Will XRP Be Classified As A Commodity? The Latest On The Ripple Lawsuit

Table of Contents

The Core of the Ripple Lawsuit and its Impact on XRP Classification

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging that Ripple sold XRP as an unregistered security. The SEC's argument centers on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The Howey Test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

Ripple, however, vehemently denies these allegations. They argue that XRP is a decentralized digital asset and functions more like a currency or a commodity than a security. Their defense highlights the decentralized nature of XRP and its use in various payment systems, contrasting it with the centralized control typical of securities.

- The Howey Test and XRP: The SEC's application of the Howey Test to XRP is a central point of contention. They argue that Ripple's sales of XRP, particularly its programmatic sales, fit the criteria of a security offering.

- Different XRP Sales: The categorization of different XRP sales (programmatic sales, institutional sales, etc.) is crucial. Each type of sale might be judged differently under the Howey Test.

- Key Legal Arguments: Ripple emphasizes the lack of a centralized entity controlling XRP's value or its distribution, a key differentiating factor from securities. The SEC, on the other hand, points to Ripple's alleged control over XRP's distribution and its promotion as an investment opportunity.

- Implications for XRP Holders: A security classification for XRP would have profound implications for holders, potentially triggering significant regulatory burdens and impacting trading accessibility.

Expert Opinions and Legal Analysis of XRP's Potential Commodity Status

Legal experts and financial analysts offer diverse opinions on whether XRP should be classified as a commodity. Some argue that XRP's decentralized nature, its use as a medium of exchange, and its lack of centralized control align with the characteristics of a commodity. Others maintain that the circumstances surrounding XRP's creation and distribution warrant its classification as a security.

Legal precedent regarding commodity classification is sparse in the cryptocurrency context, making this case particularly challenging. There's no established legal framework specifically designed for digital assets, adding to the complexity.

- Diverse Perspectives: While some legal experts believe the SEC's case is weak, others point to the potential for the court to set a precedent that would heavily influence the regulatory landscape for other cryptocurrencies.

- Impact on the Crypto Market: The outcome will undoubtedly influence the regulatory environment for the entire cryptocurrency market, setting a standard for how other digital assets might be classified.

- Relevant Court Decisions: The judge's interpretations of existing case law and the weight given to expert testimony will play a critical role in determining the final outcome and potentially setting new legal precedents for future cases involving XRP commodity classification.

The Ripple-SEC Case's Broader Implications for the Crypto Industry

The Ripple-SEC case holds significant implications for the future of cryptocurrency regulation. The ruling could set a precedent for how other cryptocurrencies are treated, creating either more clarity or further uncertainty. The lack of comprehensive regulatory frameworks for digital assets globally is a major concern for investors and developers alike.

- Uncertainty for Investors: The ongoing legal battle creates uncertainty for investors, impacting investment decisions and the overall stability of the crypto market.

- Impact on Innovation: Regulatory clarity is essential for fostering innovation in the crypto space. Excessive regulation could stifle development, while a lack of regulation could lead to market instability.

- Future Regulatory Decisions: This case will heavily influence future regulatory decisions regarding digital assets, setting the tone for regulatory frameworks in various jurisdictions.

