XRP Future: Price Prediction Following SEC Case Developments

Table of Contents

The Ripple SEC Lawsuit and its Impact on XRP

The SEC vs. Ripple lawsuit centers around the allegation that Ripple sold XRP as an unregistered security, violating federal securities laws. The core of the SEC's argument hinges on the Howey Test, which determines whether an investment contract constitutes a security. The SEC claims XRP sales met the Howey Test criteria, implying investors purchased XRP with the expectation of profit based on Ripple's efforts.

Summary of the SEC Lawsuit

The SEC's case rests on the assertion that Ripple's distribution and sales of XRP constituted the offering of unregistered securities. They argue that XRP lacked the regulatory clarity of established cryptocurrencies and that Ripple's actions fostered an expectation of profit for investors. Ripple, in its defense, contends that XRP is a decentralized digital asset, not a security, and that its sales did not violate securities laws.

Key Developments and Court Decisions

The case has seen several significant developments, including partial summary judgments on certain aspects of the case. These rulings have had a direct and often volatile impact on the XRP price. The judge's decisions regarding programmatic sales of XRP versus institutional sales have been particularly impactful on market sentiment. Key testimonies from Ripple executives and expert witnesses have further shaped the narrative and influenced investor confidence. The ongoing legal proceedings continue to be a major driver of XRP price fluctuations.

- Summary of key arguments from both sides: The SEC emphasizes Ripple's centralized control over XRP distribution and the expectation of profit for investors. Ripple highlights XRP's decentralized nature and argues against the SEC's interpretation of the Howey Test.

- Timeline of significant events in the case: This includes the initial filing of the lawsuit, key motions filed by both parties, significant court hearings, and any partial rulings or judgments.

- Impact of judge's rulings on market sentiment: Each decision has resulted in immediate market reactions, often reflected in significant price swings.

- Mention any potential settlements or outcomes: The possibility of a settlement or a final judgment significantly impacts price predictions.

Factors Influencing Future XRP Price

Several factors beyond the immediate legal proceedings influence XRP's future price. These include market sentiment, technological advancements, and the evolving regulatory landscape.

Market Sentiment and Investor Confidence

The outcome of the Ripple SEC case significantly influences investor confidence. A favorable ruling could lead to a surge in market capitalization and trading volume, boosting XRP's price. Conversely, an unfavorable outcome could trigger further price declines and reduced investor interest. General crypto market trends also play a significant role.

Technological Advancements and Ripple's Activities

Ripple's ongoing development and adoption of XRP within its payment solutions (like ODL, xRapid, and RippleNet) are crucial. Wider adoption by financial institutions and increased transaction volume using XRP could positively influence its price. Ripple's strategic partnerships also play a vital role in driving market adoption and thereby influencing price.

Regulatory Landscape and Global Adoption

Global regulatory clarity regarding cryptocurrencies, including XRP, is essential for future growth. Favorable regulatory developments in key jurisdictions could boost investor confidence and drive institutional adoption. Conversely, stricter regulations could stifle growth and limit XRP's potential.

- Impact of positive and negative news on XRP price: News related to the lawsuit, partnerships, or regulatory changes directly influences price volatility.

- Ripple's strategic partnerships and their influence: Partnerships with banks and financial institutions signal increased adoption and potential for growth.

- Regulatory developments in various jurisdictions: Clearer regulatory frameworks in major markets will impact XRP's accessibility and appeal.

- Potential for institutional adoption of XRP: Increased institutional interest could lead to substantial price increases.

XRP Price Prediction Scenarios

Predicting the future price of XRP involves significant uncertainty, given the ongoing legal battles and the volatility of the cryptocurrency market. We can, however, outline potential scenarios based on different outcomes.

Bullish Scenario

A favorable court ruling dismissing the SEC's claims, coupled with increased institutional adoption and broader regulatory clarity, could lead to a significant surge in XRP's price. This bullish scenario anticipates a price increase to levels significantly exceeding its previous all-time high. Factors supporting this include widespread adoption of Ripple's technology and strong market sentiment.

Bearish Scenario

An unfavorable ruling against Ripple could result in a further decline in XRP's price. Decreased investor confidence and potential delisting from exchanges would contribute to this bearish outlook. This scenario forecasts a sustained period of low price and limited growth potential.

Neutral Scenario

A protracted legal battle with an unclear outcome or a compromise settlement could result in a relatively stable price range with moderate fluctuations. This scenario acknowledges continued uncertainty and assumes limited price movement either upwards or downwards.

- Price targets for each scenario: These targets are estimates only and should be treated with caution.

- Factors contributing to each scenario: Clearly defined factors are presented for each scenario, such as court decisions, regulatory changes, market sentiment, and adoption levels.

- Timeframes for achieving predicted prices: The timeframes for reaching the predicted prices are estimates and depend on market dynamics.

- Disclaimer regarding the speculative nature of price predictions: It is crucial to understand that cryptocurrency price predictions are inherently speculative and should not be taken as financial advice.

Conclusion

The future price of XRP is intricately linked to the outcome of the Ripple SEC lawsuit, market sentiment, technological advancements, and the evolving regulatory landscape. While predicting the precise future of XRP is challenging, understanding the interplay of these factors is crucial for informed investment decisions. Stay updated on the latest developments in the Ripple SEC case and continue researching XRP price prediction analyses to make your own informed decisions about this volatile cryptocurrency. Conduct thorough due diligence before investing in XRP or any other cryptocurrency. Remember that XRP price prediction is a complex area with many variables, and any investment should be carefully considered.

