Widening Cracks In The Private Credit Market: Credit Weekly Report

Table of Contents

Increased Default Rates in Private Credit

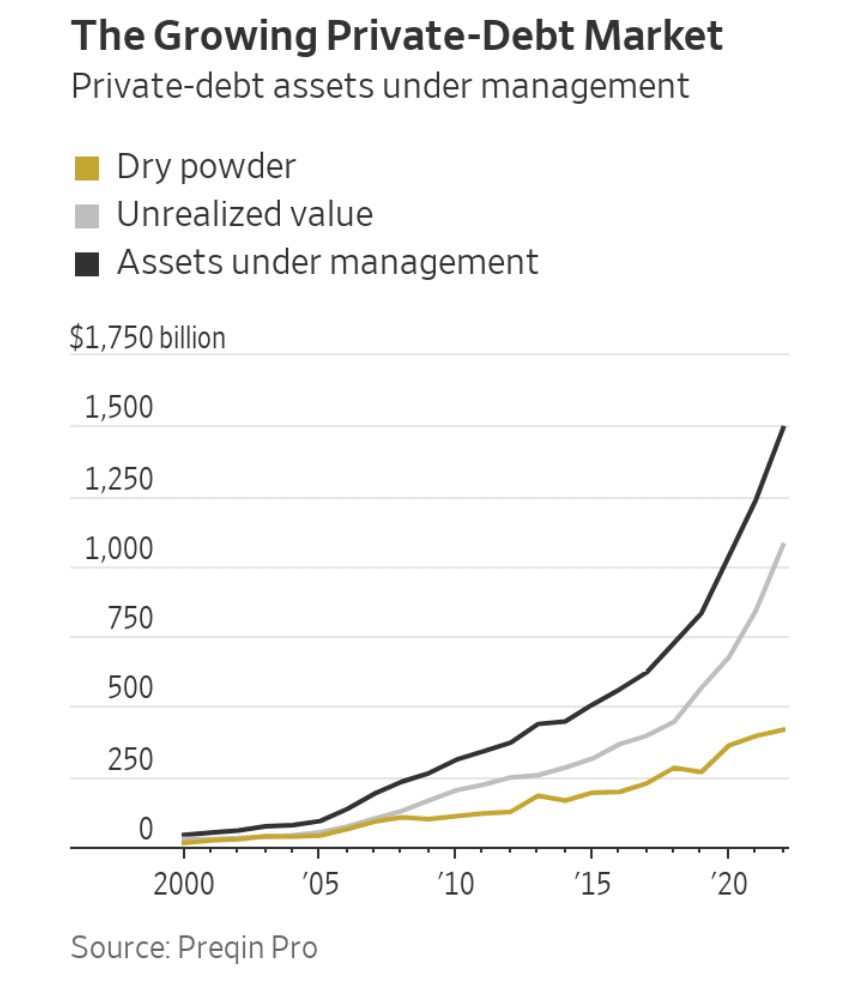

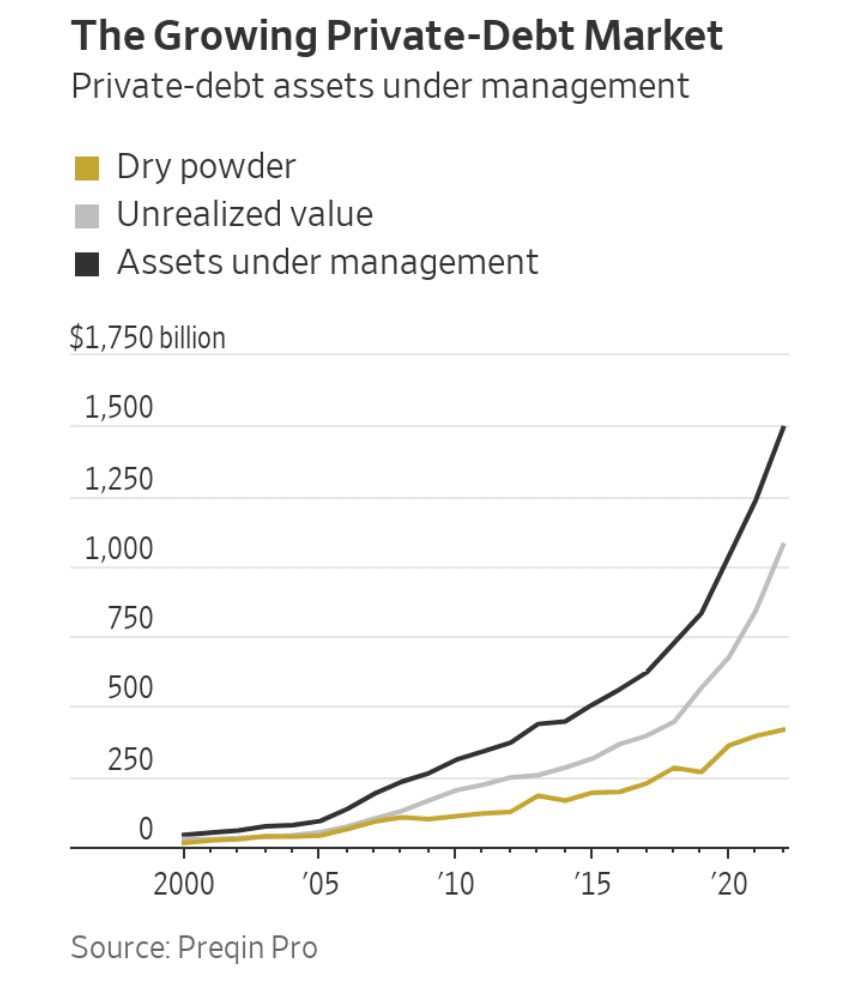

The most alarming trend is the sharp increase in default rates across various sectors of the private credit market. Leveraged loans, a cornerstone of private credit, are experiencing a surge in defaults, impacting both lenders and borrowers. Direct lending, another significant segment, is also witnessing a rise in defaults, as borrowers struggle to meet their obligations in a deteriorating economic climate.

