Ethereum's Potential $2,700 Surge: A Wyckoff Accumulation Perspective

Table of Contents

Understanding Wyckoff Accumulation in Ethereum

What is Wyckoff Accumulation?

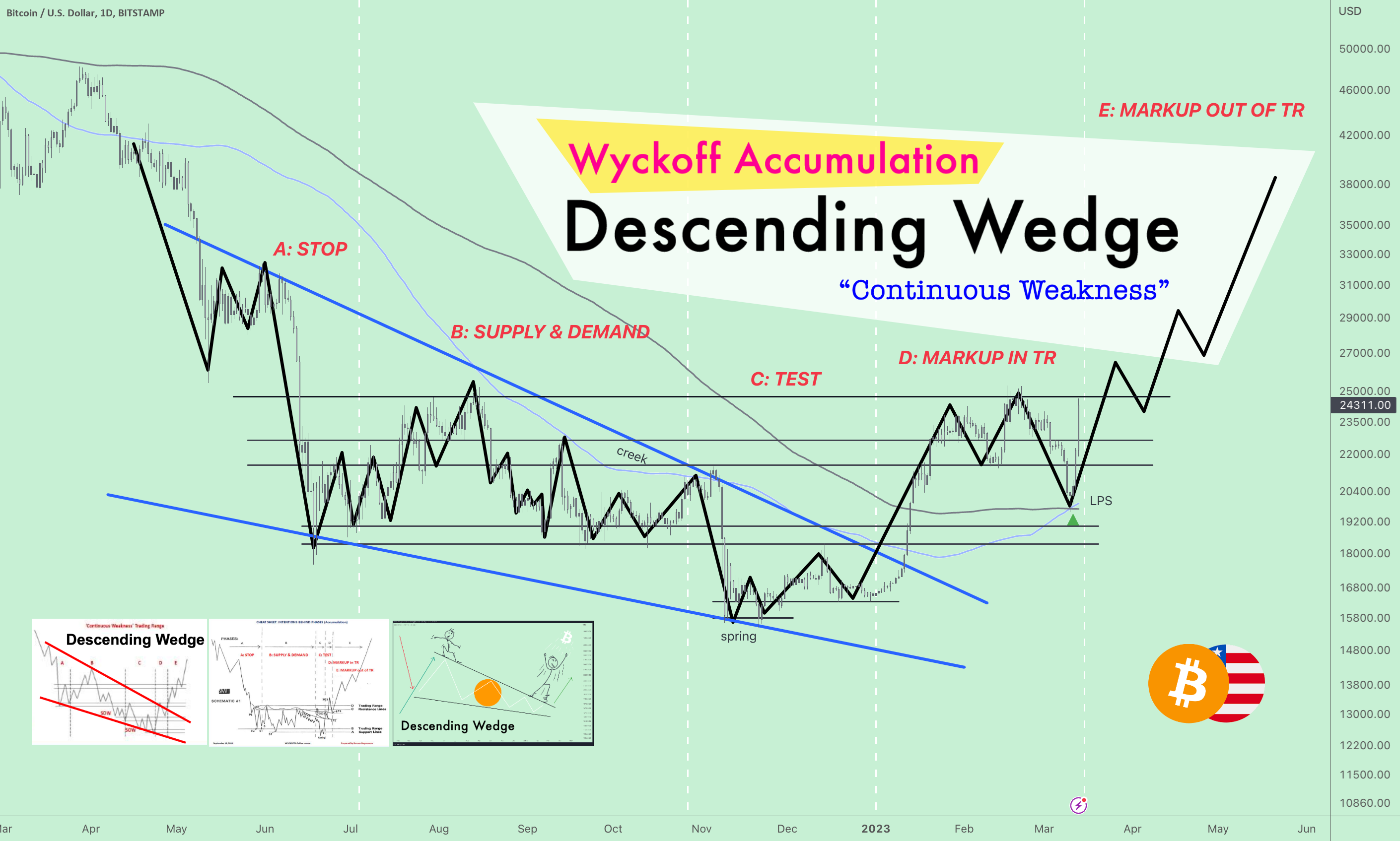

The Wyckoff Method is a sophisticated technical analysis approach that identifies periods of market manipulation and accumulation before significant price movements. Unlike simpler methods relying solely on price action or indicators, Wyckoff focuses on the interplay between price, volume, and time to predict market turning points. It differs from other technical analysis approaches by emphasizing the behavior of the market participants, rather than just the price itself. In the cryptocurrency market, specifically for Ethereum, understanding Wyckoff accumulation can provide valuable insights into potential price swings and market sentiment. Key concepts within the Wyckoff schematics include understanding Wyckoff distribution (the opposite of accumulation) and recognizing signs of potential market manipulation.

