Are Hedge Funds Betting On Norwegian Cruise Line (NCLH)?

Table of Contents

Analyzing Hedge Fund Holdings in NCLH

Understanding whether hedge funds are investing in NCLH requires a deep dive into publicly available data. This is where SEC filings and 13F reports become crucial.

SEC Filings and 13F Reports

13F filings are quarterly reports submitted by institutional investment managers with over $100 million in assets under management. These reports disclose their equity holdings, providing a glimpse into their investment strategies. While invaluable, interpreting this data presents challenges.

- Finding NCLH Holdings: Access SEC filings through the EDGAR database (). Search for NCLH (Norwegian Cruise Line Holdings Ltd.) and look for 13F filings from various institutional investors.

- Interpreting the Data: Remember that 13F reports have a lag time. The data reflects holdings at the end of a specific quarter, not necessarily the current holdings. Furthermore, reporting may not always be perfectly accurate or completely up-to-date.

Identifying Key Hedge Fund Investors

Pinpointing specific hedge funds significantly invested in NCLH requires meticulous research. Unfortunately, the full picture often remains obscured due to privacy concerns and the complex nature of hedge fund portfolios. However, by monitoring financial news outlets and press releases, we can sometimes identify major players in the travel and leisure sectors who may hold significant stakes in NCLH.

- Identifying Funds: Keep an eye on financial news sources for reports mentioning significant NCLH investments by specific hedge funds.

- Investment Strategies: Determine whether their strategy is long (betting on price increases) or short (betting on price decreases). This helps understand their overall outlook on NCLH.

- Stake Size: Estimating the size of a hedge fund's stake in NCLH, if reported, provides valuable context for understanding their level of commitment.

Assessing the Rationale Behind Hedge Fund Investments/Bets

Hedge funds aren't driven by emotion; their investment decisions are based on rigorous analysis. Let's examine the factors likely influencing their NCLH positions.

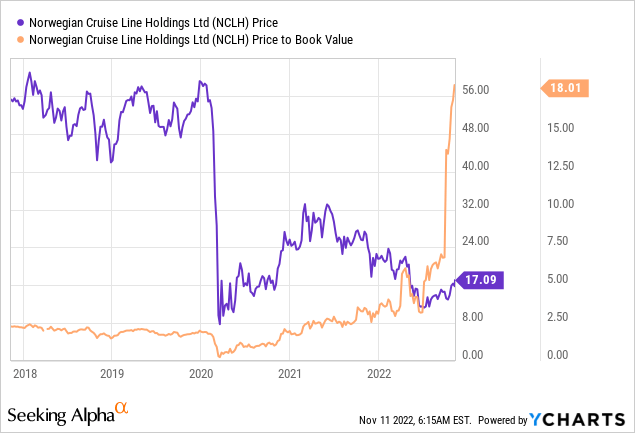

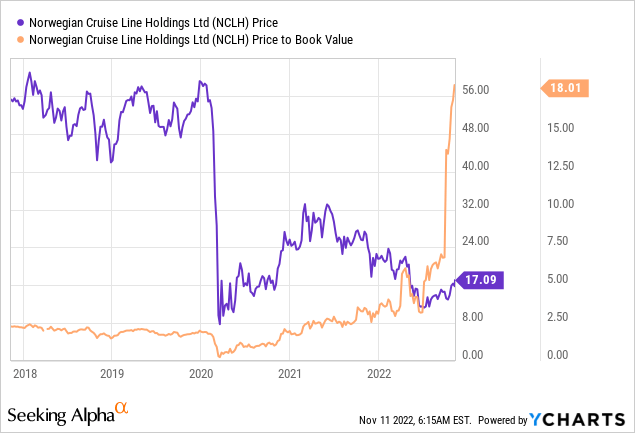

NCLH's Financial Performance and Future Outlook

NCLH's recent financial performance is paramount. Analyzing key metrics provides insights into its financial health and future prospects.

- Key Financial Metrics: Examine revenue growth, earnings per share (EPS), debt-to-equity ratios, and free cash flow. Compare these to industry averages and historical performance.

- Booking Trends: Monitor cruise bookings to gauge consumer demand and the company's ability to fill its ships. Strong booking trends signal a positive outlook.

- Debt Reduction Strategies: NCLH's ability to manage and reduce its debt load will also influence investor sentiment.

Market Sentiment and Industry Trends

The overall market sentiment toward the cruise industry and the broader travel sector significantly impacts investment decisions.

- Industry Forecasts: Consult market research reports and analyst predictions to gauge future growth potential. Consider factors like fuel prices, geopolitical stability, and the potential for new travel restrictions.

- Expert Opinions: Follow reputable financial analysts and industry experts for their insights and outlook on the cruise industry's recovery and NCLH's competitive position.

- Consumer Confidence: Rising consumer confidence and increased discretionary spending are vital for the success of cruise lines like NCLH.