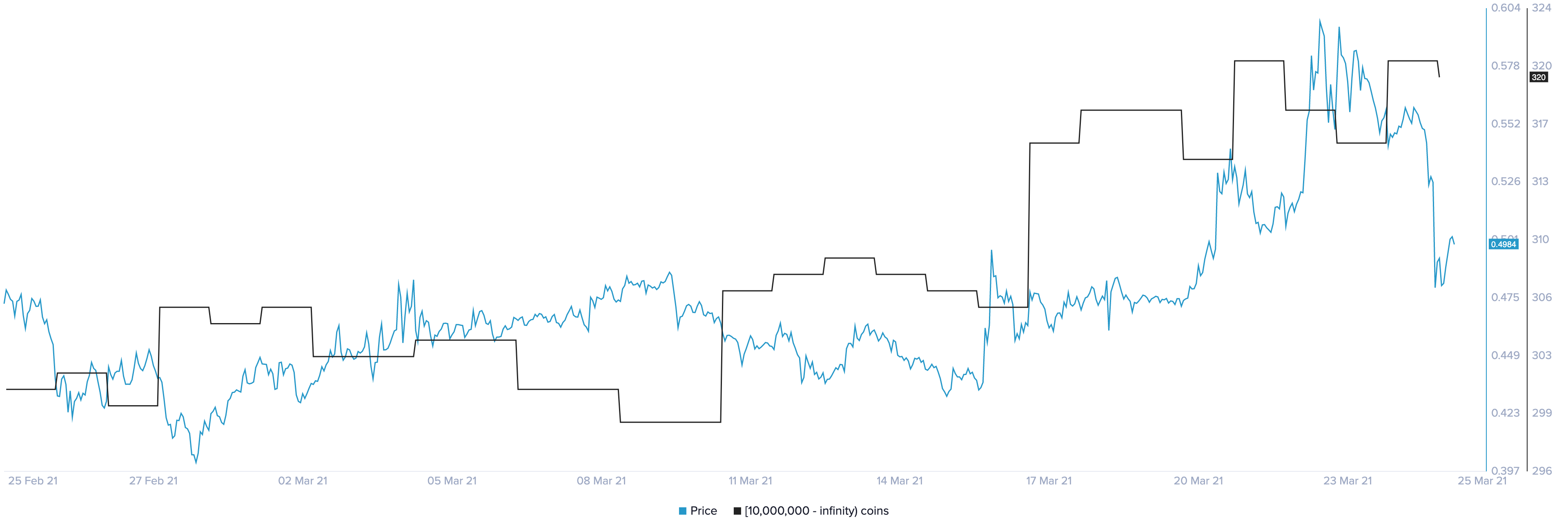

Potential Outcomes and their Impact on XRP Price and Trading

Several potential outcomes exist: XRP could be classified as a commodity, a security, or the court could determine that it falls into neither category. Each outcome has vastly different implications for XRP's price and trading volume.

- XRP as a Commodity: This scenario would likely lead to increased investor confidence and could potentially increase XRP's price and trading volume.

- XRP as a Security: This would likely result in significant consequences, potentially including delisting from major exchanges and a substantial drop in XRP's price. Investor confidence would be severely impacted.

- Neither Commodity nor Security: This outcome would introduce a level of ambiguity, potentially creating a regulatory gray area. The market reaction would depend heavily on how this ambiguity is interpreted and addressed by regulators. This outcome could lead to prolonged uncertainty regarding the future of XRP trading and valuation.

The outcome of the Ripple lawsuit is expected to heavily influence investor sentiment, impacting XRP’s price significantly. Delistings from exchanges could occur if a security classification prevails, reducing accessibility and potentially causing a price drop. Conversely, a commodity classification could lead to increased adoption and price appreciation.

Conclusion

The question of whether XRP will be classified as a commodity remains unanswered, but the Ripple lawsuit's impact on the cryptocurrency market is undeniable. The arguments for and against XRP's commodity classification hinge on interpretations of the Howey Test, the decentralized nature of XRP, and the overall regulatory landscape. The uncertainty surrounding the final outcome poses significant risks and opportunities for investors.

Stay informed about the ongoing Ripple lawsuit and its potential impact on the future of XRP. Continue to research the XRP commodity classification debate for a better understanding of this evolving legal and financial landscape. Follow reputable news sources for the latest updates on the case and its implications for your XRP holdings.

