current Market Conditions and Price Volatility

XRP's price is notoriously volatile, exhibiting significant swings even within short timeframes. Several interconnected factors influence these fluctuations, making it crucial to understand them before considering investing in XRP below $3.

- Correlation with Bitcoin: XRP often demonstrates a strong correlation with Bitcoin's price movements. A Bitcoin price drop frequently triggers a corresponding decline in XRP's value, regardless of Ripple's specific performance. Closely monitoring Bitcoin's price trends is essential for XRP investors.

- Market Sentiment and News: Investor sentiment plays a huge role in XRP's price volatility. Positive news, such as successful partnerships or technological advancements, can drive the price up. Conversely, negative news, regulatory uncertainties, or broader cryptocurrency market sell-offs can quickly push XRP below $3.

- Trading Volume and Liquidity: Low trading volume can make XRP highly susceptible to sharp price swings, both upward and downward. High volume, on the other hand, typically signifies stronger market support and less volatility. Analyzing XRP trading volume is crucial for gauging market confidence.

2. Regulatory Landscape and Legal Battles

The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and investor confidence. The uncertainty surrounding the outcome creates a considerable risk for those considering investing in XRP below $3.

- SEC Lawsuit Implications: The SEC's classification of XRP as an unregistered security has created significant uncertainty. A negative judgment could severely impact XRP's price and adoption, potentially driving it further below $3.

- Potential Outcomes and Their Impact: A favorable ruling could significantly boost XRP's price, potentially leading to substantial gains for investors. However, an unfavorable outcome could result in a dramatic price drop, potentially causing significant losses.

- Regulatory Uncertainty as a Key Risk Factor: The ongoing legal uncertainty surrounding XRP's regulatory status is a primary risk factor for investors. It's essential to carefully weigh this uncertainty against the potential for returns.

3. Ripple's Technological Advancements and Partnerships

Despite the regulatory challenges, Ripple continues to invest in technological advancements and strategic partnerships within the financial industry. Assessing these factors helps determine the long-term potential of XRP, even if the price remains below $3.

- On-Demand Liquidity (ODL) Adoption: Ripple's ODL solution is gaining traction among financial institutions globally. Its success in facilitating faster and cheaper cross-border payments is a positive factor that could drive future XRP price appreciation.

- Strategic Partnerships and Institutional Adoption: Ripple's collaborations with various banks and payment providers demonstrate a growing adoption of its technology. This increased institutional usage could lead to higher demand for XRP, positively influencing its price over time.

- Technological Innovation and Future Development: Ripple's commitment to continuous technological innovation and improvement of its payment solutions suggests potential for long-term growth and increased investor confidence in XRP.

4. Investment Strategies for XRP Below $3

Investing in XRP when its price is below $3 demands a calculated approach, balancing potential rewards with inherent risks. Consider these strategic approaches:

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a potentially unfavorable price point.

- Thorough Risk Assessment: Before investing in XRP, conduct a thorough risk assessment and ensure it aligns with your overall investment strategy and risk tolerance. Remember, XRP is a high-risk investment.

- Portfolio Diversification: Never invest all your capital in a single asset, especially a high-risk one like XRP. Diversifying across multiple asset classes reduces overall portfolio risk.

Conclusion: Navigating the XRP (Ripple) Market Below $3

Investing in XRP when it trades below $3 presents a complex equation of risk and reward. Understanding the current market dynamics, the ongoing regulatory landscape, and Ripple's ongoing technological advancements is crucial for making informed decisions. A careful risk assessment, the consideration of diversified investment strategies like dollar-cost averaging, and staying informed about news and developments are paramount. Remember to conduct your own thorough due diligence before investing in XRP (Ripple), whether it's below $3 or at any price point. This information is for educational purposes only and should not be considered financial advice.