Alternative Investment Strategies

Hedge funds employ diverse strategies beyond simply buying and holding stock.

- Options Trading: They might use options to hedge risk or speculate on price movements.

- Mergers and Acquisitions: Rumors of potential mergers or acquisitions involving NCLH can also drive hedge fund activity.

Conclusion: The Verdict – Is NCLH a Hedge Fund Favorite?

Determining whether hedge funds favor NCLH requires considering multiple factors. While definitive conclusions are difficult without access to their complete portfolios, analyzing publicly available data, including SEC filings, financial performance, and industry trends, allows for a reasonable assessment. Based on the available information, the level of hedge fund interest in NCLH appears [insert your assessment here – e.g., moderate, with a mix of long and short positions reflecting the inherent volatility of the cruise industry]. However, it's vital to remember that this is a snapshot in time, and the situation can change rapidly.

Conducting thorough due diligence before investing in NCLH or any other stock is crucial. Further research into Norwegian Cruise Line’s financial statements, competitive landscape, and industry-specific news will provide a more comprehensive understanding. Consider exploring additional resources on hedge fund investment strategies and NCLH stock analysis to make informed investment decisions. Remember to always diversify your portfolio and consult a financial advisor for personalized guidance.

Featured Posts

-

Cavaliers Secure 50th Win Hunters 32 Points Key In Overtime Triumph

May 01, 2025

Cavaliers Secure 50th Win Hunters 32 Points Key In Overtime Triumph

May 01, 2025 -

Priscilla Pointer Actress Dies At 100

May 01, 2025

Priscilla Pointer Actress Dies At 100

May 01, 2025 -

How To Prepare A Winning Pitch For Dragons Den

May 01, 2025

How To Prepare A Winning Pitch For Dragons Den

May 01, 2025 -

Spds Coalition Push Germany Awaits Party Vote On Agreement

May 01, 2025

Spds Coalition Push Germany Awaits Party Vote On Agreement

May 01, 2025 -

Understanding The Dragons Den Investment Process

May 01, 2025

Understanding The Dragons Den Investment Process

May 01, 2025

Latest Posts

-

Spd Proposes Lars Klingbeil As Vice Chancellor And Finance Minister

May 01, 2025

Spd Proposes Lars Klingbeil As Vice Chancellor And Finance Minister

May 01, 2025 -

Germanys Next Finance Minister Spd Nominates Lars Klingbeil

May 01, 2025

Germanys Next Finance Minister Spd Nominates Lars Klingbeil

May 01, 2025 -

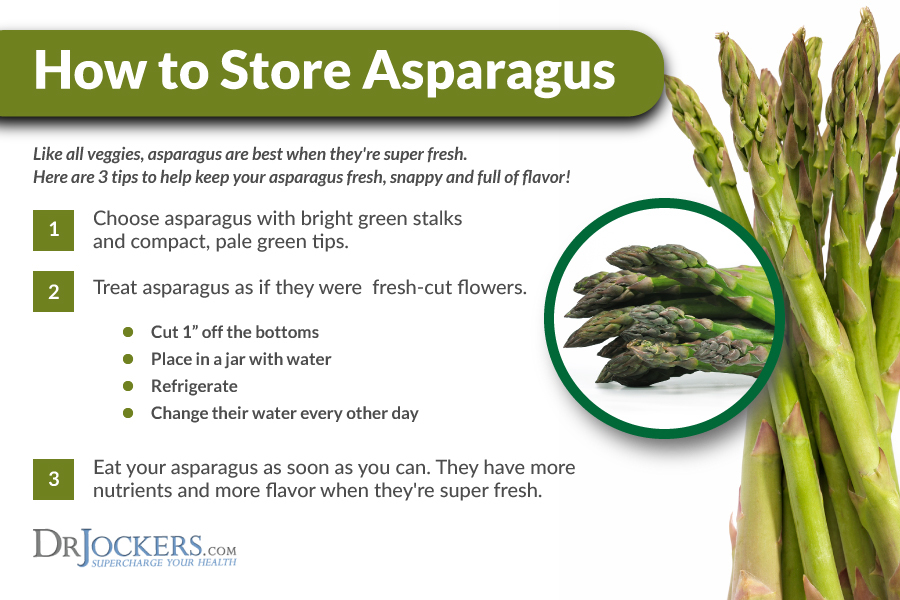

Understanding The Health Impacts Of Asparagus Consumption

May 01, 2025

Understanding The Health Impacts Of Asparagus Consumption

May 01, 2025 -

The Ultimate Guide To Asparagus And Its Health Benefits

May 01, 2025

The Ultimate Guide To Asparagus And Its Health Benefits

May 01, 2025 -

Lars Klingbeil Germanys Potential Vice Chancellor And Finance Minister

May 01, 2025

Lars Klingbeil Germanys Potential Vice Chancellor And Finance Minister

May 01, 2025