XRP ETF Approval: Analyzing The Potential For Immediate $800 Million Inflows

Table of Contents

The $800 Million Prediction: A Deep Dive

The $800 million figure isn't plucked from thin air. Several reputable sources and analyses contribute to this prediction, painting a picture of significant institutional interest in XRP. These projections are based on a combination of factors, including existing XRP holdings, anticipated demand from institutional investors, and the inherent appeal of an ETF structure.

- Specific Investment Firms and Predicted Inflows: While precise figures from individual firms remain largely undisclosed due to market sensitivity and competitive reasons, analysts at firms such as Grayscale Investments (although not specifically stating this amount for XRP) have historically shown significant interest in the digital asset space, suggesting a potential for substantial investment if an XRP ETF is approved. This is further supported by reports from other financial institutions predicting large-scale crypto ETF investments overall.

- Underlying Market Demand: The demand stems from the increasing acceptance of XRP as a viable digital asset for cross-border payments. Its speed and relatively low transaction costs make it attractive for institutional investors seeking efficient and cost-effective solutions.

- Impact of Institutional Investors: The entry of institutional investors is arguably the most significant factor contributing to the projected inflows. These entities, with their substantial capital, can significantly impact market liquidity and price discovery. Their participation in an XRP ETF would signal a significant shift in market perception and confidence.

- Existing XRP Holdings: Many institutional investors already hold XRP, and an ETF would provide a more streamlined and regulated way to manage and potentially increase their holdings. This conversion of existing holdings into ETF shares would contribute to the initial surge of capital.

Factors Contributing to Potential XRP ETF Inflows

Several factors are driving the anticipation of substantial inflows should an XRP ETF receive approval.

-

Increased Institutional Interest in Cryptocurrencies: The cryptocurrency market is maturing, attracting increased scrutiny and investment from institutional players. Hedge funds, pension funds, and other large financial institutions are increasingly seeking exposure to the crypto market through regulated products such as ETFs.

-

Advantages of ETFs for Institutional Investors: ETFs offer several advantages over direct cryptocurrency investment, including regulatory compliance, simplified portfolio management, and ease of access. This makes them attractive to institutions with strict regulatory requirements.

-

Further Considerations:

- Comparison to Other Crypto ETF Investments: The success of other crypto ETFs, like those tracking Bitcoin or Ethereum, demonstrates the potential market appetite for such instruments and provides a benchmark for projecting XRP ETF inflows. However, each asset has its own unique market dynamics.

- Regulatory Approvals in Other Jurisdictions: Positive regulatory developments in other countries regarding crypto ETFs could further boost investor confidence and attract more capital to an XRP ETF.

- Regulatory Uncertainty and its Impact: Regulatory uncertainty remains a significant risk. Any further delays or negative rulings from regulatory bodies could dampen investor enthusiasm and reduce the predicted inflows.

- SEC Approval and Investor Confidence: The SEC's potential approval would significantly boost investor confidence, attracting both new and existing investors to participate in the XRP ETF. This signals a level of legitimacy and reduces the perceived risk associated with direct cryptocurrency investments.

The Ripple Effect on XRP Price and Market Cap

A massive influx of capital into an XRP ETF would likely cause significant price volatility.

-

Potential Price Scenarios:

- Best-Case Scenario: A rapid and sustained price increase, potentially exceeding current market predictions.

- Worst-Case Scenario: A short-lived price surge followed by a sharp correction due to profit-taking or unforeseen market events.

- Most Likely Scenario: A significant price increase followed by a period of consolidation, with the final price depending on various market forces.

-

Impact on Market Capitalization and Ranking: A substantial price increase would lead to a corresponding increase in XRP's market capitalization, potentially boosting its ranking among cryptocurrencies.

-

Potential for Price Correction: After any initial surge, a price correction is likely as investors take profits. The magnitude of this correction would depend on several factors, including market sentiment and the overall crypto market conditions.

Risks and Challenges Associated with XRP ETF Approval

Despite the potential for significant growth, several risks and challenges could impact the success of an XRP ETF.

-

Ongoing Legal Battles: The ongoing SEC lawsuit against Ripple Labs represents a major uncertainty. A negative outcome could significantly impact XRP's price and hinder ETF adoption.

