S&P 500 Investment Protection: Mitigate Risk With Downside Insurance

Table of Contents

Understanding the Risks of S&P 500 Investing

The S&P 500, while historically a strong performer, is not immune to market fluctuations. Understanding these risks is crucial for effective S&P 500 investment protection.

Market Volatility and Corrections

The stock market is inherently volatile. The S&P 500 experiences periods of both significant gains and sharp declines. These corrections can be sudden and dramatic, impacting even the most well-diversified portfolios.

- Examples of past market downturns: The dot-com bubble burst (2000-2002), the 2008 financial crisis, and the COVID-19 market crash (2020) all highlight the potential for substantial S&P 500 volatility.

- Percentage drops: During these events, the S&P 500 experienced double-digit percentage drops within short periods.

- Recovery times: While markets generally recover, the recovery period can vary significantly depending on the severity and underlying causes of the downturn. Understanding this S&P 500 volatility is key to effective risk management.

Systemic Risk and Black Swan Events

Systemic risk refers to the risk of a widespread market collapse. Unforeseen events, often termed "black swan events," can trigger these collapses, impacting the entire market, including the S&P 500.

- Examples of black swan events: The 2008 financial crisis, triggered by the subprime mortgage crisis, and the unexpected COVID-19 pandemic are prime examples. Both caused significant S&P 500 downturns.

- Their impact on the S&P 500: These events demonstrate the vulnerability of even seemingly stable investments like the S&P 500 to unpredictable, large-scale shocks. Effective S&P 500 investment protection requires considering these possibilities.

Inflation and Interest Rate Hikes

Inflation and interest rate hikes significantly influence the S&P 500's performance. Rising interest rates can decrease the attractiveness of stocks, leading to lower valuations. High inflation erodes the purchasing power of returns.

- The relationship between inflation, interest rates, and stock valuations: Higher interest rates often lead to lower stock valuations as investors seek higher yields in fixed-income securities. High inflation reduces corporate profitability and investor confidence.

- Historical examples: Periods of high inflation have historically been correlated with periods of lower S&P 500 returns. This highlights the importance of inflation risk mitigation in S&P 500 investment protection strategies.

