Ethereum Price Targets $2,700: Wyckoff Accumulation Analysis

Table of Contents

The cryptocurrency market is constantly fluctuating, but some analysts believe Ethereum (ETH) is showing strong signs of accumulation, potentially leading to a price target of $2700. This article delves into a Wyckoff accumulation analysis, examining key indicators and predicting future price movements for ETH. We'll explore the technical aspects supporting this bullish projection and consider the potential risks involved.

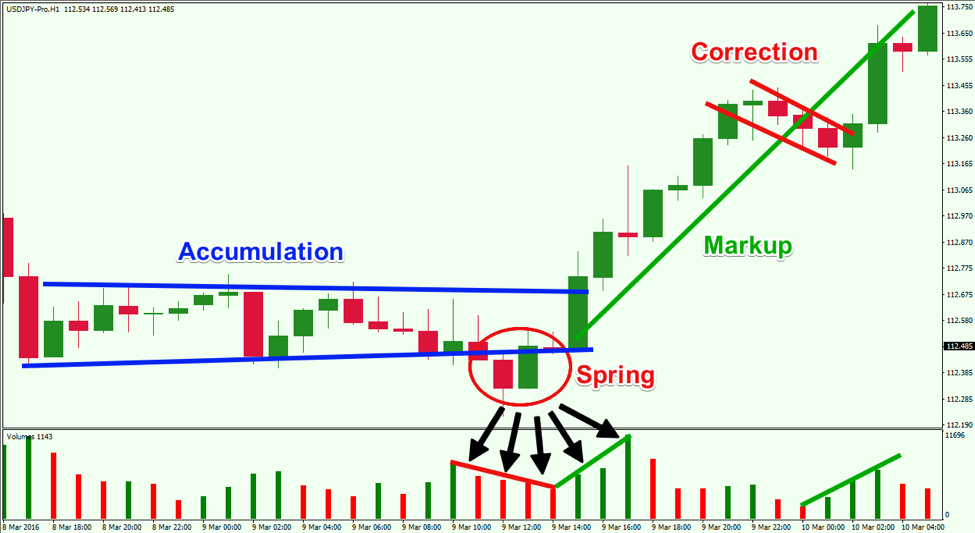

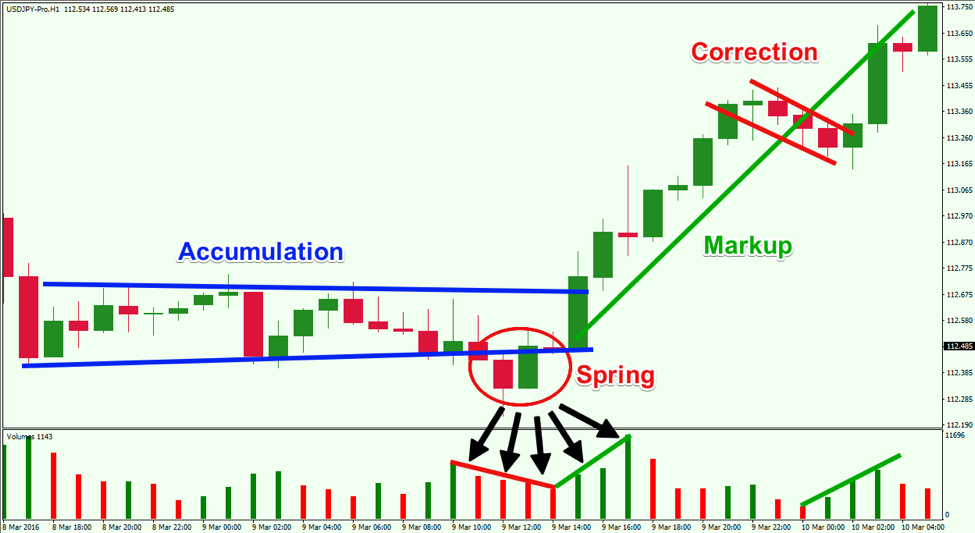

Understanding Wyckoff Accumulation

The Wyckoff method is a technical analysis framework that identifies market manipulation and accumulation phases to predict significant price movements. It focuses on understanding the behavior of large market participants (whales) and how they accumulate assets before a significant price increase. The core principle is that large players don't buy an asset all at once; instead, they gradually accumulate it over time, often through a series of carefully orchestrated price actions.

Key phases of Wyckoff accumulation include:

-

PSY (Preliminary Supply): This phase shows the initial distribution of the asset at higher prices. In the context of ETH, we may have seen this in the previous price declines. The volume during this phase is crucial to watch.

-

SOS (Sign of Weakness): This marks a period of declining prices and volume, indicating weakening selling pressure. This is often a crucial entry point for large buyers. For ETH, identifying a clear SOS is vital for validating the accumulation theory.