Featured Posts

-

Geweldsincident Van Mesdagkliniek Groningen Malek F In Beschuldiging

May 01, 2025

Geweldsincident Van Mesdagkliniek Groningen Malek F In Beschuldiging

May 01, 2025 -

Dragons Den Success Strategies For Pitching Your Business

May 01, 2025

Dragons Den Success Strategies For Pitching Your Business

May 01, 2025 -

Open Ais Chat Gpt Revolutionizing Online Shopping And Competing With Google

May 01, 2025

Open Ais Chat Gpt Revolutionizing Online Shopping And Competing With Google

May 01, 2025 -

Tongas U 19 Womens Team Secures 2025 Ofc Championship Spot

May 01, 2025

Tongas U 19 Womens Team Secures 2025 Ofc Championship Spot

May 01, 2025 -

Kort Geding Kampen Vs Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025

Latest Posts

-

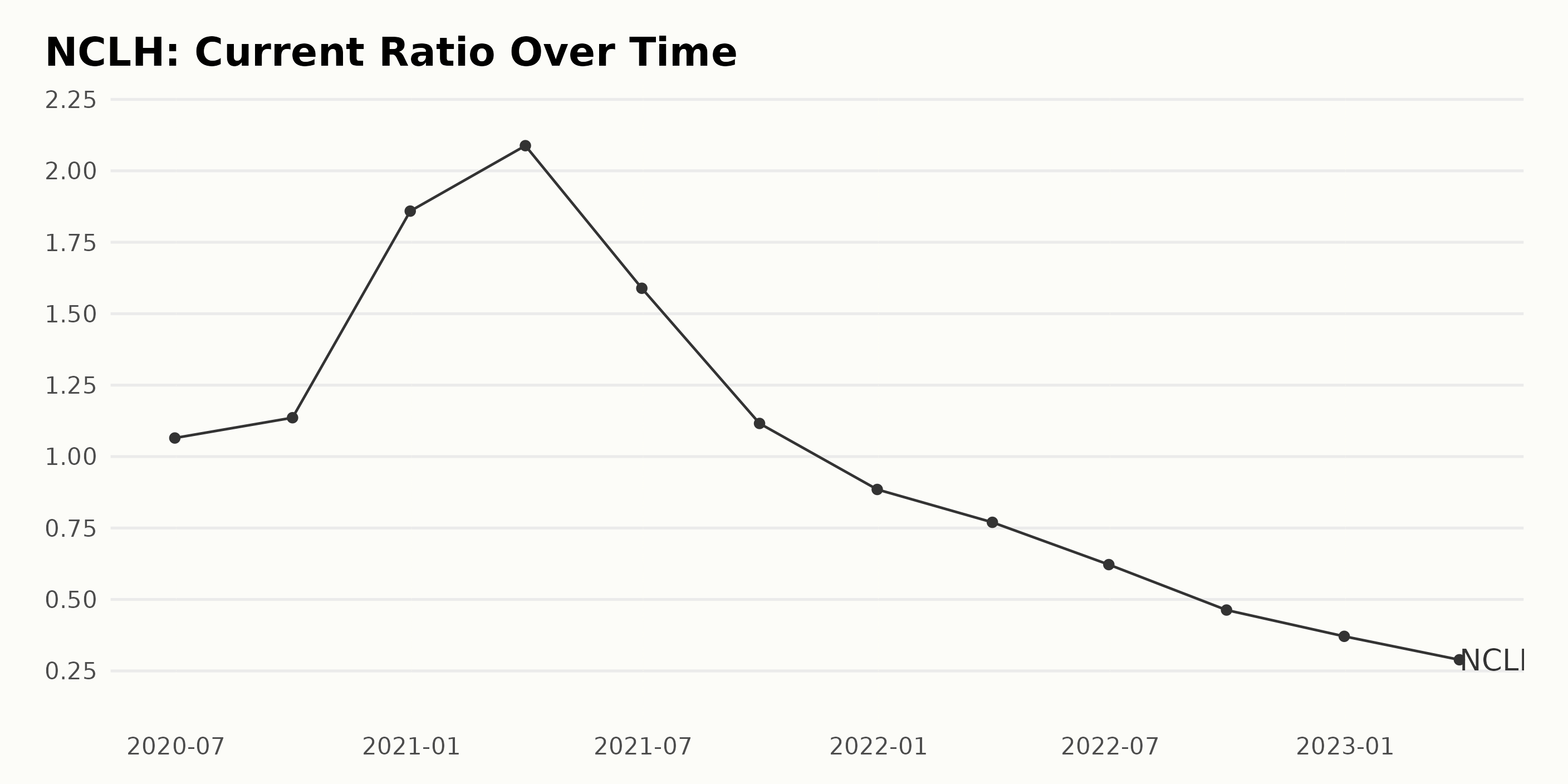

Norwegian Cruise Line Nclh A Hedge Fund Perspective On Investment

May 01, 2025

Norwegian Cruise Line Nclh A Hedge Fund Perspective On Investment

May 01, 2025 -

Southern Caribbean Cruises 2025 New Ships And Exciting Destinations

May 01, 2025

Southern Caribbean Cruises 2025 New Ships And Exciting Destinations

May 01, 2025 -

Are Hedge Funds Betting On Norwegian Cruise Line Nclh

May 01, 2025

Are Hedge Funds Betting On Norwegian Cruise Line Nclh

May 01, 2025 -

Cruising The South In 2025 The Ultimate Guide To New Itineraries

May 01, 2025

Cruising The South In 2025 The Ultimate Guide To New Itineraries

May 01, 2025 -

Choosing The Best Family Cruise Line 5 Top Picks

May 01, 2025

Choosing The Best Family Cruise Line 5 Top Picks

May 01, 2025