Norwegian Cruise Line (NCLH): A Hedge Fund Perspective On Investment

Table of Contents

NCLH's Financial Performance and Valuation

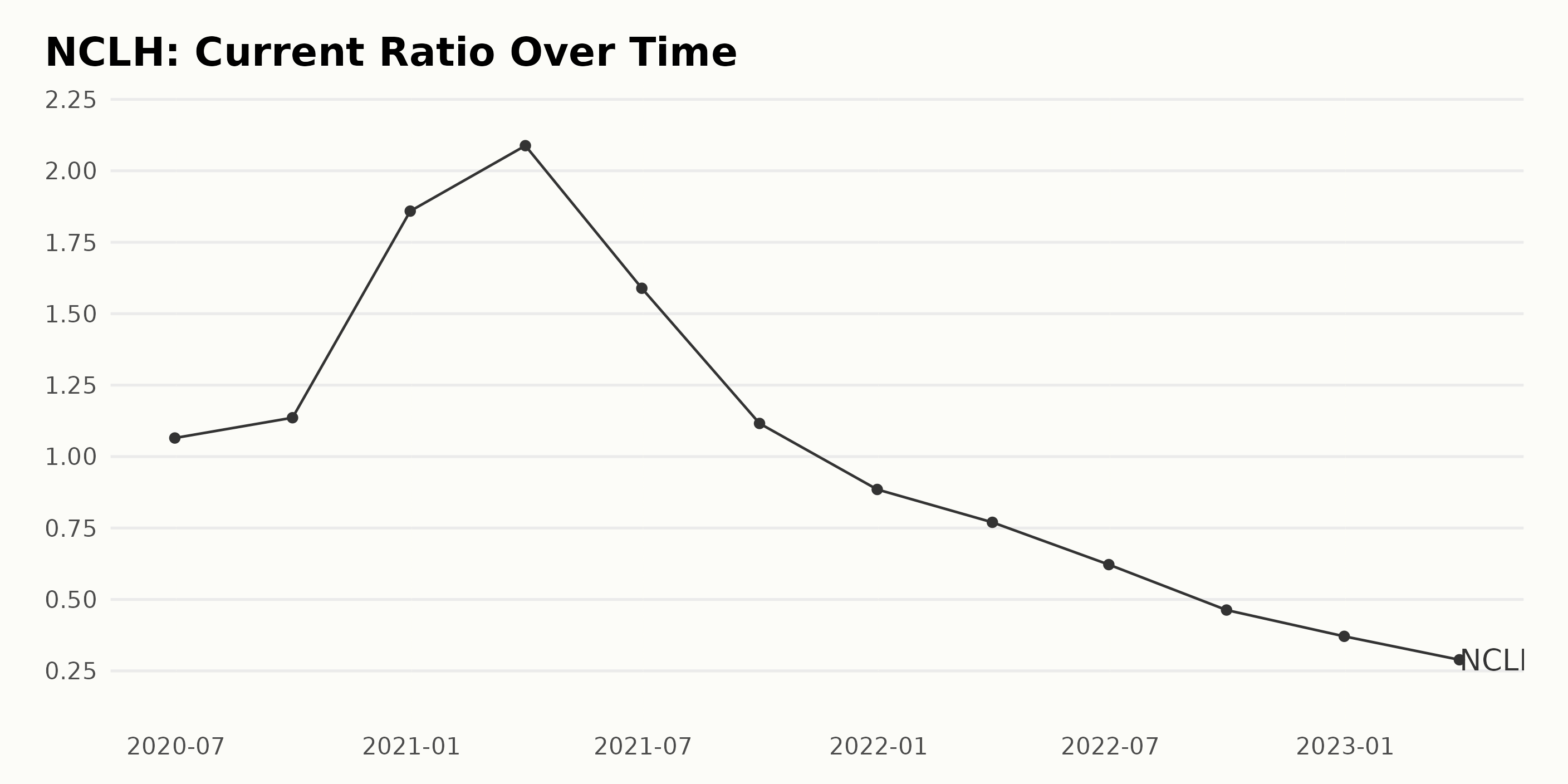

Analyzing NCLH's financial performance is crucial for any potential investor. Recent financial statements reveal key insights into the company's revenue generation, profitability, and debt levels. Comparing NCLH's valuation metrics – such as its Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio – to its competitors, like Carnival and Royal Caribbean, and to its historical averages, provides a crucial benchmark.

- Key Financial Ratios and Implications: Analyzing key ratios like the debt-to-equity ratio, return on equity (ROE), and operating margin helps gauge NCLH's financial health and its ability to generate profits. A high debt-to-equity ratio, for example, could indicate higher financial risk.

- Industry Benchmarks: Comparing NCLH's performance to Carnival and Royal Caribbean provides context. Analyzing revenue growth, profit margins, and operational efficiency relative to these competitors helps determine NCLH's competitive positioning within the cruise line investment landscape.