Featured Posts

-

S And P 500 Investment Protection Mitigate Risk With Downside Insurance

May 01, 2025

S And P 500 Investment Protection Mitigate Risk With Downside Insurance

May 01, 2025 -

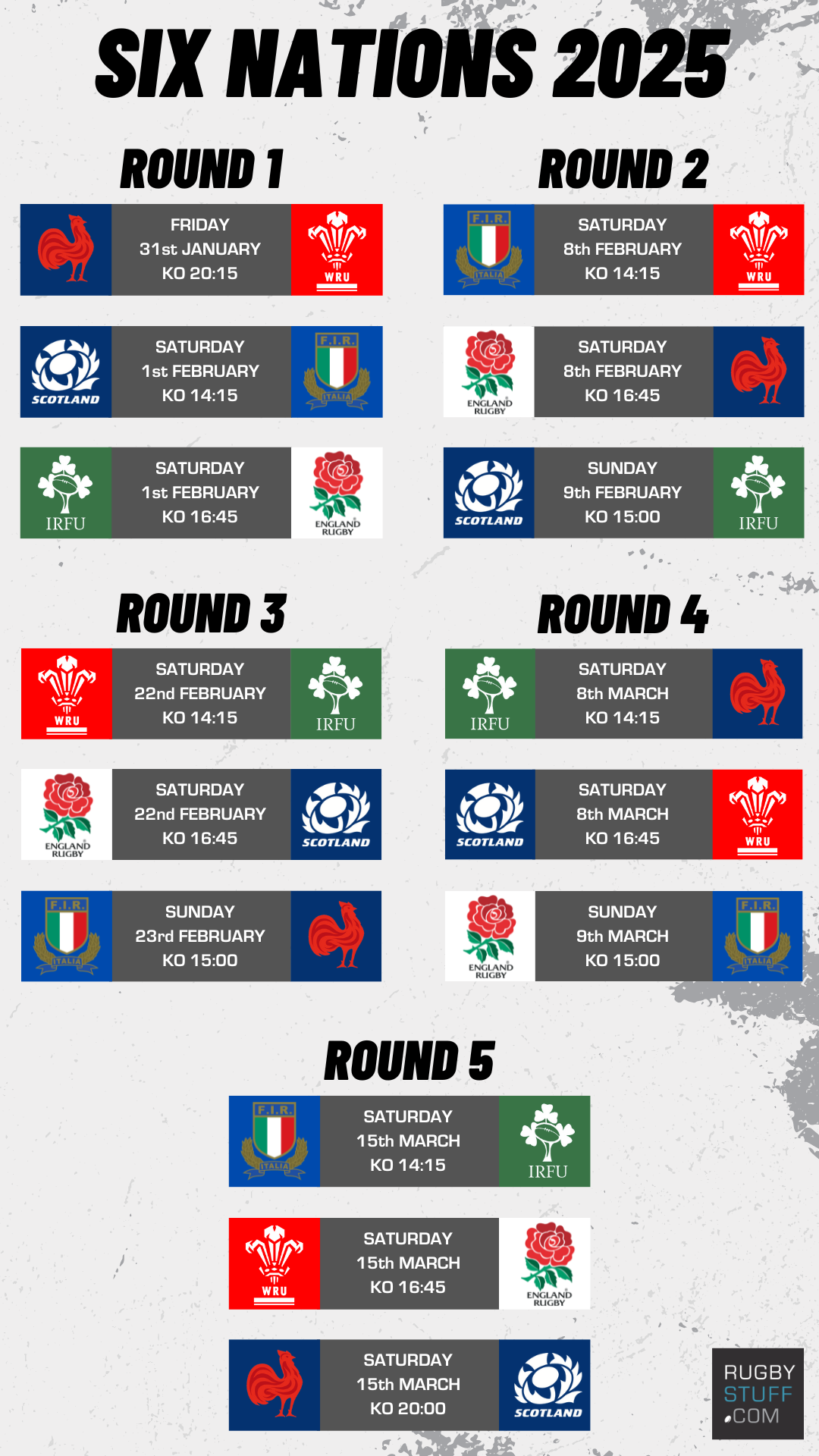

Six Nations 2025 Scotlands True Potential Flattering To Deceive Or Genuine Contenders

May 01, 2025

Six Nations 2025 Scotlands True Potential Flattering To Deceive Or Genuine Contenders

May 01, 2025 -

Thes Dansants Optimiser Votre Evenement Avec L Accompagnement Numerique

May 01, 2025

Thes Dansants Optimiser Votre Evenement Avec L Accompagnement Numerique

May 01, 2025 -

Nothings Phone 2 A Deep Dive Into Its Modular System

May 01, 2025

Nothings Phone 2 A Deep Dive Into Its Modular System

May 01, 2025 -

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

May 01, 2025

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

May 01, 2025

Latest Posts

-

Cruises Com Launches Innovative Points Based Rewards Program

May 01, 2025

Cruises Com Launches Innovative Points Based Rewards Program

May 01, 2025 -

Carnival Cruise Lines 7 Big Announcements For Next Month

May 01, 2025

Carnival Cruise Lines 7 Big Announcements For Next Month

May 01, 2025 -

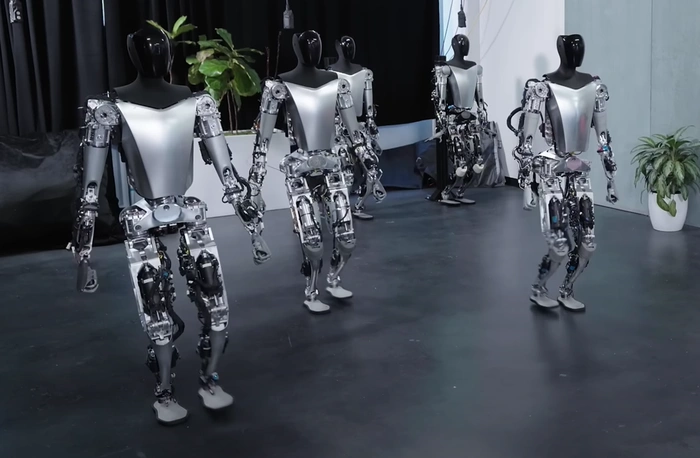

Will Ups Deploy Figure Ais Humanoid Robots A Look At The Partnership

May 01, 2025

Will Ups Deploy Figure Ais Humanoid Robots A Look At The Partnership

May 01, 2025 -

Ups Exploring Humanoid Robots With Figure Ai

May 01, 2025

Ups Exploring Humanoid Robots With Figure Ai

May 01, 2025 -

Ups And Figure Ai Humanoid Robots In Logistics

May 01, 2025

Ups And Figure Ai Humanoid Robots In Logistics

May 01, 2025