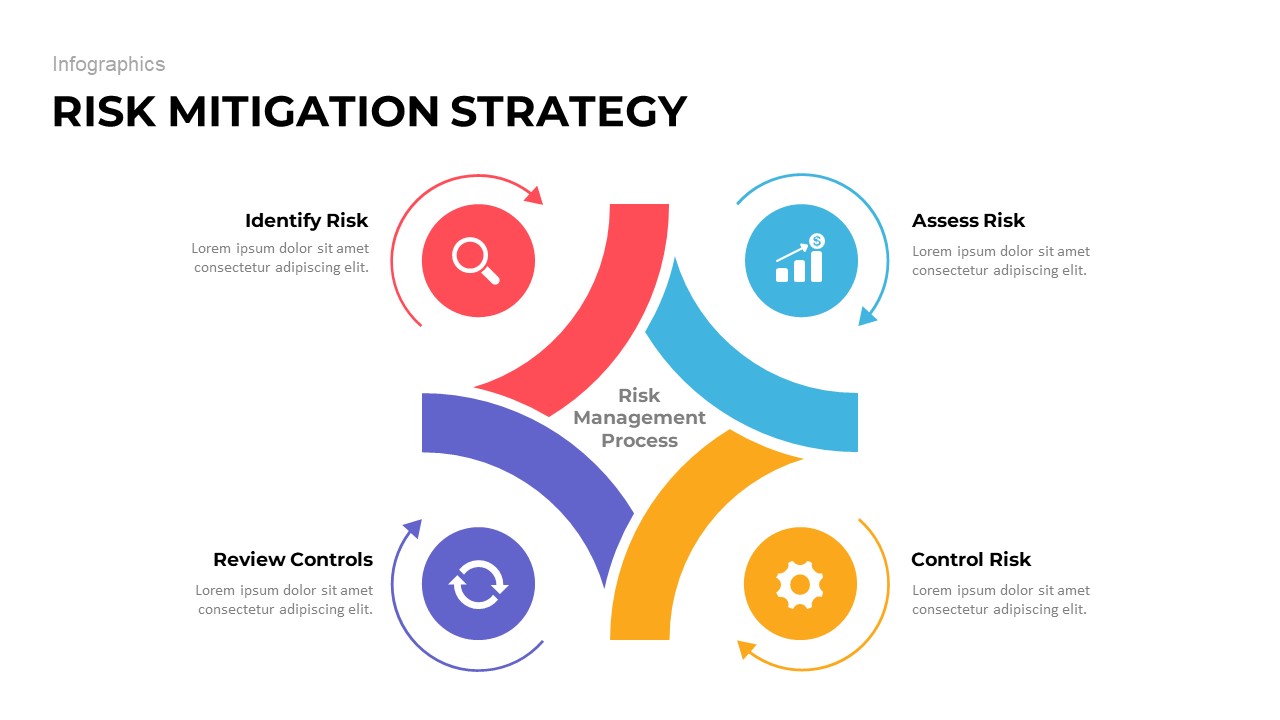

Strategies for S&P 500 Investment Protection

Several strategies can help mitigate the risks associated with S&P 500 investing. Implementing a combination of these approaches provides a robust framework for S&P 500 investment protection.

Diversification

Diversification is a cornerstone of risk management. By spreading investments across different asset classes, you reduce the impact of poor performance in any single area.

- Examples of asset classes: Bonds, real estate, commodities, and international stocks offer diversification benefits.

- Benefits of diversification: A diversified portfolio reduces overall portfolio volatility and enhances the potential for consistent returns, even during market downturns. This is a crucial element of S&P 500 downside insurance.

Hedging with Options

Options contracts, particularly protective puts, can act as insurance against S&P 500 losses.

- Explanation of protective puts: A protective put involves buying a put option on an underlying asset (like an S&P 500 index fund) to limit potential losses.

- How they work: The put option grants the holder the right, but not the obligation, to sell the asset at a predetermined price (the strike price) before the option expires.

- Calculating cost and potential benefits: The cost is the premium paid for the put option, which acts as the insurance premium. The benefit is the limitation of potential downside risk. This is a powerful technique for S&P 500 downside insurance.

Utilizing Downside Insurance Products

Various products offer downside insurance, providing protection against significant market declines.

- Explanation of different products: Beyond protective puts, collars (combining a long put and a short call) and other sophisticated risk management tools can be employed.

- Their features, cost-benefit analysis for each: Each product has varying costs and levels of protection, requiring careful consideration of your risk tolerance and investment goals to provide effective S&P 500 downside insurance.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- How DCA works: This strategy reduces the risk of investing a lump sum at a market peak.

- Its benefits and limitations: While DCA doesn't eliminate risk, it mitigates the impact of poor market timing, acting as a form of S&P 500 investment protection.

Choosing the Right S&P 500 Investment Protection Strategy

Selecting the optimal strategy depends on individual circumstances.

Assessing Your Risk Tolerance

Understanding your risk tolerance is fundamental.

- Questions to ask to determine risk tolerance: How much potential loss are you comfortable with? What is your investment timeline? What are your financial goals?

- Matching strategies to risk profile: Conservative investors may favor diversified portfolios and downside insurance, while more aggressive investors might accept higher risk for potentially greater returns. This is critical for effective S&P 500 downside insurance.

Considering Your Investment Timeline

Your investment timeline significantly impacts your risk tolerance and strategy choices.

- Long-term vs. short-term investment strategies: Long-term investors have greater capacity to withstand market volatility and may require less aggressive downside protection.

- Impact of time horizon on risk tolerance: Short-term investors may prioritize capital preservation and employ more conservative strategies.

Conclusion

Protecting your S&P 500 investments requires a proactive approach to risk management. By understanding the potential risks and employing strategies like diversification, options hedging, and downside insurance products, you can significantly mitigate losses and enhance your portfolio's resilience. Remember, the right S&P 500 investment protection strategy depends on your individual risk tolerance and financial goals. Don't leave your investments vulnerable – explore the options for effective S&P 500 downside insurance today and secure your financial future.

