US-China Trade War Intensifies: Market Reaction And UK Brexit Trade Deal Analysis

Table of Contents

The Intensifying US-China Trade War: A Market Overview

The US-China trade war, characterized by escalating tariffs and trade restrictions, has significantly impacted global markets. Its effects ripple across various sectors, creating both opportunities and challenges for businesses worldwide.

Impact on Global Stock Markets

Trade war announcements often trigger significant volatility in major stock indices.

- Dow Jones Industrial Average: Experiences fluctuations reflecting investor sentiment towards trade tensions and their potential impact on US corporations.

- Nasdaq Composite: The tech-heavy Nasdaq is particularly sensitive due to the significant presence of US companies involved in technology trade with China.

- Shanghai Composite and Hang Seng Index: These indices experience considerable volatility directly reflecting the impact of tariffs and trade restrictions on Chinese businesses.

Investor sentiment closely correlates with trade war developments. Periods of escalating tensions often lead to decreased investor confidence and market sell-offs, while periods of de-escalation can trigger rallies. Specific sectors, like technology and manufacturing, have been disproportionately impacted, experiencing heightened uncertainty and investment hesitancy. (Insert relevant chart or graph showing market fluctuations correlated with trade war events)

Commodity Price Fluctuations

Tariffs and trade disruptions significantly influence commodity prices.

- Soybeans: US soybean exports to China have been significantly affected, leading to price volatility for farmers and consumers alike.

- Oil: Geopolitical uncertainty linked to the trade war, and its impact on global growth, frequently affects oil prices.

- Metals: Tariffs on metals like aluminum and steel have created price instability, affecting manufacturing costs and supply chains.

These price fluctuations create ripple effects across global supply chains, contributing to inflation and impacting businesses' profitability. Companies are employing various strategies, including hedging, diversification of suppliers, and cost-cutting measures, to mitigate the impact of price volatility.

Currency Market Reactions

The trade war has also influenced currency exchange rates.

- US Dollar: The dollar's strength or weakness often reflects investor confidence in the US economy amidst the trade war.

- Chinese Yuan: The yuan has experienced periods of depreciation against the dollar, partly driven by trade war uncertainties.

Speculation and investor hedging strategies play a crucial role in currency movements. The potential for currency wars, where countries manipulate their exchange rates to gain a trade advantage, remains a significant concern.

The UK's Post-Brexit Trade Landscape and its Vulnerability

The UK's post-Brexit trade landscape adds another dimension to its exposure to the US-China trade war.

Impact of the US-China Trade War on UK Trade

The UK relies significantly on trade with both the US and China, making it potentially vulnerable to the trade war's consequences.

- Financial Services: The UK's financial services sector faces challenges due to potential disruptions in cross-border transactions and regulatory changes.

- Automotive: The automotive industry is susceptible to disruptions in global supply chains and fluctuating prices for imported components.

The UK risks being caught in the crossfire of the trade war, facing potential disruptions to its supply chains and reduced access to key markets.

Analysis of the UK's New Trade Deals

The effectiveness of the UK's post-Brexit trade agreements in mitigating the negative effects of the US-China trade war remains to be seen. These deals aim to:

- Provide alternative markets for UK businesses.

- Diversify supply chains to reduce reliance on specific regions.

However, diversifying trade relationships quickly presents significant challenges.

UK Economic Resilience in the Face of Global Trade Uncertainty

The UK's economic vulnerability is a key concern given its exposure to both Brexit uncertainties and the US-China trade war. Government policies aimed at bolstering economic resilience include:

- Investment in infrastructure and innovation.

- Support for affected industries through targeted financial aid.

However, the overall success of these policies in mitigating the negative economic consequences remains uncertain.

Interplay Between US-China Trade War and UK Brexit Trade Deal

The US-China trade war presents both opportunities and challenges for the UK.

Opportunities for the UK

- Foreign Direct Investment (FDI): The UK could potentially attract businesses relocating from China due to trade tensions.