- Debt Burden and Future Profitability: NCLH's level of debt significantly impacts its future profitability. High debt can restrict the company's flexibility in investing in new ships or marketing initiatives. Analyzing the company's ability to service its debt is crucial.

- Free Cash Flow Generation: A strong free cash flow is a positive indicator, suggesting the company can generate cash after covering its operating expenses and capital expenditures. This is a crucial factor for long-term NCLH stock valuation.

Market Factors Affecting NCLH Stock

Numerous market factors significantly influence NCLH stock performance and the overall cruise line investment sector. Understanding these factors is essential for a successful NCLH hedge fund strategy.

- Macroeconomic Factors: Fuel prices directly impact operating costs, while global economic growth and inflation affect consumer spending and travel patterns. Recessions often lead to decreased cruise bookings.

- Consumer Behavior and Travel Trends: Changing consumer preferences and travel trends influence booking rates. The rise of alternative vacation options, for instance, poses a competitive challenge.

- Geopolitical Events: Global instability, political unrest, or health crises (like pandemics) can severely disrupt travel and negatively impact NCLH’s revenue.

- Seasonality: The cruise industry is highly seasonal, with peak demand during specific periods of the year. Understanding this seasonality is crucial for accurately predicting NCLH's performance.

- Competitive Landscape: NCLH competes with other major cruise lines, such as Carnival and Royal Caribbean. Its market share and competitive advantages directly influence its profitability and stock price.

- Technological Advancements: Technological disruption, such as the rise of online booking platforms and the increasing importance of digital marketing, presents both opportunities and challenges for NCLH.

NCLH's Growth Strategy and Competitive Advantages

NCLH’s growth strategy involves several key initiatives aimed at increasing revenue and market share. Understanding these strategies and NCLH’s competitive advantages is essential for evaluating its long-term potential as a cruise line investment.

- Fleet Modernization: Investing in new ships enhances capacity and improves the overall customer experience, potentially leading to higher occupancy rates and revenue.

- Market Expansion: Expanding into new markets and targeting different demographics through strategic marketing campaigns can drive revenue growth.

- Brand Differentiation: NCLH’s unique brand identity and innovative onboard experiences aim to attract and retain customers. The success of these differentiation strategies is critical for its long-term success.

- Loyalty Programs: Robust loyalty programs can enhance customer retention and drive repeat business, contributing positively to long-term profitability.

- Pricing Strategies: Effective pricing strategies, balancing revenue optimization with competitive pricing, are vital for maintaining market share.

- Innovation in the Cruise Experience: Continuous innovation in onboard amenities and entertainment offerings helps attract new customers and differentiate NCLH from its competitors.

Risks Associated with Investing in NCLH

Investing in NCLH stock involves significant risks. A thorough understanding of these risks is paramount for any potential investor considering an NCLH hedge fund strategy or other NCLH investment options.

- Economic Downturns: Economic recessions can significantly reduce consumer spending on discretionary items like cruises, leading to lower demand and potentially impacting NCLH's revenue.

- Geopolitical Instability: Global events can disrupt travel patterns and negatively affect NCLH's operations.

- Health Crises: Pandemics or other health crises can significantly impact demand for cruises, causing severe revenue declines and operational disruptions.

- Operational Risks: Accidents, mechanical failures, or other operational disruptions can lead to significant financial losses.

- Environmental Regulations: Increasingly stringent environmental regulations can impose significant costs on cruise lines, affecting profitability.

- High Debt Levels: High levels of debt can make NCLH vulnerable to economic downturns and limit its financial flexibility.

Conclusion

Investing in NCLH stock presents both significant opportunities and considerable risks. The cruise industry's inherent volatility necessitates careful consideration of financial performance, market factors, growth strategies, and potential downside scenarios. While NCLH’s growth initiatives and innovative offerings present attractive prospects, investors must carefully assess the risks associated with macroeconomic conditions, geopolitical uncertainty, and health crises. This analysis offers a starting point for further research and due diligence. Before making any investment decisions regarding NCLH stock, always conduct thorough research and consider seeking professional financial advice. Remember to carefully consider your own risk tolerance before investing in NCLH stock or other cruise line investments.