Featured Posts

-

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

Michael Sheens Port Talbot Home Paying Off Neighbours Debts

May 01, 2025

Michael Sheens Port Talbot Home Paying Off Neighbours Debts

May 01, 2025 -

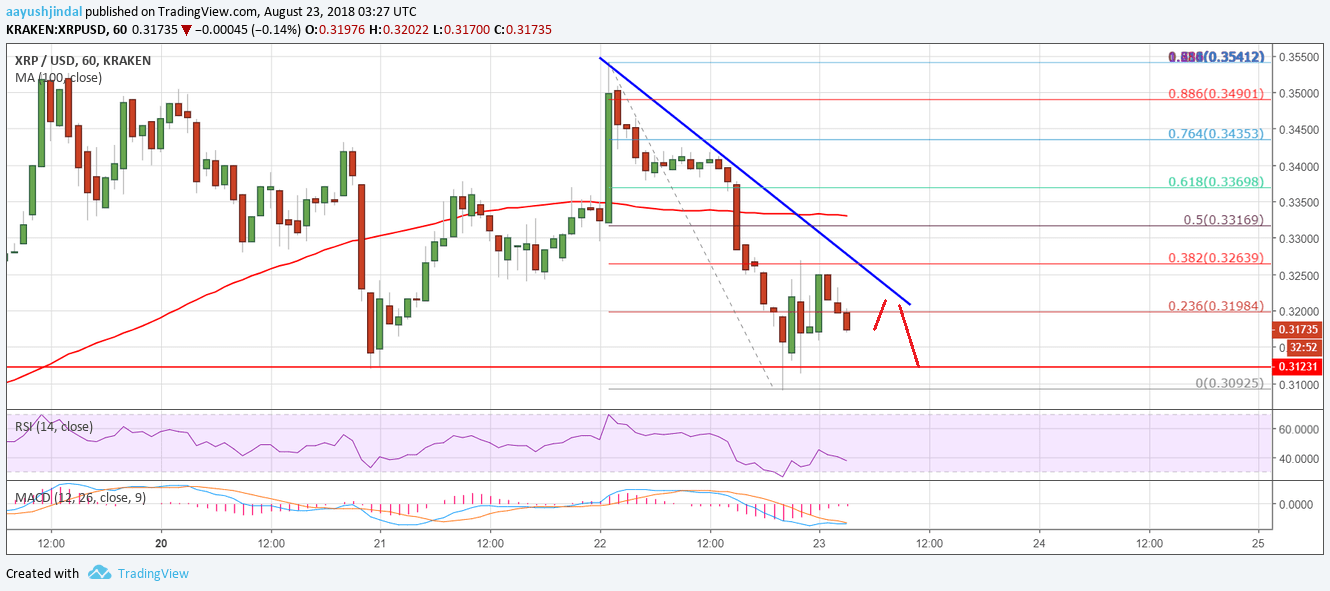

Xrp Ripple Price Analysis Buy Or Sell Below 3

May 01, 2025

Xrp Ripple Price Analysis Buy Or Sell Below 3

May 01, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 01, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 01, 2025 -

Pregnancy Craving Fuels Chocolate Bars Global Success And Price Increases

May 01, 2025

Pregnancy Craving Fuels Chocolate Bars Global Success And Price Increases

May 01, 2025

Latest Posts

-

Lich Thi Dau Thaco Cup 2025 Thong Tin Chi Tiet Tran Dau Hap Dan

May 01, 2025

Lich Thi Dau Thaco Cup 2025 Thong Tin Chi Tiet Tran Dau Hap Dan

May 01, 2025 -

Ai La Nguoi Chien Thang Dau Tien Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025

Ai La Nguoi Chien Thang Dau Tien Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025 -

Alqdae Ydyn Ryys Shbab Bn Jryr Tfasyl Alhkm

May 01, 2025

Alqdae Ydyn Ryys Shbab Bn Jryr Tfasyl Alhkm

May 01, 2025 -

Dai Hoc Ton Duc Thang Chien Thang Ngoan Muc Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025

Dai Hoc Ton Duc Thang Chien Thang Ngoan Muc Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025 -

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Thoi Gian Va Dia Diem Xem Truc Tiep

May 01, 2025

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Thoi Gian Va Dia Diem Xem Truc Tiep

May 01, 2025