- New Trade Partnerships: The trade war might encourage the UK to forge stronger trade links with other countries, diversifying its markets.

Challenges for the UK

- Geopolitical Complexity: Navigating the complex geopolitical landscape requires strategic alliances and effective diplomacy.

- Economic Uncertainty: The trade war adds another layer of uncertainty to the already volatile post-Brexit economic situation.

Conclusion

The escalating US-China trade war presents significant challenges for the global economy, and the UK, in the midst of its post-Brexit transition, is particularly vulnerable. Understanding the market reactions to the trade war and analyzing the effectiveness of the UK's new trade deals is crucial for navigating this complex landscape. While the UK might find some opportunities amidst the turmoil, it faces significant challenges that require careful strategic planning and international cooperation. Staying informed about the evolving dynamics of the US-China trade war and its impact on global trade is essential for businesses and policymakers alike. Continuous monitoring of this complex situation is vital for mitigating risk and capitalizing on emerging opportunities within the shifting global trade environment. Understanding the intricacies of the US-China trade war impact is key for informed decision-making.

Featured Posts

-

The Tarlov Pirro Debate A Heated Exchange On The Canada Trade War

May 10, 2025

The Tarlov Pirro Debate A Heated Exchange On The Canada Trade War

May 10, 2025 -

Nottingham Attack Survivor Speaks Out A Heartbreaking Plea

May 10, 2025

Nottingham Attack Survivor Speaks Out A Heartbreaking Plea

May 10, 2025 -

Ftc Launches Probe Into Open Ai And Chat Gpt A Deep Dive

May 10, 2025

Ftc Launches Probe Into Open Ai And Chat Gpt A Deep Dive

May 10, 2025 -

August Deadline Treasury Signals Potential Us Debt Limit Crisis

May 10, 2025

August Deadline Treasury Signals Potential Us Debt Limit Crisis

May 10, 2025 -

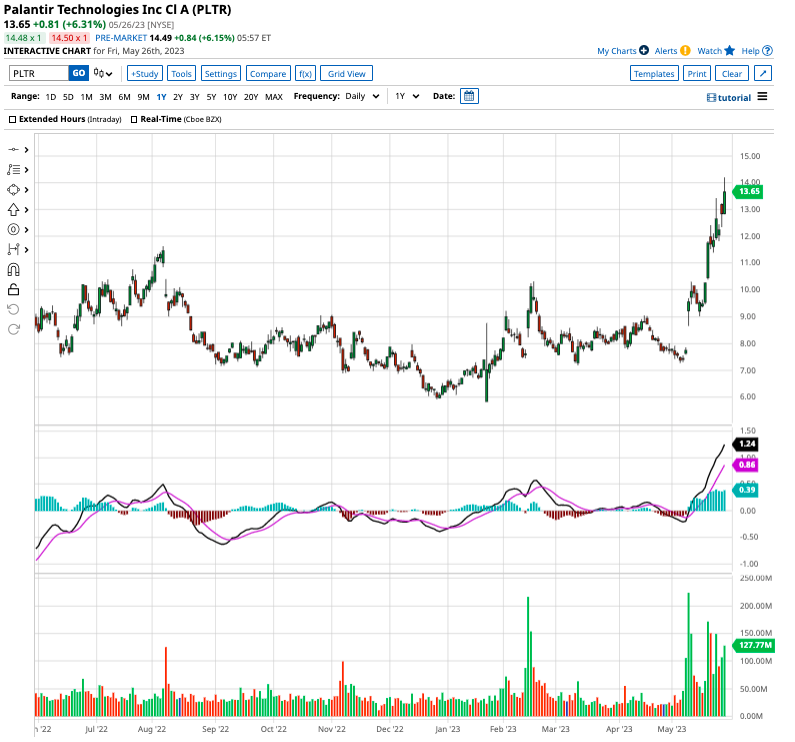

Is A 40 Increase In Palantir Stock Realistic By 2025

May 10, 2025

Is A 40 Increase In Palantir Stock Realistic By 2025

May 10, 2025