-

Test: This phase involves a retest of support levels to confirm the strength of the buyer's commitment. A successful test involves buying pressure overpowering selling pressure. This test phase can be seen as a confirmation of the accumulation phase in the Ethereum chart.

-

Significance for ETH: Applying the Wyckoff method to the current ETH chart reveals potential signs of accumulation. We need to analyze specific chart patterns like support levels (e.g., around $1,600-$1,800), resistance breakouts, and the overall volume profile. Sustained volume during these phases is a key indicator of accumulation.

Ethereum's Current Market Position: Technical Indicators

Ethereum's current price action aligns with certain aspects of the Wyckoff accumulation model. Let's examine several technical indicators:

-

RSI (Relative Strength Index): A low RSI reading (below 30) often suggests oversold conditions, which can precede a price bounce. Observe the RSI alongside other indicators for confirmation.

-

MACD (Moving Average Convergence Divergence): A bullish MACD crossover (MACD line crossing above the signal line) can signal a potential upward trend reversal. Note the MACD's behavior around support levels.

-

Moving Averages (MA): A bullish crossover (e.g., 50-day MA crossing above the 200-day MA) suggests a potential change in momentum. The position of ETH's price relative to these MAs is significant.

-

Visual Examples: [Insert Chart/Graph showing RSI, MACD, and moving averages for ETH, highlighting key support and resistance levels.] The chart clearly shows support around the $1,600 level and potential resistance around the $2,000 level. The breakout of this resistance is key to reaching the $2,700 target.

-

Implications: The confluence of these technical indicators suggests a potential bullish reversal, supporting the Wyckoff accumulation thesis and the $2700 price target.

Fundamental Factors Supporting the Price Target

Beyond technical analysis, several fundamental factors support the potential for Ethereum to reach $2700:

-

Network Upgrades: Ethereum's ongoing upgrades, such as EIP-1559 (reducing transaction fees) and the implementation of sharding (improving scalability), enhance the network's efficiency and attract more users and developers. These factors boost demand for ETH.

-

Institutional Investment: Increased institutional interest in ETH, with major players adding it to their portfolios, signifies growing confidence in the asset's long-term value. This increased institutional adoption can fuel a significant price increase.

-

Market Sentiment: Positive market sentiment and increasing adoption of decentralized finance (DeFi) applications built on Ethereum drive demand for ETH. These factors collectively contribute to the bullish outlook for Ethereum.

-

Impact: These upgrades and increasing adoption contribute to a more robust and scalable Ethereum network, making it more attractive to a broader range of users, thereby influencing price appreciation.

Risks and Potential Downsides

While the $2700 target is plausible, several risks could hinder price appreciation:

-

Macroeconomic Conditions: Global economic uncertainty and potential downturns in the stock market can negatively affect the cryptocurrency market, including ETH's price.

-

Regulatory Uncertainty: Regulatory changes and stricter oversight of cryptocurrencies could create volatility and impact price movements. The future regulatory landscape for cryptocurrencies is uncertain and presents a risk factor.

-

Resistance Levels: Strong resistance levels may prevent Ethereum's price from easily reaching $2700. Failure to break through these levels could lead to consolidation or a price correction.

-

Impact: These factors could cause significant price volatility, potentially delaying or preventing Ethereum from reaching the $2700 target.

Conclusion

This Wyckoff accumulation analysis suggests a potential bullish trajectory for Ethereum, with a price target of $2700. The confluence of technical indicators, such as the RSI, MACD, and moving averages, combined with positive fundamental factors like network upgrades and institutional investment, supports this prediction. However, macroeconomic conditions, regulatory uncertainty, and potential resistance levels present significant risks.

While no investment prediction is guaranteed, this Ethereum price analysis suggests a potential bullish trajectory toward $2700. Stay informed on Ethereum price movements and continue your research to make informed investment decisions. Learn more about Wyckoff accumulation analysis and its applications to cryptocurrency trading.

Featured Posts

-

Bitcoins Future Analyzing The 100 000 Prediction After Trumps Speech

May 08, 2025

Bitcoins Future Analyzing The 100 000 Prediction After Trumps Speech

May 08, 2025 -

How Trump Medias Crypto Com Etf Partnership Impacts The Crypto Market

May 08, 2025

How Trump Medias Crypto Com Etf Partnership Impacts The Crypto Market

May 08, 2025 -

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

Nezapirliv Vesprem Desetti Triumf Vo L Sh Ps Zh Padna

May 08, 2025

Nezapirliv Vesprem Desetti Triumf Vo L Sh Ps Zh Padna

May 08, 2025 -

Which Cryptocurrency Could Weather The Trade War Storm

May 08, 2025

Which Cryptocurrency Could Weather The Trade War Storm

May 08, 2025