Identifying Wyckoff Accumulation in ETH Charts

Identifying Wyckoff accumulation in ETH charts requires careful observation of specific phases. These phases, often depicted using candlestick patterns and volume analysis, typically include the "Preliminary Support" (PS), "Spring," "Sign of Weakness" (SOW), "Test," and "Markup" phases. Let's break down how to spot these phases:

- Preliminary Support (PS): A period of consolidation where selling pressure is gradually absorbed, often characterized by declining volume.

- Spring: A short, sharp decline designed to shake out weak holders, followed by a quick recovery.

- Sign of Weakness (SOW): A brief test of support levels, often with increased volume, confirming the strength of the buyers.

- Test: A final confirmation of support, often with lower volume than the SOW.

- Markup: The initiation of the uptrend, characterized by increasing volume and price.

Analyzing historical ETH charts reveals several instances where these phases align with significant price increases. (Insert chart examples here illustrating Wyckoff accumulation phases on ETH charts. Clearly label each phase) Successful identification relies on a combination of candlestick patterns, volume analysis, and the understanding of support and resistance levels.

Evidence Supporting a Potential $2,700 ETH Surge

Analyzing the Current Market Conditions for ETH

Several factors suggest a potential bullish outlook for Ethereum. Currently, Ethereum network activity, as measured by active addresses and transaction volume, demonstrates robust engagement and usage. This on-chain data, coupled with sustained development activity around Ethereum 2.0 and other scaling solutions, points towards a healthy and growing ecosystem. Market sentiment, while fluctuating, shows increasing confidence in Ethereum's long-term prospects. The correlation between Bitcoin price and ETH price, while not always perfectly aligned, often sees ETH following Bitcoin's upward trends.

Technical Indicators Supporting the Wyckoff Accumulation Thesis

Beyond the Wyckoff analysis, several technical indicators support the potential for a $2,700 ETH surge. For example:

- Relative Strength Index (RSI): A reading below 30 often indicates oversold conditions, suggesting potential buying opportunities. (Insert chart showing RSI)

- Moving Average Convergence Divergence (MACD): A bullish crossover could signal an impending upward trend. (Insert chart showing MACD)

- Bollinger Bands: A price breakout from the lower Bollinger Band could indicate a significant price move. (Insert chart showing Bollinger Bands)

- Fibonacci Retracements: Identifying key retracement levels can help predict potential support and resistance areas. (Insert chart showing Fibonacci Retracements)

Potential Risks and Challenges

Factors that Could Impact the Predicted Surge

While the analysis suggests a bullish outlook, several factors could impact the predicted $2,700 ETH surge. Market volatility remains a constant threat, and unexpected corrections are always possible. Regulatory uncertainty surrounding cryptocurrencies in various jurisdictions presents a significant headwind. Furthermore, the emergence of competing cryptocurrencies and altcoin season could divert investment away from Ethereum. Finally, delays or unforeseen issues with the Ethereum 2.0 upgrade could also negatively impact the price.

Risk Management Strategies for Investors

Investing in cryptocurrencies, including Ethereum, inherently involves risk. Effective risk management is crucial. Investors should always diversify their portfolios, avoiding overexposure to any single asset. Employing stop-loss orders to limit potential losses is also recommended. Careful position sizing, based on individual risk tolerance, is essential to manage potential downsides. Thoroughly researching and understanding the risks associated with Ethereum before making any investment decisions is paramount.

Conclusion

This analysis suggests a potential $2,700 Ethereum surge based on the observed Wyckoff accumulation patterns, supported by favorable market conditions and technical indicators. However, it's crucial to acknowledge the inherent risks in cryptocurrency investments. Market volatility, regulatory uncertainty, and competition are all factors that could influence the actual price movement. Remember to conduct thorough research and employ effective risk management strategies. Learn more about Ethereum price predictions and master the Wyckoff method to navigate the dynamic world of cryptocurrency investments. [Link to further resources/relevant page]

Featured Posts

-

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025 -

Uber One Arrives In Kenya Get Free Deliveries And More

May 08, 2025

Uber One Arrives In Kenya Get Free Deliveries And More

May 08, 2025 -

Wall Street In Degisen Kripto Para Stratejileri Analiz Ve Tahminler

May 08, 2025

Wall Street In Degisen Kripto Para Stratejileri Analiz Ve Tahminler

May 08, 2025 -

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Forecasts

May 08, 2025

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Forecasts

May 08, 2025 -

Understanding The Papal Conclave Selection Of A New Pope

May 08, 2025

Understanding The Papal Conclave Selection Of A New Pope

May 08, 2025