Featured Posts

-

The Target Dei Controversy A Case Study In Brand Reputation And Consumer Response

May 01, 2025

The Target Dei Controversy A Case Study In Brand Reputation And Consumer Response

May 01, 2025 -

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025 -

Kycklingnuggets Med Majsflingor Krispiga And Goda Med Asiatisk Kalsallad

May 01, 2025

Kycklingnuggets Med Majsflingor Krispiga And Goda Med Asiatisk Kalsallad

May 01, 2025 -

L Accompagnement Numerique Un Atout Pour Vos Thes Dansants

May 01, 2025

L Accompagnement Numerique Un Atout Pour Vos Thes Dansants

May 01, 2025 -

Ireland On Notice Frances Convincing Six Nations Victory

May 01, 2025

Ireland On Notice Frances Convincing Six Nations Victory

May 01, 2025

Latest Posts

-

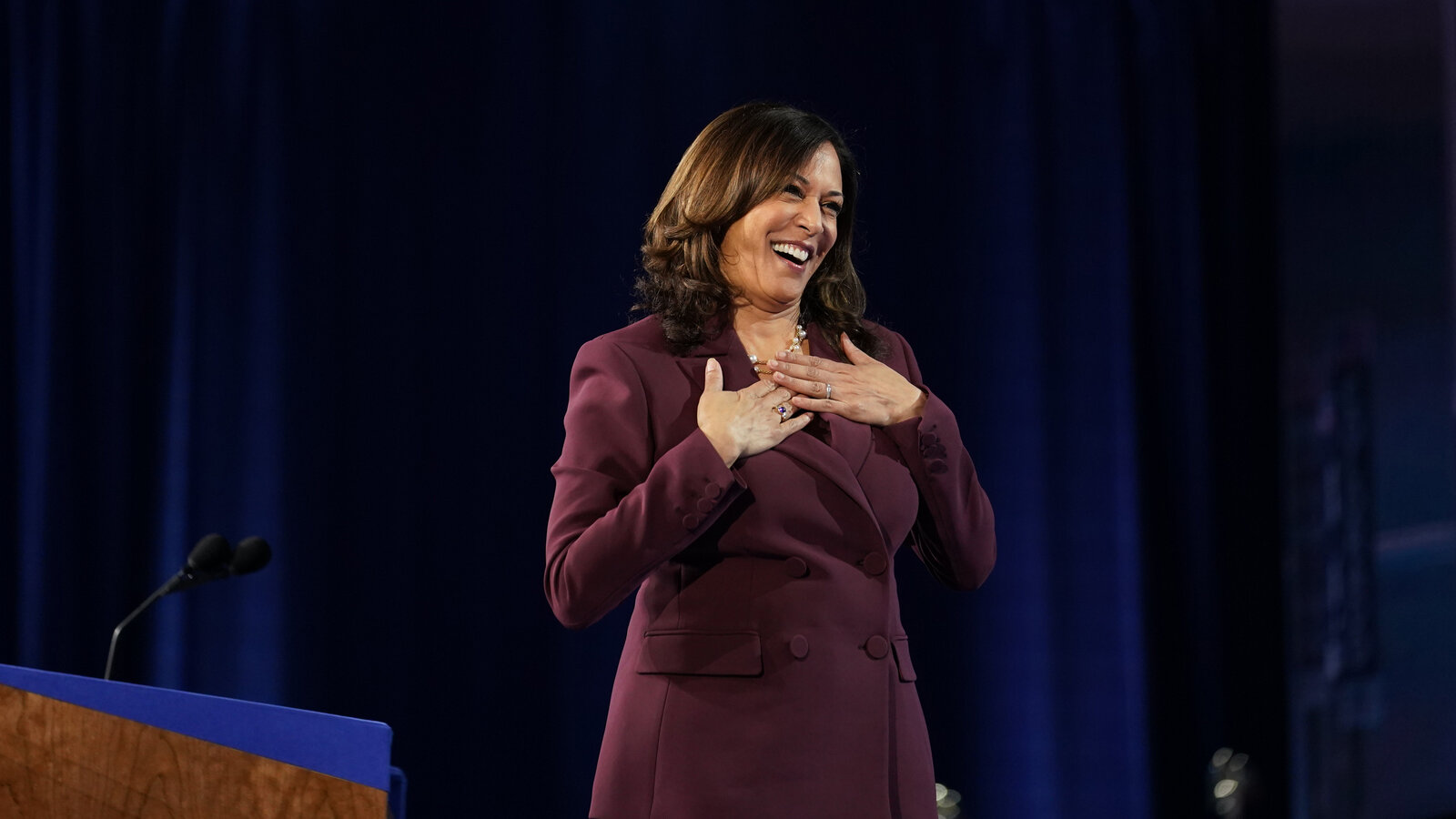

Kamala Harris Today A Look At Her Recent Activities And Impact

May 01, 2025

Kamala Harris Today A Look At Her Recent Activities And Impact

May 01, 2025 -

Lars Klingbeil Awarded Order Against Animal Cruelty

May 01, 2025

Lars Klingbeil Awarded Order Against Animal Cruelty

May 01, 2025 -

Kamala Harriss Evolving Role

May 01, 2025

Kamala Harriss Evolving Role

May 01, 2025 -

Kamala Harris A New Chapter

May 01, 2025

Kamala Harris A New Chapter

May 01, 2025 -

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025