Featured Posts

-

Leading Cause Of Early Death Doctor Points To A Surprising Culprit Food

May 01, 2025

Leading Cause Of Early Death Doctor Points To A Surprising Culprit Food

May 01, 2025 -

Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 01, 2025

Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 01, 2025 -

France Vs England Six Nations Dalys Late Try Decides Thriller

May 01, 2025

France Vs England Six Nations Dalys Late Try Decides Thriller

May 01, 2025 -

Understanding Pasifika Sipoti April 4th Overview

May 01, 2025

Understanding Pasifika Sipoti April 4th Overview

May 01, 2025 -

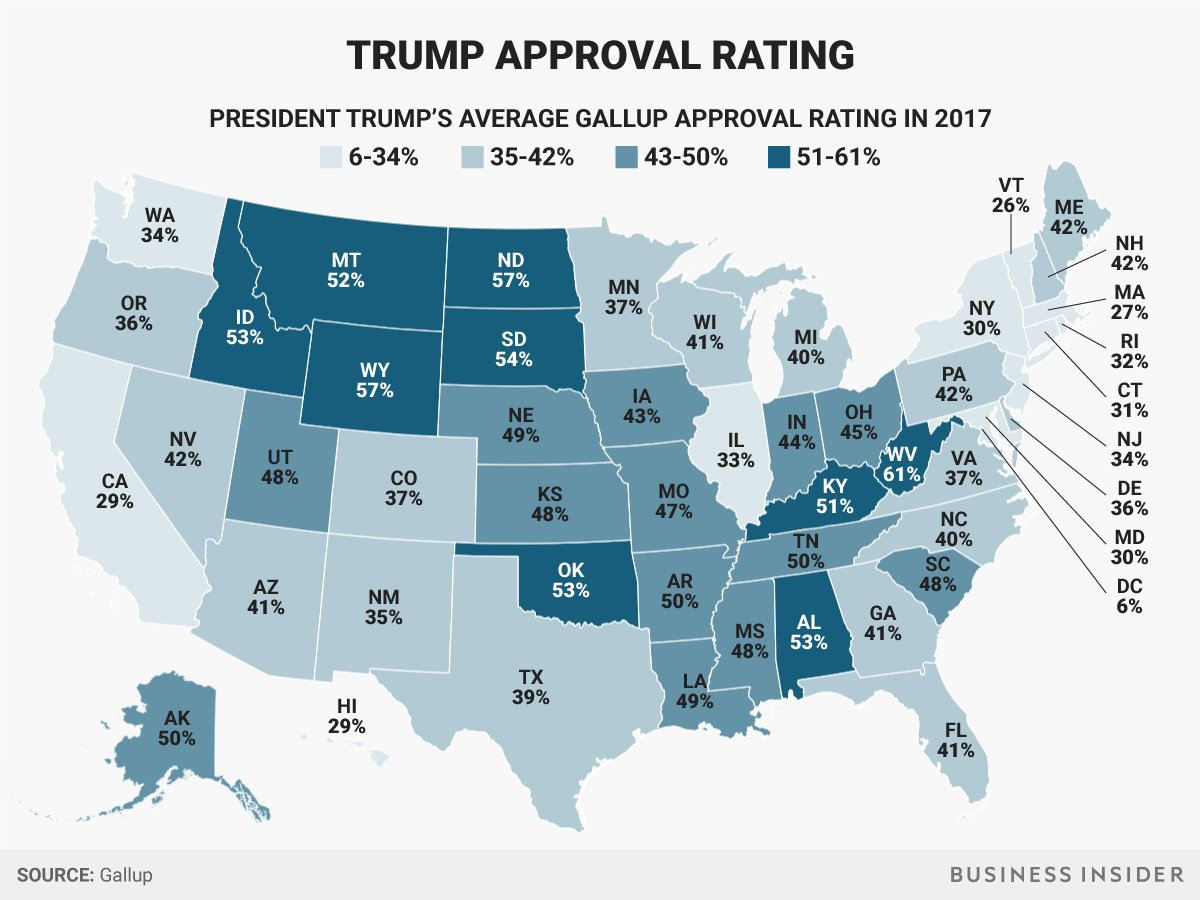

Trump Approval Rating Drops To 39 Analysis Of The First 100 Days

May 01, 2025

Trump Approval Rating Drops To 39 Analysis Of The First 100 Days

May 01, 2025

Latest Posts

-

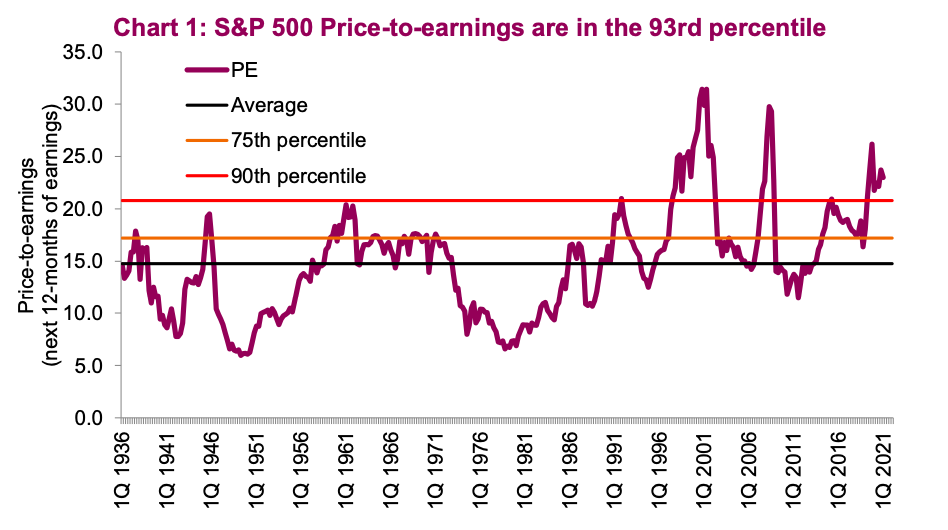

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025 -

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025