Several high-profile defaults have recently shaken investor confidence. For example, [insert example of a recent high-profile default and its impact]. This underscores the growing vulnerability within the market. Several factors contribute to this concerning trend:

- Rising Interest Rates: Higher interest rates increase borrowing costs, making it harder for companies with high levels of debt to service their obligations.

- Inflationary Pressures: Soaring inflation erodes profitability and reduces cash flow for many businesses, increasing the risk of default.

- Supply Chain Disruptions: Ongoing supply chain issues continue to strain businesses, impacting their ability to generate revenue and meet debt obligations.

- Economic Slowdown: A slowing global economy is further exacerbating the challenges faced by borrowers, increasing the likelihood of defaults.

Key Metrics:

- Default rates have increased by [insert percentage] compared to the same period last year.

- Sectors most affected include [list specific sectors, e.g., real estate, energy, technology].

- Companies facing significant financial distress include [list examples of companies].

Reduced Availability of Private Credit

The increased risk of defaults has led to a significant tightening of lending standards by private credit providers. Lenders are becoming increasingly risk-averse, demanding higher interest rates and stricter loan covenants. This reduction in the availability of private credit has significant implications for businesses seeking financing, particularly smaller companies and startups.

The decreased appetite for risk is evident in several ways:

- Increased Scrutiny of Borrowers: Lenders are conducting more thorough due diligence, scrutinizing borrowers' financial health more rigorously.

- Higher Interest Rates and Stricter Covenants: Borrowers are facing significantly higher interest rates and stricter loan terms to compensate for the increased risk.

- Funding Difficulties: Businesses are finding it increasingly challenging to secure funding for expansion projects or refinancing existing debt.

Impact on Different Investor Groups

The widening cracks in the private credit market are impacting various investor groups, including hedge funds, private equity firms, and institutional investors. Many are facing potential losses as defaults increase and valuations decline. Investors are employing various strategies to mitigate risks, such as diversifying their portfolios and increasing their exposure to distressed debt opportunities.

Investor Implications:

- Private Credit Fund Performance: The performance of private credit funds has deteriorated, with many experiencing negative returns.

- Investor Sentiment: Investor sentiment has shifted, with many reducing their allocations to private credit.

- Distressed Debt Opportunities: The increasing number of defaults is creating opportunities for investors specializing in distressed debt.

Regulatory Scrutiny and Potential Reforms

The challenges facing the private credit market are attracting increased regulatory scrutiny. Regulators are concerned about transparency and risk management within the sector and are exploring potential reforms to enhance oversight. These potential regulatory changes could significantly impact market liquidity and access to credit.

Regulatory Developments:

- Recent regulatory announcements and proposals include [mention specific regulatory actions].

- Potential changes to lending regulations may include [mention potential regulatory changes].

- The impact on market liquidity and access to credit is likely to be [discuss the potential impact].

Conclusion: Navigating the Widening Cracks in the Private Credit Market

This report highlights the significant challenges facing the private credit market. Rising default rates, reduced credit availability, and the impact on various investor groups underscore the need for caution and proactive risk management. Potential regulatory changes will further shape the landscape of the private credit market. Staying informed about developments in this dynamic environment is crucial. Regularly check for updates on the "Widening Cracks in the Private Credit Market" and similar reports to navigate this challenging period. Consider subscribing to our newsletter or following leading experts in the field to stay ahead of the curve.

Featured Posts

-

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Challenged

Apr 27, 2025

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Challenged

Apr 27, 2025 -

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025 -

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025 -

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025

Premier Leagues Path To A Guaranteed Fifth Champions League Spot

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Latest Posts

-

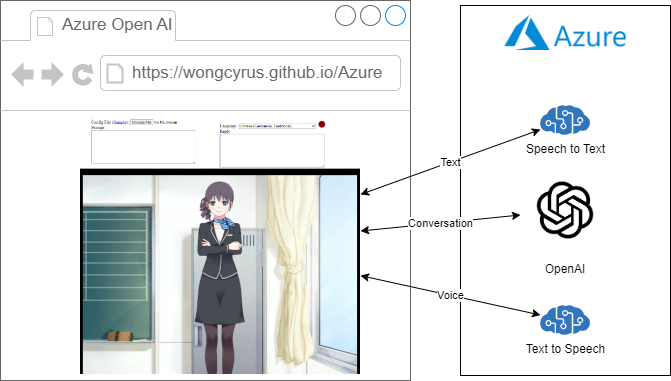

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025 -

T Mobile Fined 16 Million For Repeated Data Breaches

Apr 28, 2025

T Mobile Fined 16 Million For Repeated Data Breaches

Apr 28, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 28, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 28, 2025 -

Using Ai To Transform Repetitive Scatological Data Into A Poop Podcast

Apr 28, 2025

Using Ai To Transform Repetitive Scatological Data Into A Poop Podcast

Apr 28, 2025