-

Regulatory Hurdles and Delays: Regulatory approval processes can be lengthy and unpredictable, leading to potential delays or even rejection of the ETF application.

-

Other potential problems:

- Market Manipulation: The possibility of market manipulation around the launch of the ETF cannot be ruled out.

- Investor Disappointment: If the predicted inflows fail to materialize, or if the price increase is less than anticipated, investors might experience disappointment, leading to potential sell-offs.

Conclusion

The potential approval of an XRP ETF represents a significant turning point for XRP and the broader cryptocurrency market. The predicted $800 million in immediate inflows highlights the substantial interest from institutional investors and the potential for exponential growth. While challenges and risks remain, including the ongoing legal battles surrounding Ripple, the potential rewards could be substantial. Understanding the factors driving this prediction, along with the associated risks, is crucial for navigating the evolving landscape of XRP and making informed investment decisions. Stay informed about the latest developments surrounding XRP ETF approval and its potential impact on the cryptocurrency market. Further research into XRP investments and crypto ETF trends is highly recommended.

Featured Posts

-

Cavs Rookies Car Filled With Popcorn Donovan Mitchells Hilarious Prediction

May 07, 2025

Cavs Rookies Car Filled With Popcorn Donovan Mitchells Hilarious Prediction

May 07, 2025 -

Powells Dilemma The High Stakes Gamble Of Delayed Interest Rate Cuts

May 07, 2025

Powells Dilemma The High Stakes Gamble Of Delayed Interest Rate Cuts

May 07, 2025 -

Official Lotto Results Saturday Draw April 12th

May 07, 2025

Official Lotto Results Saturday Draw April 12th

May 07, 2025 -

Trg Svetega Petra Papezev Blagoslov Urbi Et Orbi In Mnozicni Pozdrav

May 07, 2025

Trg Svetega Petra Papezev Blagoslov Urbi Et Orbi In Mnozicni Pozdrav

May 07, 2025 -

Could Xrp Reach 5 By 2025 A Realistic Analysis

May 07, 2025

Could Xrp Reach 5 By 2025 A Realistic Analysis

May 07, 2025

Latest Posts

-

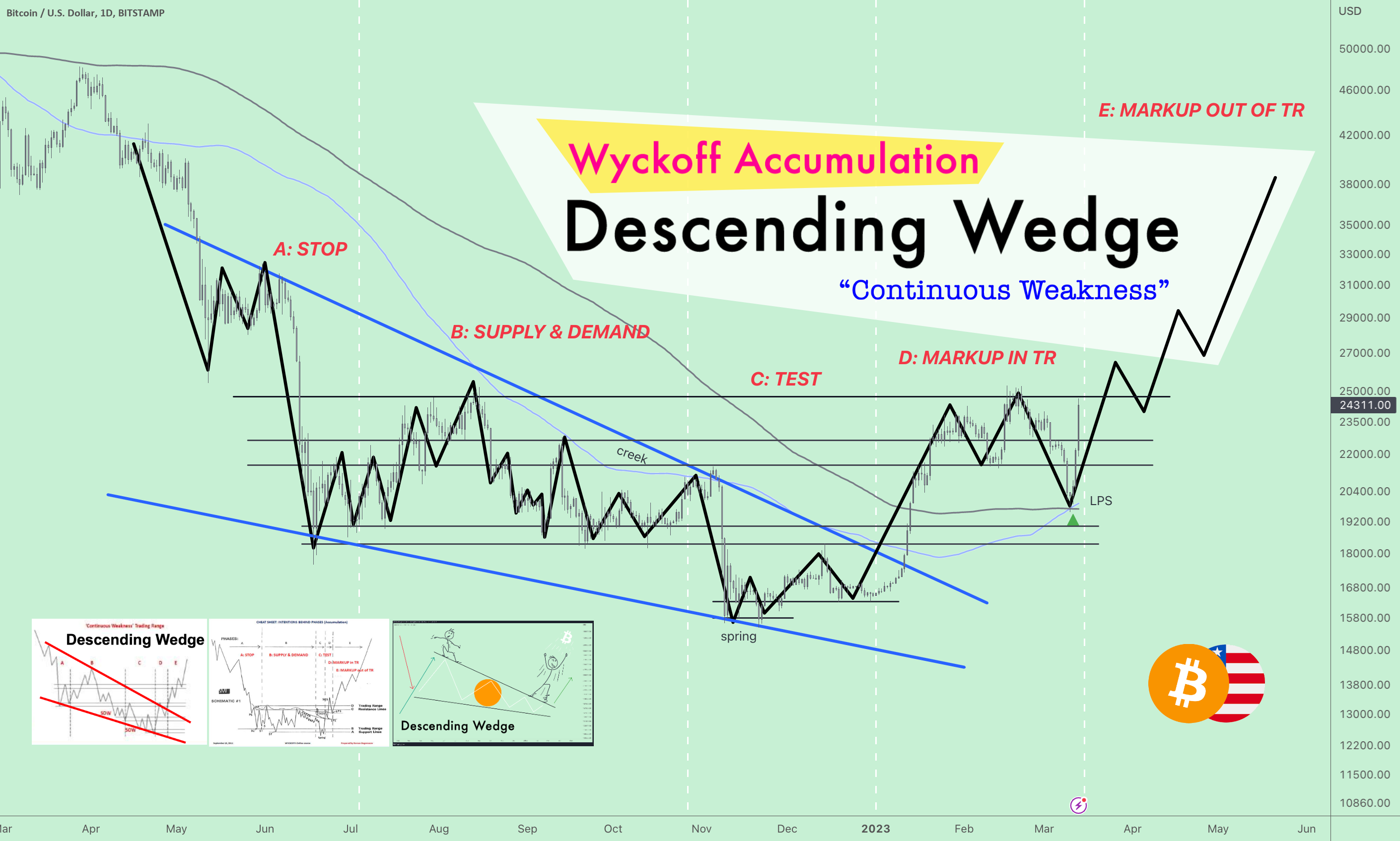

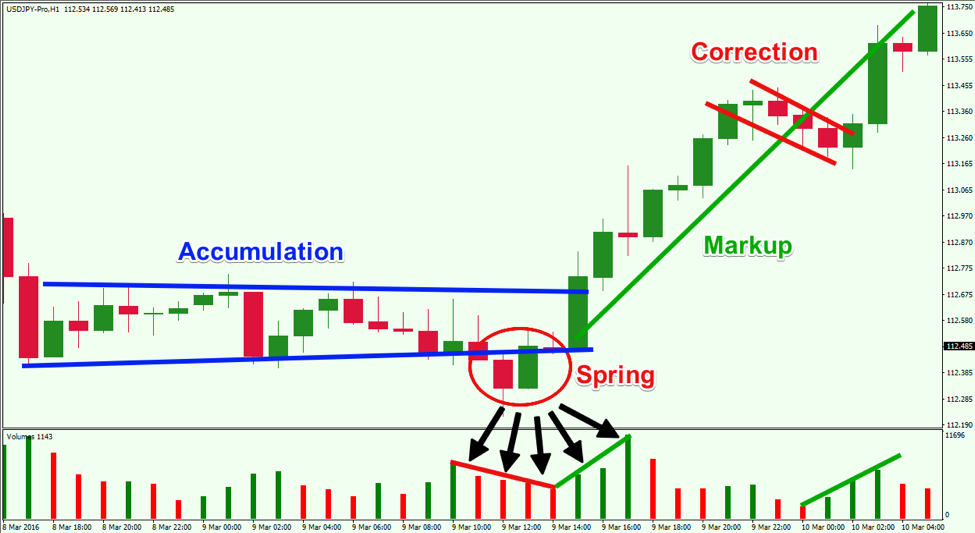

Ethereums Potential 2 700 Surge A Wyckoff Accumulation Perspective

May 08, 2025

Ethereums Potential 2 700 Surge A Wyckoff Accumulation Perspective

May 08, 2025 -

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025 -

Ethereum Price Targets 2 700 Wyckoff Accumulation Analysis

May 08, 2025

Ethereum Price Targets 2 700 Wyckoff Accumulation Analysis

May 08, 2025 -

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025 -

Trump Medias Partnership With Crypto Com A Game Changer For Etfs

May 08, 2025

Trump Medias Partnership With Crypto Com A Game Changer For Etfs

May 08, 2025